简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Cope False Breakout during Day Trading

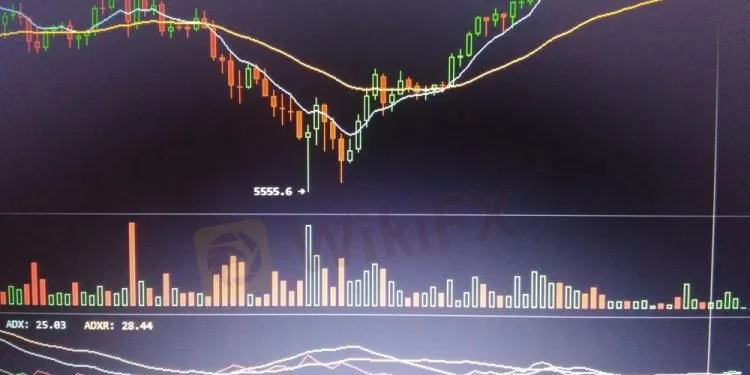

Abstract:Many new day traders think that false breakout is irritating. A false breakout happens when a stock, forex, or futures contracts look about to move to one direction, it moves, then it suddenly reverts to the opposite direction.

This situation has stopped many day traders or put them in a losing position. Therefore, false breakouts are frustrating and costly for many day traders. Yet, the truth is, everyone can reverse the situation. Here is how you can gain capital from false breakouts.

The Psychology of False Breakouts

Many traders learn various breakout strategies when they first interested in trading. The idea behind a breakout strategy is to get a big move from a pattern that easily spotted.

Indeed, trading breakouts can gain huge profits. Yet, you have to be extra careful with a false breakout. False breakouts can be really frustrating when market continuously tells you something wrong.

Since it happens many times, now, you have to start considering trading false breakout instead of the trading breakout.

False Breakout Strategy

For example, a thick chart of BBB company shows moving higher prices, then pull back low, and move back in a higher direction. During this period you have to ask yourself these questions.

What is the trend direction of your trade?

What will trigger a false breakout? If that happens, where and how will you get in? Will you use a market order or limit order?

Where should you put your stop loss?

The strategy can be simple, yet it requires practices and focus to use it. Lets get back to the example. As the trader, you have to consider that the price will continue to decline if it declines below the previous swing low.

If that happens, you should not go long. Yet, if the price moves slightly from the previous low, then go sharply back above the previous low, you have to buy it.

Do not forget to set a stop loss below the new low. That way, you just need to monitor the price moves and find the point to exit a profitable trade.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Malaysian Vendor Falls Victim to Forex Scam, Losing RM500K in Life Savings

A Malaysian night market vendor has lost RM500,000 which is the entirety of his and his wife’s life savings after falling prey to a fraudulent foreign exchange investment scheme registered in Seychelles, East Africa.

What Can Expert Advisors Offer and Risk in Forex Trading?

Know the pros and cons of Expert Advisors in Forex trading—automation boosts efficiency, but risks like over-reliance and glitches require careful balance.

ASIC Banned the Director of JB Markets

The Australian Securities and Investments Commission (ASIC) has banned Peter Aardoom, the director of JB Markets, for eight years from associating with any financial services firm. This ban follows a series of regulatory actions against JB Markets, which included the cancellation of its Australian Financial Services (AFS) license less than a year ago.

5 Steps to Empower Investors' Trading

Forex trading is a world full of opportunities and challenges, attracting investors from around the globe to participate.

WikiFX Broker

Latest News

Brazilian Man Charged in $290 Million Crypto Ponzi Scheme Affecting 126,000 Investors

Become a Full-Time FX Trader in 6 Simple Steps

ATFX Enhances Trading Platform with BlackArrow Integration

Decade-Long FX Scheme Unravels: Victims Lose Over RM48 Mil

The Top 5 Hidden Dangers of AI in Forex and Crypto Trading

5 Steps to Empower Investors' Trading

How to Find the Perfect Broker for Your Trading Journey?

The Most Effective Technical Indicators for Forex Trading

What Can Expert Advisors Offer and Risk in Forex Trading?

Indian National Scams Rs. 600 Crore with Fake Crypto Website

Currency Calculator