简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Scam Alert: FCA Warns Against LoyalFXMarkets!!!

Abstract:The British regulator FCA issued a warning against LoyalFXMarkets on November 1st!!!

Investors who are still trading forex at LoyalFXMarkets had better quit trading ASAP!!! Investors who have been deceived by this broker please contact WikiFX to help you recover your funds!!!

To start with the most essential, you may check the recent warning issued on November 1stby the Financial Conduct Authority (FCA) in the UK against LoyalFXMarkets on the screenshot below (source: https://www.fca.org.uk/news/warnings/loyalfxmarket)

The FCA points out that this broker is not authorized to offer financial services in the UK, has not met any requirements, and is therefore not a reliable investment choice. Clients of LoyalFXMarkets would be not entitled to the same protections as clients of licensed UK brokers.

WikiFX also paid a visit to the broker's official website to learn more. LoyalFXMarkets brazenly claims that it is based and regulated in the UK, which is obviously a lie given the FCA warning shown above!

The minimum deposit LoyalFXMarkets asks for is $100. There is an abundance of reliable brokers who offer trading accounts for the same or even lower prices! The broker also claims that you would be able to get access to leverage as high as 1:1000 if you start trading with it. No legitimate UK broker could legally offer such high leverage – leverage caps exist in the country and prevent brokers from offering leverage higher than 1:30 on forex majors to retail traders. The reason for that is that trading with such high rates could lead to much bigger losses, especially if you are still an inexperienced new trader. If you would like to trade with higher leverage, make sure that you have sufficient knowledge and experience and only seek out brokers who can legally offer higher rates.

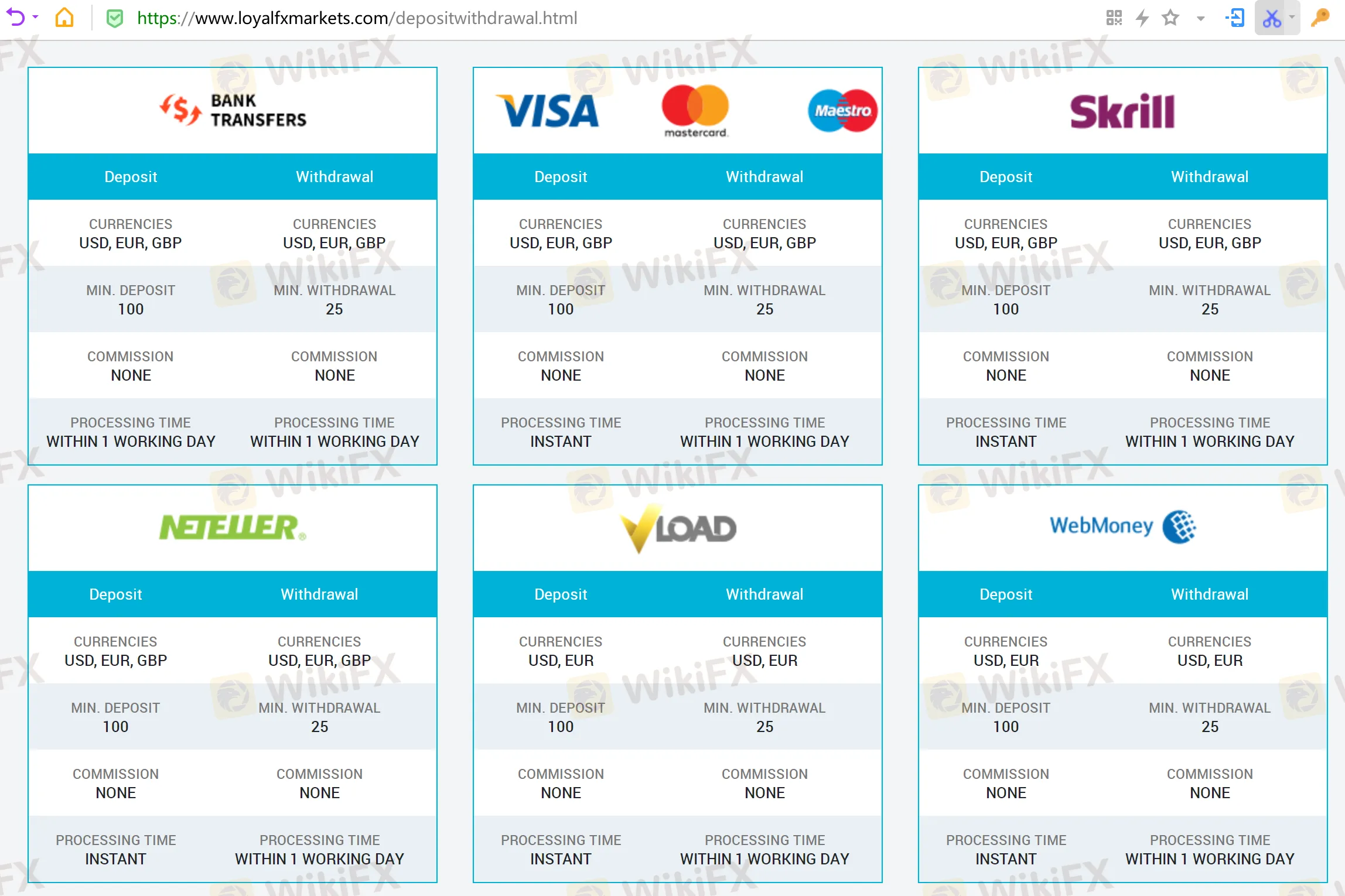

LoyalFXMarkets supposedly supports a fair number of deposit methods – wire transfer, credit/debit card, Neteller, Skrill, VLOAD, and WebMoney. However, since WikiFX was not offered the possibility to actually open an account, we cannot confirm that all of these deposit methods will actually be available. Keep in mind that scammers would often urge you to deposit in crypto – since such payments are both anonymous and irreversible.

In conclusion, trusting a broker like LoyalFXMarkets is simply not worth it – you will certainly end up robbed. The so-called brokerage is nothing more than an outright scam, which is in the spotlight of a recent investigation by the British financial authorities, who have already blacklisted the website for targeting UK customers without proper authorization.

WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing. You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Axi Reveals Game-Changing Edge Score Tool to Elevate Traders

Axi launches the Edge Score Explainer, a tool providing traders with real-time insights, personalized metrics, and actionable data to enhance trading performance.

High Risk, High Returns: Is This True?

Leverage is one of the most talked-about tools in trading. It promises big returns but comes with huge risks. Traders often wonder if leverage is a blessing or a curse. There are arguments on both sides. Some traders believe it is a game-changer. Others think it can ruin your account. What is your take on this?

FCA Plans to Transform Financial Regulations in the UK

The Financial Conduct Authority (FCA) has revealed plans to reform its regulatory framework to support economic growth in the United Kingdom.

Is eToro Leaving London to Focus on a $5B U.S. IPO in 2025?

eToro plans a $5B U.S. IPO in 2025, shifting focus from London to the U.S. market. Discover details on eToro's valuation, SEC filing, and future in fintech.

WikiFX Broker

Latest News

Plus500 Collaborates with Topstep, Prop firm

Robinhood Launches Crypto Trading Services in Spain

Archax Secures FCA Approval to Oversee Crypto Promotions in the UK

CLS Global Admits to Crypto Fraud

Philippine SEC Urges Caution Regarding Ecomamoni

Become Women Brand Ambassador of Yamarkets

Naira Falls Against Dollar as Nigeria Reshapes Economic Blueprint

How Often Do U.S. Recessions Impact Online Trading Trends?

Scam Impersonating U.S. Treasury Token Issuance Spreads on Social Media

Is eToro Leaving London to Focus on a $5B U.S. IPO in 2025?

Currency Calculator