简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

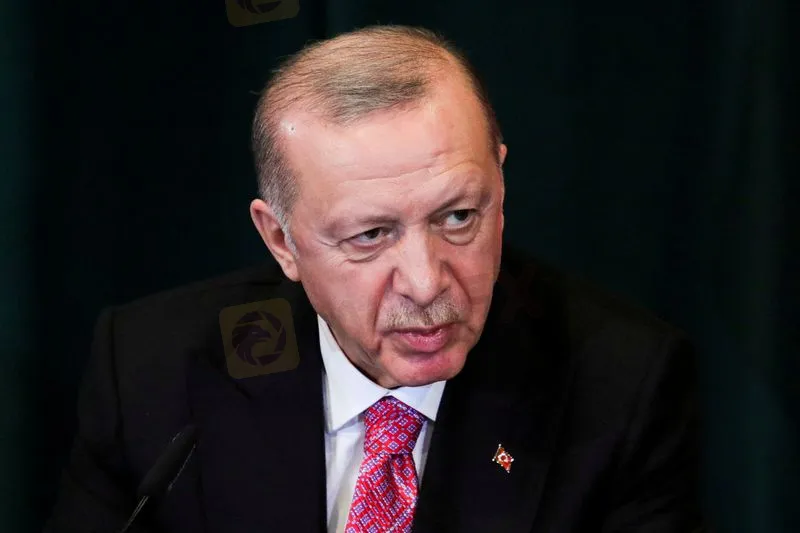

Erdogan says May figures show inflation is on downward trend

Abstract:Turkish President Tayyip Erdogan said on Sunday that inflation figures from the month of May, when annual consumer prices jumped to a 24-year high, showed inflation was now on a downward trend.

Turkish President Tayyip Erdogan said on Sunday that inflation figures from the month of May, when annual consumer prices jumped to a 24-year high, showed inflation was now on a downward trend.

Inflation jumped to 73.5% in May - fuelled by a tumbling lira, rising energy costs and the war in Ukraine - though the figure was slightly lower than economists had feared.

Speaking to members of his ruling AK Party, Erdogan said his government was working on ways to alleviate Turks' economic woes and combat soaring prices. For more forex news, please download WikiFX - the Global Dealer Regulatory Inquiry APP.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why Fed Keeps Interest Rates Unchanged, How Does It Affect To Forex Market?

Fed keeps interest rates at 4.25%–4.50%, impacting forex market. Dollar may rise as tariffs loom. Explore why rates unchanged and forex effects.

Do Tariffs Refueling Inflation? Understanding the Connection

Investigate how tariffs impact inflation. Learn how trade barriers influence prices and the broader economic landscape.

Will Trump's Trade Policies Fuel Inflation? BlackRock Warns of Economic Risks

Bitcoin and crypto prices plummet as recession fears and inflation warnings shake markets. Experts warn of prolonged economic challenges ahead.

How Will Central Bank Digital Currencies Could Shape Everything?

Central bank digital currencies (CBDCs) could reshape financial stability, addressing inflation, banking risks, and monetary policy challenges.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

The Growing Threat of Fake Emails and Phishing Scams

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator