简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WIKIFX REPORT: CySEC-regulated LegacyFX attacks European clients via unauthorized offshore entity!

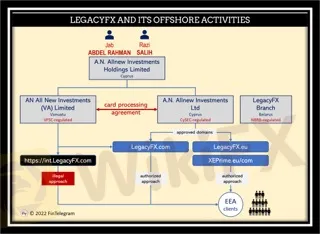

Abstract:For European authorities, offshore onboarding to avoid ESMA and FCA standards is still a major concern. As FinTelegram has often pointed out, CySEC, in particular, has had an issue with this method for years. A.N. All News Investments Ltd d/b/a A.N. All News Investments Ltd d/b/a A.N. All News Investment LegacyFX is a CySEC-regulated CIF that works with offshore mutations to attract European clients. Their offshore broker is AN All New Investments (VA) Ltd in Vanuatu. However, the CySEC-regulated entity processes all of this offshore broker's card transactions. Here's the latest news!

Offshore onboarding to circumvent ESMA and FCA guidelines is still a big issue for European regulators. Especially CySEC has had a problem with this approach for years, as FinTelegram has pointed out repeatedly. A.N. All News Investments Ltd d/b/a LegacyFX is one of those CySEC-regulated CIFs that works with offshore mutations to solicit clients in Europe. AN All New Investments (VA) Ltd in Vanuatu is their offshore broker. However, all card transactions of this offshore broker are processed by the CySEC-regulated entity. Here is an update!

The narrative

The offshore entity in Vanuatu, regulated by the Vanuatu Financial Services Commission (VFSC), is used to operate the international LegacyFX platform (https://int.legacyfx.com). However, this entity is also used to attract consumers in Europe, Asia, Australia, and Africa for which it has no authorization.

EU residents, when registering on the offshore site of LegacyFX.com, are asked which leverage they want to have and with which regulator – VFSC, NBRB, or CySEC – they want to register. When selecting the leverage 1:200 and VFSC, one receives the hint that ESMA is not responsible for this site and therefore, registration is at your own risk.

In addition, you will receive a declaration statement by email, which you should sign. In this statement, the new offshore client confirms that he has decided to register on his own initiative. This Declaration Statement should be signed.

In our review on 10 April 2022, we registered for the 1:200 leverage broker with the VFSC-regulated AN All New Investments (VA) Ltd. Although we did not sign this Declaration Statement and did not verify our ID or address, we could have theoretically made unlimited deposits.

Unlimited pre-KYC deposits

In particular, the following limits have been stated with the different payment options in our reviews in February and April 2022:

unlimited deposits via bank transfer through Volt or by credit and debit card.

up to €6.5k via BridgerPay and card payments

up to €200,000 via Swiss payment processor Xentum

up to €200,000 via crypto exchange Finrax

up to €100,000 with the Russian Perfect Money

up to €50,000 with Jeton

Payment services for credit and debit cards and bank transfers go through BridgerPay Cashier. Bank transfers are processed through Volt (https://volt.io). In addition to BridgerPay, there is also the option to make deposits with credit cards through Trust Payments.

Conclusion

LegaxyFX, as well as other CySEC CIFs, systematically use offshore onboarding to circumvent and violate ESMA and CySEC regulatory requirements. Neither the onboarding procedure (without proper KYC/AML) nor the offered leverage of up to 1:200 complies with regulatory requirements in UK and EU. The reference that the customer signs up at their own risk is ineffectual. How many minutes do you think it would take a LegacyFX call center to convince the client of the benefits of the offshore broker?

It would be very easy for LegacyFX, FXORO, IC Markets, and the other CIFs to apply algorithmic procedures to prevent UK or EU clients from registering with the offshore entity. The truth, however, is that this offshore onboarding is done willfully and knowingly. The payment options are designed for European customers with SEPA transfers and accounts in the UK or EU.

Clients of offshore entities are not entitled to investor compensation schemes or other ESMA intervention measures. They are also not entitled to assistance from Financial Ombudsman institutions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Is Billion Bucks Fx Scam?

Recent claims on YouTube and social media platforms allege that Billion Bucks Fx is a scam broker. Many traders have reportedly lost money after investing with this broker, and it has been given a notably low score of 1.06/10 by independent rating platforms. In this article, we break down the details of Billion Bucks Fx, assess the risks, and provide insight into whether investors should be wary of its services.

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

The worlds of social media and decentralized finance (DeFi) have converged under a new banner—SocialFi. Short for “Social Finance,” SocialFi leverages blockchain technology to reward user engagement, giving individuals direct control over their data and interactions. While SocialFi has primarily emerged in the context of content creation and crypto communities, its principles could soon revolutionize the forex market by reshaping how traders share insights and monetize social influence.

Do This ONE Thing to Transform Your Trading Performance Forever

The story is all too familiar. You start trading with high hopes, make some quick profits, and feel like you've finally cracked the code. But then, just as fast as your gains came, they disappear. Your account balance dwindles, and soon you’re left wondering what went wrong. Worse still, fear and confusion creep in, making every new trade a stressful gamble rather than a calculated decision. If this cycle sounds familiar, you’re not alone.

This FREE App Is Helping Millions Avoid Financial Scams

Fraudulent brokers, Ponzi schemes, and deceptive trading platforms are on the rise, making it increasingly difficult to distinguish between legitimate and illicit financial services. Fortunately, there’s a powerful, free tool designed to help users identify and avoid scams before it’s too late—WikiFX.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator