Score

DBG Markets

Australia|5-10 years| Benchmark A|

Australia|5-10 years| Benchmark A|https://www.dbgmarketsglobal.com/

Website

Rating Index

Benchmark

Benchmark

A

Average transaction speed (ms)

MT4/5

Full License

DBGMarketsUK-Live3

Benchmark

Speed:AAA

Slippage:A

Cost:B

Disconnected:AAA

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

Singapore

SingaporeContact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 8 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

Australia

AustraliaAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed DBG Markets also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Pepperstone

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Benchmark

Sources

Language

Mkt. Analysis

Creatives

Website

dbgpromotion.com

Server Location

Singapore

Website Domain Name

dbgpromotion.com

Server IP

8.223.29.128

dbgmarketsglobal.com

Server Location

Singapore

Website Domain Name

dbgmarketsglobal.com

Server IP

170.33.13.188

dbgmarket.org

Server Location

Singapore

Website Domain Name

dbgmarket.org

Server IP

170.33.13.188

Genealogy

VIP is not activated.

VIP is not activated.COZFX

FOPU

FPFX

Relevant Enterprises

Company Summary

| Broker Name | DBG Markets |

| Founded in | 2007 |

| Registered in | United Kingdom |

| Regulated by | ASIC, FCA, FSCA ( Out of the business scope) |

| Trading Instruments | Forex, Precious Metals, Shares, Indices, Commodities |

| Demo Account | Yes |

| Maximum Leverage | 1:500 |

| Minimum Spread | 0.0 pips onwards |

| Trading Platforms | MT4, MT5 |

| Minimum Deposit | $100 |

| Deposit & Withdrawal | Visa, Bank Transfer, Chinese UnionPay, Skrill, Webmoney, Crypto |

| Customer Service | 24/7 live chat, online messaging, phone: +27 0861888221, email: support@dbgm.com |

| Promotions | Yes |

What is DBG Markets?

DBG Markets, established in 2007, is indeed a well-known online broker, commanding a strong market presence for over a decade. It operates from its London and Sydney headquarters, while also maintaining offices across the Asia-Pacific and South America.

DBG Markets offers access to some popular markets, which include forex, precious metals, shares, indices, and commodities, with the maximum leverage of up to 1:500.

Additionally, the broker's offerings are accessible via the MetaTrader 4 and MetaTrader 5 platforms - renowned platforms popular amongst traders for their advanced charting tools, automated trading abilities, and user-friendly interfaces.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

What Type of Broker is DBG Markets?

DBG Markets is a MarketMaking(MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, DBG Markets acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered.

However, this also means that DBG Markets has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with DBG Markets or any other MM broker.

Pros & Cons

| Pros | Cons |

| • Strictly regulated | • Regional restrictions |

| • Extensive trading instruments | |

| • Demo accounts available | |

| • MT4/5 supported | |

| • Multiple payment options without fees | |

| • 24/7 multi-channel support |

Pros:

- Regulated by multiple reputable financial authorities, including FCA, ASIC.

- Offers a wide range of trading instruments, including forex, precious metals, shares, indices, commodities.

- Offers risk-free demo accounts for traders to test trading environment.

- Offers the popular MT4 and MT5 trading platforms, as well as a range of educational resources.

- Provides multiple deposit and withdrawal options, with no fees charged for deposits or withdrawals.

- Customer support is available 24/7 via live chat, online messaging, phone, and email.

Cons:

- DBG Markets does not offer services to residents of certain jurisdictions, including but not limited to the United States of America, Iran, Afghanistan, Belgium, Hongkong, Japan, or any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Is DBG Markets Legit ?

DBG Markets is a regulated broker, operating under the oversight of several reputable financial regulatory bodies.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| ASIC | DBG MARKETS (AUSTRALIA) PTY LTD | Market Making(MM) | 247017 |

| FCA | DBG MARKETS (UK) LLP | Investment Advisory License | 469459 |

| FCSA | DBG MARKETS ZA (PTY) LTD | Financial Service Corporate | 41920 |

• DBG MARKETS (AUSTRALIA) PTY LTD is regulated by Australia Securities & Investment Commission (ASIC, No. 247017).

• DBG MARKETS (UK) LLP, its entity in the United Kingdom, is regulated by the Financial Conduct Authority (FCA, No. 469459).

• DBG MARKETS ZA (PTY) LTD, its entity in South Africa, has also registered with the Financial Sector Conduct Authority (FSCA) in South Africa, holding a Financial Service Corporate license under license no. 41920.

These regulators are known for their rigorous standards and require brokers to adhere to strict financial guidelines aimed at protecting traders.

However, while being regulated by these bodies grants legitimacy to DBG Markets, it's always recommended for traders to perform their due diligence when choosing a broker. This includes researching the broker's reputation, reading online customer reviews, and fully understanding the terms and conditions attached to the broker's services.

It's also important to note that while regulatory supervision can lower the risk of fraudulent activity, it can't eliminate such a risk entirely. Hence, adequate research and scrutiny should always be undertaken before deciding to trade with any broker.

Market Instruments

DBG Markets offers over 300 products available to traders, covering Forex, Precious Metals, Shares, Indices, Commodities. However, it does not support trading on Futures, Options, even Cryptocurrencies. Plus, in comparison to other brokers, DBG Markets doesn't have quite as many products to offer.

| Tradable Assets | Supported |

| Forex | ✅ |

| Precious Metals | ✅ |

| Shares | ✅ |

| Indices | ✅ |

| Commdoties | ✅ |

| Cryptocurrencies | ❌ |

| Futures | ❌ |

| Options | ❌ |

This includes forex, ensuring access to the dynamic foreign exchange market with various currency pairs.

They also offer opportunities to trade in precious metals such as gold and silver, which can provide a hedge against economic instability.

For those who are interested in equity investments, DBG Markets offers trading on numerous shares from a variety of businesses.

Moreover, you can also access various indices, giving you the ability to take positions on the overall performance of a selection of companies in a specific market segment.

Additionally, they also offer commodities that could include energy products like oil and gas, agricultural goods, and more.

Account Types

DBG Markets offers three account types tailored for different trading needs and preferences: Standard (STD), ECN, and VIP accounts.

The Standard Account provides a straightforward entry point for traders. It features spreads starting from 1.6 pips and offers trading instruments covering forex, precious metals, shares, indices, and commodities. This account type operates with zero commission and supports multiple currencies.

For traders seeking tighter spreads, the ECN Account is an excellent choice. It offers spreads from 0 pips, making it ideal for high-frequency traders and those employing scalping strategies. While it does come with a $6 commission, the potential for price improvement often outweighs this cost for many traders.

The VIP Account combines elements of both, offering spreads from 0.6 pips with zero commission. This account type is well-suited for experienced traders who maintain larger account balances and require premium trading conditions.

Notably, DBG Markets distinguishes itself by offering account opening with no minimum deposit requirement, providing accessible entry for traders at all levels.

How to Open an Account?

To open an account with DBG Markets, you would generally follow these steps:

Step 1: Visit the DBG Markets official website.

Step 2: Click on the “Open an Account” button located on the homepage.

Step 3: You'll be directed to an online registration form. Fill out the form with your personal information including your full name, email address, phone number, country of residence and choose the type of account you wish to open.

Step 4: Agree to the terms and conditions and click Submit.

Step 5: You may be required to verify your identity and address. This often involves uploading a clear, readable copy of your ID (like a passport or driver's license) and a proof of residence document (like a utility bill or bank statement that clearly shows your full name and address and is not more than 3 months old).

Step 6: Once your application is approved and your identity verified, you'll be able to fund your account.

Step 7: After making a deposit, you can then access your account and start trading.

You should check the exact details as per DBG Markets' policy on their website or by contacting their support service. It's also crucial to familiarize yourself with the trading platform, and understand all the risks involved in trading before you start.

Leverage

DBG Markets offers a maximum leverage of up to 1:500, which is relatively high compared to other brokers in the industry. This high leverage allows traders to open larger positions with a smaller deposit, potentially increasing their profit potential.

However, it also comes with significant risks as high leverage can amplify losses, especially for traders with limited experience or those who do not use proper risk management techniques. Traders should be aware of the risks associated with high leverage and use it responsibly to avoid excessive losses.

| Pros | Cons |

| • Allows traders to open larger positions with smaller deposits | • High leverage can increase the risk of significant losses |

| • Can potentially increase potential profits | • Requires a good understanding of risk management to avoid excessive losses |

| • Provides greater flexibility in trading strategies | • High leverage may encourage overtrading and impulsive trading decisions |

Spreads & Commissions

DBG Markets offers a tiered structure of spreads and commissions across its three account types. The Standard (STD) Account features spreads starting from 1.6 pips with no additional commission, suitable for traders who prefer straightforward pricing. For those seeking tighter spreads, the ECN Account provides spreads from 0 pips, coupled with a $6 commission per trade, appealing to high-volume and algorithmic traders. The VIP Account strikes a balance, offering spreads from 0.6 pips without commission, tailored for experienced traders with larger account balances.

Overall, DBG Markets appears to offer pricing that's in line with industry standards, with potentially advantageous terms for higher-volume traders.

| Account Types | STD Account | ECN Account | VIP Account |

| Spreads | From 1.6 pips | From 0 pips | From 0.6 pips |

| Commissions | Zero | $6 | Zero |

Trading Platforms

DBG Markets offers access to four chocies of trading platforms for clients who trade on this platform: MetaTrader 4 & MetaTrader 5, PAMM/MAM, as well as a webtrader.

MetaTrader 4 (MT4)

DBG Markets provides the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both renowned for their robust features and user-friendly interfaces. These platforms are accessible across multiple devices, including desktop computers, mobile phones, and tablets, as well as through web browsers, ensuring traders can manage their positions from anywhere.

MetaTrader 5 (MT5)

PAMM/MAM

For investors seeking managed accounts, DBG Markets supports PAMM/MAM systems, allowing for efficient fund management.

WebTrader

Additionally, the broker offers a proprietary Webtrader platform, providing a lightweight, browser-based alternative for traders who prefer not to download software.

| Pros | Cons |

| • Vast tools and indicators for technical analysis | • Limited selection of social trading features |

| • User-friendly interface with customizable charts and workspace | • Limited integration with third-party platforms |

| • Ability to run automated trading strategies with Expert Advisors (EAs) | • Limited support for backtesting and strategy optimization |

| • Available on desktop, web, and mobile devices for flexible access | |

| • Support for multiple order types, including pending orders and stop losses |

Deposit & Withdrawal

| Payment Method | Currency | Fees | Processing Time |

| VISA Cards | USD, EUR, GBP, AUD, NZD, CAD | $0 | Instant |

| Bank Transfer | USD, EUR, GBP, AUD, NZD, CAD | $0 | 1-3 working Days (Deposit)/1 Working Day (Withdrawal) |

| Chinese UnionPay | CNY | $0 | Instant |

| Skrill | USD | $0 | Instant |

| Webmoney | USD | $0 | Instant |

| Crypto | USDT | $0 | Instant |

DBG Markets offers several deposit and withdrawal options, including Visa, Bank Transfer, Chinese UnionPay, Skrill, Webmoney, and Crypto, with no fees for transactions. The company supports various currencies such as USD, EUR, GBP, AUD, NZD, CAD, CNY and USDT.

The minimum deposit to open an account with DGB Markets is $100.

Most of DBG Markets' deposit and withdrawal methods are geared for instant transactions, providing a smooth flow of funds for DBG Markets' clients. However, it's worth noting that transactions involving Bank Transfers may take a bit longer. Deposits done via Bank Transfer could take approximately 1-3 working days to arrive and be processed, while for withdrawals a processing time of 1 working day is usually required. This expected delay is generally due to the banking systems and processing times of the banks involved, which vary between institutions. Thus, it is advisable to plan your transactions ahead, particularly if you prefer using Bank Transfers for your financial operations.

Customer Service

DBG Markets offers multiple channels for clients to reach out with inquiries or concerns. The brokerage maintains a support team accessible via phone at +27 0861888221 and email atsupport@dbgmfx.com. For those who prefer written communication, a message form is available on their website, allowing clients to submit detailed inquiries. Online chat is also available, which supports English, Vietnamese, and Chinese communication.

Physical Address: No. 9 Cassius Webster Building, Grace, Complex, PO Box 1330, The Valley, AI-2640 Anguilla

However, there is limitedFAQ section available on their website, which can be inconvenient for traders seeking quick answers to common questions.

However, there is no dedicated account manager available, and DBG Markets does not provide support through social media platforms.

| Pros | Cons |

| • 24/7 live chat support | • No dedicated account manager |

| • 24/7 phone support | • No social media support |

| • Quick email response time | |

| • Physical address listed on website | |

| • FAQ section available |

Frequently Asked Questions (FAQs)

Is DBG Markets regulated well?

Yes. It is regulated by ASIC in Australia, FCA in the UK, and FSCA in South Africa.

At DBG Markets, are there any regional restrictions for traders?

Yes. It does not offer services to residents of certain jurisdictions, including but not limited to the United States of America, Iran, Afghanistan, Belgium, Hongkong, Japan, or any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Does DBG Markets offer demo accounts?

Yes, it offers demo accounts.

Does DBG Markets offer industry leading MT4 & MT5?

Yes. Both MT4 and MT5 are available.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Keywords

- 5-10 years

- Regulated in Australia

- Regulated in South Africa

- Market Maker (MM)

- Retail Forex License

- MT4 Full License

- MT5 Full License

- Global Business

- High potential risk

News

Review DBG Markets: Market Report for Mar 28, 2025

Market InsightsGOLD - GOLD prices rose as expected, making a clear breakout from the consolidation zone after the MACD and overall price action signaled a continuation of the uptrend. While the RSI di

2025-03-28 13:40

Review DBG Markets: Market Report for Mar 27, 2025

Market AnalysisGOLD - GOLD is showing increased potential for a bullish continuation, though prices remain consolidated. The MACD continues to move sideways, while the RSI signals overbought levels, i

2025-03-27 15:59

Review DBG Markets: Market Report for Mar 26, 2025

MARKET ANALYSISGOLDGOLD prices remain consolidated, aligning with our expectations. While prices are holding steady, there are signs of a slowdown. We maintain our readings from yesterday and continue

2025-03-26 13:50

Review DBG Markets: Market Report for Mar 25, 2025

MARKET ANALYSISGOLD prices were stable but went lower after a period of consolidation, testing the previous high swing. Although the drop did not have enough volume to continue selling below the zone,

2025-03-25 13:43

Review DBG Markets: Market Report for Mar 24, 2025

MARKET ANALYSISGOLDGold prices followed expectations, pulling back from record highs while maintaining the broader bullish sentiment. The MACD remains stable in its selling momentum, though the antici

2025-03-24 14:27

Review DBG Markets: Market Report for Mar 21, 2025

MARKET ANALYSIS GOLD - GOLD prices have consolidated at record highs, with a potential retracement expected this Friday. The MACD and RSI indicate increasing bearish momentum and volume, suggesting a

2025-03-21 13:43

Comment 193

Content you want to comment

Please enter...

Comment 193

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

阿狸75247

Hong Kong

怕是黑平台 ,就在MT4查了一下监管,嘿!这个平台根本就没有监管,有图有真相。

Exposure

02-25

FX3887147570

Vietnam

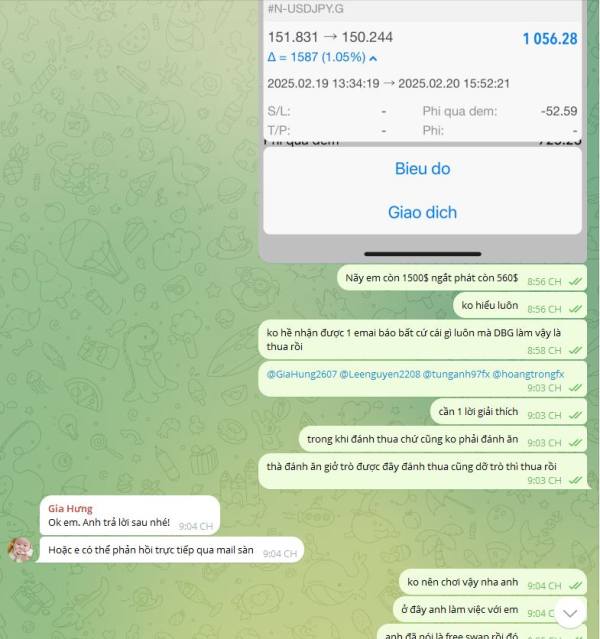

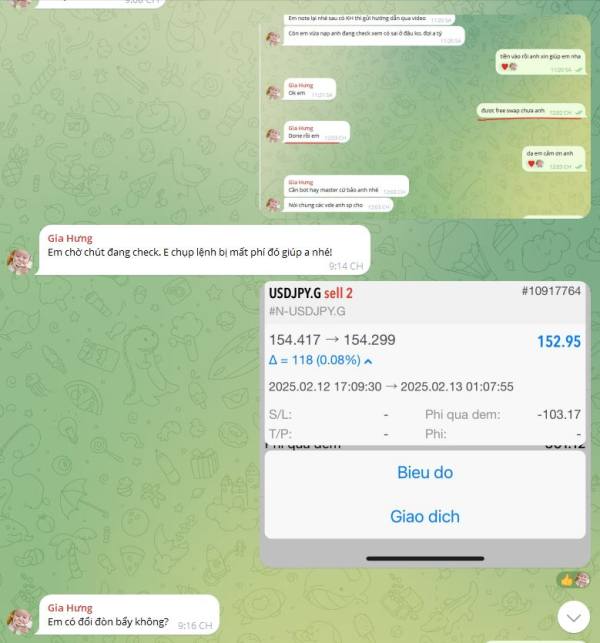

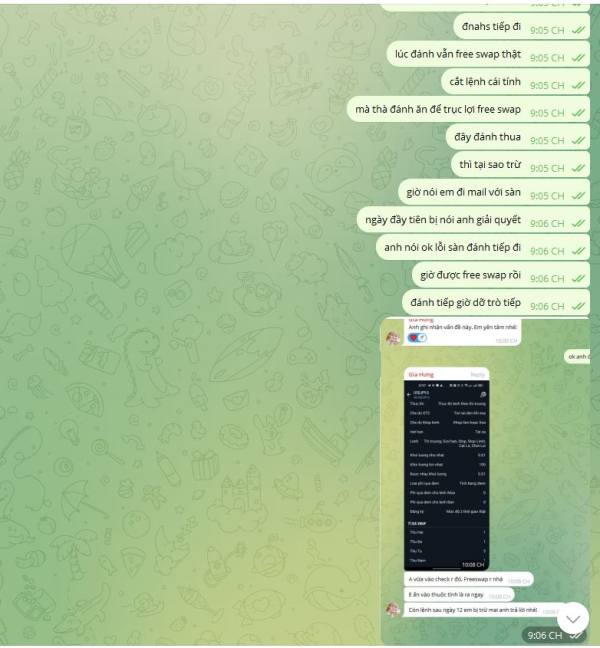

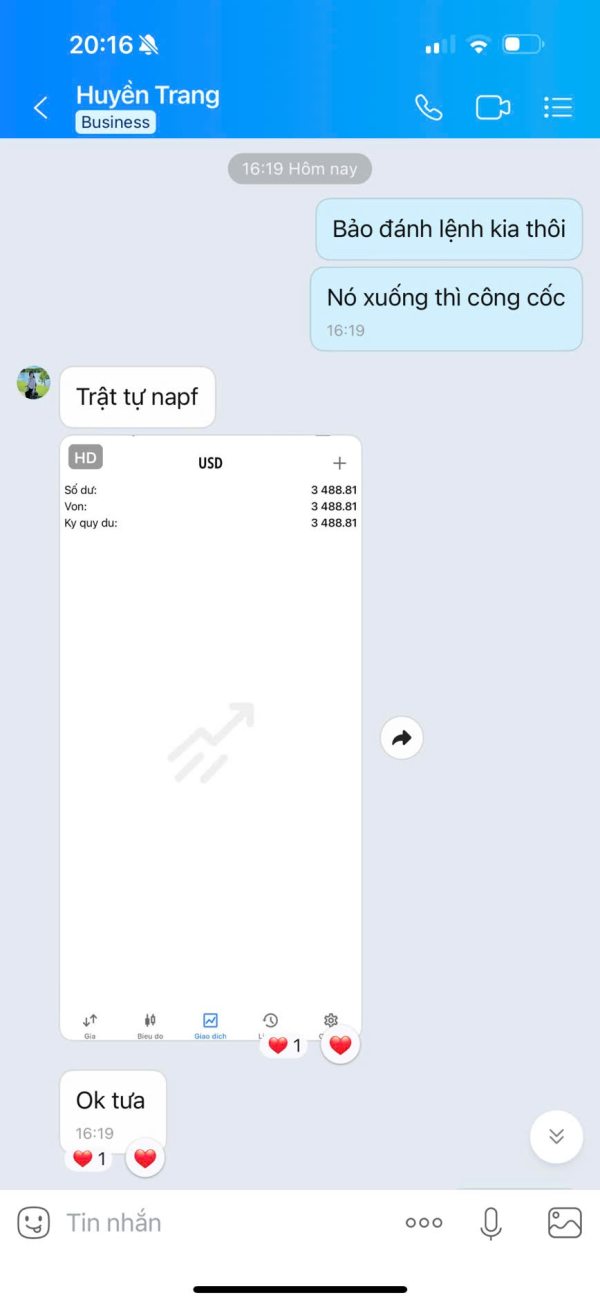

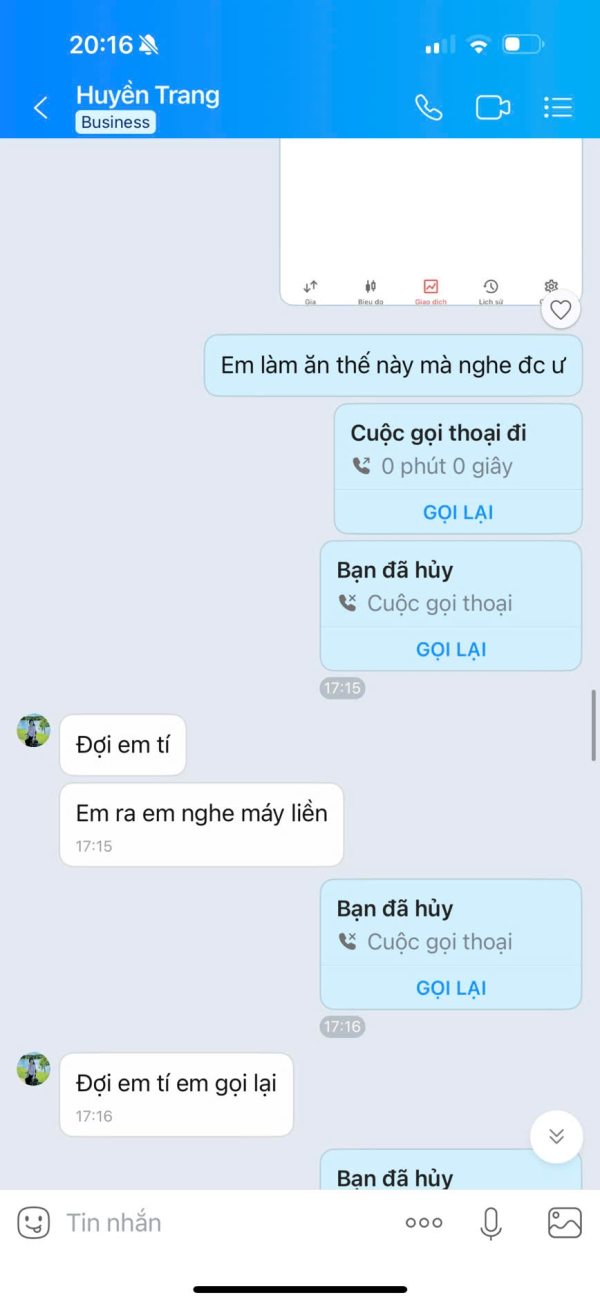

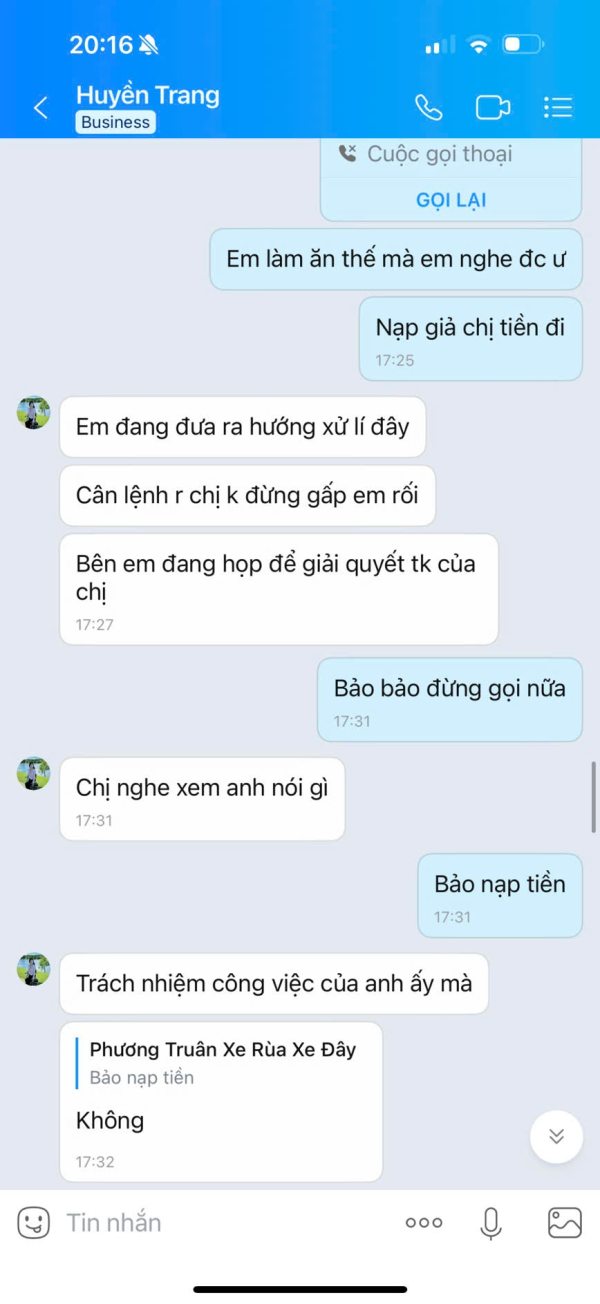

CẢNH BÁO LỪA ĐẢO – SÀN DBG SCAM! ⚠️ Mình muốn chia sẻ trải nghiệm cay đắng với sàn DBG để mọi người tránh mắc bẫy! 🔴 Chiêu trò lừa đảo: Ban đầu, đội ngũ hỗ trợ mời chào nạp 2.000$ với cam kết miễn phí swap. Khi mình giao dịch, giữ lệnh qua đêm không mất phí swap như cam kết. Tuy nhiên, ngay khi đóng lệnh, phí swap tự nhiên xuất hiện! 🤯 🔴 Thủ đoạn đối phó: Lần đầu khi mình phản ánh, họ bảo lỗi hệ thống và sẽ xử lý. Khi hỏi lại, họ xác nhận đã fix lỗi, bảo mình tiếp tục giao dịch. Nhưng khi mình tiếp tục giao dịch, vẫn bị tính phí swap như cũ! 😡 🚨 Kết quả: Sau khi tố cáo, đội ngũ hỗ trợ thách thức và cuối cùng im lặng, không phản hồi! Tổng thiệt hại: 1.000$! ⚠️ MỌI NGƯỜI HÃY TRÁNH XA SÀN DBG! ⚠️ Đừng để bị lừa như mình! Hãy cẩn thận với những lời mời gọi hấp dẫn từ những sàn kém uy tín! 🚫

