简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

6 Factors to Consider When Selecting A Broker

Abstract:When choosing an online Forex broker, it is crucial to be highly aware of the potential for scams. Conducting such due diligence can be overwhelming and time-consuming, so WikiFX is here for the rescue. Keep reading to find out our useful tips!

When choosing an online Forex broker, it is crucial to be highly aware of the potential for scams. Here are some things to consider when selecting a broker in order to avoid falling victim to fraudsters schemes:

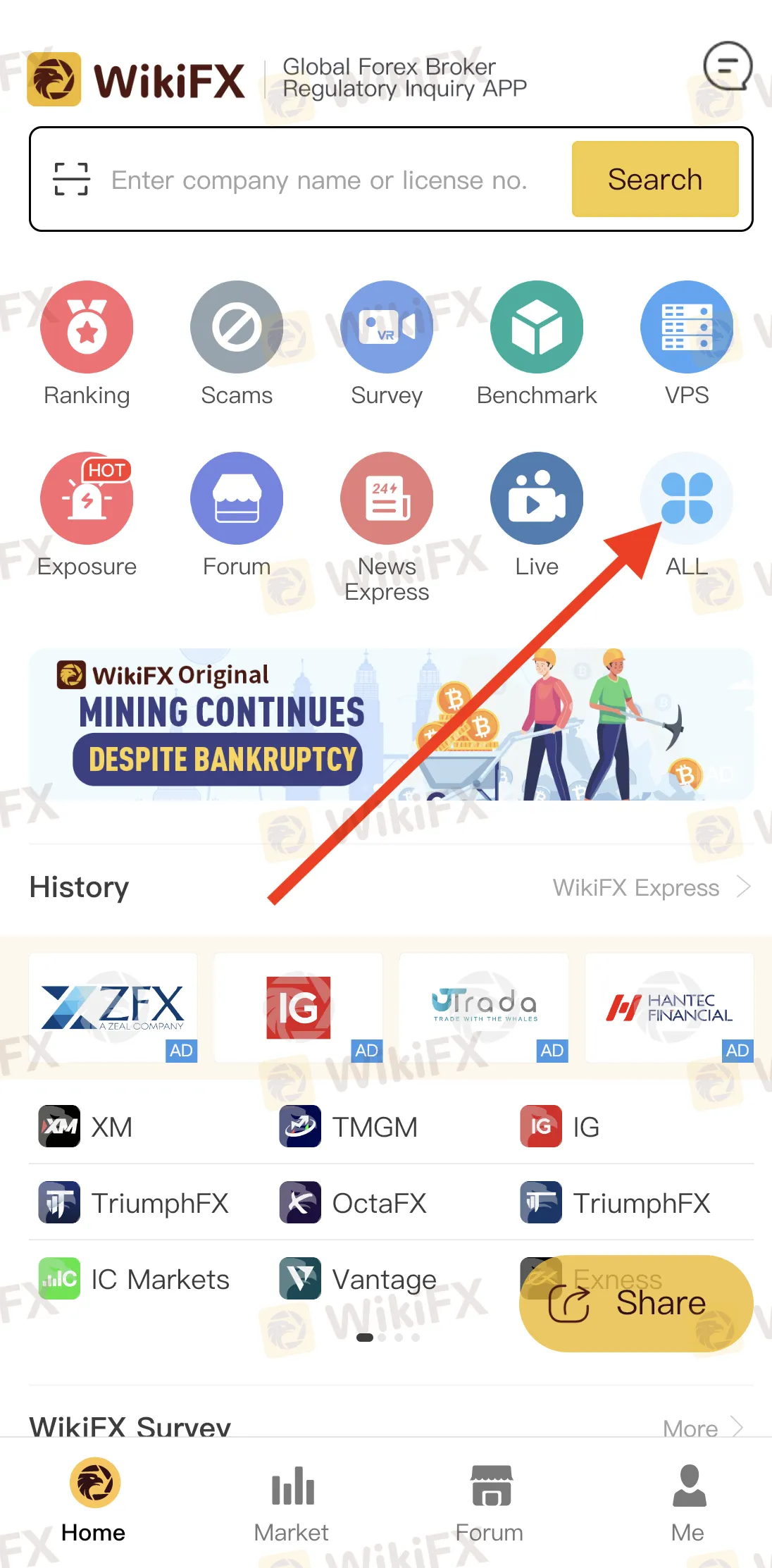

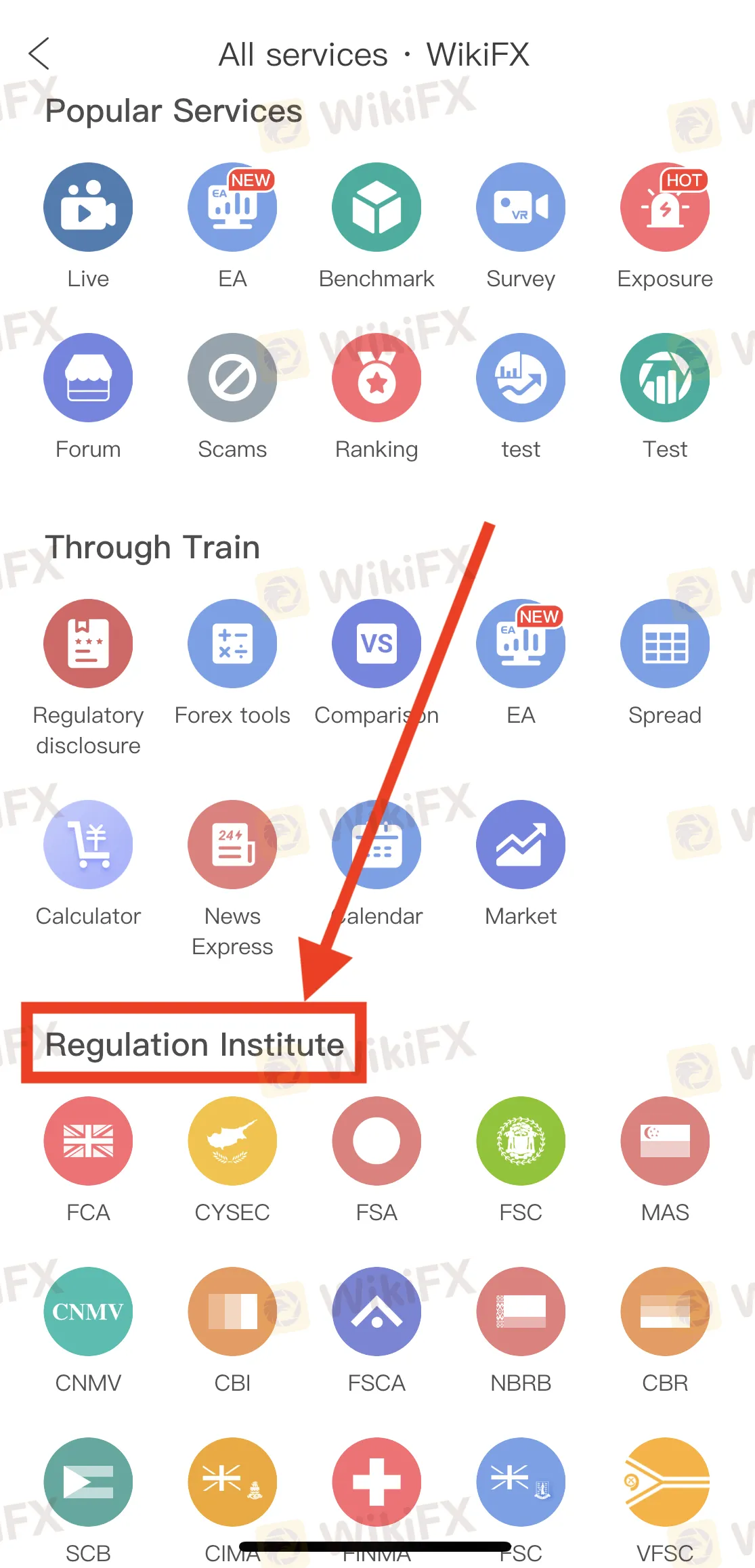

