简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Moneta Markets to Fly Solo After Separating From the Vantage Group

Abstract:Now in its third year of operation, Moneta Markets has vastly expanded its services throughout 2022, emphasizing a “client-focussed” approach in which delivering value where others fall short is paramount.

Global Forex and CFD broker Moneta Markets recently announced that they are embarking on a path of their own having secured a team of investors. Having launched three years ago as an entity under the Vantage Group of brands, the broker has recently acquired new licences and authorisations of its own to operate as its own entity.

Now in its third year of operation, Moneta Markets has vastly expanded its services throughout 2022, emphasizing a “client-focussed” approach in which delivering value where others fall short is paramount.

In addition to its new licences and relevant authorisations under FSCA, ASIC, and SVGFSA, the broker continues to vastly expand its collection of tradable products, which now exceeds 1000, including over 700 Share CFDs, as well as their increasing range of FX Pairs, Indices, Commodities, Crypto CFDs and ETFs, many of which are available for clients to trade with zero commission fees.

The broker has also recently introduced zero swaps trading on their gold and crypto trading and slashed commissions on its range of US Share CFDs from $6 to $0.

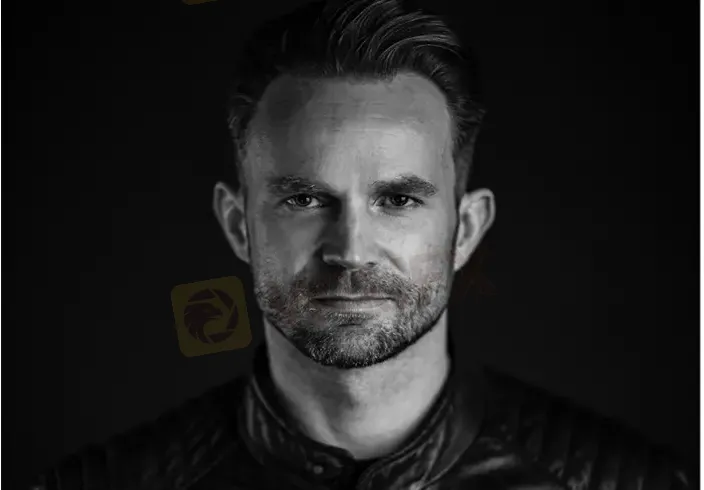

We caught up with David Bily, Founder and CEO of Moneta Markets, who said Since its inception, the intention has always been to build Moneta Markets into a brand that can operate on its own. The technological and infrastructural support of the Vantage Group, in the beginning, was vital in helping us launch and become a serious market contender, as well as in achieving our independence.

And, it was instrumental in enabling Moneta to attract investors who want to be involved in our growth journey. Now, with our ever-increasing range of products, our continuous effort to improve our offering, and an enthusiastic group of investors supporting us, we are on track to build Moneta Markets into a position where it can become the preferred retail FX and CFD broker of choice around the world.

Moneta‘s recent separation from the Vantage Group follows the company’s success over the past 24 months, where they have realised consistent growth across all key metrics, including client acquisition, trading volume, and monthly deposits, all of which have helped to create a solid foundation to build upon in 2023, as we enter the closing months of 2022. Coupled with the backing of several investors, the broker looks on track to shake things up within the industry for the remainder of the year and into the next!

Moneta Markets is a multi-asset FX and CFD broker offering* access to the most popular global markets including 1000+ FX pairs, Indices, Commodities, Share CFDs, Cryptos, and ETFs to traders, investors, and fund managers alike. And, Moneta Markets clients can take advantage of a suite of educational tools and resources, trading ideas, the powerful MT4, MT5, and PRO Trader platforms, and their in-house proprietary daily market analysis.

For more information or to open a demo or live trading account, visit the Moneta Markets website here. For Partnership or media inquiries, please contact austen.plummer@monetamarkets.com

*Moneta Markets Pty Ltd is an Australian entity and is not authorised to issue financial products and can only give general advice to both wholesale and retail clients.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

In today’s digital age, reviews influence nearly every decision we make. When purchasing a smartphone, television, or home appliance, we pore over customer feedback and expert opinions to ensure we’re making the right choice. So why is it that, when it comes to choosing an online broker where real money and financial security are at stake many traders neglect the crucial step of reading reviews?

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator