简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

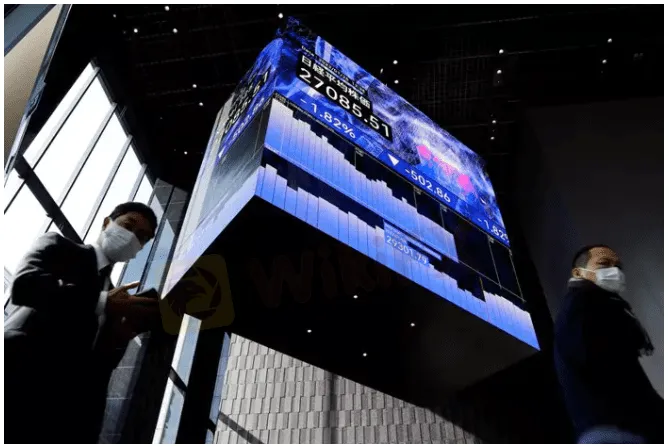

Miners lead gains as war and rate hikes rattle nerves

Abstract:Gains in banks, energy and mining stocks lifted Asian equities a little higher on Tuesday as investors braced for aggressive U.S. rate hikes and war disrupting oil supplies.

Oil futures rose nearly 3% to a two-week high in Asia.

The yen fell through the key 120 level against the dollar for the first times since 2016 and Treasuries extended losses after U.S. Federal Reserve Chairman Jerome Powell on Monday flagged a more aggressive tightening of monetary policy than previously anticipated.

MSCI‘s broadest index of Asia-Pacific shares outside Japan rose 0.2% led by gains in Australia’s miner-and-bank heavy index <.AXJO, which hit a two-month high. [.AX]

Japans Nikkei rose 1.7% to 27,276. [.T]

“This very sharp spike in commodity prices is actually having relatively mixed impacts … because we have some notable commodity exporters in this region, who would possibly stand to benefit,” said Manishi Raychaudhuri, Asia-Pacific equity strategist at BNP Paribas.

Meanwhile, “investors are coming to terms with the fact that the developed markets central banks would normalise monetary policy,” he said.

Powell had sparked a bond rout overnight after he told the National Association for Business Economics the U.S. central bank was prepared to do what it takes to combat inflation and that bigger-than-usual hikes would be deployed if needed.

Treasuries and U.S. stock futures remained on edge, with S&P 500 futures down 0.3% and rates-sensitive Nasdaq 100 futures down 0.4%. Benchmark 10-year Treasury yields hit an almost three-year high of 2.3330%. [US/]

Fed funds futures are now pricing a two-third chance of a 50-basis-point rate hike in May.

The Japanese yen, also sensitive to rising U.S. rates, fell past 120-per-dollar briefly and last bought 119.90. [FRX/]

Chinese markets, on the other hand, are awaiting policy easing after it was flagged by authorities last week.

China‘s blue chip index opened 0.2% lower while Hong Kong’s benchmark Hang Seng Index rose 0.7%.

Hong Kong shares of China Eastern Airlines fell 5.5% after its Boeing 737-800 with 132 people on board crashed in mountains in southern China on Monday.

Meanwhile, a lack of progress in the Russia-Ukraine peace negotiations continued to weigh on sentiment. Conflict raged on as Ukraine said on Monday it would not obey ultimatums from Russia after Moscow demanded it stop defending besieged Mariupol.

Oil futures extended gains on Tuesday morning on news that some European Union members were considering imposing sanctions on Russian oil and as attacks on Saudi oil facilities sent jitters through the market. [O/R]

Brent crude rose 2.9% to $118.93 per barrel. U.S. crude ticked up 2.4% to $114.85 a barrel.

The yen fell about 0.4% to briefly hit 120.08 per dollar in early Asia trade.

In other currency trade the euro was down 0.2% on the day at $1.0992, having lost 2.09% in a month, while the dollar index, which tracks the greenback against a basket of currencies of other major trading partners, was up at 98.758.

Gold was slightly lower at $1930.27 per ounce.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Unmasking the ‘Datuk’: The Anatomy of a RM638,205 Investment Scam

Authorities in Malaysia have launched an extensive investigation into a fraudulent stock investment scheme, which has resulted in losses amounting to RM638,205.

Unmasking the ‘Datuk’: The Anatomy of a RM638,205 Investment Scam

Authorities in Malaysia have launched an extensive investigation into a fraudulent stock investment scheme, which has resulted in losses amounting to RM638,205.

ATFX Enhances Trading Platform with BlackArrow Integration

ATFX integrates the BlackArrow trading platform, offering advanced tools for forex, crypto, and stocks with automation and real-time analytics for traders.

Exposing the Truth: What Happened with the Losses of Thousands of Dollars on the GlobTFX Platform?

The facts are clear and undeniably shocking—GlobTFX has caused significant financial losses to well-known traders in the Arab world. Eighteen victims have confirmed a total loss exceeding $22,372! But this is just the tip of the iceberg…

WikiFX Broker

Latest News

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

IG 2025 Most Comprehensive Review

SEC Drops Coinbase Lawsuit, Signals Crypto Policy Shift

Construction Datuk Director Loses RM26.6 Mil to UVKXE Crypto Scam

Should You Choose Rock-West or Avoid it?

Franklin Templeton Submitted S-1 Filing for Spot Solana ETF to the SEC on February 21

Currency Calculator