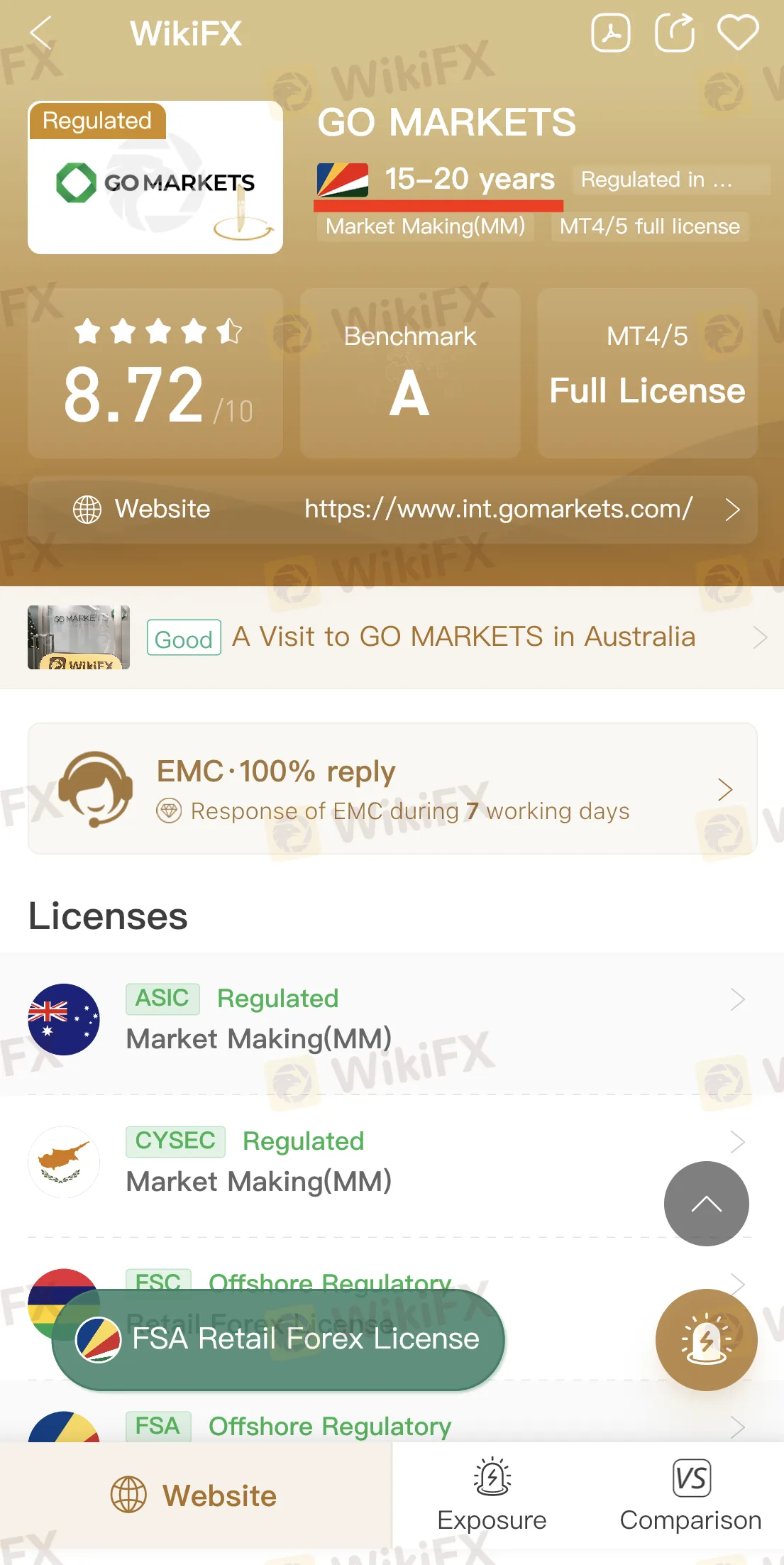

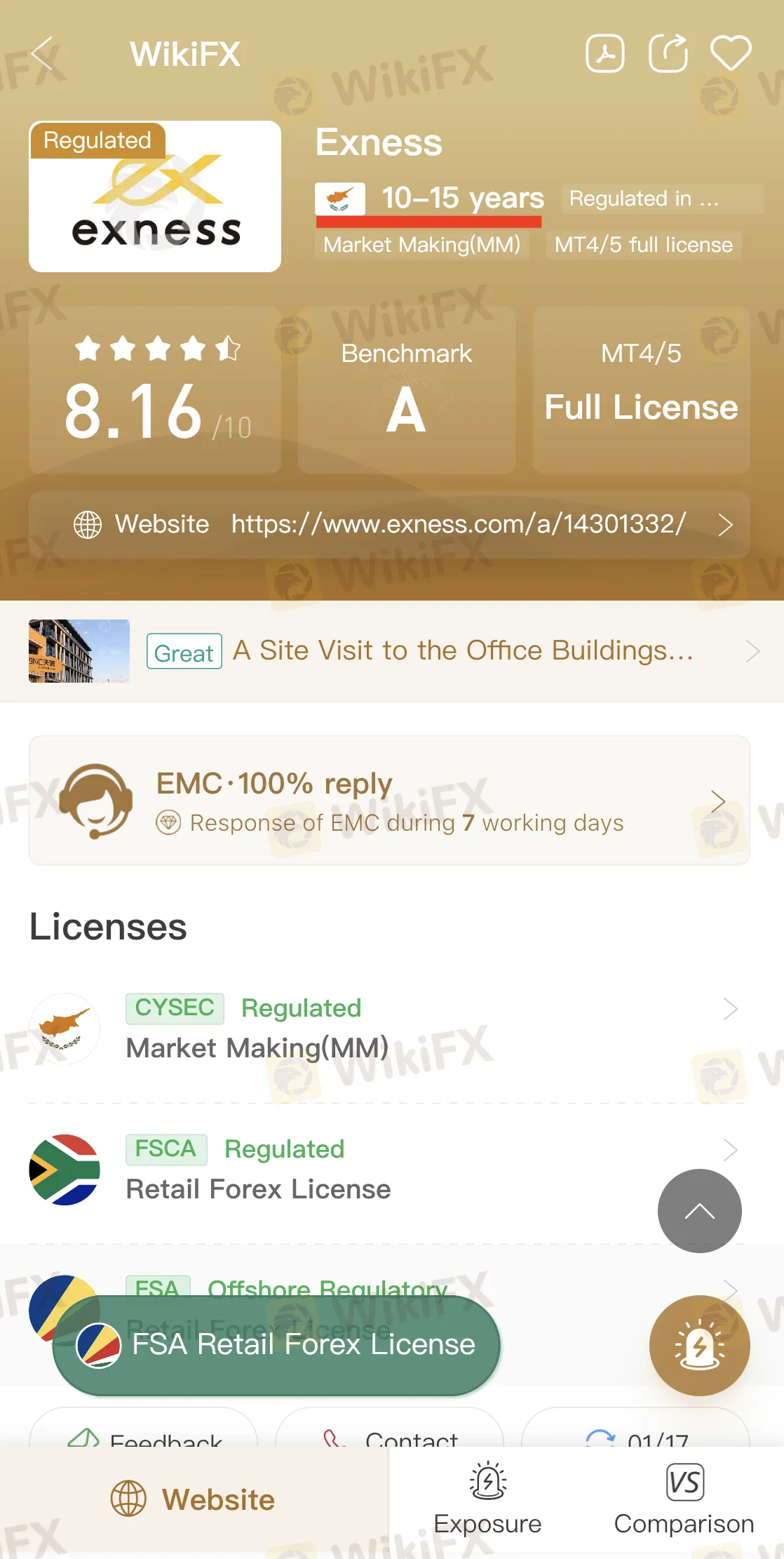

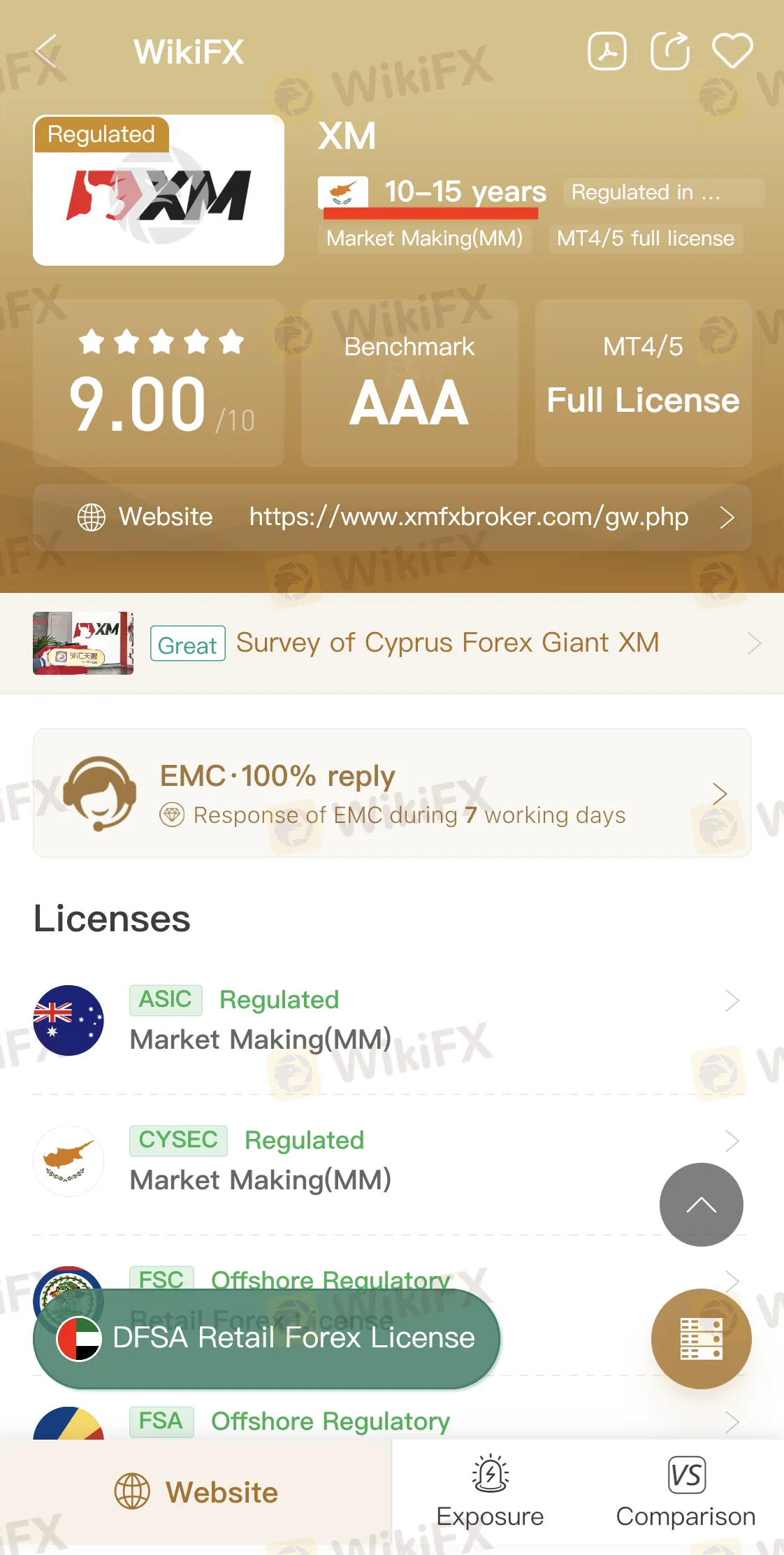

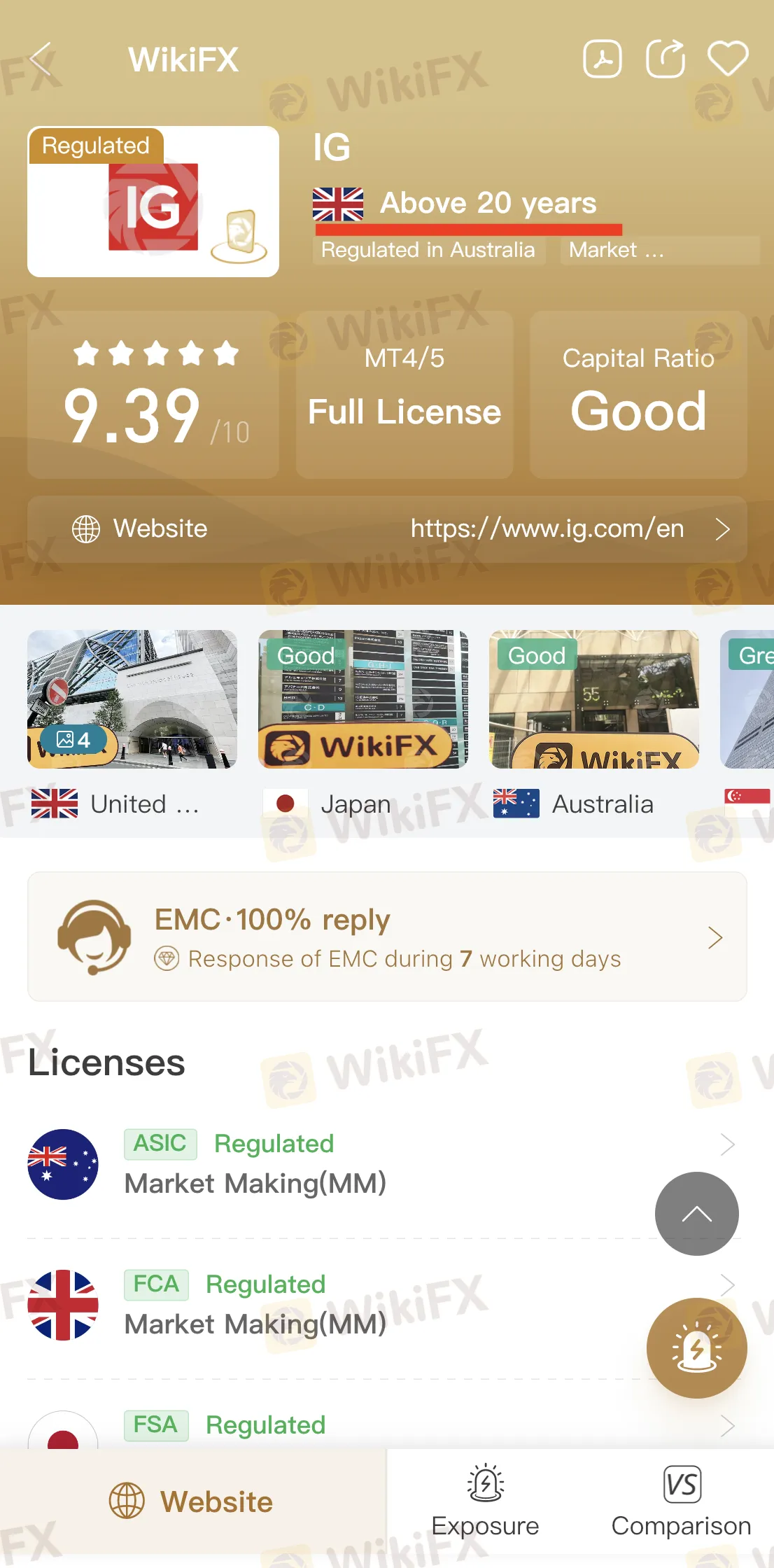

Regulation: Forex brokers are typically regulated by government bodies such as the National Futures Association (NFA) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. These regulatory bodies oversee Forex brokers' activities and ensure they comply with industry standards and regulations. When choosing a broker, it is important to verify that they are regulated by a reputable authority body, as this provides traders a fairly high level of protection against fraud or other illegal activities.

