简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Scam Alert! Ilegal FX Broker M24 Markets is Warned by UK FCA

Abstract:If you are a smart forex investor, you must not want to trade with M24 Markets.

Therefore, more and more investors see its true face now. Here we are going to show you the proof that M24 Markets is a scam.

An Anonymous Company

M24 Markets does not present all the information that it shall show to investors, such as legal documents, regulations, and other details of the company. It does not even say the company name, which makes the broker an anonymous company. Here is a red flag.

Please be aware of this kind of anonymous company since a regulated broker has no reason to hide its company name or regulation. In most situations, anonymous companies are often illegal brokers.

UK FCA Warning

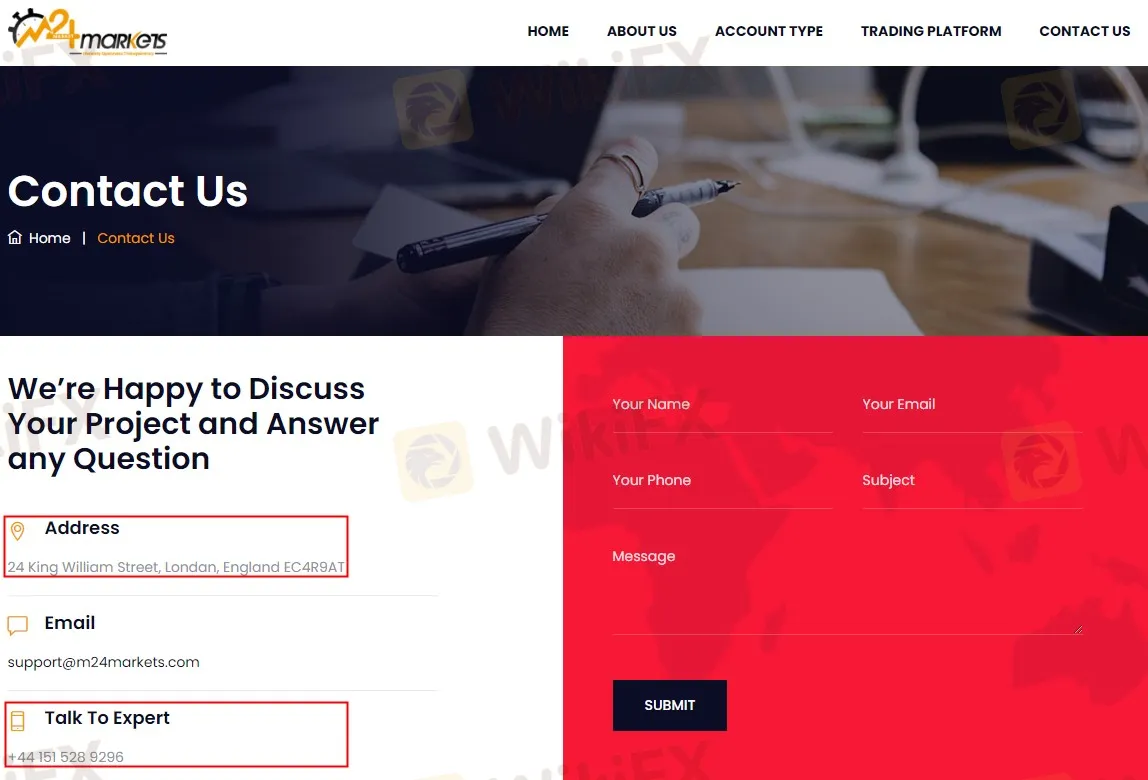

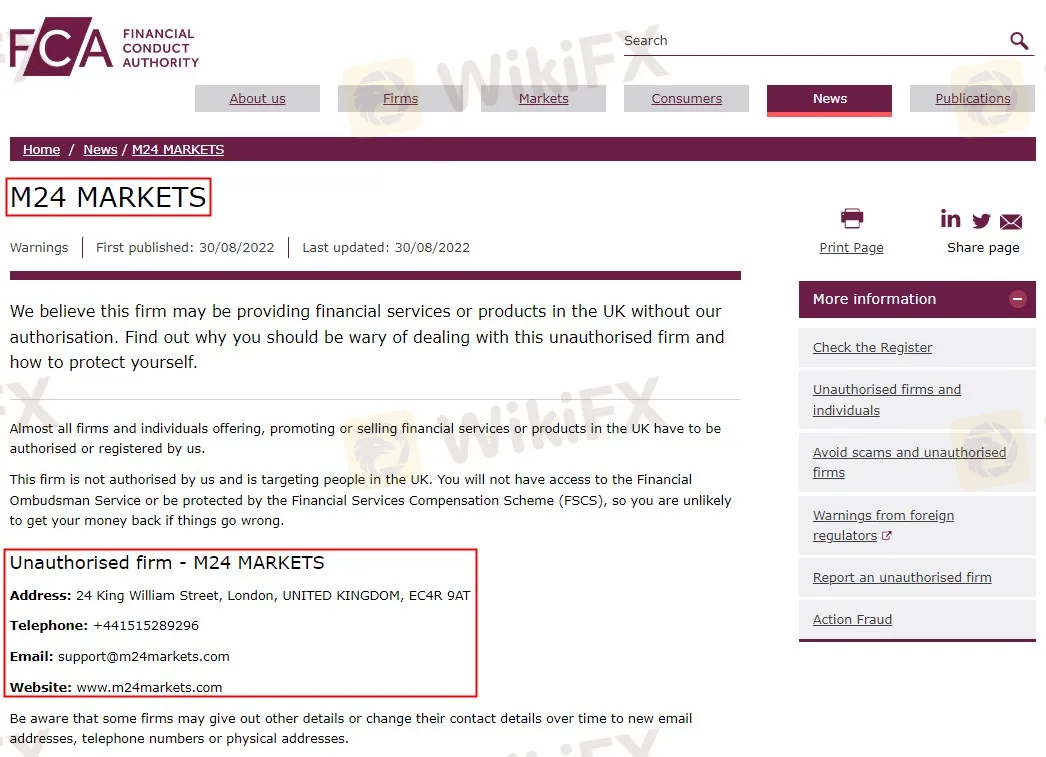

According to the telephone number and the address on its “Contact Us”, we found that M24 Markets is a broker located in the UK. So we searched the UK forex regulator - the United Kingdom Financial Conduct Authority (UK FCA). And found a warning against the scam.

UK FCA confirmed that the fraudster is providing financial services in the UK without authorization.

Risky Leverage

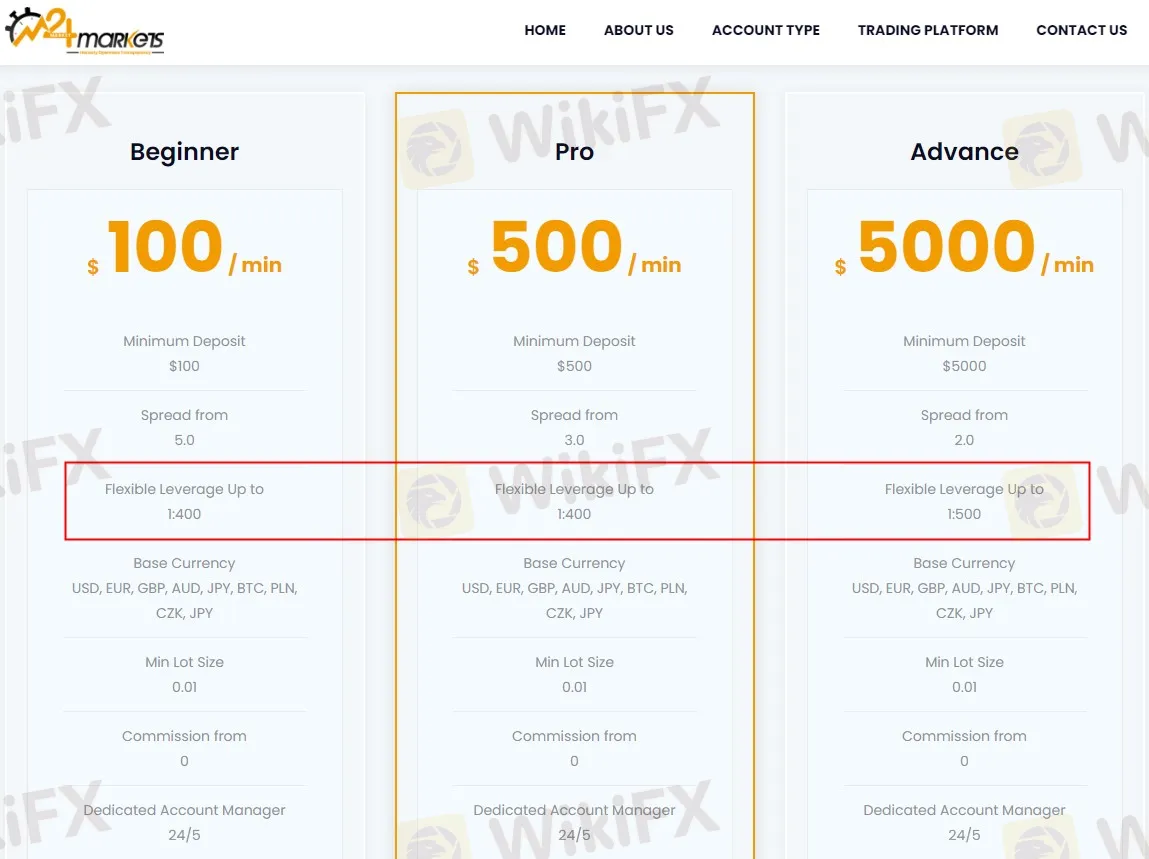

Like the other frauds, this scammer offers attractive trading conditions to lure investors.

The highest leverage it shows on the webpage reaches 1:500, which confirms that it is an unregulated broker in the UK from another aspect. Since the UK FCA has strict leverage limits for the brokers it regulates, less than 1:30.

High leverage does not always a good thing for investors because higher leverage brings higher risks. Investors therefore should choose the trading conditions that fit them.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Ultimate Guide to Automated Forex Trading in 2025

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Will natural disasters have an impact on the forex market?

The forex market is known for its rapid responses to global events, but the influence of natural disasters, such as earthquakes and typhoons, can be less straightforward. While headlines may scream about catastrophic damage and economic disruption, the long-term effects on currency values often depend on a blend of immediate shock and underlying economic fundamentals.

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Online scam groups in the Philippines trick Filipinos into gambling and love scams, from Manila to Bacolod, causing trafficking and pain as police fight back.

Why does your mood hinder you from getting the maximum return from an investment?

Investment decisions are rarely made in a vacuum. Aside from the objective data and market trends, our emotions—and our overall mood—play a crucial role in shaping our financial outcomes. Whether you’re feeling overconfident after a win or anxious after a loss, these emotional states can skew your decision-making process, ultimately affecting your investment returns.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator