Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Onion

Taiwan

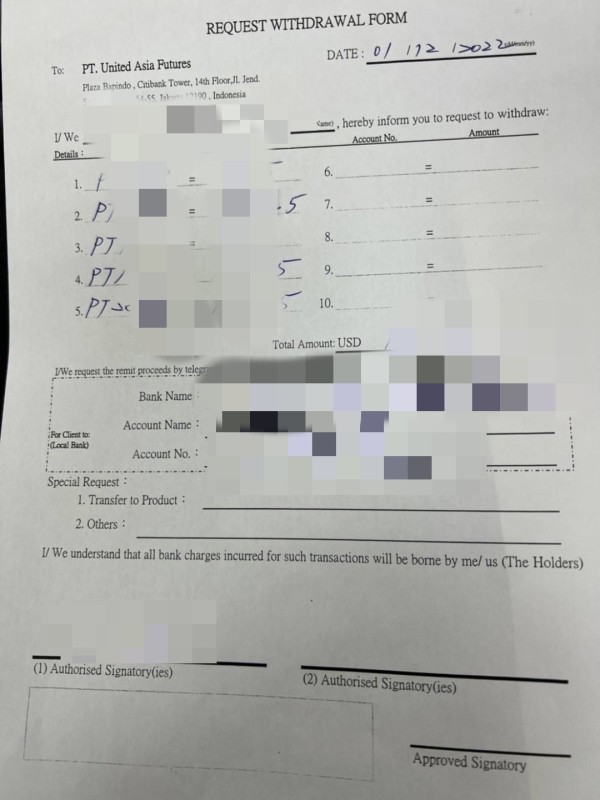

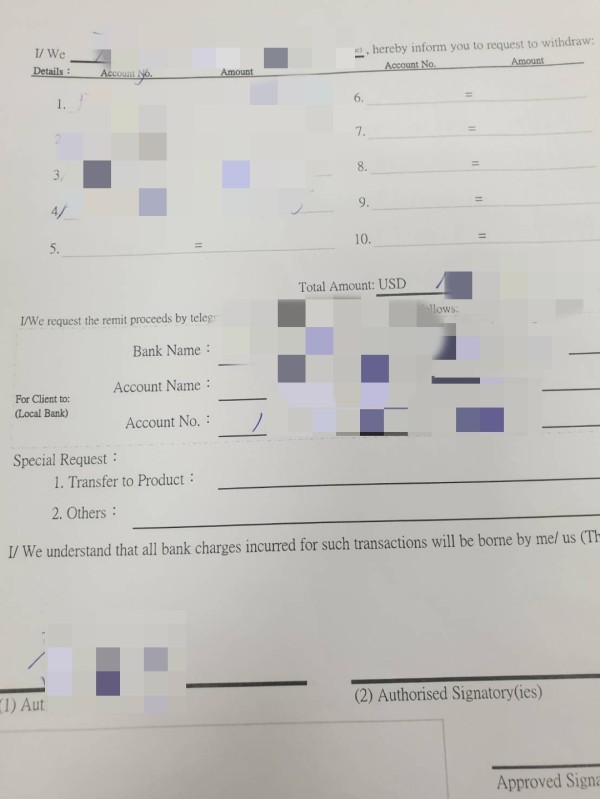

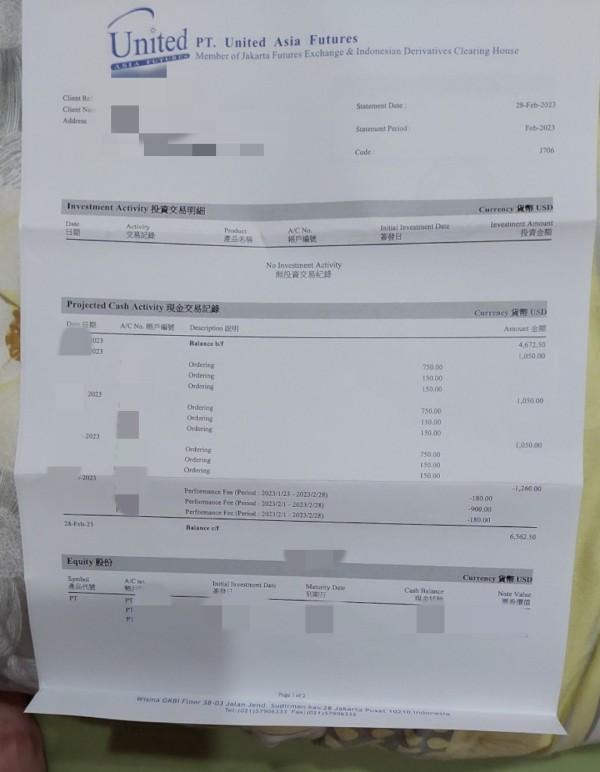

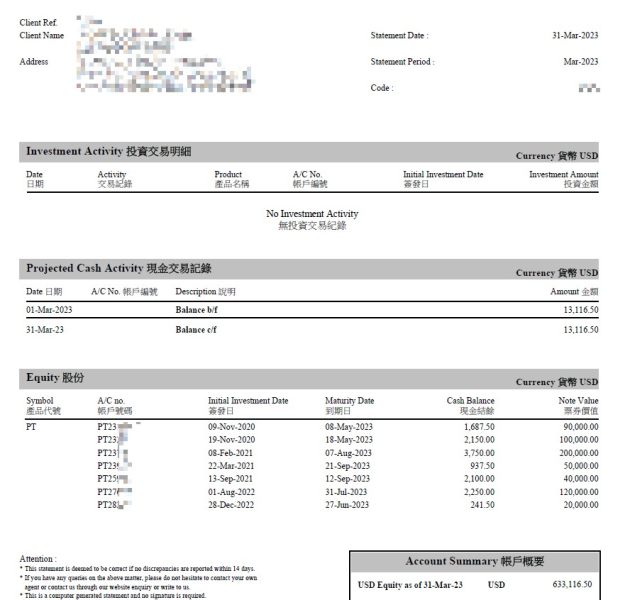

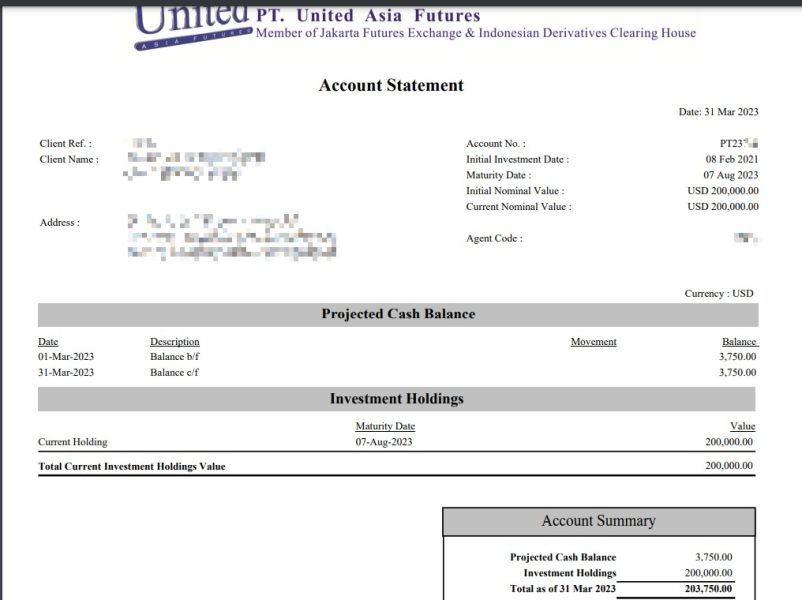

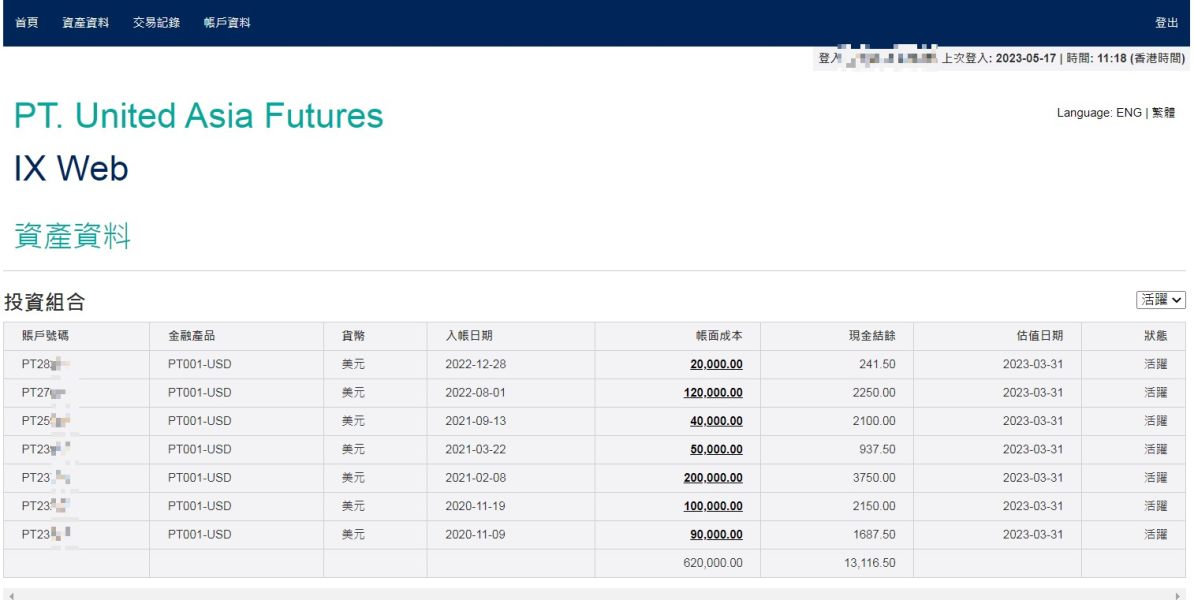

I invested in pt. united through Taiwan GFS Investment Company, and I have not been able to withdraw funds since December last year. The attachment is our withdrawal form and a list of some investments

Exposure

2023-05-19

FX1139561877

Taiwan

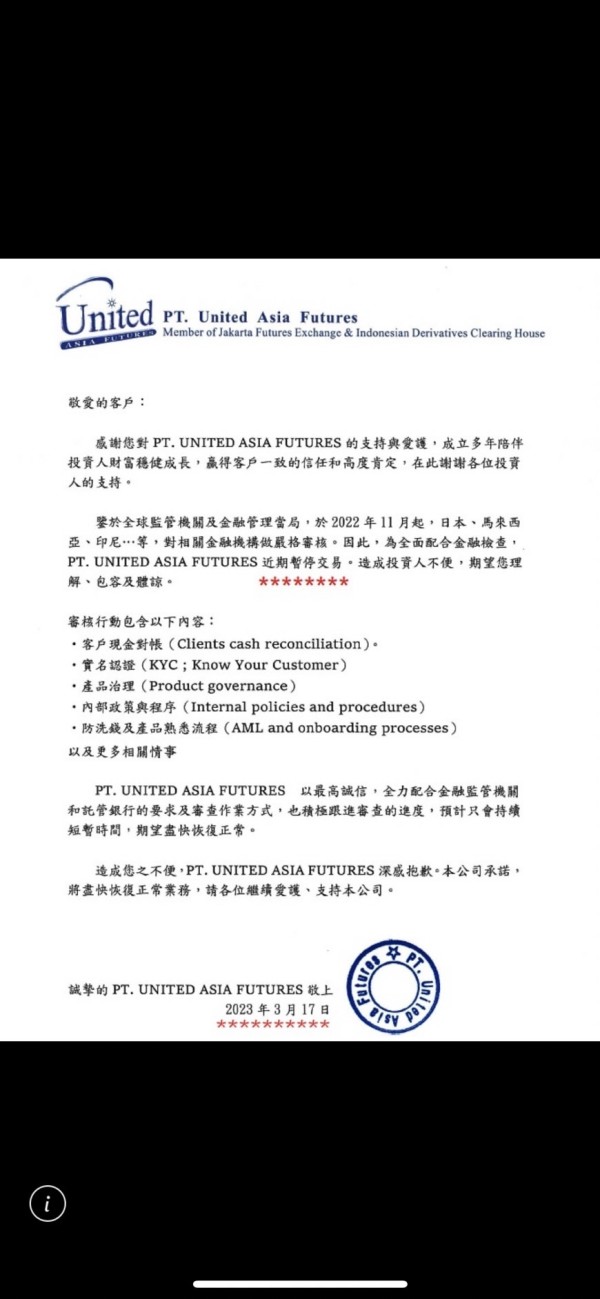

Like other exposures, I invested in pt. united through Taiwan's Zhifu GFS Investment Company, and there has been no transaction since March this year. Taiwan also replied that this broker is under financial investigation. I am very worried that the money will not be returned... Attachment It is our withdrawal order and part of the investment list

Exposure

2023-05-17

FX4095828812

Taiwan

Since the beginning of 2022, there has been no withdrawal, and the system has already fully deducted the corresponding amount. If you have encountered the same problem, you can pay attention to this problem.

Exposure

2023-05-12

Elvis

United Kingdom

Their website looks quite easy and lack of many important information. They don’t offer any educational resources while most brokers offer. The good point is that they support multilingual support, English, Indonesia and Chinese are all available.

Neutral

2022-11-22

外汇经纪人杜树澄

Mexico

This company offers a variety of financial instruments like precious metals, currency pairs, indices, stocks, commodities... It also seems safe, at least my money hasn't been scammed. I think the most important thing is safety. If your money is scammed, what is the point of other trading conditions?

Positive

2022-11-25