Exposure

02-22

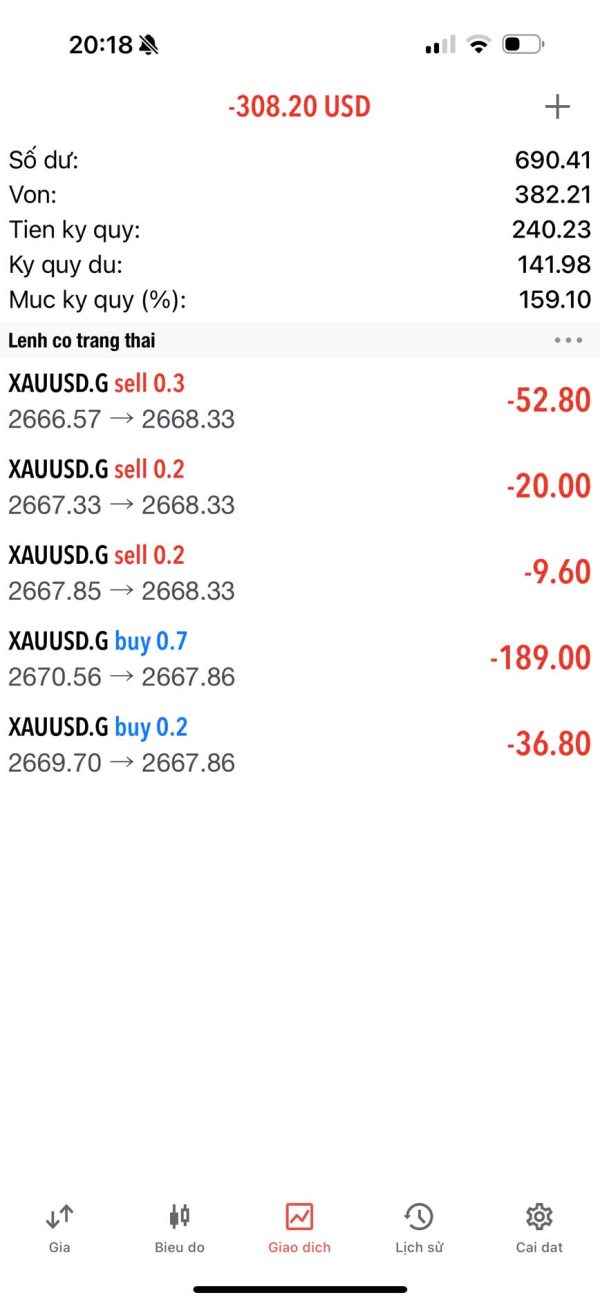

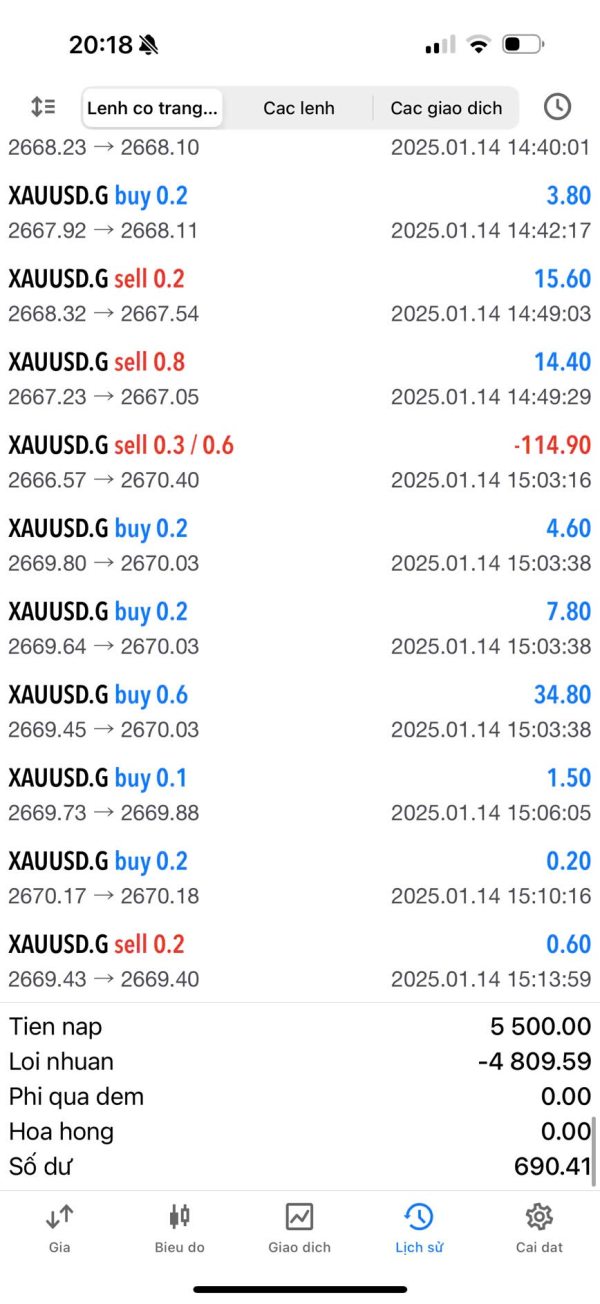

Phuong Chu Thi

Vietnam

tư vấn viên xinh đẹp lừa tiền đánh cháy của tôi trên DBG. Nạp vào 5000 đô nó đánh 2 lần bay sạch

Exposure

01-15

梧桐更兼细雨

Hong Kong

出金打到我银行卡 然后我银行卡瞬间被冻结 寻求解决平台不积极。

Exposure

