简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The High And Low of The Day. A Sure-fire Strategy

Abstract:There is no one perfect strategy for trading forex. There is no elixir that will grant you grant you trading powers and guarantee success every single time. However there are strategies out there with a better success rate that will help you gain confidence quicker in the market, or at least there is a bit of information that when your ad with your own trading strategy you will be able to gain a better edge. Today I want to discuss one of the best trading pieces of knowledge that if you were to incorporate it into your trading strategy you would surely see favorable results.

If you intend on using some of this information to trade it is best that you find a broker with very small spreads to give yourself the best chances of winning in the market. To find such a broker I recommend you do your research using WikiFX. This all-in one helps you find the best regulated and verified brokers world wide. They also show you which brokers are known scammers, so you can avoid these people before you lose your money. For any broker query you may have, I recommend you use WikiFX.

Why are the highs and lows of the day crucial?

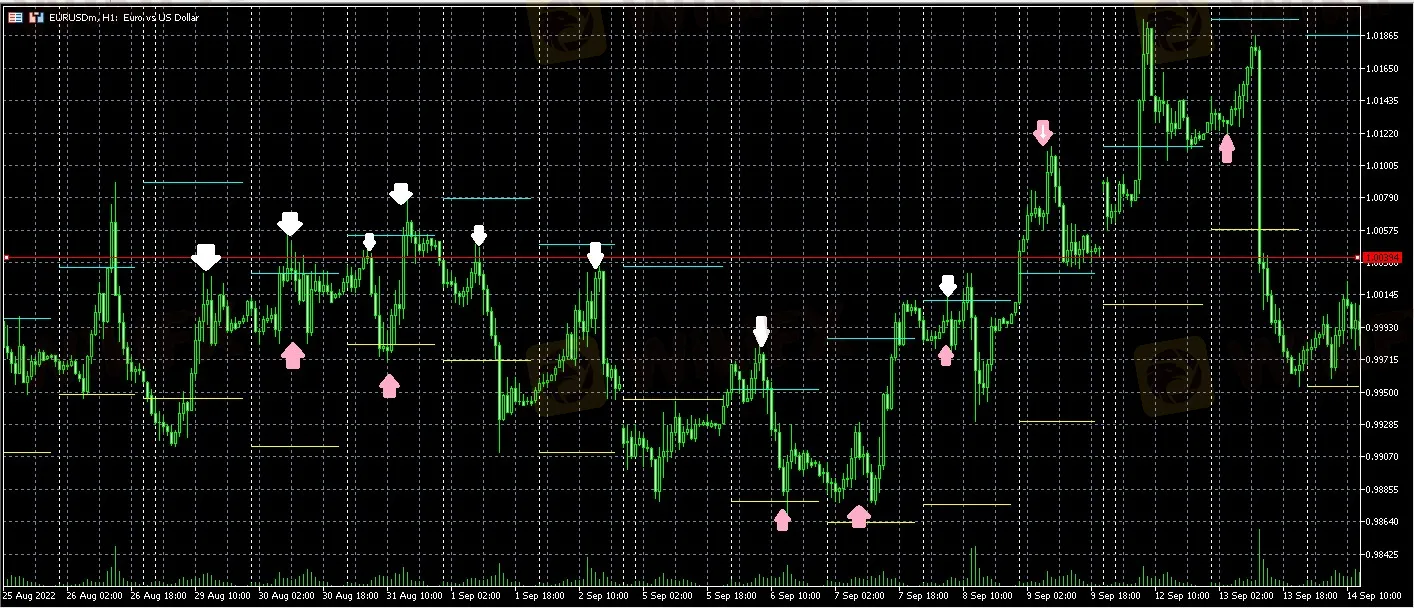

Before I carry on look at this chart

Here I have marked out all of the possible trades just using the high and the low of the current and previous days. It is quite easy to see that be it may that some days where the trades do not succeed, a majority of the time prices reject right around these points.

Why does this happen

I am sure we are all knowledgeable about support and resistance. No trading strategy does not use some kind of version of support and resistance as they help us determine at which point of the chart will price bounce off or return. They aid us with entries and exits, but some support and resistance are built differently and carry more weight.

At any given time frame there are a number of supports and resistances, however, it is more common for these areas to be broken and last for short periods of time. On a bigger time frame, we get stronger rejection areas, and hence we are using the high and low of the day as rejection zones

When big banks and big money steer the market they usually have to leave some losing positions open when they are done manipulating the markets. They have to close these positions at break even so they have to steer the market back to these areas. The high and the low of the day are usually above everyone's stop loss of the day so they usually want to breach the high of the day to stop out traders. This is when we enter when we see this manipulation going on.

This information is useful when you paid it along with the current trend. The aim is not to try to take advantage of every single trade. It is to find one or two good trades a day that you maximize on and leave the charts. You can add this tool to your trading arsenal and begin seeing a better success rate.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Should You Beware of Forex Trading Gurus?

Know the reality behind forex trading gurus, examining their deceptive tactics, inflated promises, and the risks associated with trusting them for financial advice.

The Ultimate Guide to Automated Forex Trading in 2025

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

High Return Traps? WikiFX’s Complete Scam-Busting Handbook to Avoid Financial Fraud!

Financial scams are evolving faster than ever, and fraudsters are getting more creative in luring victims into traps. Whether it’s promising high returns or leveraging authority to build trust, scammers continuously innovate new ways to trick investors. From clone firms to cold calling schemes, it’s essential to understand how these scams work to protect your hard-earned money. This comprehensive guide by WikiFX will help you recognize and avoid common financial scams.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

HTFX Spreads Joy During Eid Charity Event in Jakarta

How Will the Market React at a Crucial Turning Point?

Currency Calculator