简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ASIC Seeks Court Order Against "Tyson Scholz" An ASX Influencer

Abstract:The Australian Federal Court ruled that social media 'influencer' Tyson Robert Scholz violated s911A of the Corporations Act by operating a financial services firm without an Australian financial services license between March 2020 and November 2021.

Mr. Scholz was accused of carrying on a financial services business without a license by delivering training courses and seminars about trading in ASX-listed securities, during which he made recommendations about share purchases, according to the Australian Securities and Investments Commission (ASIC). Using the name '@ASXWOLF TS,' I'm promoting those courses and seminars on Twitter and Instagram. Making share purchasing suggestions on private internet forums (which he ran) and on Instagram.

Mr. Scholz's offering to paying subscribers included:

subscription/membership fees of $500, $1,000, or $1,500

offers of various levels of share trading training referred to as ‘Stage 1’, and ‘Stage 3’ packages, which were marketed as introductory or advanced seminars

offers of individual one-off share trading suggestions, or tips for a fee

the Stage 2 package provides one year‘s access to a private chat site, named ’Black Wolf Pit, using the online communications platform Discord.

The case will be scheduled for a case management hearing on January 31, 2023, followed by a subsequent hearing to address any outstanding problems, including any orders prohibiting Mr. Scholz from doing financial services without a license.

ASIC is seeking orders prohibiting Mr. Scholz from:

promoting or carrying on the business of providing recommendations or statements of opinions about the purchase of shares in return for payments of money or other benefits

directly or indirectly carrying on any financial services business in Australia

receiving, soliciting, transferring, or disposing of customer funds received in connection to providing recommendations or opinions about the purchase of shares.

The financial product advice supplied by Mr. Scholz was an intrinsic component of this company,' her Honour Justice Downes noted in her conclusion. His advice was not one-time, but rather part of the ongoing and systematic commercial activities from which Mr. Scholz profited.

Through his Instagram lifestyle and 'life story' postings, Mr. Scholz had created a reputation as a successful share trader with the capacity to discover attractive firms in which to invest. It didn't matter that the pieces made no overt suggestion to buy the shares: it was enough that Mr. Scholz mentioned a firm or its stock in the tales, generally in a manner that suggested that he loved that company.'

ASIC filed proceedings in the Federal Court in December 2021 seeking orders prohibiting Mr. Scholz from advertising or carrying on any financial services activity in Australia. On December 16, 2021, the Federal Court issued cooperation orders prohibiting Mr. Scholz from marketing or carrying on a financial services firm. Those orders were issued until the Court's decision on ASIC's request for a permanent injunction, which was heard in a contentious hearing in October 2022.

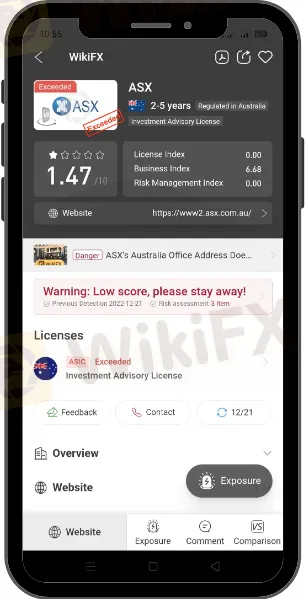

Find out more of ASX news here: https://www.wikifx.com/en/dealer/4321685308.html

Stay tuned for more Forex News.

Use the download link below to download and install WikiFX App on your mobile phones to stay updated on the latest news, even on the go.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiFX Review: Is IVY Markets Reliable?

IVY Markets, established in 2018, positions itself as a global brokerage offering a diverse range of trading instruments, including Forex, Commodities, Cryptocurrencies, and Stocks. The platform provides two primary account types—Standard and PRO—with a minimum deposit requirement of $50 and leverage up to 1:400.

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

Germany is set to hold a crucial general election on 23 February 2025, with voter frustration over migration emerging as a dominant issue.

ED Exposed US Warned Crypto Scam ”Bit Connect”

The Indian Enforcement Directorate (ED) recently exposed a crypto Scam from a firm called Bitconnect. During the investigation, which took place on February 11th and 15th, 2025. The authority recovered bitcoin worth approximately Rs 1,646 crore & Rs 13.50 Lakh in cash, a Lexus car, and digital devices. This investigation was conducted under the provisions of the Prevention of Money Laundering Act (PMLA) of 2002.

B2BROKER Launches PrimeXM XCore Support for Brokers

B2BROKER launches PrimeXM XCore support and maintenance services, enhancing trading efficiency for brokers with expert management and optimization.

WikiFX Broker

Latest News

Pi Network Mainnet Launch: Game-Changer or Crypto Controversy?

GlobTFX Users Report Same Issue! But Why?

Rate Cut or Not? It Depends on Trump’s Policies

Why Do You Keep Blowing Accounts or Making Losses?

eToro Adds ADX Stocks to Platform for Global Investors

B2BROKER Launches PrimeXM XCore Support for Brokers

Germany's Election: Immigration, Economy & Political Tensions Take Centre Stage

WikiFX Review: Is IVY Markets Reliable?

WikiFX Community Creator Growth Camp

Effect of Tariffs on Gold and Oil Prices

Currency Calculator