简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HYCM Trader: How to Build a Mobile Trading App Right

Abstract:Mobile trading has always been very important to the trading industry.

Indeed, online CFD brokers were among the first to recognise mobile as a valuable means of encouraging the broader adoption of trading as a lifestyle. As a result, theres a lot of discussion about mobile trading and mobile strategy from the perspective of the broker.

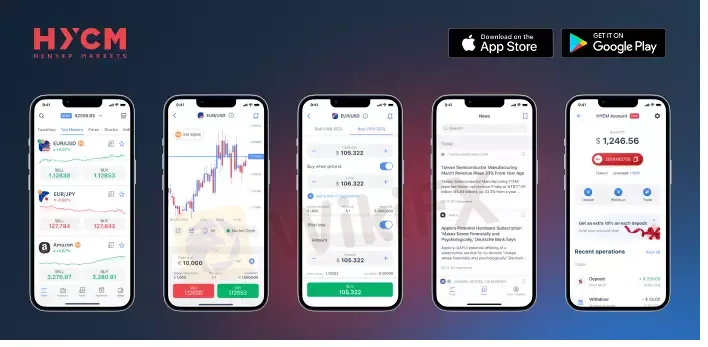

At HYCM, we recently launched our new mobile app, HYCM Trader, with the aim of appealing to a broader audience and providing clean design, intuitive UI, and all the functionality the modern trader could require. So, what are some of the ideas and principles that should be considered when creating a proprietary app?

Mobile trends

Quite often when discussing mobile, the focus is on demographics. Indeed, it is the most obvious and consistent trend to be observed; millennials spend most of their time on mobile devices, and the younger Gen-Z cohort uses them almost exclusively. In a nutshell: the original generation of online traders (Gen-X) were exclusively desktop users, the new generations are not.

What‘s much more interesting, is looking at some of the commonalities between the most popular apps across all categories to see if there’s anything to be learned there. According to Apptopia, the most downloaded apps in 2021 (worldwide) were: Tiktok, Instagram, Facebook, WhatsApp, and Telegram, in that order. What all these apps have in common, aside from all belonging to either the social media or messaging categories, are that they are almost entirely frictionless to install, easy to use, and support the idea of lifestyle and communication, unlike many financial and banking apps.

Most of us have experienced frustration with badly designed apps and cluttered screens. Therefore, our main focus was on developing a clean, modern interface and making it an intuitive, user-friendly app so that even novice traders can quickly learn how to use it.

Also, many trading apps allow clients to manage their accounts but dont actually have a trading functionality. HYCM Trader, on the contrary, allows users to buy or sell from our wide range of assets including forex, commodities, metals, stocks, indices, and cryptocurrencies (depending on the jurisdiction).

Principles of mobile design

Keeping up to date with the ever-evolving finance industry and the key trends plays a significant role in building a successful mobile application. We have identified that the ease of use, trading on the go, and integrated support are among the most desired characteristics of a mobile trading app.

To make our app easier to start using for our clients, and to potentially increase their retention, or ‘stickiness’, we designed a simple, intuitive, app-based experience that users only need to familiarise themselves with once. They will then be able to access all of our products, tools, services and support without ever needing to switch apps again. Our app features registration, document verification, funding, account management, analysis, trading, and communication with customer support, all in one place.

Verification is quite difficult to get right as each step in the process increases the odds of a potential user dropping off. To circumnavigate this, we used a prompt-based approach that quickly and easily guides the user through the process, while gathering all the relevant information in order to be fully compliant with the relevant regulators.

In addition to live trading, users can open a fully functional demo account that only requires a quick registration, so they can immediately start practising and learning via a charting interface optimised for touch. The platform itself comes with free technical indicators, a variety of chart styles, and all the required time frames for even the most demanding trader. We also integrated a Trading Central news section and an Economic Calendar to further encourage in-app planning, research, and analysis.

Because we built HYCM Trader to fulfil our clients trading needs, account management was extremely significant so we ensured that every action a client handles from their desktop client portal version is now fully incorporated into the app. This includes speedy deposits, withdrawals, and internal transfers between accounts, including between any existing MT4/MT5 accounts and the new HYCM Trader account that is created once the app is installed and registered.

Last but not least, the app also offers users the ability to get real-time support from our expert teams via their own preferred method of communication. Currently, Live Chat, WhatsApp, Messenger, Skype, Telegram, and Viber are available with the prospect of adding others in the future if we see the demand.

In conclusion

Mobile trading is no longer the future, it is the present. It has become significant for online brokerages to get their mobile app right. The approach were taking at HYCM is to create a completely new on-ramp that is designed from the ground up, to provide the kinds of retentive, all-inclusive experiences that modern users are accustomed to receiving from the most popular apps on their respective screens.

Download the HYCM Trader app from the Google Play or Apple Store

Note: Cryptocurrencies are not available for trading under HYCM (Europe) Ltd and HYCM Capital Markets (UK) Limited.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose.

Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCMs Risk Disclosure.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Blockchain Decentralization: Empowering a Trustless Future

In recent years, blockchain technology has rapidly evolved from a niche innovation behind Bitcoin into a transformative force across industries. At its core, blockchain decentralization refers to the distribution of authority and decision-making away from a central entity and into the hands of a distributed network of participants. This shift redefines how data is stored and verified and paves the way for trustless, transparent, and resilient systems that challenge traditional centralized models.

The president of @Liberland, @Vít Jedlička come on stage, dialogue on trading security.

The 2025 WikiEXPO Hong Kong Station is about to grandly open. the president of @Liberland, @Vít Jedlička come on stage, dialogue on trading security.

Countdown: 1 day.WikiEXPO2025's first stop, Hong Kong, is about to open.

⏰ Countdown: 1 day. WikiEXPO2025's first stop, Hong Kong, is just tomorrow. Focus on transaction security and explore new investment opportunities. ???? Get ready to start now. See you tomorrow.

JustForex vs JustMarkets: A Comprehensive Comparison in 2025

Selecting the right forex broker can make the difference between trading success and frustration for most investors, especially retail investors. As retail traders gain unprecedented access to global markets, the choice between platforms like JustForex and JustMarkets becomes increasingly significant. Both brokers offer some shining features within the forex and CFD trading space, but their approaches differ in some areas.

WikiFX Broker

Latest News

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Global Panic Builds as Forex Shifts into Risk-Off Mode

Shocking! Oil Prices Plunge Below $60

BI Alerts Filipinos: Telegram, Facebook Used for Trafficking Scams

AUD/USD Hits New Lows as Panic Selling Unfolds Amid Robust U.S. Jobs Report

SEC Fines Velox Clearing $500,000 for SAR Failures

How to protect your money during Black Monday

FCA Released New List of Unauthorized Brokers

Singapore Authorities Warned Against WeChat, UnionPay, Alipay Impersonation Scams

Deepfake Scams Nearly Drain $499K from Business

Currency Calculator