简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What is a PIP? - WikiFX Forex Trading Concepts

Abstract:A point-in-percentage, or pip, is a standardized unit used to quantify tiny changes in currency pair pricing. Even modest market swings may offer potentially profitable trade settings as well as possible losses. Therefore, the tiny pip increment guarantees that constant trading chances are accessible. Furthermore, the pip dramatically improves order accuracy and spread specificity. All of our platforms automatically count pips to calculate the profit or loss of your transaction.

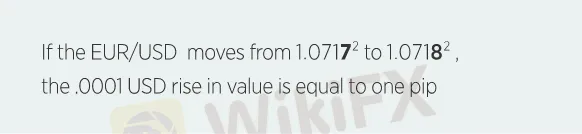

Currency values are generally reported in pips or percentages in points since they vary in such small increments. A pip is often defined as the fourth decimal point of a price, which is equivalent to 1/100th of one percent.

Pips in Fractions

The fractional pip, which is 1/10th of a pip, is represented by the superscript number at the end of each price. The fractional pip indicates price fluctuations much more precisely.

Pips in Action

Determining the worth of a pip

A pip's value fluctuates depending on the currency pairings you trade as well as which currency is the base currency and which currency is the counter currency.

Using the same example, you purchase 10,000 euros at 1.10550 versus the US dollar (EUR/USD) and earn $1 for every pip rise in your favor. You would profit $10 if you sold at 1.10650 (a 10-pip gain).

If all of the above conditions were met, but you sold at 1.10450 (a ten-pip drop), you would lose $10.

Consider the USD/JPY pair, in which the US dollar serves as the base currency.

The USD/JPY exchange rate determines the value of one pip in this situation.

So, using the same example, you purchase 10,000 US dollars at 106.20 yen and make $0.94 for every pip rise in your favor. You would profit $18.80 if you sold at 106.40 (a 20-pip gain).

If the aforementioned conditions were the same but you sold at 106.00 (a 20-pip decline), you would lose $18.80.

More WikiFX educational articles may be found at the following address: https://www.wikifx.com/en/education/education.html.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator