简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Start FX Trading with Little Money? WikiFX Makes This Possible

Abstract:Many people have this misconception that they need a significant amount of money to start trading forex. However, this is far from the truth. Forex trading is a skill set that takes time, and patience with lots of practice to master. If you are a beginner trader or have not been consistent in growing your trading account, this could be a useful tip to change your game once and for all.

For inexperienced/novice traders, it is ideal and necessary to start trading with a mini account. By investing a small amount of money and trading mini lots (compared to a standard lot, e.g. 0.01 lot), traders can test their trading knowledge and trading skills without being exposed to serious financial risks.

By starting to trade with a mini lot, traders can learn risk management and market flows more effectively and without the unnecessary psychological stress that would be associated with starting with a standard lot. Learning how to deal with risk management and trading emotions is also necessary; thus mini and micro-accounts and mini lots make the learning process more effective – as there is little to none that a trader could lose since they can start with a humble capital.

There are some brokers that not only offer mini accounts with low minimum deposit requirements, which give the freedom to choose and flexibility to their clients with a low barrier of entry into the currency markets.

Some feel comfortable trading 0.1 lots but some people find more comfort and confidence in trading only 0.01 lots. Some brokers offer cent accounts (also known as micro accounts) wherein traders can trade as low as 0.001 lot.

For mini accounts, the risk involved in trading positions of different sizes varies greatly, as illustrated by a simple example here:

Trader A has a trading account with $250 in funds, trading 0.1 lots, each pip being equivalent to $1.

Trader B has a trading account with $250 as capital, trading 0.01 lots, each pip is equivalent to $0.1.

Let's assume that both traders face a loss of 40 pips. Now, lets calculate the balance of their accounts:

Trader A will face a loss of $40. Its net account value will arrive at $210 with a 16% drop.

Trader B will face a loss of $4 only. Its net account value will arrive at $246 with a 1.6% drop.

See how significant the differences are?

If you would like to be able to calculate the total fluctuating amount based on the number of pips, simply refer to this article here: https://www.wikifx.com/en/newsdetail/202205237954395851.html

To be a good trader, you need to put risk management in the first place. For newbies, your priority should be learning the forex trading skillset through as much practice and back testing as you can, instead of focusing on the profits. Hence, it is always advisable to start small and gradually build your way up.

Among so many brokers out there, how can traders, especially inexperienced traders carry out this survey in choosing the right broker and account type for themselves?

WikiFX.com or the free WikiFX mobile application that is available on both Google Play/App Store is the answer to that question above.

Type in the name of the forex broker of your preference. To make this process easily understandable, we will implement a few examples as demonstrations.

Example 1:

IC Markets is a renowned forex broker within the industry. This image shows IC Markets‘ profile shown in the WikiFX mobile app. Here, users can obtain all the useful and relevant background information about this broker, including WikiFX’s rating and scores given to it, its regulatory status, licenses held, and years of operation, as well as global field survey documentation.

At the bottom of the page, click on “Accounts” to see what are the types of accounts are available.

As seen here, IC Markets offers 3 types of trading accounts.

Among the 3 account types offered by IC Markets, there are 2 accounts that offer a fairly low funding requirement of $200 as well as a minimum position of 0.01 lot for traders to begin their trading journey without much financial burden.

Example 2:

