简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Use the Producer Price Index or PPI in Forex Trading

Abstract:PPI is an essential piece of economic statistics since it signals future predicted inflation. Because of the positive association between inflation and interest rates, traders watch PPI in forex trading, but ultimately, traders are concerned with how the resulting interest rate changes are expected to affect currency pairings.

TALKING POINTS FOR USING PPI TO TRADE FOREX

The Producer Price Index (PPI) is an essential piece of economic statistics.

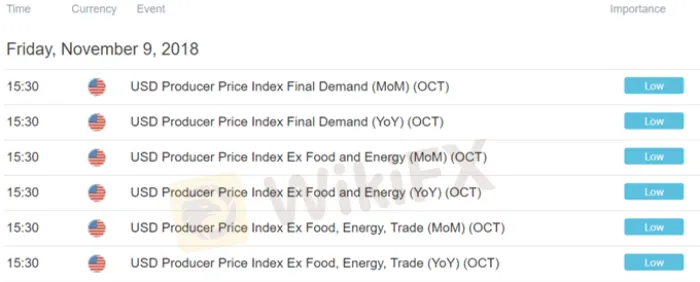

Each month, PPI data is provided in the second week.

Forex traders may use the Consumer Price Index (CPI) as a leading indicator to anticipate consumer inflation (CPI).

PPI is an essential piece of economic statistics since it signals future predicted inflation. Because of the positive association between inflation and interest rates, traders watch PPI in forex trading, but ultimately, traders are concerned with how the resulting interest rate changes are expected to affect currency pairings. Continue reading to understand more about the PPI index and its impact on the currency market.

WHAT IS PPI AND HOW DOES IT WORK?

PPI is an abbreviation for Producer Price Index, which measures the change in the price of completed products and services sold by producers. The monthly change in the average price of a basket of items bought by manufacturers is represented by PPI data.

How is PPI Calculated?

PPI looks at three types of companies: commodity-based, industrial-based, and stage-of-processing-based. PPI is calculated by the Bureau of Labor Statistics using data from a postal survey of retailers chosen by a systematic sample of all enterprises registered with the Unemployment Insurance System.

PPI movements might be shown to traders as a percentage change from the prior year or on a month-to-month basis.

PPI and Inflation

A positive rise in the PPI index indicates that costs are growing, and that price increases are eventually passed on to consumers. If this impact is big enough, subsequent CPI data will rise to reflect an increase in the overall level of prices.

The Impact of Inflation on the Economy

A rise in the overall price level is beneficial to an economy, but only if it is controlled. When demand for products and services rises, firms must raise capital investment and recruit additional personnel to match the increased demand. The issue arises when prices rise dramatically, causing the buying power of a country's currency to fall. A dollar today may buy less than it could a year ago.

Gasoline was $0.27 a gallon in the 1950s, apartment rent was $42/month, and a movie ticket cost $0.48. These statistics are nothing near where they are now, which demonstrates how inflation devalues the local currency. Central banks successfully lower inflation by increasing the benchmark interest rate to prevent the loss of buying power.

HOW DOES PPI AFFECT CURRENCY?

When it comes to money, there is always a trade-off: people may save money and earn interest, or they may spend money right away and avoid paying interest.

If the consumer price index rises, interest rates may increase as well. When interest rates rise, saving money becomes more appealing since the payoff (interest) is greater than before. Spending money becomes more expensive because customers essentially lose out on the increased interest rate when they choose to spend rather than save. As a consequence, rising PPI may lead to higher interest rates and a stronger currency.

Forex traders understand that higher interest rates result in greater financial flows from overseas investors looking to acquire the higher-yielding Euro. As demand for the Euro has risen, this impact tends to push up the value of the Euro.

The “carry trade” approach, in which traders borrow money in a low-interest-rate currency and purchase a higher-interest-rate currency, is a common technique for pursuing higher interest rates.

Money follows yield, and traders will want to capitalize on this.

HOW DOES PPI AFFECT THE US DOLLAR?

Initially, the Producer Price Index has minimal impact on the US currency. This is because there is a time lag in the actual economy between price increases from producers and increased inflation caused by consumers having to pay more at the checkout.

However, don't be deceived by this data release's “low priority” effect assessment. Astute traders may anticipate the implications of PPI on CPI and interest rates and trade appropriately. As a result, the signaling impact provided by PPI data is the most useful component of the data.

Download the WikiFX app on the App Store or Google Play Store to stay tuned on the forex trading latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

Bitpanda Secures Full Broker-Dealer License in Dubai

Bitpanda has officially obtained a full broker-dealer license from the Dubai Virtual Assets Regulatory Authority (VARA), marking a significant milestone in its international expansion. This approval, which follows preliminary authorization granted three months earlier, enables the European digital asset exchange to introduce its comprehensive suite of virtual asset services to investors in the United Arab Emirates (UAE).

RM457,000 Forex Fraud: Court Grants Conditional Release, Is Justice Delayed?

A Malaysian magistrate’s court has issued a discharge not amounting to acquittal (DNAA) for two former directors of an investment company implicated in a forex investment fraud case involving RM457,735.50.

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Interactive Brokers adds Solana, XRP, Cardano, and Dogecoin to its platform, enabling U.S. and U.K. clients to trade crypto 24/7 with low fees.

WikiFX Broker

Latest News

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Currency Calculator