01-08

FX1603656032

Hong Kong

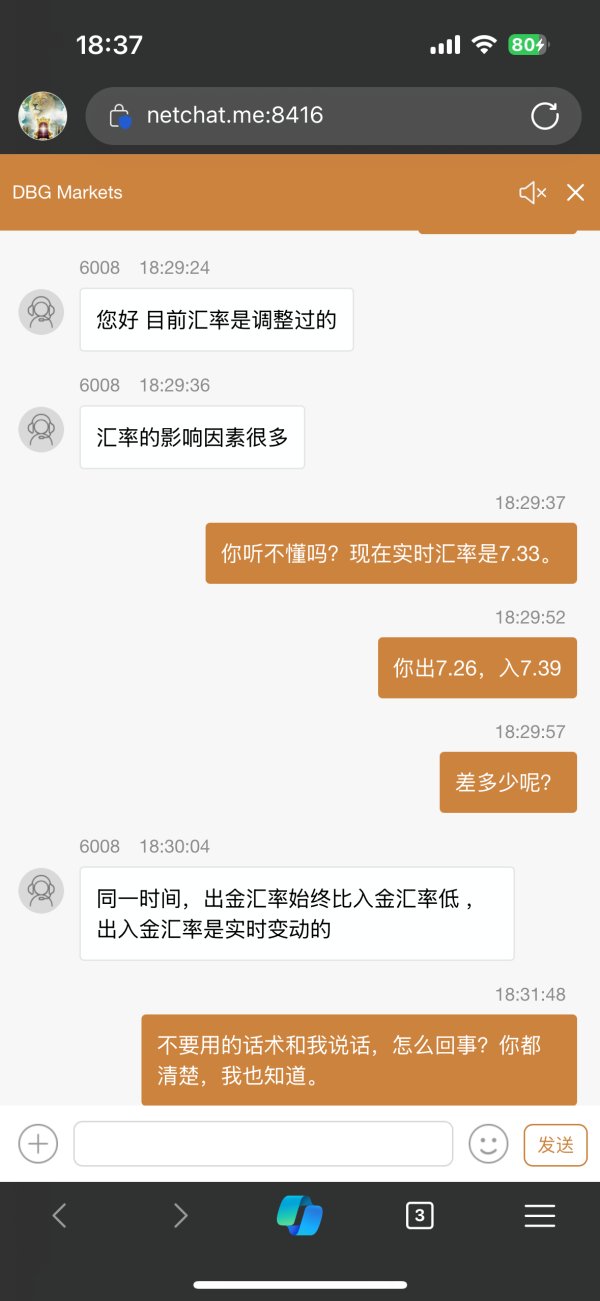

入金7.39汇率,出金7.26汇率,现在实时汇率是7.33,太TM垃圾了,吃相难看,之前一年多一直是7.22,汇率涨多少都不动√

Exposure

01-08

FX4169684232

South Korea

Support intentionally burns the account! The platform is completely fraudulent, please be careful, everyone.

