简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

RBA Statement: Pushes back on market wagers for an early rate rise

Abstract:The Reserve bank of Australia left its cash rate at a record low of 0.1% on Tuesday and ended its A$275 billion ($194.40 billion) bond-buying campaign as expected.

However, traders were disappointed because the statement has pushed back on market wagers for an early rate rise.

The statement emphasised that ceasing bond purchases did “not imply” a near-term increase in interest rates and the Board was still prepared to be patient.

“As the Board has stated previously, it will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range,” RBA Governor Philip Lowe said in a brief statement. “While inflation has picked up, it is too early to conclude that it is sustainably within the target band.”

Key points

Rba says it also decided to cease further purchases under the bond purchase program, with the final purchases to take place on 10 February.

RBA says committed to maintaining highly supportive monetary conditions.

RBA says the RBA's central forecast is for gdp growth of around 4¼ per cent over 2022 and 2 per cent over 2023.

RBA says will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range.

RBA says board is prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve.

RBA says the central forecast is for the unemployment rate to fall to below 4 per cent later in the year and to be around 3¾ per cent at the end of 2023.

RBA says while inflation has picked up, it is too early to conclude that it is sustainably within the target band

RBA says there are uncertainties about how persistent the pick-up in inflation will be as supply-side problems are resolved

RBA says likely to be some time yet before aggregate wages growth is at a rate consistent with inflation being sustainably at target

RBA says ceasing purchases under the bond purchase program does not imply a near-term increase in interest rates.

RBA says the board will consider the issue of the reinvestment of the proceeds of future bond maturities at its meeting in May.

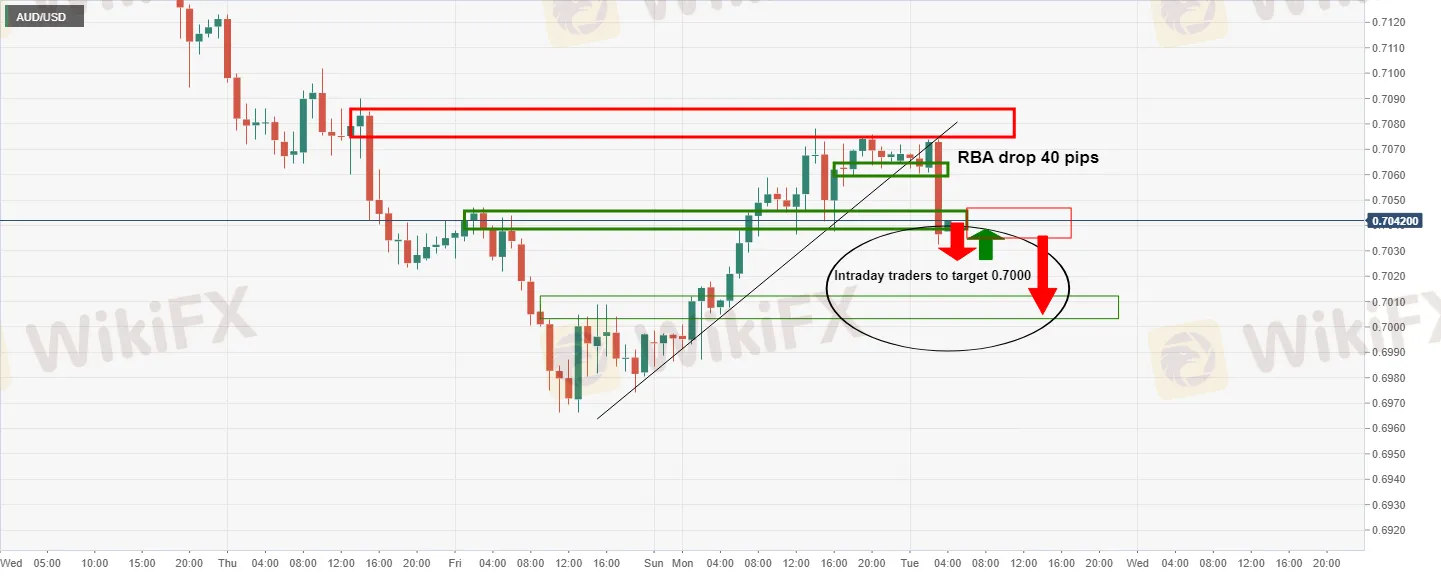

AUD/USD reaction

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Using Trendlines in Technical Analysis

Trendlines are a cornerstone of technical analysis, offering traders a visual guide to understanding market movements. By connecting specific price points, such as higher lows in an uptrend or lower highs in a downtrend, trendlines define the market’s trajectory.

What Really Drives Oil Prices?

For investors, fluctuations in oil prices represent both opportunities and risks. Understanding the factors behind these price changes can help investors make more informed investment decisions.

Mastering Support and Resistance in Forex Trading Success

Know why support and resistance levels are crucial in Forex trading, the best tools to identify them, and how they impact trading success.

Hidden Forex Fees That Can Drain Your Profits

Many traders focus on profits when entering the forex market. However, the costs of trading can silently eat into those profits. Brokers often advertise low fees and tight spreads, but hidden costs can add up. Understanding these fees is crucial for managing your trading expenses.

WikiFX Broker

Latest News

Top Regulated Forex Brokers with Prop Trading Options

Forex Regulators Around the World: Who’s the Strictest?

What Happens When a Broker Goes Bankrupt?

Woman Scammed Out of RM200,000 in Investment Fraud

XS.com Launches AI Insights to Transform Trading Behavior

Why Do Some Brokers Block Your Withdrawals?

FCA Cautions Against ALT-COINFX

Unlocking the Secrets of Prop Trading: How to Succeed in Proprietary Trading Firms

Tether’s $13B Profits in 2024 Amid UK Regulatory Scrutiny

Philippine Authorities Bust Manila Online Scam Farm, Arrest 100

Currency Calculator