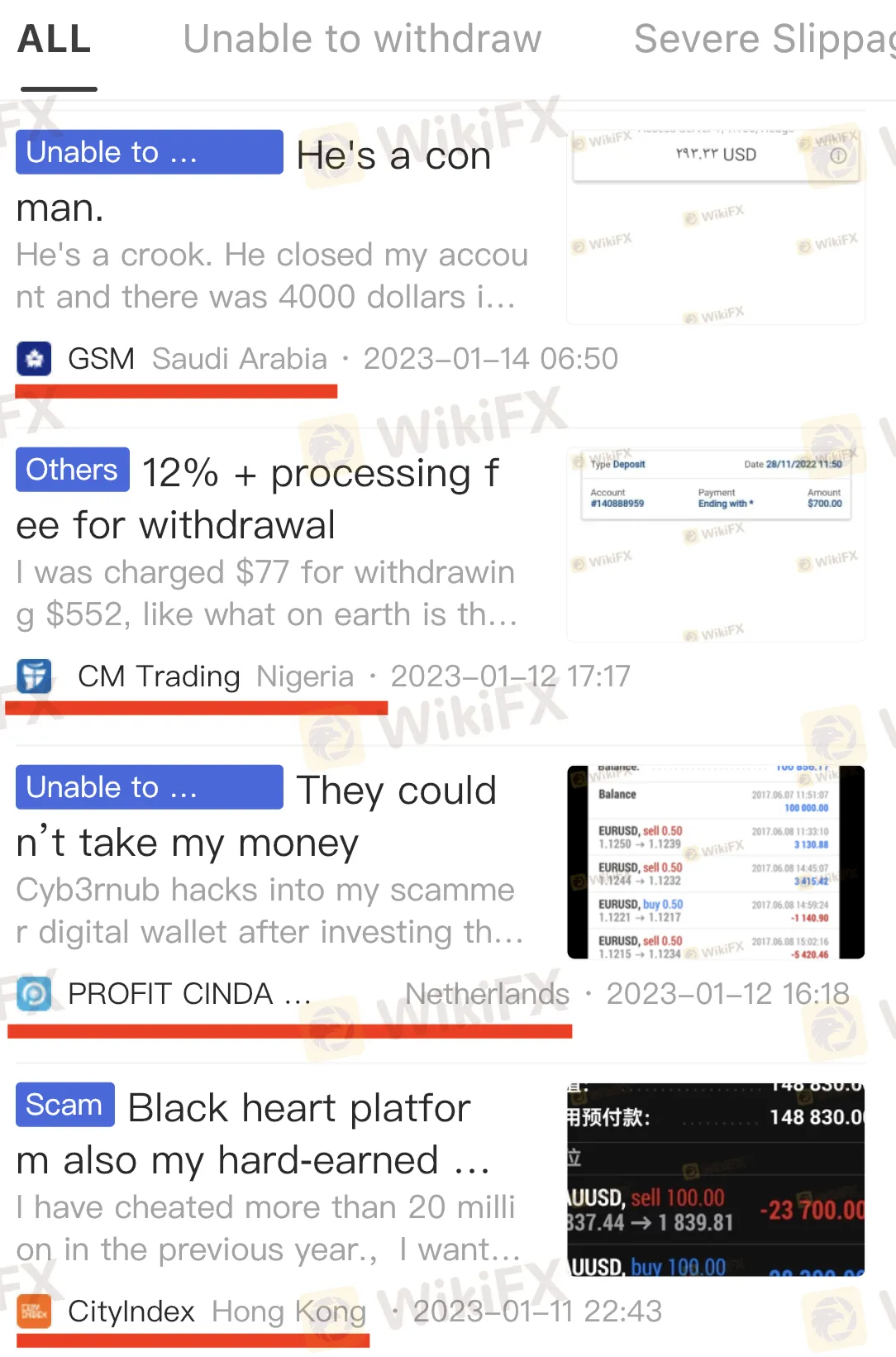

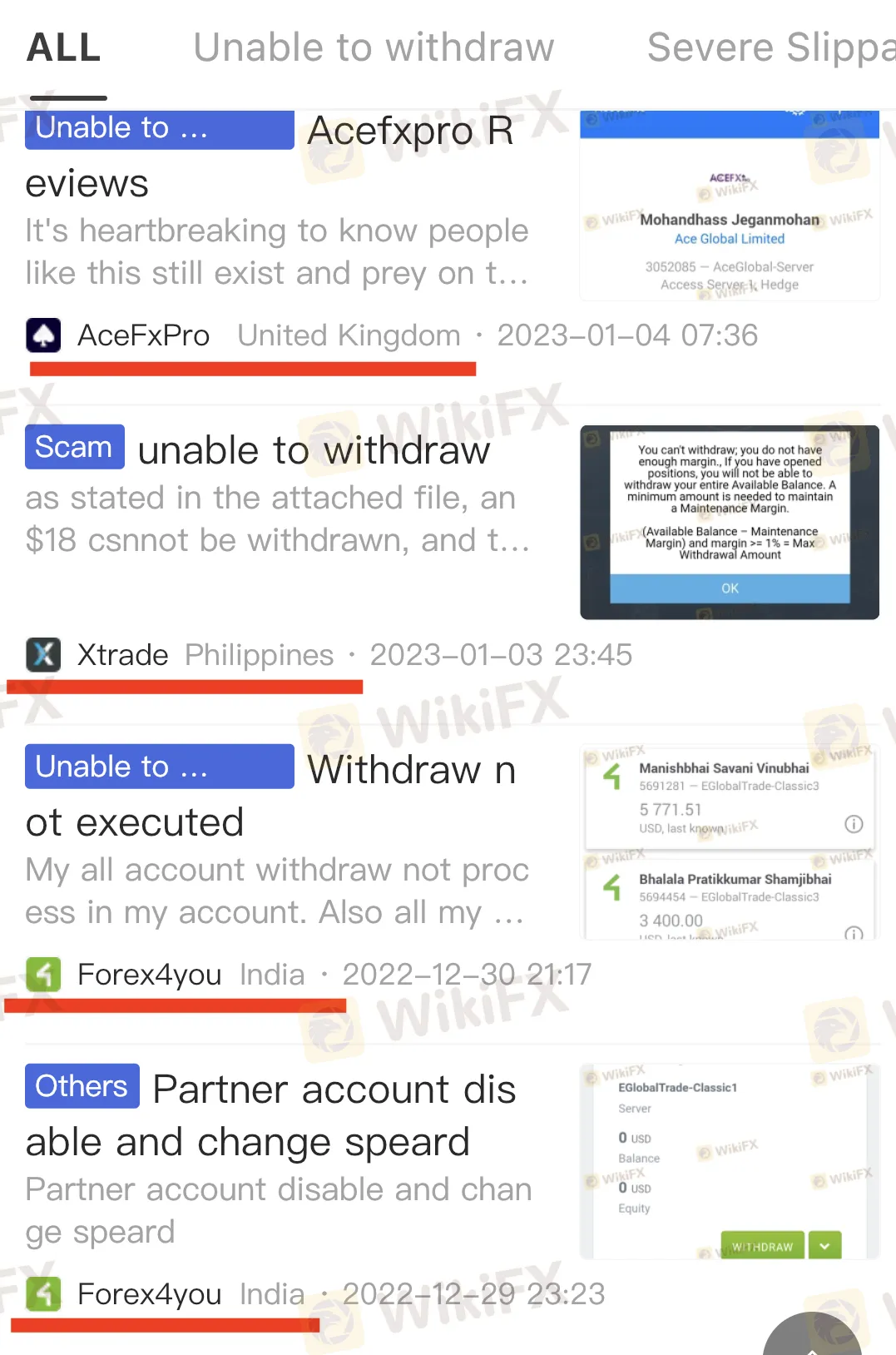

2. Reputation: Researching the reputation of a Forex broker is important because this can give traders an idea of how the broker operates and whether they have a history of satisfied customers. Traders can read online reviews, ask for recommendations from other traders, or check out forums where traders discuss their experiences with different brokers. A broker with a good reputation is more likely to be trustworthy and provide a positive trading experience.

3. Transparency: A reputable Forex broker will be transparent about their trading policies, fees, and other important information, such as contact details. They will clearly state the terms and conditions of trading on their website and will not hide any important information from traders. Transparency is also vital when choosing a broker, as it helps traders make informed decisions about their trading activities.

4. Account Safety: A reputable Forex broker will take the necessary measures to protect client accounts from unauthorized access. This includes keeping client funds separate from their operating funds, implementing robust security protocols, and using secure servers to store client information. When choosing a broker, it is important to verify that they have a solid system in place to protect client accounts.

5. Customer Service: A reputable Forex broker will have a dedicated customer service team to assist traders with any questions or concerns. This includes providing support during the trading process, answering questions about the broker's policies and procedures, and addressing any issues traders may encounter. A broker with good customer service is more likely to provide a positive trading experience.

