简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Exposes SAEN Markets | An Unregulated Broker that Cheats Its Clients

Abstract:Saen Markets is a forex market that was established in 2021 in the United Kingdom. Upon writing this article, we realised that Saen Markets does not give a good impression.

Why is WikiFX warning our users about SAEN Markets? We received a client complaint through our Exposure page https://exposure.wikifx.com/en/revelation/1.html detailing his unpleasant experience with SAEN Markets.

This is because its official website saenmarkets.com fails to load even after several attempts, on both desktop and mobile devices. This possesses a big risk to its clients because they do not have access to their trading funds and trading accounts let alone a customer support team to seek help from.

Saen Markets gets a fairly low WikiFX score because this broker does not have much reliable information for the public.

Although SAEN Markets pridefully claims that it is licensed by the United States National Futures Association (NFA) under license number 054282, WikiFX did a thorough review and found that this license is not authorized by that regulatory body.

For more tips on identifying the underlying risks of forex brokers, read these 2 articles here:

Link to article: https://www.wikifx.com/en/newsdetail/202206026004646933.html

Link to article: https://www.wikifx.com/en/newsdetail/202206141794544736.html

Now, let us take a look at the complaint that we received in regards to SAEN Markets and its ploy, alongside the evidence that was provided by the client himself.

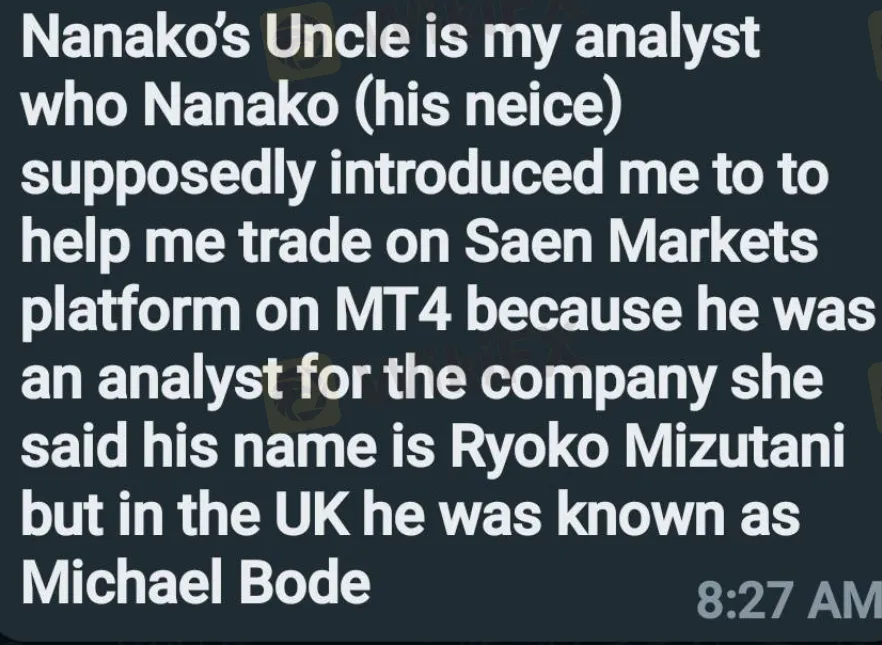

Firstly, the client was approached by Nanako from Japan (real name: Linda from the UK) who claimed to be a successful client of SAEN Markets. She then introduced him to her uncle, Ryoko Mizutani (real name: Michael Bode from the UK) who is an analyst at Saen Markets that contributed greatly to her personal success and profits.

The client believed both of them and thought he could make huge gains under Ryoko Mizutani's guidance.

Like any conventional scammers who play the long game, they lure victims into thinking that they are on the “right track” by giving them instant benefits and advantages. In this case, the fraudster analyst gained the client‘s trust through his winning signals which brought the client’s initial capital of less than $10,000 to nearly $50,000.

