*Note: The information in this table is based on the available data at the time of writing and may be subject to change.

Overview of Vestrado

Vestrado is a relatively new forex broker that was founded in 2020 and is based in Saint Vincent and the Grenadines. The company offers online forex trading services to retail clients worldwide. Vestrado is an ECN/STP broker, which means that it provides clients with access to the interbank forex market without any dealing desk intervention. The broker offers a wide range of trading instruments, including currency pairs, commodities, and indices, and allows clients to trade using the MetaTrader 4 trading platform, and the maximum trading leverage offered is up to 1:2000.

Vestrado offers four different types of trading accounts, ranging from Frux Standard Account STP, Frux CENT Account (coming soon), Fides Cashback Account, Respectus ECN account, with the minimum deposit all from $10. Besides, swap-free trading accounts are also applicable for all four types of trading accounts.

Vestrado says its customer support can be reached through 7/24, and there are also some social media platforms can be reached, such as Facebook, Twitter, Instagram, and Youtube.

Is Vestrado legit or a scam?

Vestrado is registered in Saint Vincent and the Grenadines with the registration number 25911 BC 2020. However, Vestrado is currently not regulated by any notable financial authority, which may cause some potential clients to feel uneasy about the lack of oversight and potential risks involved with trading with an unregulated broker.

Pros and Cons of Vestrado

Vestrado offers a wide range of trading instruments, including forex, metals, energies, and indices, and provides four different types of trading accounts with relatively low minimum deposits. However, Vestrado is not regulated by any notable financial authorities, and its customer support is limited to only email and a contact form on its website.

Market Intruments

Vestrado offers a wide range of financial instruments for trading, including forex, metals, shares, cryptos, and indices.The broker's diverse selection of financial products provides traders with ample opportunities to diversify their portfolios and minimize risk. Additionally, the forex market is one of the largest and most liquid markets in the world, providing traders with ample opportunities for profit. The availability of other instruments, such as metals, shares, cryptos, and indices, allows traders to hedge against currency fluctuations and capitalize on the movements of these underlying assets. However, it is important to note that each financial instrument has its own unique risks and rewards, and traders should carefully consider their investment objectives and risk tolerance before entering into any trades.

Account Types

Vestrado offers four types of trading accounts: Frux Standard Account STP, Frux CENT Account (coming soon), Fides Cashback Account, and Respectus ECN.

The Frux Standard Account STP is a traditional trading account with variable spreads and no commissions. The minimum deposit is $10, and traders can use leverage up to 1:2000.

The Frux CENT Account is also a traditional account with similar features to the Frux Standard Account STP but is designed for smaller trades. Traders can get access to trading leverage up to 1:1000.

The Fides Cashback Account is a unique account that offers cashback rewards based on the trading volume. The minimum deposit to open this account is $10, and clients can get access to the maximum trading leverage up to 1:1000.

The Respectus ECN account is a more advanced account type with lower spreads and commissions. The minimum deposit for the Respectus ECN account is $10, and traders can also use leverage up to 1:2000.

How to open an account?

To open an account with Vestrado, you need to follow these steps:

Visit the Vestrado website and click on the “Open Live Account” button.

2. Then you will need to fill out the registration form on their website, including your name, email address, and phone number. Then you need to provide personal identification documents and proof of address.

3. Once your account has been verified, you can fund it and start trading. It's important to note that different account types may have different requirements for minimum deposit and other conditions.

Leverage

Vestrado offers leverage ranging from 1:1000 to 1:2000, depending on the type of trading account chosen. While high leverage can amplify profits, it can also increase the risk of significant losses, particularly in volatile markets. Therefore, traders should carefully consider their risk tolerance and trading strategy before using high leverage.

It is also worth mentioning that Vestrado's leverage options are higher than what many other brokers offer, which can be attractive to traders who prefer to trade with high leverage. However, it is important to keep in mind that higher leverage is not always better, and traders should assess their risk tolerance and trading style before choosing a leverage level.

Spreads & Commissions (Trading Fees)

Concerning the spread, the spread is various in light of the account types. Vestrado claims to offer low spreads and commissions on their trading accounts. The exact fees charged by the broker depend on the account type chosen by the trader. The Cent, Standard, and Fides Cashback accounts offer a zero-commission trading environment, with spreads from 1.5 pips, and 0.8 pips, respectively. Respectus ECN offers spreads from 0.0 pips, with a commission of 6 USD per lot.

Non-Trading Fees

In addition to trading fees, Vestrado also charges non-trading fees. These fees include inactivity fees, withdrawal fees, and deposit fees. If you do not trade for a period of 60 days or more, Vestrado charges an inactivity fee of $15 per month. The withdrawal fee varies depending on the method you choose to withdraw your funds, ranging from $5 to $30. Deposit fees also vary depending on the method used, but Vestrado does not charge fees for deposits made via bank transfer. It's important to note that these fees are subject to change and you should always check with the broker for the most up-to-date information.

Trading Platform

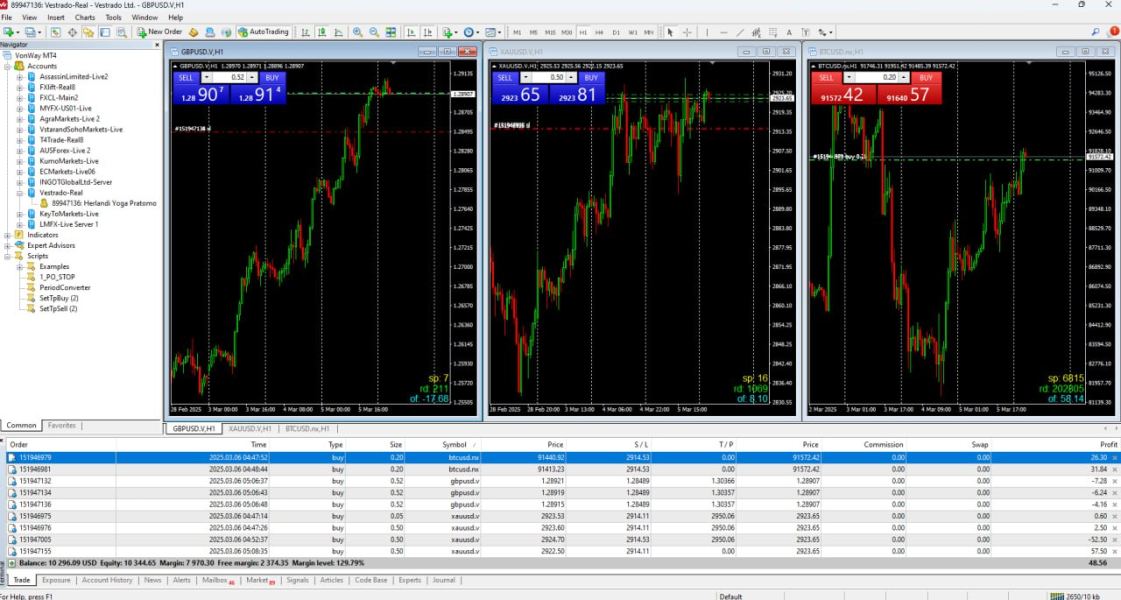

Vestrado offers the popular MetaTrader 4 (MT4) trading platform, which is widely used in the industry for its user-friendly interface, advanced charting tools, and customizable features. MT4 allows traders to execute trades quickly and easily, and is available on desktop, mobile, and web versions. Additionally, Vestrado provides the MT4 MultiTerminal platform, which allows traders to manage multiple accounts simultaneously.

It is worth noting that Vestrado does not offer the newer MetaTrader 5 (MT5) platform, which some traders may prefer for its additional features and capabilities. However, MT4 is still a reliable and widely used platform in the industry.

Deposit & Withdrawal

Deposit

Vestrado offers a variety of payment methods for both deposit and withdrawal transactions. These methods include local transfer, wire transfer, credit card, USDT, e-wallet, virtual bank account, cryptocurrencies, and local depositor. With such a wide range of options, traders can choose the payment method that best suits their needs and preferences. The minimum deposit amount is $10, making it accessible for traders of all levels, while the maximum deposit amount is $10,000, providing enough flexibility for larger transactions.

Withdrawal

Withdrawals can be done through local transfer, wire transfer, credit card, USDT, e-wallet, virtual bank account, cryptocurrencies. The minimum withdrawal amount is $100, and the maximum withdrawal amount is USD 100.

Customer Support

Clients can reach the broker's support team through email, phone, and live chat. The live chat feature is available on the broker's website, and it is accessible 24/7. Traders can also contact Vestrado's customer service team via social media platforms such as Facebook and Twitter. Furthermore, the broker provides a basic FAQ section on its website, which covers some common questions that traders may have. Feel free to contact customer support, if so desired, please e-mail at support@vestrado.com within a reasonable.

Educational Resources

Vestrado does not seem to offer any significant educational resources for traders. There are no tutorials, webinars, or other resources available to help traders improve their skills and knowledge of the market. This lack of educational resources may make it more challenging for new traders to get started and succeed in the markets.

Risk Warning

Trading in leveraged financial instruments carries a high level of risk, including the risk of losing your entire invested capital, and may not be suitable for all investors. The high leverage and volatility of such instruments can work against you as well as for you. Before you decide to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. Wherever in doubt, you should consult and receive advice from independent experts, including legal, tax, and financial advisers.

Conclusion

In conclusion, Vestrado is a newly established forex broker that offers a range of trading instruments, including forex, metals, shares, cryptocurrencies, and indices. The broker offers four different account types, each with different features and benefits, which cater to the needs of various types of traders. Vestrado also provides a user-friendly and customizable trading platform, as well as a range of payment options, making it easy for clients to deposit and withdraw funds.

However, the broker is not regulated, which may be a concern for some traders. Additionally, Vestrado's customer support options are limited, and the broker does not provide any educational resources.

FAQs

Q: Is Vestrado a regulated broker?

A: No, Vestrado is not currently regulated by any financial regulatory authority.

Q: Is Vestrado a good broker to trade with?

A: Vestrado has its advantages, such as a wide range of trading instruments, multiple account types, and multiple payment options. However, its lack of regulation and slow customer support response times may be a cause for concern for some traders.

Q: What types of trading accounts does Vestrado offer?

A: Vestrado offers four types of trading accounts: Frux Standard Account STP, Frux CENT Account (coming soon), Fides Cashback Account, and Respectus ECN.

Q: What is the minimum deposit required to open a trading account with Vestrado?

A: The minimum deposit required to open a trading account with Vestrado is $10.

Q: What is the maximum leverage offered by Vestrado?

A: Vestrado offers leverage ranging from 1:1000 to 1:2000 based on the account types chosen.

Q: What trading instruments are available at Vestrado?

A: Vestrado offers a variety of trading instruments, including forex, metals, shares, cryptocurrencies, and indices.

Q: What trading platforms does Vestrado offer?

A: Vestrado offers the popular MetaTrader 4 (MT4) trading platform.