CMC Markets Information

CMC Markets is an established brokerage firm registered in Australia and regulated by FCA, FMA, MAS, and CIRO. With over 20 years of experience, they offer 12,000+ trading instruments including forex, indices, commodities, shares, and cryptocurrencies. Traders can access their services through the popular MT4/5 platforms as well as CMC NextGen Platform. CMC Markets provides a flexible account structure with no minimum initial deposit requirement and offers free demo accounts for practice trading. They have a strong customer support system, and provide various educational resources to assist traders in their financial journey.

Pros and Cons of CMC Markets

✅Where CMC Markets Shines:

Operate under a strong regulatory frame: CMC Markets has strong regulatory endorsement. CMC Markets are regulated by top-tier financial authorities, including FMA, FCA, CIRO, and MAS. A strict regulatory system can protect the security of users' assets.

Low spreads and low trading commissions (except stock CFDs): CMC Markets has the lowest fee structure in the industry. Traders trading on this platform can get a better trading experience, but its stock CFD trading fees are higher.

Provide a wide range of trading varieties: Trade CFDs on more than 12,000 instruments across global markets with confidence, including Forex, Indices, Commodities, Cryptocurrencies and more.

Wide range of educational resources: CMC Markets provides investors with a knowledge hub for news & analysis, learn CFD trading and platform guides. Investors can choose learning resources that suit them according to their characteristics and improve their trading capabilities.

No minimum deposit: CMC Markets has no minimum deposit, which is a great advantage for many investors with small amounts of capital.

❌Where CMC Markets Falls Short:

High stock CFD trading fees: Although CMC Markets low trading fees are an advantage, its stock CFD trading fees are very high, and stock CFD investors need to choose other cheaper traders for trading.

Is CMC Markets Legit?

CMC Markets is a globally recognized trading platform, rigorously regulated by several top-tier financial authorities including the Financial Conduct Authority (FCA) in the United Kingdom, the Financial Markets Authority (FMA) in New Zealand, the Canadian Investor Protection Fund (CIRO) in Canada, and the Monetary Authority of Singapore (MAS).

These regulations ensure that CMC Markets adheres to strict standards of market making and retail forex trading, offering a secure and transparent trading environment across multiple jurisdictions. This regulatory framework supports CMC Markets' commitment to providing safe and reliable trading services to its clients worldwide.

Market Instruments

CMC Markets provides a diverse range of trading instruments to cater to the needs of different traders. With CFD trading, users have the flexibility to go long or short on a variety of assets including forex, indices, commodities, cryptocurrencies and shares. This allows traders to profit from both rising and falling markets, maximizing their trading opportunities.

In addition, CMC Markets offers share investing in International Shares, Domestic Shares, ETFs, Options, and Crypto. This allows for a comprehensive portfolio diversification and investment in different sectors and industries.

Trading Accounts

CMC Markets provides two account types, namely Standard account and FX Active account. No matter which type of account a user chooses, the products available to the user are very rich. The following introduces the specific contents of the two accounts.

If an account remains inactive for 1 year—meaning no open positions or trading activity—it is considered dormant. For such accounts, a monthly inactivity fee of $15 AUD (or the equivalent in other currencies) will be charged. This fee is deducted from the account balance, usually within 3 business days of the start of the new month.

Additionally, CMC Markets provides free demo accounts wth $10,000 virtual funds, enabling traders to practice and familiarize themselves with the platform before opening a live account.

Demo MT4/5 accounts have initial period of 30 days, while no no expiry date for demo Next Generation account.

Traders have the flexibility to select the account type that aligns with their trading preferences, taking advantage of the benefits offered by each option.

How to Open a CMC Markets Account?

Step 1:Start the Process

Visit the CMC Markets website and click the “Open account” button located at the top right of the navigation bar.

Step 2: Choose Your Account Type

If you want to invest in shares, you can open a Share Investing account. If you want to trade CFDs, you can open a CMC account or MT4 account. Both offer demo accounts for practice. We recommend starting with a demo account to trade risk-free and familiarize yourself with the broker's trading conditions and platforms.

Step 3: Complete the Application

Follow the on-screen instructions to complete your application. You will need to fill in your personal information, including your email address, password, and more.

Step 4: Verify and Fund Your Account

Once your application is processed, verify your identity if required, and then you can fund your account to begin trading.

Leverage

The maximum leverage offered by CMC Markets is up to 1:200 for retail traders. While leverage can provide traders with several advantages, such as greater trading flexibility, potential for higher profits, increased market access, and enhanced trading opportunities, it also comes with certain disadvantages. One of the primary disadvantages is the increased risk exposure, as leverage magnifies both gains and losses. Traders need to exercise caution and implement proper risk management strategies to avoid significant losses. Additionally, the use of leverage requires a good understanding of the market and trading principles to make informed decisions.

Spreads and Commissions

CMC Markets offers competitive spreads for major currency pairs, with a live spread form indicating indicative prices. However, it's important to note that spreads may vary, especially during volatile market conditions. The company adopts a transparent commission structure, with commissions varying depending on the specific instruments traded.

Share CFD commissions vary on the country where the share product originates. It is worth mentioning that share commissions are subject to minimum charge requirements, such as the minimum commission charge of US$10 for US shares. Traders should carefully consider these factors and evaluate their trading strategies to effectively manage spreads, commissions, and other associated costs.

For detailed pricing, visit https://www.cmcmarkets.com/en-au/cfd/pricing

Trading Platform

CMC Markets provides traders with three platform options: MT4, MT5, and CMC NextGen.

MT4/5 is a widely recognized and popular trading platform known for its extensive range of technical indicators and automated trading tools. It offers a user-friendly interface and provides access to a diverse set of features.

On the other hand, CMC NextGen platform is a proprietary platform specifically designed for CMC Markets clients. It offers seamless integration with other CMC Markets services and features, providing a cohesive trading experience.

Traders can choose the platform that suits their preferences, whether they prefer the familiarity and customization options of MT4/5 or the integrated features of CMC Markets platform.

Deposit and Withdrawal

CMC Markets accepts deposits and withdrawals via credit/debit card, bank transfer, PayID or PayPal. The deposit fee is 1% for credit card payments and 0.6% for debit cards, while no any info on withdrawal fees.

Educational Resources

CMC Markets provides a comprehensive knowledge hub. Here, you can access market news and analysis, and learn about share investing with guides on getting started, platform use, investing basics, ETFs, and international markets. Additionally, you can explore CFD trading through their CFD knowledge hub, platform guides, MT4 academy, trading strategies, and trading guides.

CMC Markets also provides a user-friendly navigation system with various labels to help you quickly find what you need. These labels include Beginner, Advanced, Forex, How-to, Shares, Indices, Charting, Platform, Research, Strategy, Treasuries, Rates and Bonds, Commodities, Share Baskets, and Research Tools.

For instance, if you're a beginner looking for educational resources, simply click the “Beginner” label to view relevant materials. If you're interested in tutorials, the “How-to” label will guide you to those resources.

Explore more on their website for a well-designed and intuitive user experience.

Frequently Asked Questions (FAQs)

What are the trading platforms offered by CMC Markets?

CMC Markets provides MT4/5 and CMC NextGen.

Is there a minimum initial deposit required to open an account with CMC Markets?

No, CMC Markets does not require a minimum initial deposit.

Does CMC Markets offer a demo account?

Yes. Demo MT4/5 accounts have initial period of 30 days, while no no expiry date for demo Next Generation account.

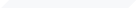

haha1351

Vietnam

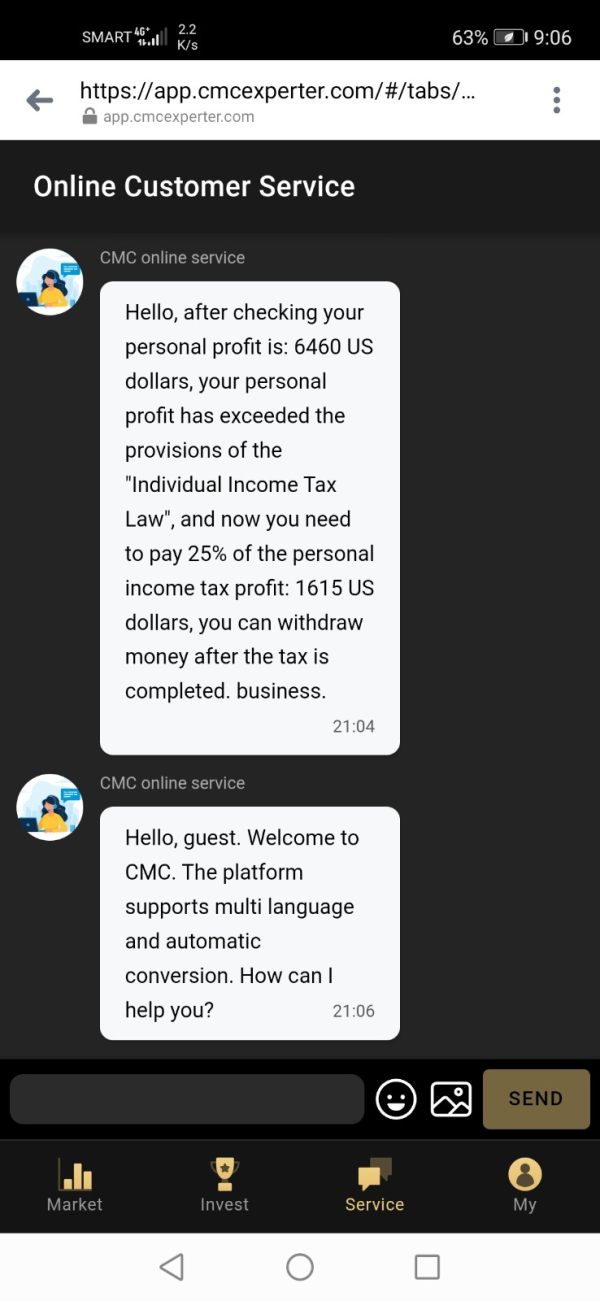

The first time I deposited a small amount of money, I withdrew it after 5p, then I added my account to $5685 and withdrew it to pay 20% tax because over 100 million has personal income tax, if I don't pay it, my account will freeze after 24 hours. Money hangs for 1 day

