简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A Clone Firm: FTSFX is in the Blacklist of Hong Kong SFC

Abstract:FTSFX is an illegitimate broker operating in Hong Kong and the website is available in both English and Chinese.

It states its advantages - customer first, global market financial instruments, separated deposit of funds and strong financial regulation. Looking at the overall theme, the platform does look enticing. However, it just tries to mislead investors into thinking it is legit, while in fact, the best conditions including it claimed are just signs of a scam.

Domain age of about 100 days

Fraudulent forex entities create sites that are generally 1 to 2 years old and disappear to recreate another domain name. The domain age of the website(https://www.ftsfx.net/) was created just about 100 days ago and will expire on the same day in the next year. This is on purpose as after 6 to 12 months the company will then just move to a new website and continue to change its image for scamming. It's a common defrauding tactic used by fraudsters.

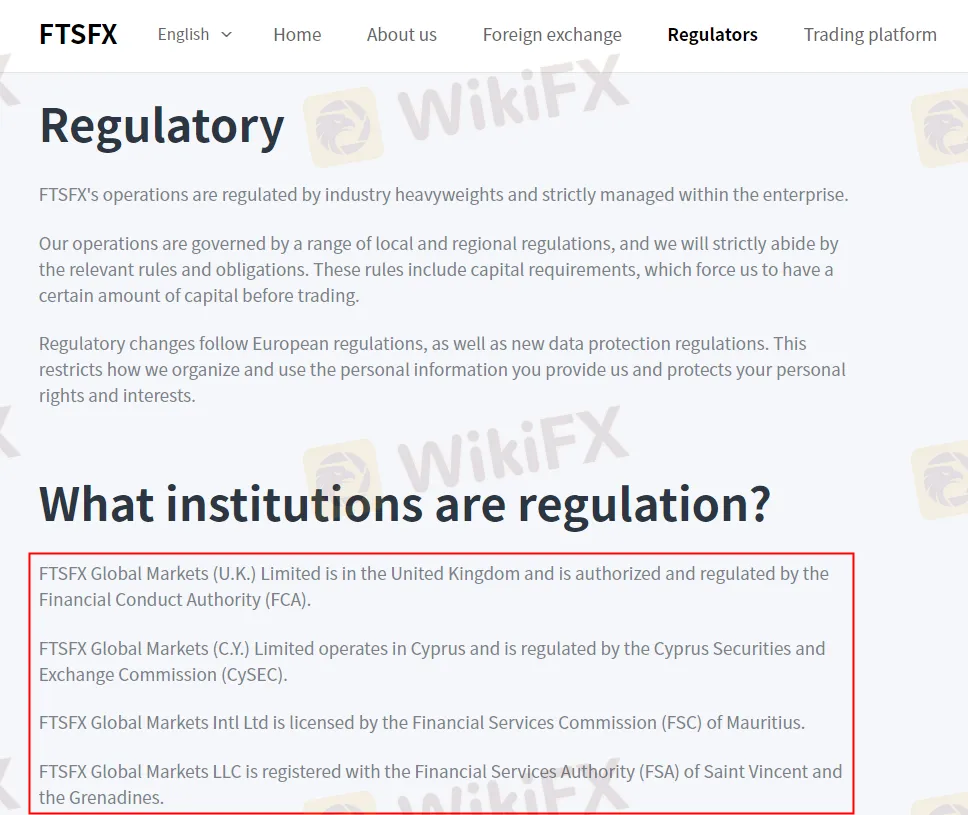

Claims to be regulated by a few global regulators

FTSFX offers multiple currency pairs on its online forex trading platform. The firm claims to be governed by a range of local and regional regulations to try and improve its credibility with unsuspecting investors:

· authorized by the Financial Conduct Authority (FCA).

· regulated by the Cyprus Securities and Exchange Commission (CySEC).

· licensed by the Financial Services Commission (FSC) of Mauritius.

· registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines.

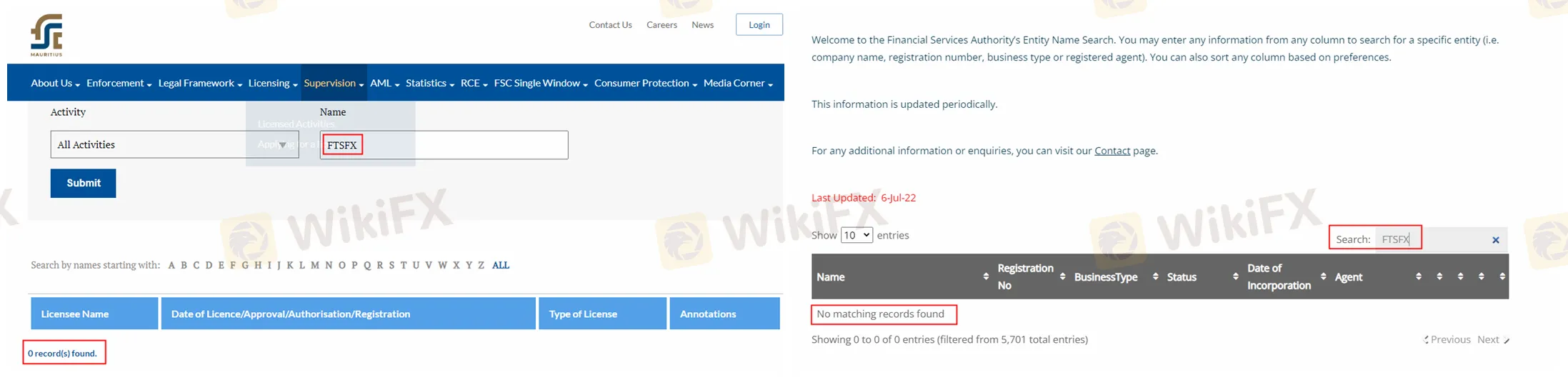

But we found no results matched with the entity in the database of the above four mentioned authorities regulated brokers list.

That is to say - FTSFX is telling lies and running without any regulatory license.

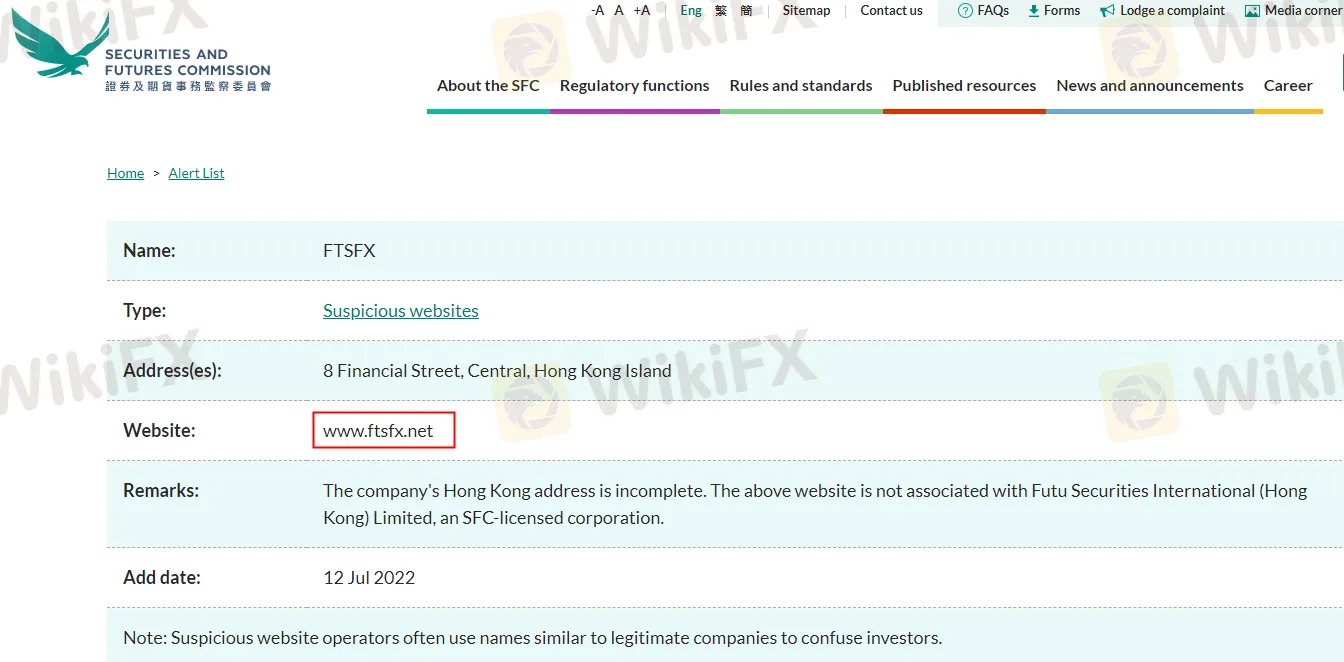

Added to the blacklist of Hong Kong financial regulator

The website cannot be legitimate because it is obviously breaching the laws and regulations governing companies that provide financial services. As you can see, the broker is in the blacklist of Hong Kong financial regulator - SFC. The authority warned public that FTSFX is a clone of a licensed company recently. Investors should not to transact any business with FTSFX because it is extremely risky.

Therefore, this broker is suspected to be a scam according to the above researches done by our team.

The problem with an unregulated company is that it will not follow the industry's practices, and thus consumers are likely to lose their money.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Ultimate Guide to Automated Forex Trading in 2025

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Will natural disasters have an impact on the forex market?

The forex market is known for its rapid responses to global events, but the influence of natural disasters, such as earthquakes and typhoons, can be less straightforward. While headlines may scream about catastrophic damage and economic disruption, the long-term effects on currency values often depend on a blend of immediate shock and underlying economic fundamentals.

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Online scam groups in the Philippines trick Filipinos into gambling and love scams, from Manila to Bacolod, causing trafficking and pain as police fight back.

Why does your mood hinder you from getting the maximum return from an investment?

Investment decisions are rarely made in a vacuum. Aside from the objective data and market trends, our emotions—and our overall mood—play a crucial role in shaping our financial outcomes. Whether you’re feeling overconfident after a win or anxious after a loss, these emotional states can skew your decision-making process, ultimately affecting your investment returns.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator