简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

$4.3bn Got Stolen in Crypto!!

Abstract:According to a recent study by the cybersecurity and data privacy firm Privacy Affairs, the value of cryptocurrency stolen by hackers in the first 11 months of the year increased by 37% to $4.3 billion in 2022. The company stated that FTX's demise was the biggest cryptocurrency scam to date this year, with about $1 to $2 billion in unrecovered customer funds.

The failure of FTX, Axie Infinity's Ronin Network attack in March ($615 million), the Wormhole crypto bridge hack in February ($320 million), the JuicyFields.io scam in July ($273 million), and the Unique-Exchange.co/PARAIBA world scam also in July ($267 million) are the top five cryptocurrency scams committed this year, according to Privacy Affairs.

The Wintermute hack in September cost 160 million dollars, the Beanstalk DeFi project flash loan attack in April cost 182 million dollars, the Nomad cross-chain bridge attack in August cost 190 million dollars, the Elrond blockchain exchange hack in June cost 113 million dollars, the Harmony Horizon Bridge hack in June cost 100 million dollars, and the Mango Market flash loan attack in October cost 100 million dollars.

The cybersecurity company claims that young people between the ages of 20 and 40 are more vulnerable to scams that are carried out via WhatsApp (9%) and Telegram (7%), Facebook (26%), Instagram (32%), and Telegram (26%). The company also discovered that the top three coins chosen by scammers for their fraudulent activities are Bitcoin (70%), Tether (10%), and Ether (9%).

Giving a more detailed breakdown of the figures, the company stated that 97% of all cryptocurrency stolen during the first quarter of the year used DeFi protocols.

Americans lost $329 million to cryptocurrency scammers during the first quarter of this year, when compared country by country. Additionally, throughout 2022, Australian investors lost $166 million. Additionally, since the year's beginning, investors in Hong Kong have lost $50 to cryptocurrency fraud.

In the meantime, there are increasingly more instances of cryptocurrency flash loan scams. A flash loan attack takes place when a con artist takes advantage of a platform's smart contract security to borrow sizable sums of money with no security.

Over $308 million was lost as a result of 27 flash loan attacks in Q2 2022. In October 2022, a flash loan attack on the cryptocurrency trading platform Mango Market cost $100 million. According to statistics, flash loan attacks rose 66.7% in Q2 2022 compared to Q1 2022, according to Privacy Affairs founder Miklos Zoltan.

The company also pointed out that while investors lost about $2.8 billion to rug pulls last year, 2022 has seen over 188,000 rug pulls on different blockchains like BNB and Ethereum, with over $2.6 billion devoured by the Turkish crypto exchange, Thodex.

The total loss from rug pulls in Q2 2022 was $37.46 million. According to Zoltan, investors lost $32.7 million in July 2022 because of an exit scam run by Raccoon Network on its IDO/fundraising project.

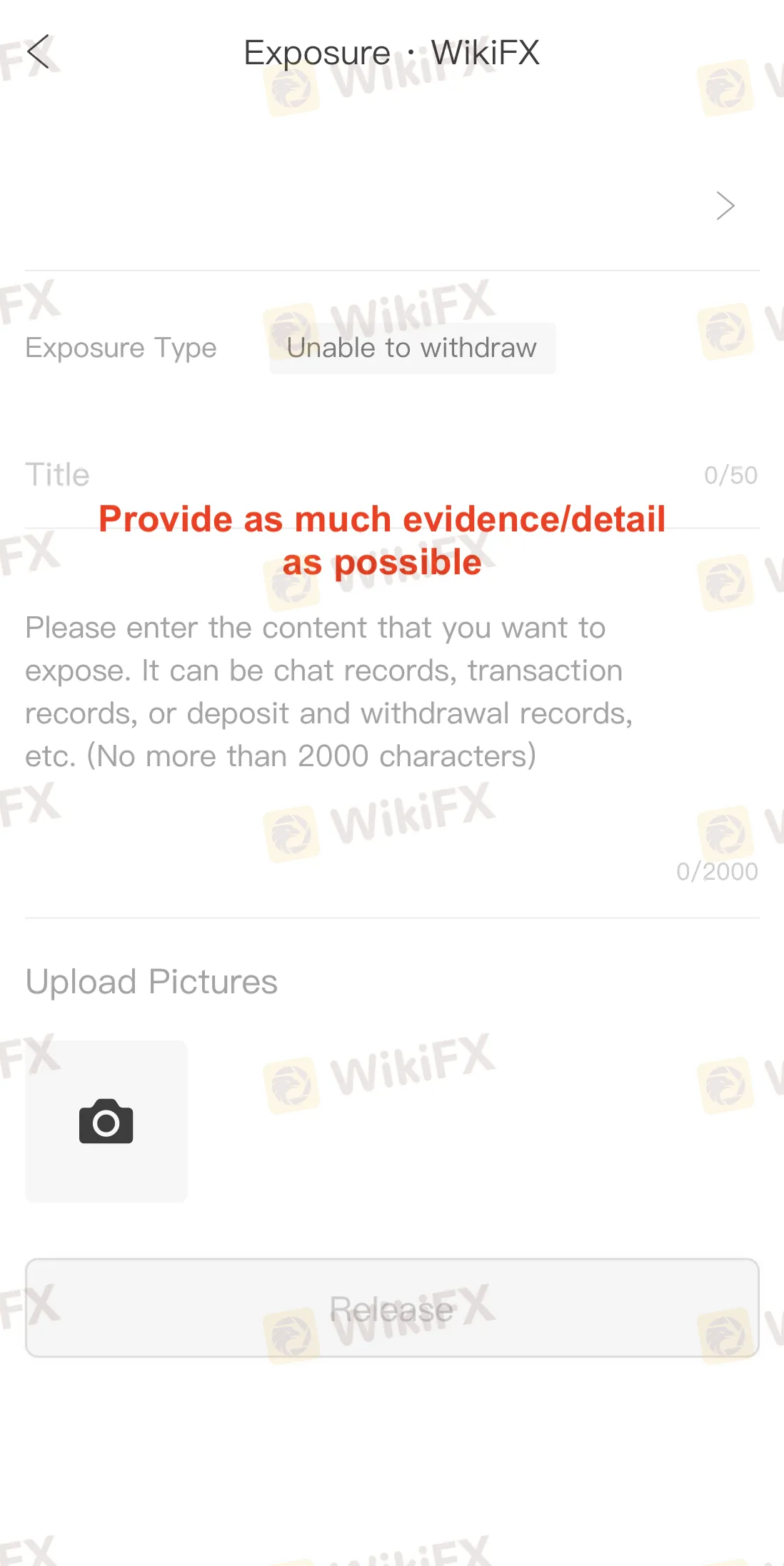

WikiFX is more than just a tool for finding out about the regulatory compliance of foreign exchange brokers; we also act as a mediator in cases where trading clients feel their foreign exchange brokers have not treated them fairly.

Simply download the free WikiFX mobile app from Google Play or the App Store, then adhere to the instructions below:

Please feel free to get in touch with the WikiFX customer service team through the channels listed below if you have any questions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Why More People Are Trading Online Today?

Discover why online trading is booming with tech, AI, and a push for financial freedom. From stocks to crypto, it’s a thrilling hustle for all.

SEC Ends Crypto.com Probe, No Action Taken by Regulator

The SEC has closed its investigation into Crypto.com with no action taken. Crypto.com celebrates regulatory clarity and renewed momentum for the crypto industry.

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

Interactive Brokers adds Solana, XRP, Cardano, and Dogecoin to its platform, enabling U.S. and U.K. clients to trade crypto 24/7 with low fees.

Couple Arrested in Thailand for Billion-Baht Crypto Scam & International Kidnapping

Thai authorities have announced the arrest of 27-year-old Chinese national Wu Di, who is believed to be at the centre of a large-scale cryptocurrency investment scam that has defrauded victims of over 600 million baht (approximately US$17.7 million) within a span of just two months.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Broker Comparison: FXTM vs XM

Currency Calculator