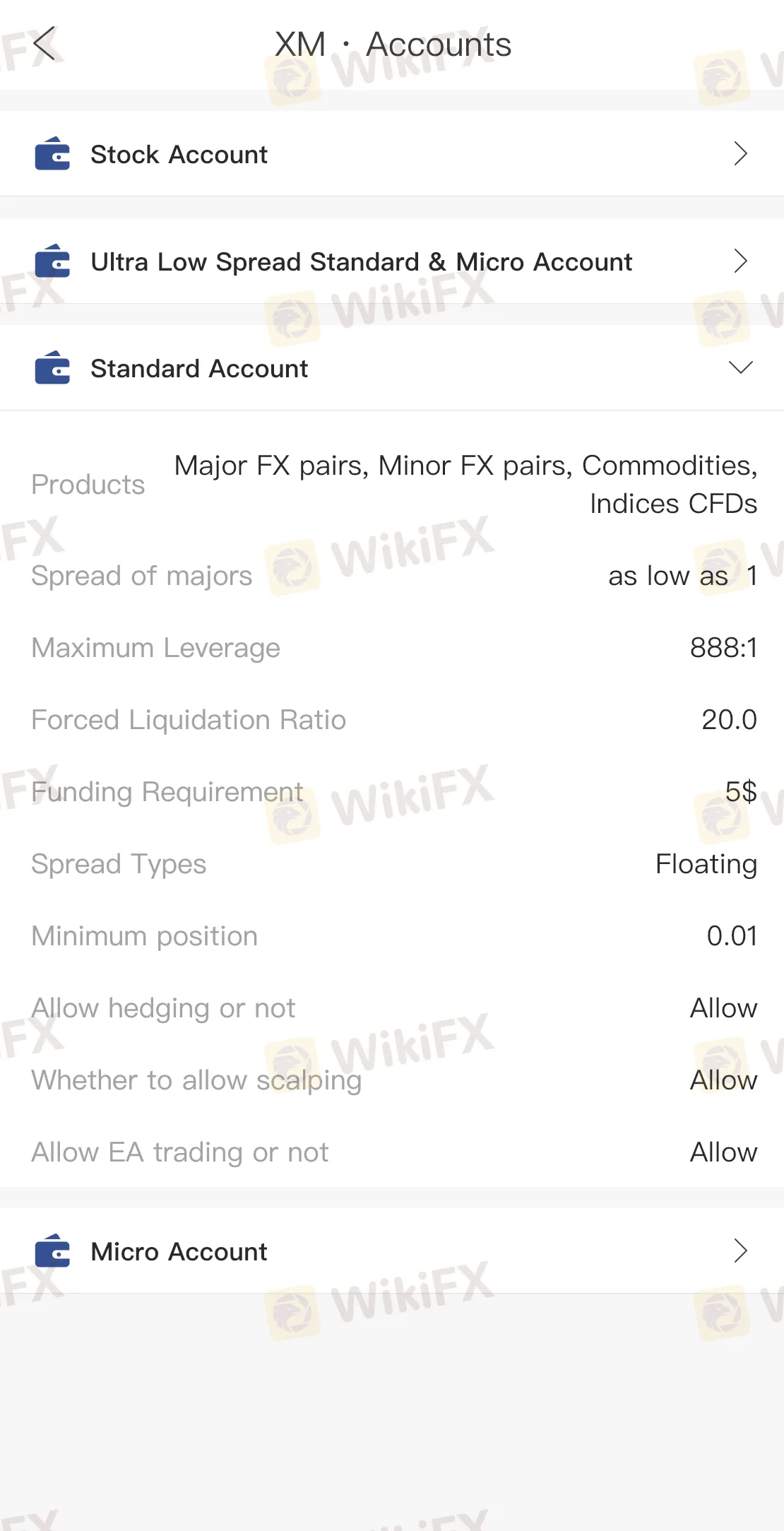

XM is the next example that we will be studying in this article.

Same as the example above, click “accounts” as we scroll down XMs profile in the WikiFX mobile app.

XM offers 4 different account types, including 1 stock trading account.

Generally, a stock trading account require a much larger capital than a forex trading account.

In all the other forex trading accounts offered by XM, traders can begin trading with a mere $5 deposit and open positions as low as 0.01 lot but with high leverage that goes up to 888:1.

In these 2 examples, we can see how easily WikiFX can help you survey and review forex brokers effortlessly, which is not limited to their regulatory statutes and licenses, but also accounts, platforms, and trading instruments offered, minimum deposit requirement, leverage levels, and minimum position allowed for trading, as well as whether it is compatible with an EA (forex trading robot that helps you trade automatically).

Before we end this article, there is some good news for you:

If you are a trader that is currently using an EA or would like to try out a forex EA (you can check if your account is compatible with an EA implementation with the same steps mentioned above), WikiFXs EA giveaway is something that you should not miss!

For more information on how to win a free WikIFX EA to upgrade your trading experience and performance, click this article here for more information: https://www.wikifx.com/en/newsdetail/202206168584426253.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

INFINOX has teamed up with Acelerador Racing, sponsoring an Acelerador Racing car in the Porsche Cup Brazil 2025. This partnership shows INFINOX’s strong support for motorsports, adding to its current sponsorship of the BWT Alpine F1 Team.

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

WikiFX Broker

Latest News

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

The Dark Side of Trading Gurus: Are You Following a Fraud?

Currency Calculator