Exposure

2024-11-29

在人间24842

Hong Kong

绝大多数是黒平台,你想出金了你想也别想,没人理你客服找不到,邮件也不回你

Exposure

2024-11-21

有舍有得

Hong Kong

大家千万不要用,这是黑平台

Exposure

2024-10-25

小强7738

Hong Kong

不让出金,各种理由拒绝!直接断网,要不就是说利润被银行扣了,银行扣他们钱,管我们什么事?直接把钱黑掉了!

Exposure

2024-10-23

次优行

Hong Kong

亏了就是好用户,赚了就是说什么违规操作!总共坑了18万共计两万多刀不给出金,官方群里直接给我禁言,还说我造谣

Exposure

2024-10-22

FX2199233236

Hong Kong

大家千万不玩、吸血鬼平台、不让人出金、外汇的朋友注意

Exposure

2024-10-21

FX1768247325

Hong Kong

在平台代理处托管账户,代理答应赔付50%,后代理赖账,与平台前后反应多次无果并不回复我的邮件,直到我说要曝光平台的行为才勉强回复一封邮件,现怀疑平台与代理是一伙的,完全不在乎客户的权益,对代理也没有任何处理,放任代理存在这种行为,后续能不能出金也可能是个问题,毕竟从这个事件就可以看出来这种平台不会管你死活的。客服也是一直说反馈但是没有后续。建议大家擦亮眼睛不要使用这个平台,毕竟点差有50呢,他只要代理给他拉客户进来操作就有钱赚,才不会对帮平台赚钱的代理下手,只会对受害者下手

Exposure

2024-09-25

FX1931019286

Hong Kong

,今天我做了空单,点位2629.25的时候资金1120点位下来到2628.70资金反而变少了,这样的情况以前很多,所以让我亏损50多万美金当时没有截屏,这次为了很好的证明截屏了,希望平台赔偿.如果得不到赔偿我一定会报警

Exposure

2024-09-23

FX2936572168

Hong Kong

这家的太不是人了,给我账户做单,从1500做到剩下200,而且还收手续费点差什么的高点差高手续费

Exposure

2024-09-12

开心32844

Hong Kong

要求平台给与处理解封银行卡,回复说2-3天。至今未解决,而且邮箱和客服直接断联。张家界公安局永定分局(有公安证明),张家界公安局(联系不上),唐河县公安局(公示能查到我但具体未知),其中永定分局已经提交公安证明,其他还在联系。明明平台与承兑商的黑的问题可以直接解决,让下游客户承担。

Exposure

2024-09-08

vv vvvvv

Hong Kong

官网异常,疑似跑路。。。。。。。。。。。。

Exposure

2024-09-07

开心32844

Hong Kong

2024.6-8月顿博平台出金后银行卡被三个地方公安局司法刑事冻结。平台邮箱不回复,客服失联。至今为解决我银行卡被冻结问题。平台和承兑商涉黑钱导致客户银行卡被冻结资金,这是正经平台吗,这是有牌照平台吗,这是一个一个正规平台管理承兑商的有口碑平台吗。总是要求客户提供这个那个,平台承兑商账号是否涉嫌黑钱违法他们不处理,和承兑商一同搞死客户银行卡。事件已经两个多月未处理,我提交的一份公安证明已经三周不处理。现在直接失联。客户银行卡被司法冻结赌博的承兑商平台很清楚,就是在为难客户。还有开不出公安证明的怎么办。这是诈骗,涉黑

Exposure

2024-09-07

开心32844

Hong Kong

2024.6-8月份三次被公安冻结,要求平台处理,至今为解决,网站客服失联,顿博邮箱不回复,其中一个涉及被冻出金的交易账户无法登陆。被冻结单位:张家界公安局永定分局,张家界公安局,唐河公安局。涉及资金目前已知1306+24371=35677(银行柜台提供的)。最初知晓是在7月初,让我提供与警察录音就行解决,然后是提供公安证明就能解决,我努力去沟通警察,目前第一个证明发顿博已经三个星期之久。平台承兑商黑的钱已经被司法冻结的账号,平台出金时候打款给下游出金客户,百般设卡敷衍,迟迟不解决,这是个什么平台,这个平台是如何正规的,又是如何为客户服务的,现在客服人员也与我锻炼,竟然从中文说英文了“无法建立连接”,顿博网站反馈又过了一周到现在无音讯,我用126邮箱发文件和附件竟然说他们打不开,这是个什么组织。我要求平台立刻消除我张家界公安局的两笔冻结

Exposure

2024-09-07

雨来123

Hong Kong

开平仓响应时间达半分钟之久,持仓账户盈利后就取消交易功能,无法开平仓,设置止损止盈,盈利达到一定额度后就直接关闭账户,自主设定账户余额出金后关闭客户所有账户。一般给出的解释:账户有赠金则是不正当交易,无赠金则是系统异常,强制平仓后关闭账户。

Exposure

2024-09-04

雨来123

Hong Kong

提款已批准,但我的银行账户还没有收到钱。客服说需要等待48到72小时才能收到钱。已经超过72小了,还没有收到钱。对这个经纪人要小心。

Exposure

2024-09-04