Exposure

2023-04-11

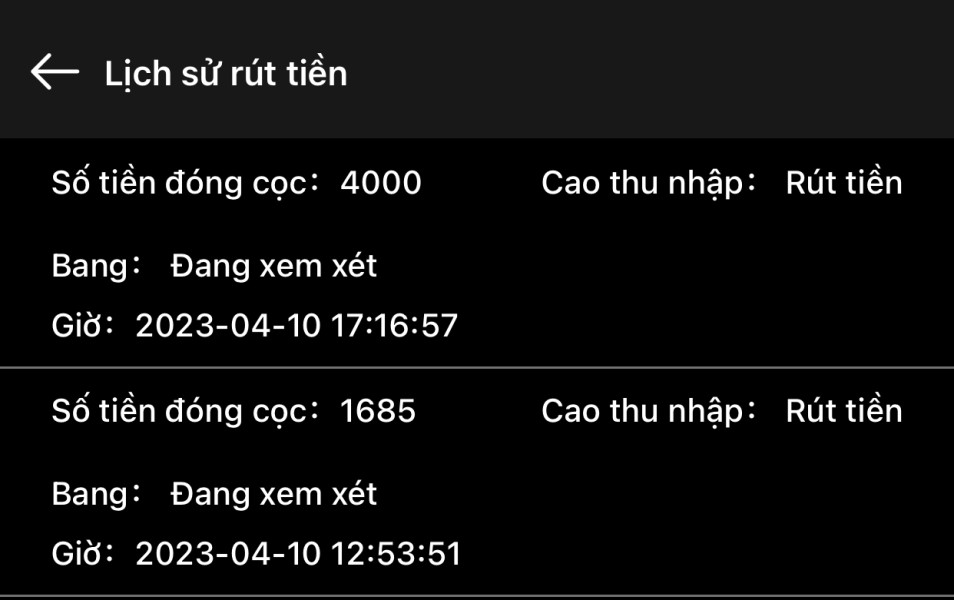

Heba5649

Libya

im being helpless trying to contact any legel department of your behlalf no one answerd me is that a legal paper of your legal depratment or not

Exposure

2022-12-19

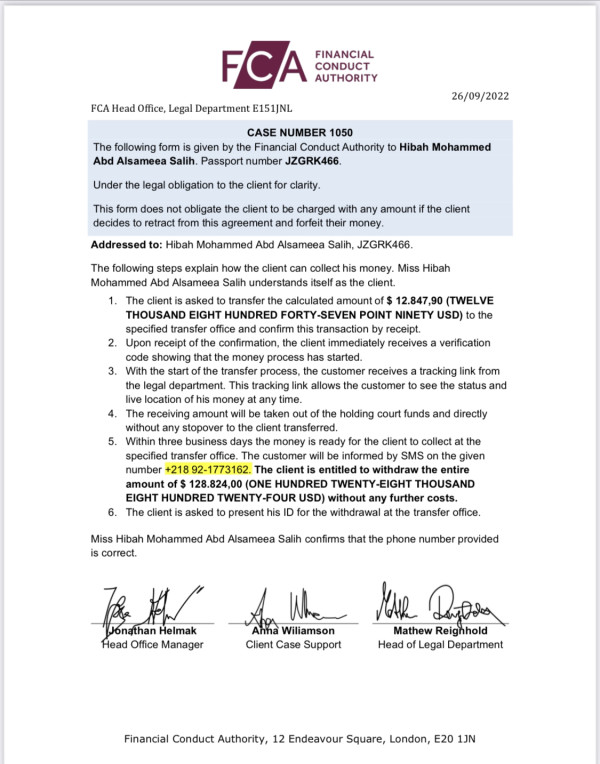

Kim Anonuevo

Philippines

At first they will allow you to withdraw the capital and the little profit then the next time you deposit and traded it they will hold your account then force you to pay personal income tax. They will ban your account and hold the balance, even if you paid the personal income tax already they have some alibi for you not to withdraw your money and still banned your account. Can you help me to withdraw my money. Thanks a lot.

Exposure

2022-01-30

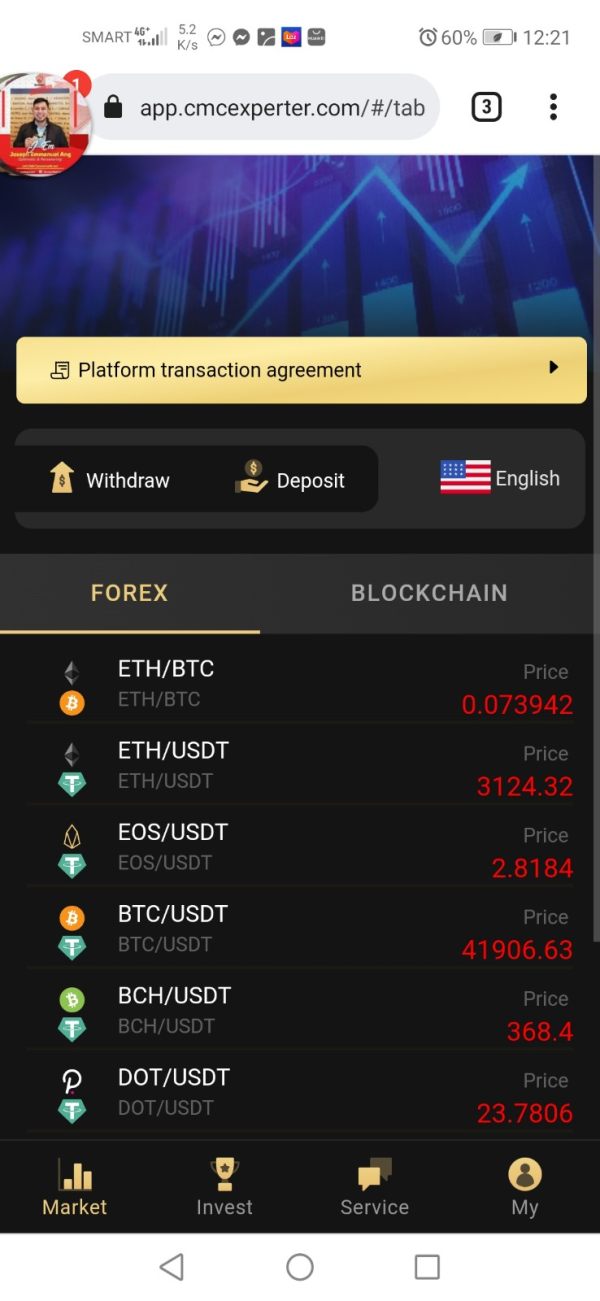

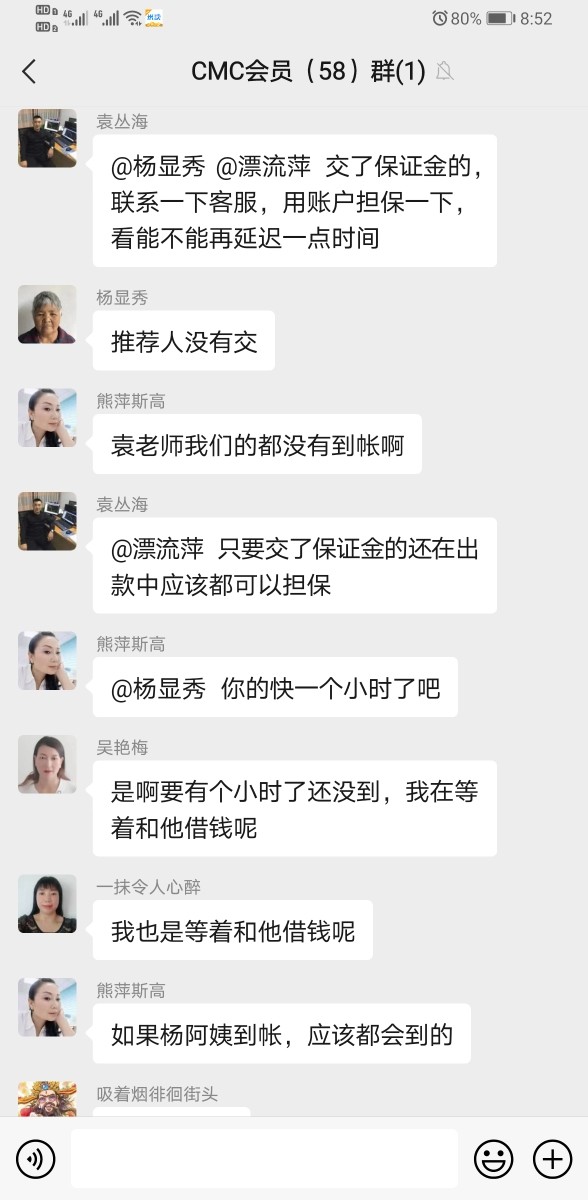

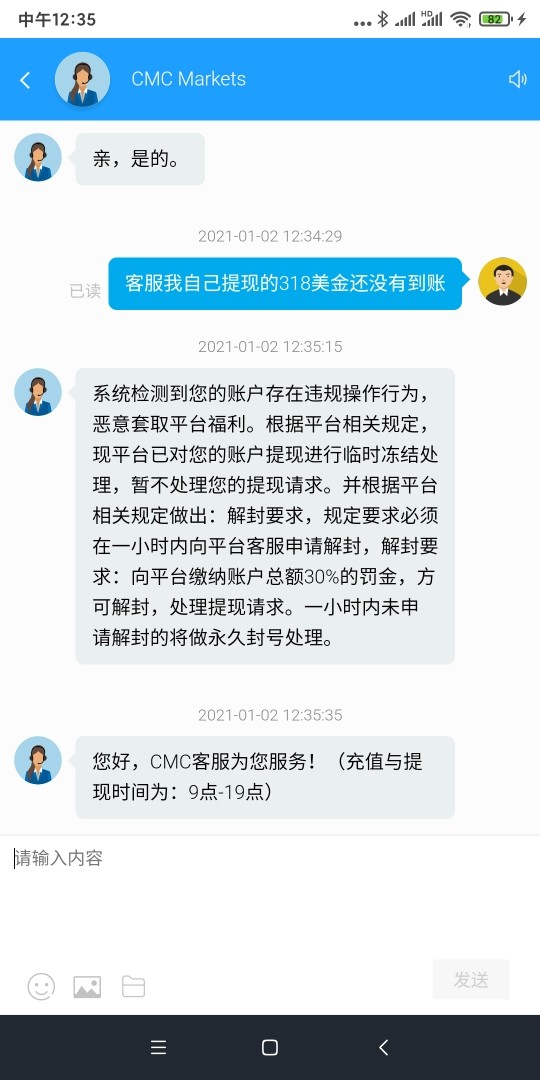

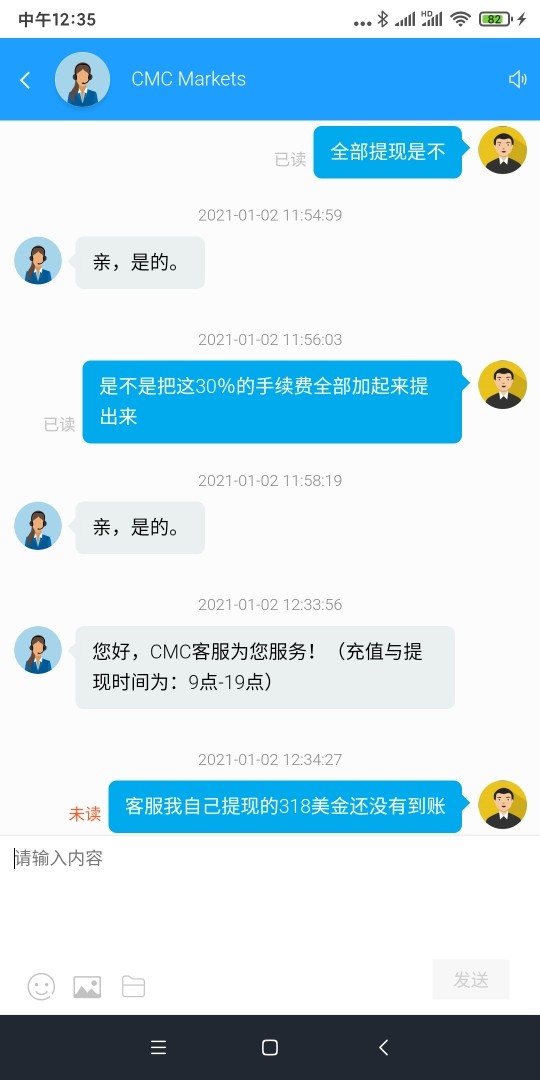

青青青®

Hong Kong

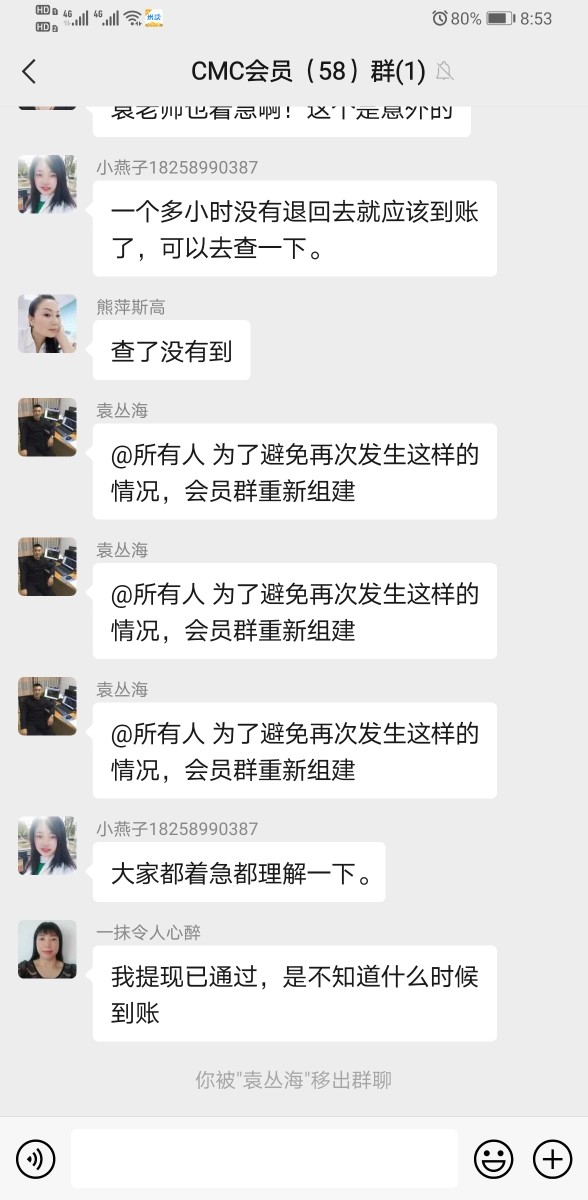

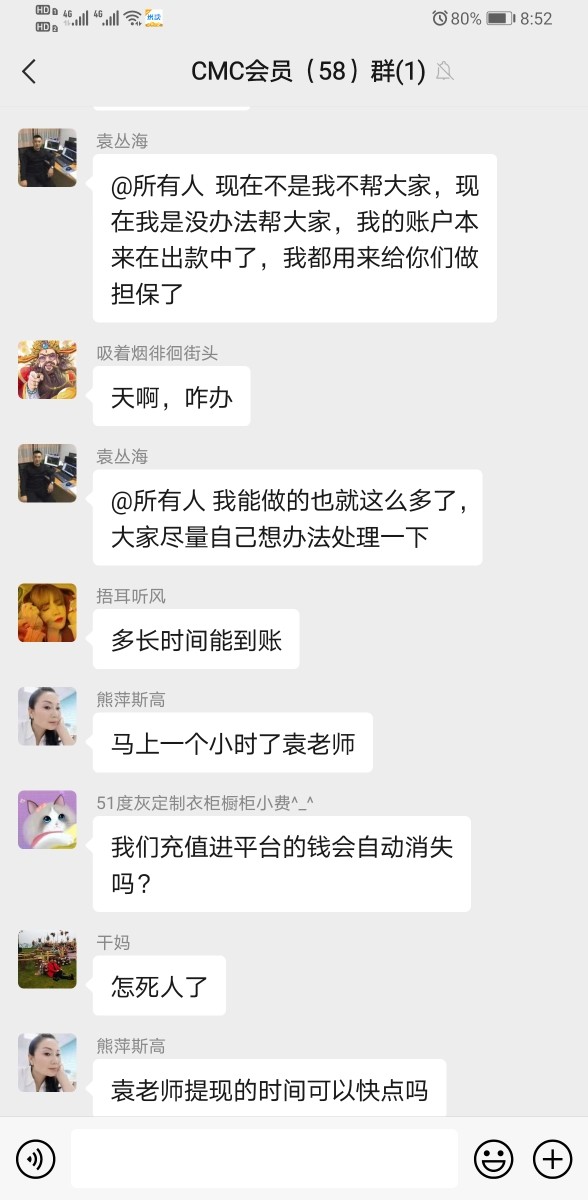

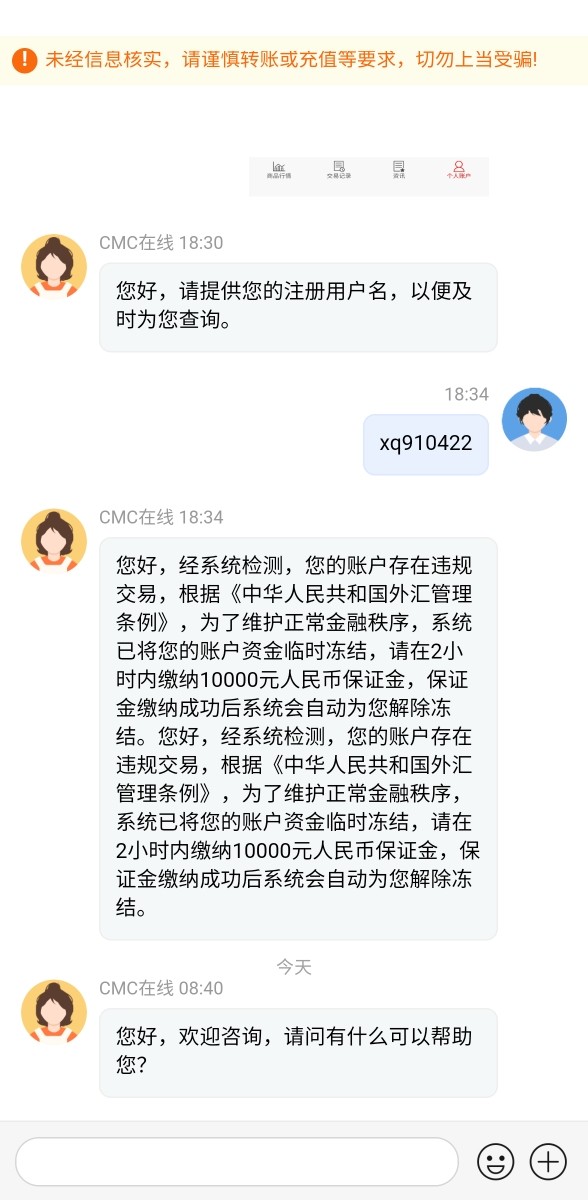

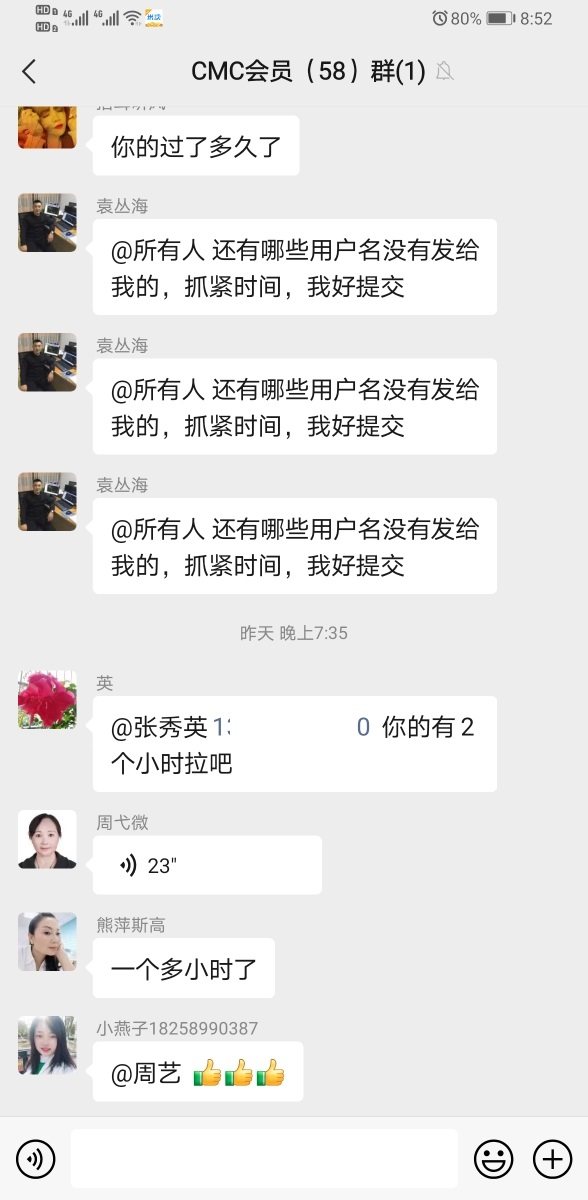

The so-called teacher of CMC teaches you how to make money. First, build a group, and then a group of people continue to talk about how good the teacher is, how much money