6. History: A broker with a long history of operating in the market shows stability and reliability and has been able to adapt to market changes. Only credible brokers can withstand the test of time and still excel till this day.

By following these guidelines, traders can increase their chances of selecting a reputable and trustworthy Forex broker. It is important to remember that even regulated brokers can go bankrupt. Therefore, it is important to also diversify your investment and not invest more than you can afford to lose.

In short, before choosing any online Forex broker, traders should do their due diligence by researching the broker's regulations, reputation, transparency, account safety, and customer service. This will help traders find a trustworthy and reliable broker that will provide them with a positive trading experience.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

IG Group acquires Freetrade for £160M, boosting its UK investment offerings. Freetrade to operate independently, with plans for growth and innovation.

Webull Launches SMSF Investment Platform with Zero Fees

Webull introduces commission-free SMSF trading, offering over 3,500 US and Australian ETFs, with no brokerage fees and enhanced portfolio tools.

How Will the Market React at a Crucial Turning Point?

Safe-haven assets like gold and U.S. Treasuries are surging, while equities face mounting pressure. As this pivotal moment approaches, how will the market react?

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Gold prices have hit record highs for three consecutive days, with a remarkable 19% gain in the first quarter, marking the strongest quarterly performance since 1986. As market risk aversion rises, demand for gold has surged significantly.

WikiFX Broker

Latest News

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator