简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

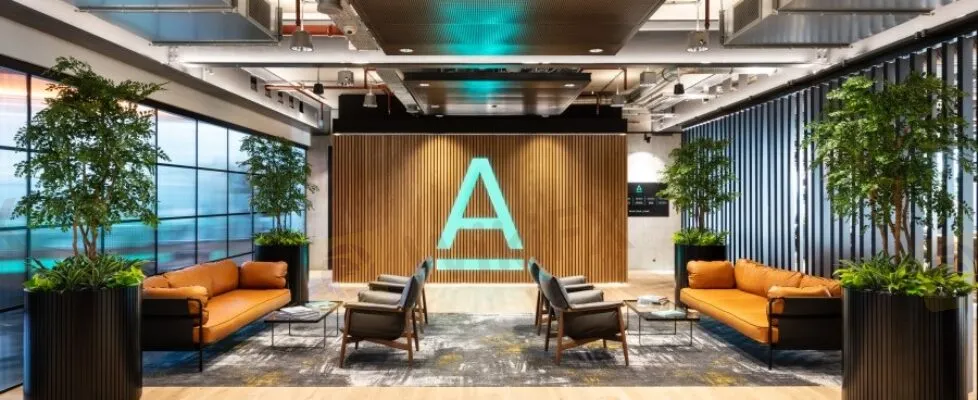

WIKIFX REPORT: Alpha FX Group reports 68% jump in revenue for 2021

Abstract:Alpha FX Group plc (LON:AFX), a high-tech, high-touch provider of FX risk management, accounts and payments solutions to corporates and institutions internationally, today reported its audited Full Year Results for the financial year ended 31 December 2021.

Alpha FX Group plc (LON:AFX), a high-tech, high-touch provider of FX risk management, accounts and payments solutions to corporates and institutions internationally, today reported its audited Full Year Results for the financial year ended 31 December 2021.

In the year ended 31 December 2021 revenue increased by 68% over the prior year to £77.5 million with strong growth across all divisions.

The FX Risk Management division focuses on supporting corporates and institutions that trade currency for commercial purposes through the Groups sales teams located in London, Toronto and Amsterdam. Revenue grew by 43% over the prior year to £57.0 million with strong growth across all regions.

Alternative Banking Solutions revenue grew substantially from £6.4 million in the prior year to £20.4 million in 2021. The revenue includes £1.1 million (2020: £nil) relating to the recharge of bank fees incurred by the Group on Euro E-money wallet balances which attract a negative interest rate, with the cost being directly passed to the client.

As account fees are a growing revenue stream within the Group, management has reassessed revenue recognition relating to account fees. As a result, in 2021, revenue from annual account fees is recognised on a straight-line basis over the 12 months from the date the account was opened. At 31 December 2021 there was £2.2 million of deferred revenue that will be recognised in the Statement of Comprehensive Income for 2022.

Total revenue from hedging products (forwards and options) has increased against the prior year from £27.5 million to £40.7 million. The revenue from forward transactions represents the difference between the rate charged to clients and the rate paid to banking counterparties. There were no structural changes in forward commission rates in the year in comparison to the prior year.

Spot revenue increased from £14.7 million to £26.1 million due to the growth of Alpha Pay, a branch of Alpha FX Limited (formerly Alpha Platform Solutions), together with increased spot flow from the Institutional business, where underlying activities mean that spot transactions are more common.

The underlying profit excludes the impact of share-based payments, and on this basis, the underlying profit before tax in the year increased by 91% to £33.4m. Statutory profit before tax increased by 94% to £33.2m.

The year ended 31 December 2021 was another year of significant investment. Overall headcount increased in the year from 147 to 214 at 31 December 2021 to support future long-term growth. Despite this investment and the impact of the recharge in bank charges of £1.1m being included in revenue, the underlying profit before tax margin increased to 43% (2020 – 38%). This was in line with the statutory profit before tax margin of 43% (2020 – 37%).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Interactive Brokers adds Solana, XRP, Cardano, and Dogecoin to its platform, enabling U.S. and U.K. clients to trade crypto 24/7 with low fees.

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Fidelity Investments tests a stablecoin, joining major financial firms in the booming crypto sector. Discover how this impacts digital payments and blockchain adoption.

Hantec Markets Launches InsightPro: AI-Powered Real-Time Trading Signal Tool for Traders

Hantec Markets introduces InsightPro, an AI-powered trading tool offering real-time market insights, signals, and analysis for better trading success.

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

A finance manager in Malaysia lost more than RM364,000 after falling victim to an online investment scam that promised quick and high returns.

WikiFX Broker

Latest News

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Currency Calculator