简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Vantage Introduces Social Trading Platform to Attract British Traders

Abstract:Vantage anticipates that the new solution, developed using Pelican Trading's unique technology, would attract new market participants to its platform, hence extending its client base and boosting total trading activity.

Vantage anticipates that the new solution will encourage new market entrants to join its platform.

Vantage, the multi-asset trading platform for consumers and professional traders, announced today the debut of V Social, its new social trading offering.

V Social is a professional “social network” that enables traders to auto-copy signals, make trades, communicate, and evaluate success. Beginner traders have the option of subscribing to and copying the signals of skilled traders, who get improved status and a percentage of the winnings in exchange.

Vantage anticipates that the new solution, developed using Pelican Trading's unique technology, would attract new market participants to its platform, hence extending its client base and boosting total trading activity.

According to Shunyu Li, Head of Sales and Marketing at Vantage, “Social and copy trading is expanding throughout the financial sector, with features like commenting, resharing, and liking postings making it easy for a surge of next-generation, digital native traders.” It is also being adopted by more seasoned traders searching for their next trading opportunity.

We are ecstatic to be able to provide social trading possibilities to new and current customers in conjunction with such a prestigious and well-established brand as Pelican.

David Shayer, UK CEO of Vantage, explains, “After our rebranding last year, Vantage was the UK's fastest-growing broker. To maintain this momentum, we determined that the tens of thousands of young, motivated traders who entered the sector after the epidemic provided tremendous potential. We have always thought that the trading industry should be more accessible to everyone, not just experienced traders, and we were happy to find Pelican as a partner that shared this view. We can now give current, new, and prospective customers a user-friendly, all-in-one platform on which they can execute trades, copy and learn from some of the world's top investors, and contribute to a community of energetic, inventive traders.”

About Vantage

Vantage is a worldwide multi-asset broker that provides customers with access to a nimble and robust service for trading CFDs on Forex, commodities, indices, and stocks.

With a decade or more of market experience. Vantage presently employs over a thousand people across more than thirty worldwide locations.

Vantage is not only a broker. It offers customers a reliable trading environment and a quicker and more intuitive trading platform, allowing them to take advantage of trade possibilities.

When you have the ability to capitalize on market opportunities more effectively.

Vantage on WikiFX App

WikiFX assigns Vantage a rating depending on their profile. WikiFX has collaborated with thirty financial regulators to give reliable broker information. Its authenticity and verification are without reproach. It is a legitimate broker with a valid operating license. We cannot refute WikiFX's reputation for resolving difficulties between traders and their brokers. WikiFX has been getting a large number of complaints from its traders throughout the world.

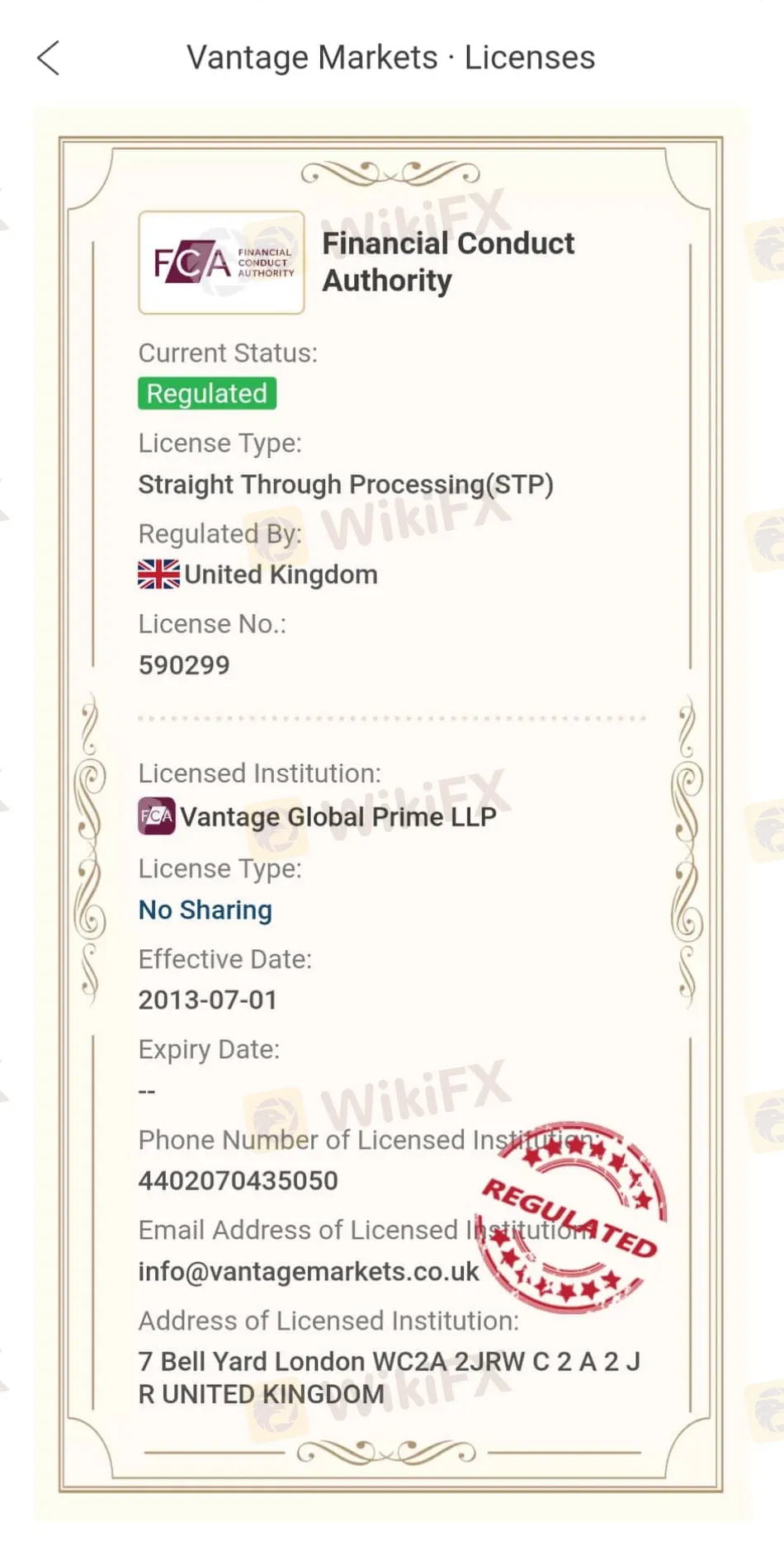

Licenses

In terms of the legality of their activities. According to their website, WikiFX has visited their headquarters, which are located in the United Kingdom and Australia.

United Kingdom: https://www.wikifx.com/en/survey/596728a5f9.html

Australia: https://www.wikifx.com/en/survey/1905877be5.html

Vantage is a broker governed by ASIC, FCA, and SIMA regulations (see the licenses below).

Stay tuned for more news about Vantage.

Download the WikiFX App for free on App Store and Google Play Store to access the news on the go

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

TradingView Brings Live Market Charts to Telegram Users with New Mini App

TradingView has launched a mini app on Telegram, making it easier for users to track market trends, check price movements, and share charts.

March Oil Production Declines: How Is the Market Reacting?

Oil production cuts in March are reshaping the market. Traders are closely watching OPEC+ decisions and supply disruptions, which could impact prices and future production strategies.

How to Calculate Leverage and Margin in the Forex Market

Leverage amplifies both potential profits and risks. Understanding how to calculate leverage and margin helps traders manage risks and avoid forced liquidation.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator