简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Can 1Market make your money safe?

Abstract:What does 1Market look like? A reliable licensed broker can protect clients’ fund at any condition. Is 1Market reliable? Can we withdraw money from it? If you want to know whether 1Market is a reliable forex broker or not, please continue to read.

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of 1Market based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 31,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether 1Market is a scammer or not, we evaluated 1Market from different aspects, such as regulatory status, exposure, etc.

Table of Contents

1.Evaluate the reliability of 1Market based on its general information and regulatory status

(source: Twitter)

To understand 1Market better, we explore 1Market by analyzing three main perspectives:

A. General Info of 1Market

B. Regulatory Status

C. Fund Security

A. General Info of 1Market

1Markets general info has been shown below:

(source: WikiFX)

1Market has two clients portals, EU clients portal and global clients portal.

1Market clients portal for globe:

(source: WikiFX)

1Market clients portal for EU:

(source: WikiFX)

We can see the differences between the EU portal and the global portal in addresses and company phone numbers.

According to its website, 1Market is owned and operated globally by Podora Ltd., a Marshall Islands company with registration number 107838.

The website of 1Market supports 15 different languages.

a. Instruments&Assets

Instruments available at 1Market are currency pairs, shares, commodities, indices, Zero commission stocks, ETFs. 1Market provides traders with hundreds of different trading assets, which means people have a lot of options to invest in. The broker also offers over 120 technical indicators and charting options.

b. Minimum Deposit

There are six account options in total available at 1Market. The account types and their corresponding minimum deposit requirements are as followings: Mini (deposit from $500 to $1,000), Standard (deposit from $1,000 to $10,000), Gold (deposit from $5,000 to $50,000), Platinum (deposit from $10,000 to $100,000), Diamond (deposit from $50,000 to $500,000), and VIP accounts (deposit from $100,000 to $1,000,000).

1Markets requires a deposit of at least $500 as a trading start, which seems to be relatively higher than most brokers who ask only $50 to $100 for new investors to open an account.

(source: WikiFX)

c. Leverage

The maximum leverage offered by this broker is up to 1:400, however, investors are advised to use leverage in light of their risk tolerance.

d. Spreads & Commissions

On the 1Markets website, there is no specific information on spreads and commissions, which is kind of weird for a regulated broker does not display its important trading conditions. So investors should be careful.

e. Trading Platforms

1Markets traders are given access to two trading platform options, MT5 trading platform, and a proprietary online platform.

f. Insight Trading

Insight delivers up-to-the-minute, measurable trade insights which are the essence of successful online trading. With Insight Feed, you can measure the activity of your peers as they trade. Gather steam and lead the trend. Powered by a set of intelligent algorithms, Insight scans the trading activity of thousands of traders and assets available on 1Market's platform to provide real-time, data-driven insights into the community's morale.

g. Deposit & Withdrawal

1Market allows traders to deposit and withdraw funds via bank transfer, Credit/Debit card, and some e-payment processors including Neteller, Skrill, Paysafecard, Sofort. The time taken to process transactions may vary depending on the payment method used.

h. Customer Support

1Market offers a customer support team that claims to be available 24/5 and can be contacted via telephone, email, online form, and social media.

(source: WikiFX)

B. Regulatory Status

The legitimate license of 1Market

1Market is a licensed broker. It is regulated by CySEC.

(source: WikiFX)

C. Fund Security

As a broker regulated by CySEC, 1Market needs to keep the clients funds on segregated bank accounts. Account segregation is imperative since it allows traders to have access to their funds all the time. Even if the broker is bankrupt, traders will still be capable of getting their money back.

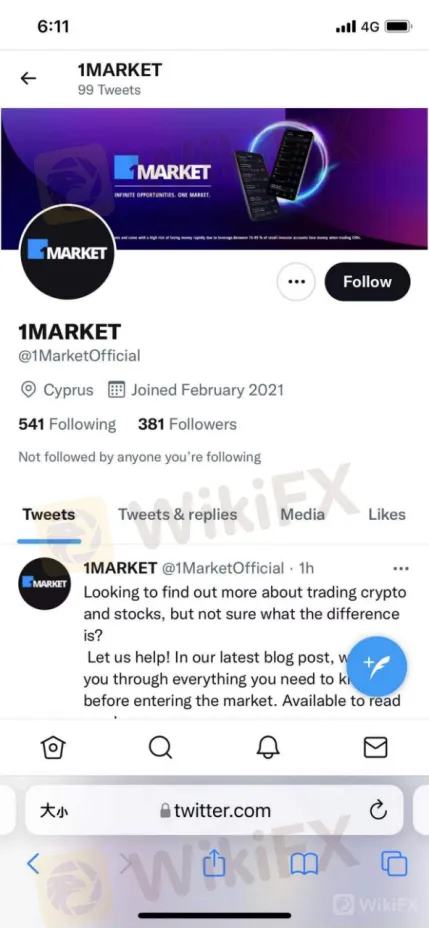

2. The feedback from Twitter

Joined Twitter on February 2021, 1Market does have an official account on Twitter. It recently has 99 Tweets. Compared to many other forex brokers, the number of followers is smaller.

(source: Twitter)

On Twitter, it is hardly easy to find feedback about 1Market from traders. But we do find the recent news related to 1Market. This news depicts how 1Market is improving itself to offer clients better services.

3.Exposure related to 1Market on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

WikiFX currently doesnt have an exposure related to 1Market.

4.Special survey about 1Market from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring criteria of Brokers on WikiFX |

| Lisence index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software Index: trading platform,instruments etc |

| Risk Management index: the degree of asset security |

According to WikiFX, 1Market has been given a decent rating of 4.66/10.

(source: WikiFX)

It seems that 1Market has a strong ability of risk management. Risk management includes the measurement, assessment, and contingency strategy of risk. Ideally, risk management is a series of prioritized events. The broker has enough capital and good strategies to secure clients' assets in the unstable market. This may be one of the reasons why WikiFX didn't receive negative reviews about 1Market yet.

B. Field Investigation

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

As of February 21st, 2022. WikiFX didnt do a site survey on 1Market yet.

5.Conclusion

1Market is a licensed broker that offers you a decent environment to invest in, but we recommend you do more research and get yourself comfortable before making a decision. After all, there are many better alternatives in the forex market. WikiFX contains details of more than 31,000 global forex brokers, which gives you a huge advantage while seeking the best forex brokers. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers that you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

IG 2025 Most Comprehensive Review

This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

EXNESS 2025 Most Comprehensive Review

This article evaluates the broker from multiple dimensions, including a basic introduction, fees, safety, account opening, and trading platforms.

WikiFX Review: Is IVY Markets Reliable?

IVY Markets, established in 2018, positions itself as a global brokerage offering a diverse range of trading instruments, including Forex, Commodities, Cryptocurrencies, and Stocks. The platform provides two primary account types—Standard and PRO—with a minimum deposit requirement of $50 and leverage up to 1:400.

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

Germany is set to hold a crucial general election on 23 February 2025, with voter frustration over migration emerging as a dominant issue.

WikiFX Broker

Latest News

Why Do You Keep Blowing Accounts or Making Losses?

eToro Adds ADX Stocks to Platform for Global Investors

B2BROKER Launches PrimeXM XCore Support for Brokers

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Checkout FCA Warning List of 21 FEB 2025

Google Bitcoin Integration: A Game-Changer or Risky Move?

IG 2025 Most Comprehensive Review

Why Should Women Join FX Market?

ED Exposed US Warned Crypto Scam ”Bit Connect”

Currency Calculator