简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

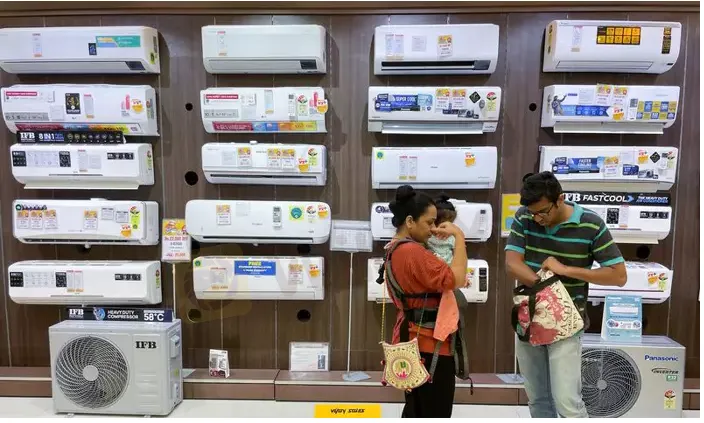

India inflation may remain elevated despite July dip

Abstract:India’s headline retail inflation that eased for the third straight month in July is expected to remain above the central bank’s upper tolerance range in the near term, necessitating more rate hikes in coming months, analysts said.

India‘s consumer inflation dipped to 6.71% in July, helped by a slower increase in food and fuel prices. The year-on-year figure, published on Aug. 12 by the National Statistics Office, was marginally lower than the 6.78% forecast by economists in a Reuters poll, but it remained above the central bank’s tolerance band for a seventh month in a row.

The Reserve Bank of India aims to maintain inflation at 4.00% in the medium term, with a tolerance range of 200 basis points on either side.

“The outlook on food inflation still faces uncertainties given the uneven rainfall. For the first two weeks of August prices of vegetables, cereals (rice and wheat) and pulses are tracking higher. Rice sowing has been impacted by deficient rainfall in key producer states,” said Gaura Sen Gupta, India economist at IDFC First Bank.

Even as inflation eases, economists believe the RBIs monetary policy committee will continue to hike policy rates though the quantum of such moves may come down as compared to the previous three actions.

The MPC has raised key policy rate by 140 basis points to 5.40% since May as stubborn inflation continues to remain a major concern. The next policy decision of is due on Sep. 30 with most market participants expecting another hike.

While Nomura and IDFC First Bank expect the RBI to hike repo rate by another 60 bps to 6.00%, Barclays eyes another 50 bps rise in interest rates over the next two meetings. Meanwhile, Nomura sees inflation to average 6.8% in this fiscal, IDFC First Bank sees it at 6.5%, below central banks 6.7% prediction.

We expect the RBI to deliver two 25 bps rate hikes each at the September and December meetings, taking the repo rate to 5.90%. However, if global commodity prices continue to decline, we note the risk that the bank does not raise rates in

December, Rahul Bajoria, chief India economist at Barclays said.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

The internet is inundated with advertisements and promotions from self-proclaimed trading gurus who promise to teach you how to become a successful trader and earn a substantial secondary income. These individuals often claim that their trading techniques can make you rich, even if you have zero experience. However, these assertions are typically false, and many people fall victim to these scams. This article aims to expose these fake trading gurus, explain how they operate, and provide tips on how to avoid being scammed.

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

The financial world is transforming, driven by the rapid integration of artificial intelligence (AI) and innovative fintech solutions. This change is most apparent in forex markets, where algorithmic trading and deep learning are redefining strategies, risk management, and decision-making. In this article, we explore how AI-driven technologies are not only revolutionizing forex trading but are also propelling fintech innovations that enhance customer experiences, bolster security, and unlock new market opportunities.

The One Fear That’s Costing You More Than Just Profits

The fear of missing out (FOMO) is NOT what you think it is! Read the three lesser-discussed components that contribute greatly to FOMO trading!

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

WikiFX Broker

Latest News

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Why More People Are Trading Online Today?

SEC Ends Crypto.com Probe, No Action Taken by Regulator

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

Gold Surges to New Highs – Is It Time to Buy?

Bitpanda Secures Full Broker-Dealer License in Dubai

Lost Money to Scam Recently?! This Article Could Help You!

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Currency Calculator