they made, thank the teacher in various ways, and then say how much money they have invested and how much they made. Others followed the investment and even some people borrowed money everywhere to invest. After that, the funds could not be withdrawn, and they contacted customer service. The customer service said that the funds were frozen and needed 10,000 yuan to unfreeze. After that, except for the victims, the scammers were not found.

Exposure

2021-01-27

董 建

Hong Kong

Criminal gangs. Pls pay attention and free from being cheated. We were cheated of several millions

Exposure

2021-01-02

小汽车

Hong Kong

Unbale to withdraw. There was a campaign if you deposit you can get bonus at Christmas. But after the campaign, unable to withdraw

Exposure

2020-12-28

FX3312406671

Vietnam

I applied for withdrawing my money in August but haven’t received my money yet. I wish to get some support!

Exposure

2020-10-07

Kaye Lam

Australia

I can't tarde by MT4 with no notification. I didn't know the situation until I called the service customer. However, the service customer didn't know when the MT4 would be available.

Exposure

2020-08-24

qingdaops

Hong Kong

I was asked to pay margin in wake of wrong account information. After that, CMCMarkets asked me to make up for insufficient credit score, with 10 thousand per score. Having been scammed of 340 thousand, I called the police!

Exposure

2020-08-01

我的电脑

Hong Kong

CMCMarkets kept holding off time. It claimed that the withdrawal would be available on the afternoon of the day. I applied for it on Saturday, while it was yet to be received as of Thursday.

Exposure

2020-07-22

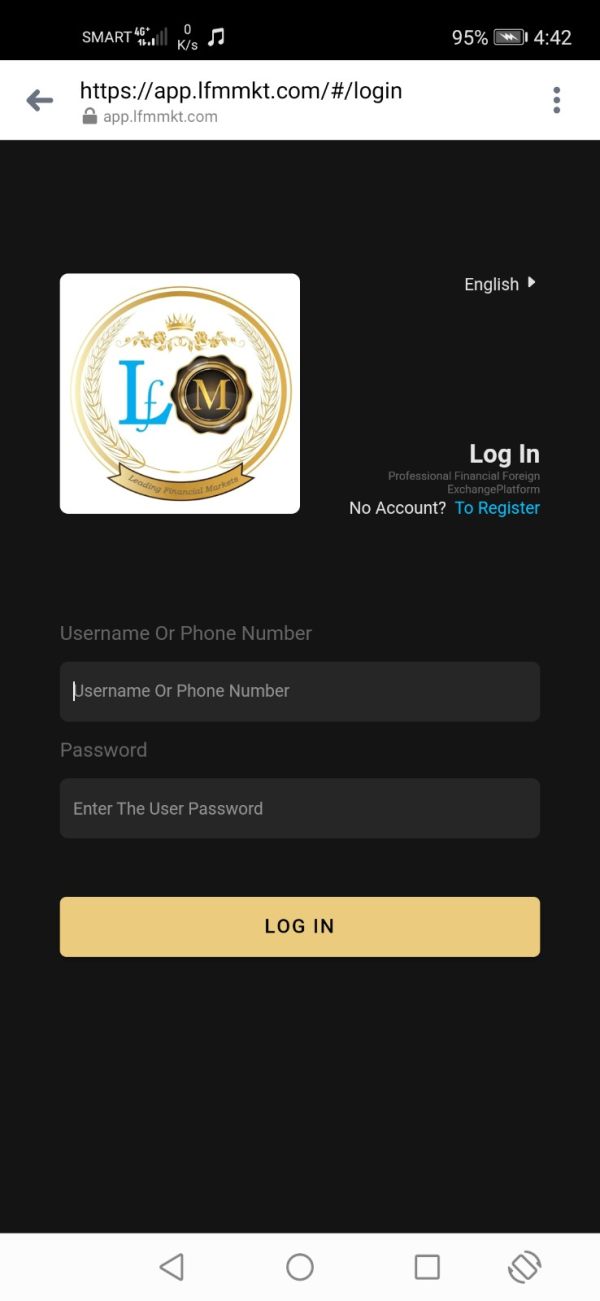

FX2572528622

Singapore

The withdrawal is unavailable. CMCMarkets banned me to modify the bank account. The APP is not the official one. The interface of the real one is on the second pic. It has banned clients in Chinese mainland to register since last year.

Exposure

2020-06-29

FX4381079132

Hong Kong

The platform refused to give access to withdrawal.

Exposure

2020-05-02

FX1928061071

Hong Kong

Can any department see to this and take the fund back for me?

Exposure

2019-11-18

牧马人

Hong Kong

CMCMarkets’s UnitedFinancial doesn’t allow to withdraw money, suspending my account. After I called the police, the problem has not been processed. CMC shirked the responsibility with the excuse that Feng Hao and Song Ying resigned and the former foreign exchange department disbanded. Of the two people, one ran to Shandong and one hide in Beijing. For four months, the case has not progressed due to various reasons, and the negotiations have been fruitless. I hope everyone will be vigilant.

Exposure

2018-08-06

Sarre

United States

Trading transparency is appreciated, but the platform's fee structure can be confusing. A clear breakdown would be helpful.

Neutral

2024-08-06

Algernon Cholmondeley

Ecuador

While customer support is generally helpful, I've had occasional delays in their response. The fees are competitive, but it's crucial to be aware of the costs associated with certain services.

Neutral

2023-12-06

Una丶Daddy

Cyprus

Absolutely loving CMC Markets! The platform is super easy to navigate, making trading a breeze. They offer a wide range of assets to choose from, and the educational resources are top-notch. The Next Generation platform is a game-changer, providing advanced tools for market analysis. Customer support has been responsive via chat and email, but I wish phone support was more efficient.

Neutral

2023-12-05

Golden88

Cyprus

CMC Markets, what a ride it's been! The intuitive mobile platform and excellent spreads made trading a breeze most of the time! BRAVO!!!

Positive

2024-04-19

Tard

Philippines

it's a reliable platform and been using for a few months and I'm not having a problem

Positive

2023-06-14

^_^^_^依一

Cyprus

Having been using CMC Markets for years, first-class trading platform, and customer service, very good executions and never had an issue with mobile trading. CMC, Markets, good!

Positive

2023-02-20