简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

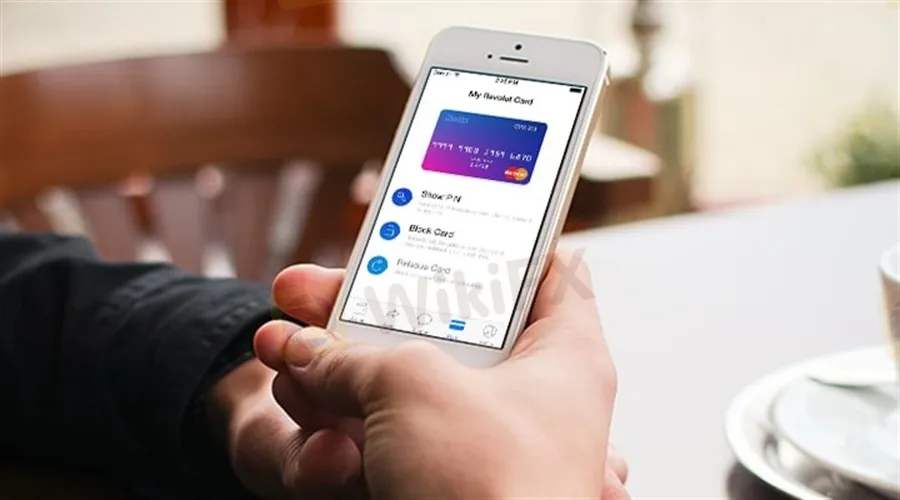

Revolut Collaborates with Stripe to Accelerate International Expansion

Abstract:The fintech firm will use Stripe to support payments in the UK, Europe and several other global markets. The companies are planning to deliver innovative payment products.

Stripe, one of the prominent financial infrastructure platforms for businesses, recently announced that Revolut has added Stripe to drive international expansion. The fintech firm is planning to leverage Stripes infrastructure to enter several new markets.

Take Advantage of the Biggest Financial Event in London. This year we have expanded to new verticals in Online Trading, Fintech, Digital Assets, Blockchain, and Payments.

Founded in 2015, Revolut is one of the most valuable fintech startups in the world. Last year, the company raised $800 million in a funding round and reached a valuation of $33 billion. Additionally, Revolut has more than 18 million customers.

According to the details shared by Stripe, Revolut will initially use the companys platform to facilitate seamless payments across the United Kingdom and Europe.

“Revolut builds seamless solutions for its customers. That means access to quick and easy payments and our collaboration with Stripe facilitates that. We share a common vision and are excited to collaborate across multiple areas, from leveraging Stripe‘s infrastructure to accelerate our global expansion to exploring innovative new products for Revolut’s more than 18 million customers,” said David Tirado, the Vice President of Business Development at Revolut.

Expansion Plans

Among new markets, Revolut is planning to launch in Mexico and Brazil soon. In addition to the current collaboration, both companies aim to increase their partnership in the near future to deliver technology-driven payment products.

“Revolut and Stripe share an ambition to upgrade financial services globally. We‘re thrilled to be powering Revolut as it builds, scales and helps people around the world get more from their money,” said Eileen O’Mara, the EMEA Revenue and Growth Lead at Stripe.

In the past few months, Revolut has formed several partnerships with some of the leading financial companies to accelerate its international presence. Recently, the fintech company collaborated with Tink to ease money transfers across the European region. In February, the firm announced the expansion of its services in Australia through the launch of stock trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

This acquisition attempt by AxiCorp Financial Services Pty Ltd, Axi’s parent company, values SelfWealth at AUD 0.23 per share and is notably higher than a recent bid made by Bell Financial Group Limited (ASX), which offered AUD 0.22 per share.

Crypto Influencer's Body Found Months After Kidnapping

The body of missing crypto influencer Kevin Mirshahi, abducted in June, was found in Montreal. A woman has been charged in connection with his murder.

Warning Against Globalmarketsbull & Cryptclubmarket

Are you thinking about investing in Globalmarketsbull or Cryptoclubmarket? Think again! The Financial Conduct Authority (FCA) issued a warning about these two firms. Here are the details of these unlicensed brokers.

Why Even the Highly Educated Fall Victim to Investment Scams?

Understanding why educated individuals fall victim to scams serves as a stark reminder for all traders to remain vigilant, exercise due diligence, and keep emotions firmly in check.

WikiFX Broker

Latest News

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

Dukascopy Bank Expands Trading Account Base Currencies

UK Sets Stage for Stablecoin Regulation and Staking Exemption

Axi Bids AUD 52M to Acquire Low-Cost Broker SelfWealth, Outbidding Competitor Bell Financial

Crypto Influencer's Body Found Months After Kidnapping

STARTRADER Issues Alerts on Fake Sites and Unauthorized Apps

Italy’s CONSOB Blocks Seven Unregistered Financial Websites

Bitfinex Hacker Ilya Lichtenstein Sentenced to 5 Years in Prison

Currency Calculator