简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

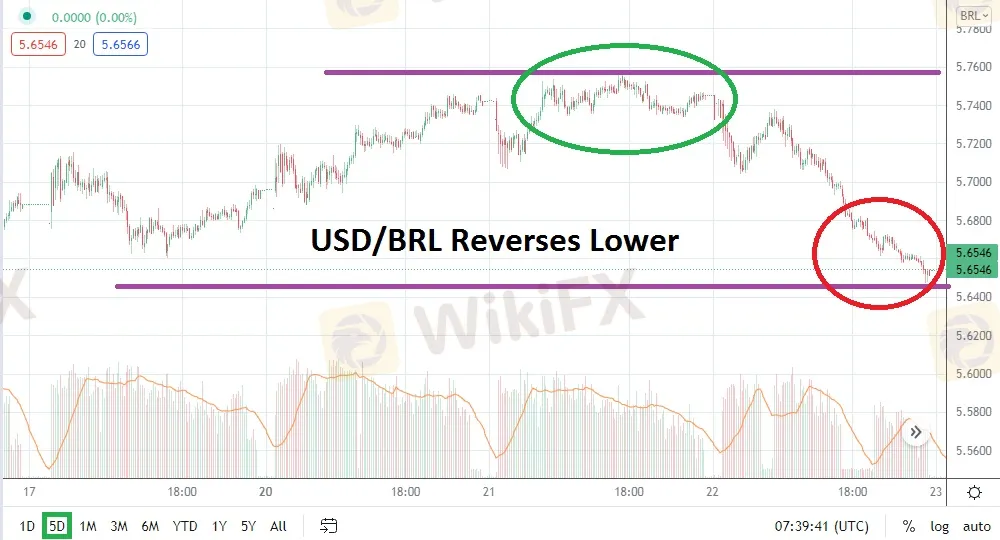

USD/BRL: Reversal Lower as Christmas Holiday Trading Looms

Abstract:Since hitting a high on the on the 21st of December near 5.7500, the USD/BRL has reversed lower, but light holiday trading awaits speculators in the coming days.

The USD/BRL will begin trading around the 5.6550 mark today and this follows a strong reversal after a high of nearly 75.7400 was displayed yesterday. The reversal lower was made after a test of mid-term highs was seen the past two days of trading. As the Christmas holiday now looms in the nearby shadows, speculators must take into consideration trading volumes will become thin but sudden choppy conditions may be demonstrated.

The reversal lower to the current value of the USD/BRL raises the question of another potential move higher which will try to recapture some of the lost territory. However, the USD/BRL is also now within sight of early December support values which, if proven vulnerable, could produce additional selling. The low for the USD/BRL this month was near the 5.5100 vicinity which was seen on the 8th and 9th. After those lows were hit, the USD/BRL began to track upwards.

The trading range for the USD/BRL may become consolidated as the Christmas holiday takes hold, and traders may want to consider the possibility that range-trading the Forex pair could produce speculative opportunities. If the USD/BRL maintains a legitimate price range of 5.5200 to 5.7400 over the next week of trading it would not be a major surprise. However, traders also should acknowledge the possibility that a momentary surge in either direction is a real possibility if a large transaction is placed with the USD/BRL that finds an imbalanced Forex market.

Traders need to understand what could appear to be a Forex pair that is almost seemingly asleep with little price action because of the holiday season, can suddenly demonstrate spikes which are hard to explain. Because of this, USD/BRL should have their stop loss and take profit orders working even if they believe the market is quiet. The recent ability of the USD/BRL to track lower may prove to be an interesting way to test the current trend particularly if support ratios begin to look strong near the 5.6200 to 5.6000 levels.

Conservative traders may want to be buyers of the USD/BRL if support is challenged but not seriously penetrated lower near term. And actually the same reasoning can be justified regarding resistance levels. Short-term, quick-hitting trades however may be hard to accomplish if a trader is too ambitious. Targets should be realistic short term, because price action could prove hard to attain as volumes from financial houses diminish.

Brazilian Real Short-Term Outlook

Current Resistance: 5.6750

Current Support: 5.6340

High Target: 5.7340

Low Target: 5.6090

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator