简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

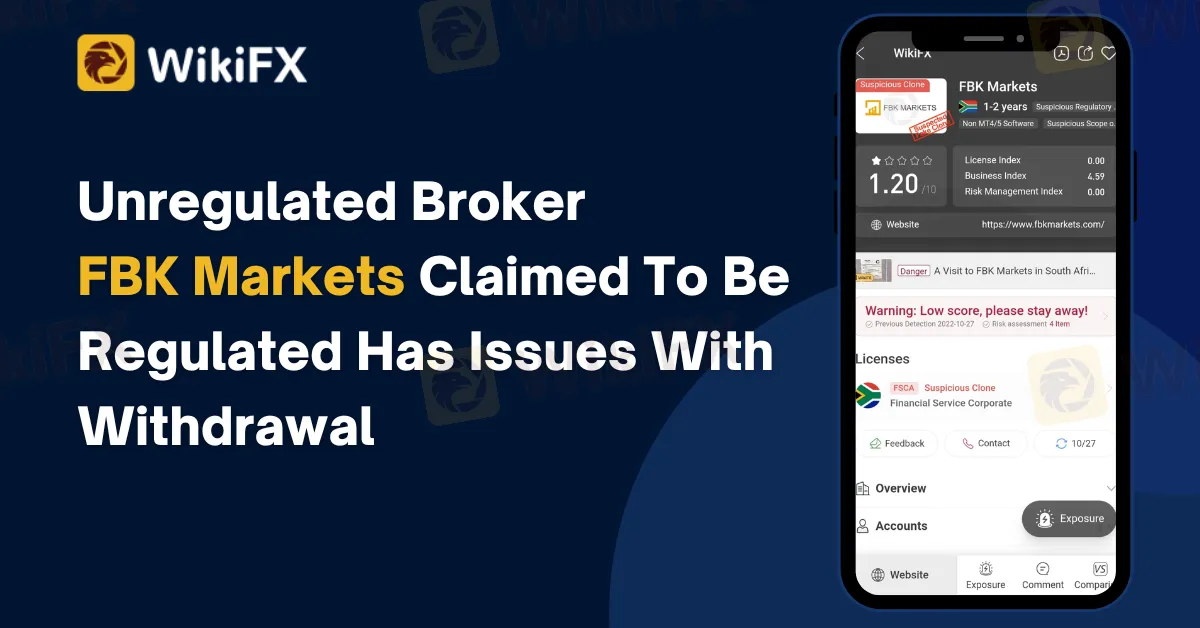

Client Feedback: Unregulated Broker FBK Markets Claimed To Be Regulated Has Issues With Withdrawal

Abstract:A complete review about FBK Markets and how they handle their investors

Since the epidemic, Forex trading has become an alternate means of making a living. Forex brokers compete with each other to be seen by many traders as the best forex broker. However, the converse effect will be that many unregulated forex brokers will also do their ways to compete with regulated brokers. One method is to partner with a licensed broker to become a regulated broker. FBK Markets is an example of a broker.

Overview of FBK Markets and Their Regulation

Through its partnership with RCG Markets, South African Forex broker FBK Markets says it is a legal and approved financial service provider. WikiFX discovered that RCG Markets has surpassed its regulatory status. (See image below.)

Upon checking the name of the the company on the FSCA official website as the largest financial regulator in South Africa the result is none.

Client Reactions

Its traders provided feedback on how FBK Markets treats its investors. The majority of the reviews or considered as complaints are about withdrawal difficulties. In a statement, a trader said that the support did not know how to assist him with his withdrawal. They claimed the same thing and withdrew, but he waited a week after receiving his money.

An identical problem occurred when the second trader studied FBK Markets. He thought he would get his money the next day after he asked to take some of his profits out. But the support couldn't help him again, and after a week of waiting, the money was taken away.

How does this broker attract clients?

Most brokers use strategies to attract additional investors to trade on their platform. After a promotion has ended, FBK Markets will establish a new one. People's minds will always be looking forward to future returns if they market in this way. The current FBK Market offer is the R500 “Know Your Broker” promotion. As a result, people will be eager to sign up so they may compete. Of course, depending on the customer service, a minimum deposit may be required for your account to be verified. Because this broker offers a micro account, they will take a small deposit of R100 or 5.57 USD.

FBK Markets on WikiFX

WikiFX is a forex trading search engine site that provides detailed information about your selected broker. It also assesses a broker's integrity and validity, as well as how they handle their clients. WikiFX gives FBK Markets a score of 1.20 because their website doesn't have any licenses or regulatory information. The partnership with RCG Markets is the sole thing that makes them regulated.

The WikiFX app has a list of over 39,000 brokers, both regulated and unregulated. It has been working with 30 financial regulators around the world to solve any trading problems between traders and brokers and to stop illegal activity with unregulated brokers.

You may reach WikiFX Support using the information provided below:

Conclusion

If we want to find the best broker to trade with, we must first look at the regulatory status and choose a broker that is considered low-risk or regulated so that we can trade without worrying. Trust that the WikiFX App is searching for information on your selected broker.

You can check out more information for FBK Markets here: https://www.wikifx.com/en/dealer/3550644013.html

Keep an eye out for more Forex broker news.

To keep up to speed on the latest news, download the WikiF App from the App Store or Google Play Store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Unlocking the Power of Algo Trading: Benefits and Limitation

Algorithmic trading merges speed, data, and automation—but can it outsmart human intuition and market chaos? Explore its power and pitfalls.

WikiEXPO Global Expert Interview: JinDao Tai ——The Future of Forex Trading

In the era of rapid changes in financial innovation and regulation, WikiGlobal, as the organizer of WikiEXPO, has always been at the forefront of the industry, capturing key topics with keen insight and presenting deep thinking and forward-looking perspectives to the industry through a series of unique interviews. This time, we are honored to invite Mr. JinDao Tai, the Managing Director of Jindaotai.com.

President of Liberland Vít Jedlička Confirms Attendance at WikiEXPO Hong Kong 2025

Vít Jedlička, President and Founder of the Free Republic of Liberland, has confirmed his participation in WikiEXPO Hong Kong 2025, one of the most influential Fintech summits in the industry. The event will bring together global leaders, innovators, and policymakers to delve into the future convergence of technology and society.

Is Billion Bucks Fx Scam?

Recent claims on YouTube and social media platforms allege that Billion Bucks Fx is a scam broker. Many traders have reportedly lost money after investing with this broker, and it has been given a notably low score of 1.06/10 by independent rating platforms. In this article, we break down the details of Billion Bucks Fx, assess the risks, and provide insight into whether investors should be wary of its services.

WikiFX Broker

Latest News

Forex Market Outlook: Key Currency Pairs and Trading Strategies for March 24–28, 2025

Singapore Police Crack Down on Scams: $1.9M Seized, 25 Arrested

Gold Prices Swing Near Record Highs

XTB Opens New Dubai Office

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

Currency Calculator