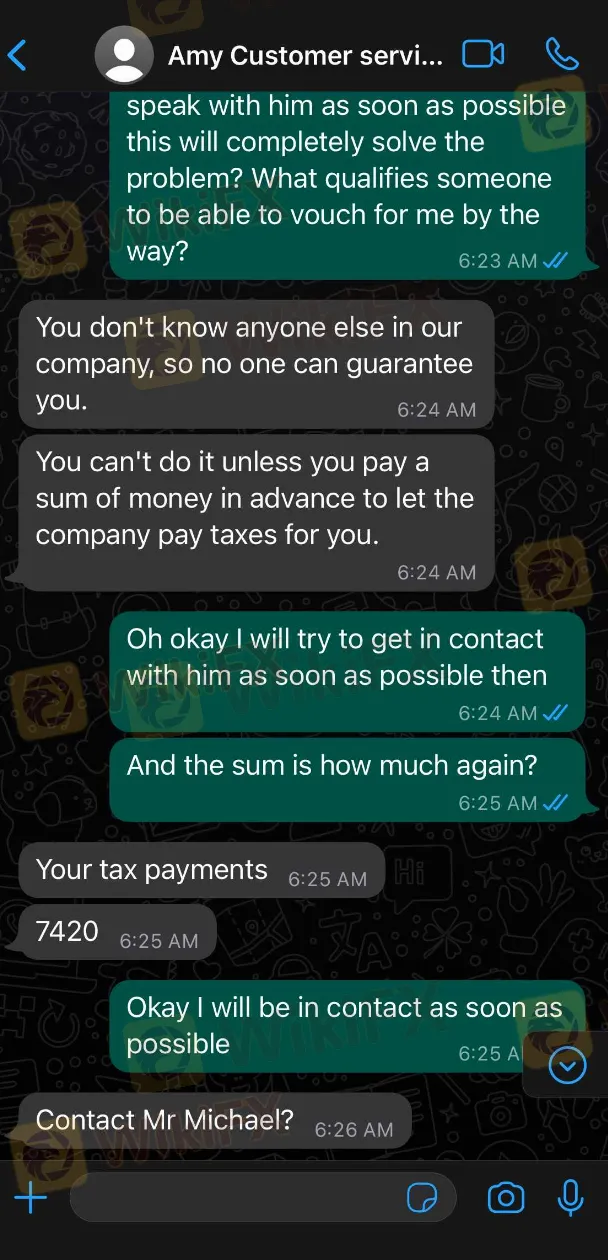

When the customer wished to make a withdrawal on his profits, he was told to pay fees and taxes by a customer service representative from SAEN Markets, named Amy, over Whatsapp. Meanwhile, the “analyst” faded out of the picture because he was “coincidentally hospitalized”.

Unfortunately, the worst happened to the customer. After he deposited the money as instructed by the customer support representative, Amy, deleted her Whatsapp account entirely. Feeling hopeless and helpless, the client reached out to WikiFX for assistance to resolve this case.

Currently, WikiFX is diligently investigating this case. We are experts in handling any forex broker-related queries and/or disputes. If you have ever been treated unfairly by your forex brokers, please do not hesitate to seek help from WikiFX through the channels below:

Alternatively, visit us at www.wikifx.com or download the free WikiFX App on Google Play/App Store to get in touch with us.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Webull Launches SMSF Investment Platform with Zero Fees

Webull introduces commission-free SMSF trading, offering over 3,500 US and Australian ETFs, with no brokerage fees and enhanced portfolio tools.

How Will the Market React at a Crucial Turning Point?

Safe-haven assets like gold and U.S. Treasuries are surging, while equities face mounting pressure. As this pivotal moment approaches, how will the market react?

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Gold prices have hit record highs for three consecutive days, with a remarkable 19% gain in the first quarter, marking the strongest quarterly performance since 1986. As market risk aversion rises, demand for gold has surged significantly.

HTFX Spreads Joy During Eid Charity Event in Jakarta

On March 14, HTFX showcased its deep commitment to social responsibility by hosting a heartwarming Eid charity event in Jakarta, Indonesia. This meaningful gathering aimed to convey warmth and care through practical actions, uniting the local community and making a significant impact on those in need.

WikiFX Broker

Latest News

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator