Attention:This broker is suspected to be a clone, and the official website is inaccessible. We have collected relevant information as much as possible.It's recommend to visit the correct official website:https://www.CFX.com.

Overview of CFX

CFX, registered in China and founded in 2016, operates in the investment sector with a focus on forex trading, commodities, and stocks. Despite being flagged as a suspicious clone by FSPR, the company offers a range of financial products, including over 30 forex pairs such as USD, EUR, and JPY.

CFX provides services like market and thematic analysis, along with an economic calendar, all accessible through the CFX MT4 Trading Platform. The platform supports a demo account for practice trading and boasts zero commission fees for account opening.

It offers leverage up to 1:100, meeting various trading strategies. Customer support is available via email at service@circleforex.com. The minimum deposit requirement is $100, with payment options including credit/debit cards and online banking.

Additionally, CFX enriches its users with educational tools comprising learning materials, a video center, and online courses to enhance their trading knowledge and skills.

Is CFX Limited Legit or a Scam?

CFX is registered on the Financial Service Providers Register(FSPR) with the current status of being identified as a “Clone Firm.” It holds a license categorized under “Financial Service Corporate,” which is regulated by authorities in New Zealand.

The license number associated with this firm is 476086. This status serves as a critical alert for potential clients and partners about the need for caution and due diligence when engaging with the firm.

Pros and Cons

Pros of CFX:

Diverse Product Offerings: CFX offers a wide range of financial products, including forex trading with over 30 currency pairs (such as USD, EUR, JPY), as well as commodities and stocks. This variety allows investors to diversify their portfolios within a single platform.

Educational Resources: The platform provides a comprehensive set of educational tools, including learning materials, a video center, and online courses, which can be particularly beneficial for novice traders looking to enhance their trading knowledge and skills.

Advanced Trading Platform: CFX utilizes the MT4 Trading Platform, which is renowned for its advanced features, user-friendly interface, and customization options, satisfying both beginner and experienced traders.

Demo Account Availability: The availability of a demo account allows users to practice trading strategies without risking real money, which is an excellent feature for beginners or those looking to test the platform.

No Commission on Account Opening: CFX promotes zero commissions on opening an account, making it more accessible for individuals to start trading without worrying about initial extra costs.

Cons of CFX:

Regulation Concerns: Being labeled as a “Suspicious Clone” by the FSPR raises significant red flags regarding the legitimacy and safety of investing with CFX, potentially putting investors' funds at risk.

Limited Leverage: While CFX offers leverage up to 1:100, which will be sufficient for conservative traders, it may not meet the needs of more aggressive traders looking for higher leverage options.

Minimum Deposit Requirement: The minimum deposit of $100 will be a barrier for those who wish to start with a smaller capital, limiting accessibility for some potential traders.

Clone Firm Status: The designation as a clone firm implies that CFX may be imitating a legitimate firm's identity, which can lead to trust issues and skepticism among potential clients about the authenticity and reliability of its services.

Geographical Limitations: Being registered in China and regulated by New Zealand authorities will impose certain geographical and regulatory limitations on the services CFX can offer to international clients, potentially affecting its global appeal and operational flexibility.

Products

The products offered by CFX encompass a variety of mainstream financial instruments in the market, including:

Forex Pairs: CFX offers trading in major forex pairs, as evidenced by the quotations for EURUSD, GBPUSD, and AUDUSD, among others. These pairs involve major currencies like the Euro, British Pound, Australian Dollar, and the US Dollar, attracting forex traders seeking to capitalize on currency fluctuations.

Commodities: The trading platform includes commodities, with quotations provided for U.S. Crude Oil, indicating that energy commodities are part of CFX's product offerings. This allows traders to engage in the commodities market, speculating on price movements of essential goods.

Precious Metals: Quotations for XAUUSD (Gold) and XAGUSD (Silver) suggest that CFX also provides opportunities to trade in precious metals, a popular choice for investors looking to hedge against inflation or currency devaluation.

Other Currency Pairs: The list includes other significant currency pairs like USDJPY, USDCHF, USDCAD, and NZDUSD, expanding the forex trading options available to investors interested in diversifying across different currencies and regional economic dynamics.

Services

CFX provides a focused range of services aimed at enhancing the trading experience through comprehensive market insights and analysis:

Market Analysis: This service offers traders valuable insights into market trends, price movements, and trading opportunities. By analyzing various market indicators and data, CFX helps traders make informed decisions based on current market conditions.

Thematic Analysis: CFX delves deeper with thematic analysis, providing an in-depth look at specific sectors, economic themes, or events that could influence the financial markets. This specialized analysis helps traders understand the broader economic and sector-specific factors that may impact their trading strategies.

Economic Calendar: The economic calendar service provides traders with a schedule of important economic events that are likely to affect the financial markets. This includes central bank announcements, economic indicators, and significant geopolitical events, enabling traders to anticipate market movements and plan their trades accordingly.

How to Open an Account?

Opening an account with a trading platform like CFX typically involves a straightforward process that can be broken down into three main steps:

Registration: Visit the CFX website and locate the account opening section. Fill out the registration form with your personal details, such as your name, email address, phone number, and any other required information. This step may also involve setting up a username and password for your account.

Verification: After submitting the registration form, you'll likely need to verify your identity and residency to comply with regulatory requirements. This usually involves uploading copies of a government-issued ID (like a passport or driver's license) and a proof of address document (such as a utility bill or bank statement).

Funding: Once your account is verified, the final step is to fund it. Navigate to the deposit section of your account dashboard and choose your preferred deposit method. This could include bank transfers, credit/debit cards, or online payment systems.

Commissions & Leverage

CFX advertises zero commissions for opening an account, which implies that traders can set up an account without incurring any charges specifically related to the account creation process.

CFX offers leverage up to 1:100 for its trading activities, enabling traders to control larger positions with a relatively small amount of invested capital.

Trading Platform

The trading platform provided by CFX is the CFX MT4 Trading Platform, renowned for its robustness, advanced features, and user-friendly interface.

The MT4 platform is highly regarded in the trading community for its comprehensive analytical tools, real-time market data, charting capabilities, and automated trading functionalities.

It meets both novice and experienced traders, offering a customizable environment that can be tailored to individual trading preferences and strategies.

Customer Support

CFX offers a dedicated customer support system aimed at providing comprehensive assistance to its clients.

Customers can reach out directly to the customer service team via email at service@circleforex.com for general support, account-related questions, or technical assistance.

Additionally, for individuals or entities interested in Introducing Broker (IB) cooperation, CFX has a separate communication channel at ib@circleforex.com, attracting specifically to partnerships and affiliate relations.

Education Tools

CFX enriches its clients' trading experience with a variety of educational tools designed to attract both novice and seasoned traders.

These resources include comprehensive learning materials that cover the basics of trading and advanced strategies, a video center that offers visual and interactive learning opportunities, and online courses that provide structured and in-depth knowledge on various aspects of trading and financial markets.

These educational tools are aimed at empowering traders with the necessary knowledge and skills to navigate the markets effectively, make informed trading decisions, and enhance their overall trading proficiency.

Through this suite of educational offerings, CFX demonstrates its commitment to supporting its clients' continuous learning and development in the dynamic world of trading.

Conclusion

CFX positions itself as a comprehensive trading platform by offering a wide array of financial products, including forex, commodities, and stocks, along with advanced trading tools like the MT4 platform.

It supports traders with zero commission on account opening, leverage up to 1:100, and a range of educational resources to enhance trading skills.

With dedicated customer support and a focus on educational development, CFX aims to attract the needs of both beginner and experienced traders, although due diligence is advised given regulatory concerns.

FAQs

Q: What types of financial products can I trade with CFX?

A: CFX offers a diverse range of financial products including over 30 forex currency pairs (such as USD, EUR, JPY), commodities, and stocks,meeting a wide spectrum of trading preferences.

Q: Is there a demo account available on CFX?

A: Yes, CFX provides a demo account feature that allows traders to practice their trading strategies in a risk-free environment using virtual funds.

Q: What trading platform does CFX use?

A: CFX utilizes the CFX MT4 Trading Platform, which is known for its advanced features, comprehensive analytical tools, real-time market data, and user-friendly interface.

Q: How can I contact CFX customer support for assistance?

A: You can reach CFX customer support by emailing service@circleforex.com for general inquiries, account issues, or technical support. For IB cooperation inquiries, you can email ib@circleforex.com.

Q: What are the educational tools provided by CFX?

A: CFX offers a comprehensive suite of educational tools, including learning materials, a video center, and online courses.

Q: What leverage does CFX offer to its traders?

A: CFX offers leverage up to 1:100, allowing traders to control larger positions with a smaller amount of invested capital, amplifying both potential profits and risks.

Chandeller Bang0000

Hong Kong

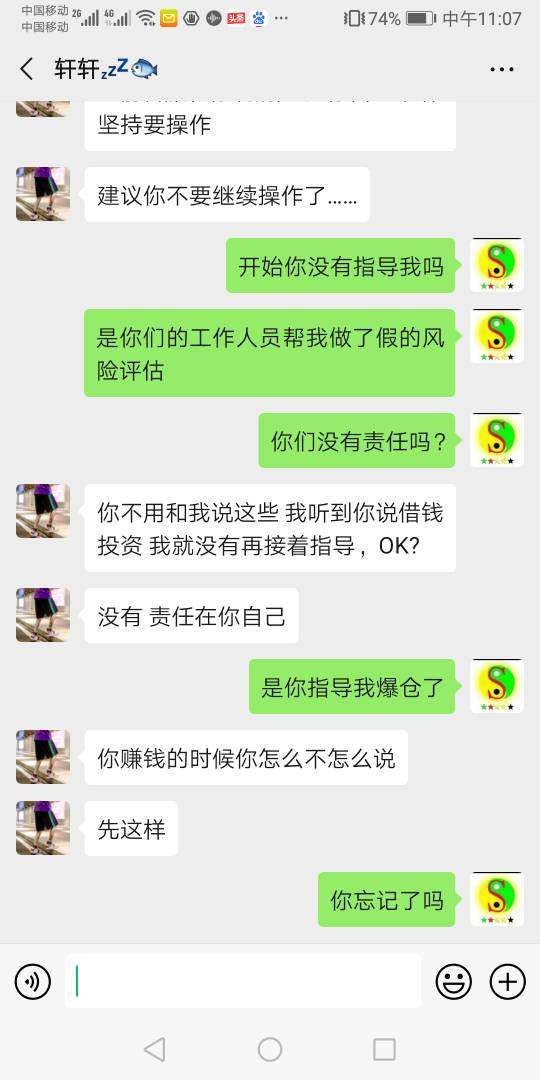

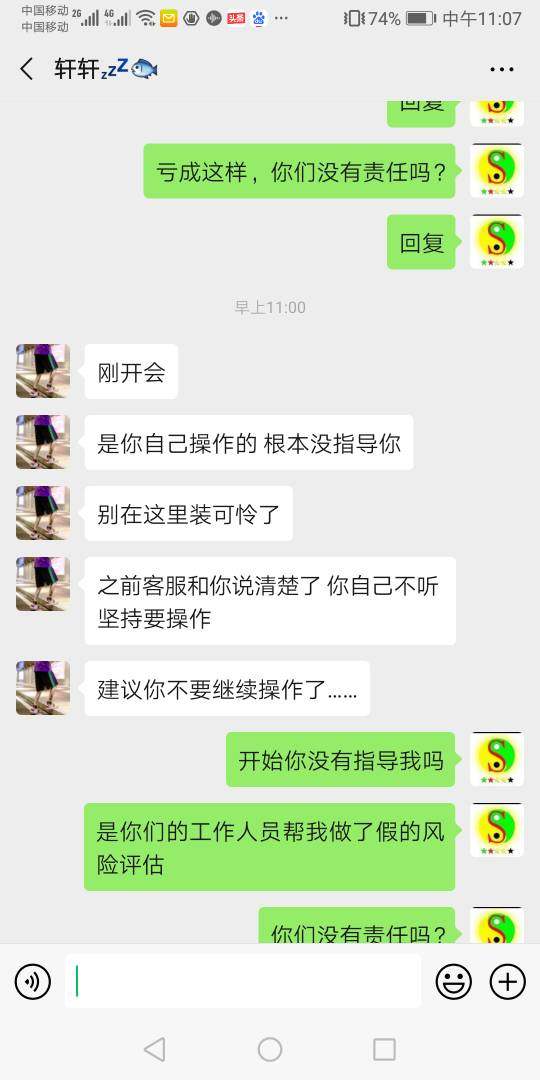

In last April, by fabricating fake information, CFX helped client pass through the risk test. Claiming that they have teachers to give instructions, they induced clients to deposit fund. After making clients’ accounts liquidated, they even threatened them to promise that the loss is irrelevant to the platform. Otherwise, their accounts would be blocked.

Exposure

2020-01-02

下雨天45122

Hong Kong

I deposited 100$ on CFX in December last year. I learned some stock knowledge through reading and refused to follow those so-called masters’ instructions. Little by little, they ignored me. At that time, I could still withdraw and trade. I didn’t suspect the platform back then, since they have live rooms. Now they are all missing. I can’t log in to the platform or withdraw.

Exposure

2019-11-12

霏薇

Hong Kong

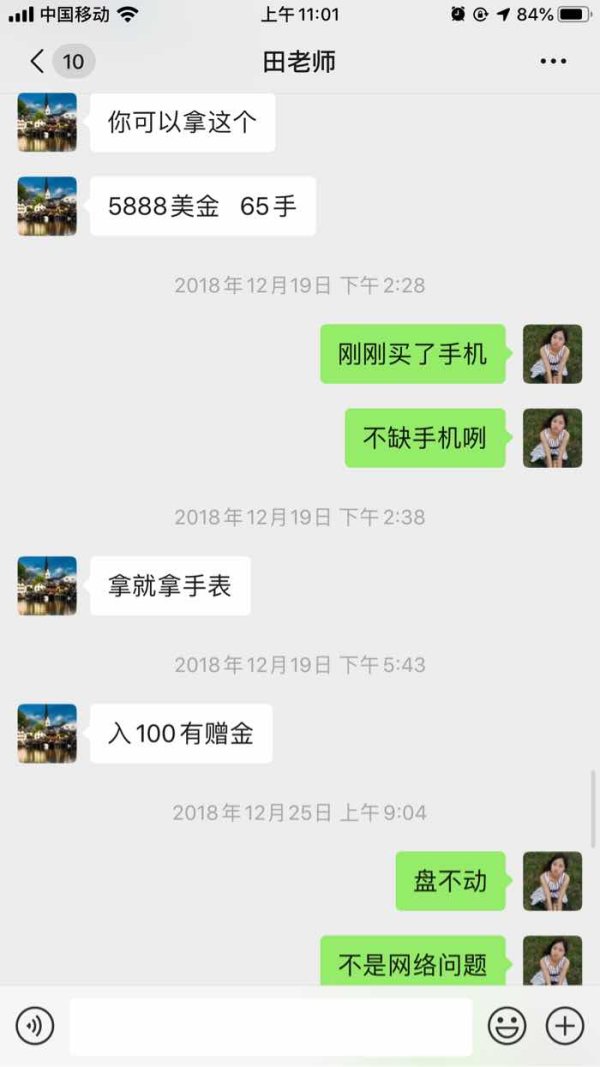

My name is Chen Liushan. I live in Qingbaijiang District, Chengdu City, Sichuan Province. In March 2018, a person from GCMASIA Foreign Exchange Investment QQ Group added me as a friend and said that he wanted to communicate foreign exchange with me. From March 2016 to March 2018, I trade on the GCMASIA forex platform and lost more than 300,000 RMB), After he added me as a friend, he induced me to go to CFX platform for foreign exchange trading, saying that the platform is very legit, and the trading spread is relatively low. In this way, this person invited me into this foreign exchange platform and then assisted me in opening an account and depositing money. Then I started trading on this platform. I deposited $1,000 for the first time, and then applied for a bonus. The platform arranged for me a female analyst named Huang. She added me on WeChat and communicated with me by phone or WeChat. After trading CFX, I quickly lost money. Then my analyst let me increase the funds and let me follow her operation to recover the loss as soon as possible. In one year, I changed a total of 3 analysts and 4 WeChat accounts on the platform. The first analyst changed two Wechat accounts before and after, which eventually led me to lose $50,000! Later I tried to contact the platform and they ignored it! I am now exposing this scam platform.

Exposure

2019-04-03

FX1800538296

Hong Kong

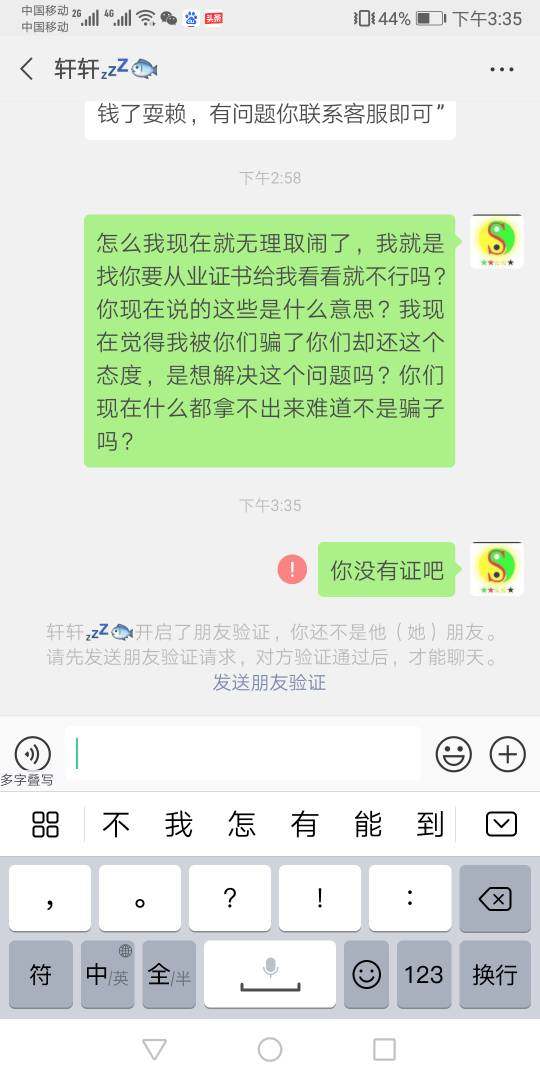

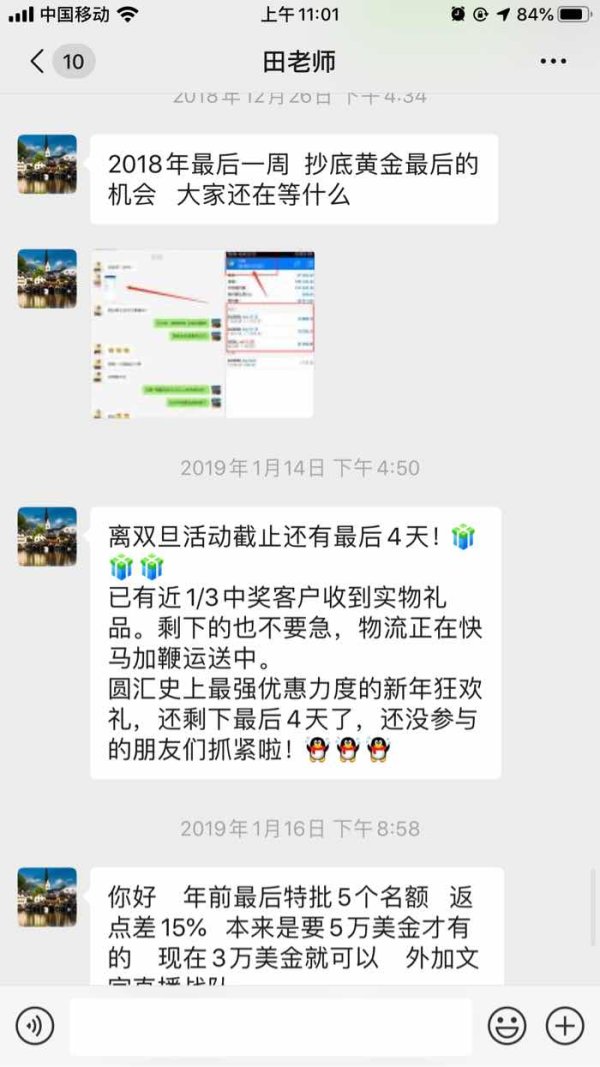

Recently someone called himself CFX’s manager Mr. Yang called me. He asked me on Wechat to delete my post “CFX’s analyst scammed clients and made their positions liquidated”. Check out the Wechat chat history. Look how he tried to coax me to delete my post.

Exposure

2019-02-27

2513694948

Hong Kong

CFX arranged its chief analyst Lin Adviser to guide me to invest in forex, gold, etc. But on August 1, 2018, she began to send me messages via WeChat and called me to increase my deposit. Lin told me that if I deposited in the platform, he would guide me by himself. Besides, he would also teach me trading technology, short-swing trading, give me her VIP treatment, look after my account. I always lost more and profited less with her guidance. Every time my order with losses was trapped in the market, she repeatedly persuaded me to insist on and not stopping out. I asked her why orders were trapped on entering, she said that there is nothing wrong with the operation and it was because I have little money to make a layout. She asked me to deposit money. In this way, under her various persuasion via WeChat and telephone, my position was getting heavier and heavier, and the losses are increasing until a forced liquidation came out. After that, I asked her for explanations, she still told me that there was nothing wrong with the operation, and she could help me to take the lost money back. She let me not worry, and she would report it to the company. I complained to the company, the company repeatedly delayed the request, saying they needed to ask the leader. Then they ignored it, and also frozen my account.

Exposure

2019-02-18

FX1800538296

Hong Kong

CFX arranged for an analyst Lin to instruct me.Lin induced me and taught me the method and managed my account.She asked me to but 1 or 2 lots by times,saying that I could earn money in this way.But I always made losses.She said the operation is no problem but the fund was small.I added fund and bought large shares constantly.I was anxious,while she told me to calm down and sent me others’ profit screenshots,as well as adjust myself.My account became forced liquidation within one month.She told me not to worry and the losses could be recovered.I made a complaint to the company,while they kept shirking and even froze my account.

Exposure

2019-02-13

FX1800538296

Hong Kong

Yuanhui platform arranged their chief analyst, mentor Lin, to take me to operate foreign exchange and gold, etc. I got to know her on August 1, 2018 and started sent WeChat messages and called to persuade me to increase my investment.Lin told me to take me personally after the deposit, but also teach me technology, take me to brush the bill, give me her VIP treatment, look after my account.But under her guidance I always lost more than I gained.Often losses were covered, she repeatedly persuaded me firmly hold losses.Ask her why go in be covered, she says operation is not wrong, it is my capital is little cannot layout, want me to continue to enter gold.So in her WeChat and phone all kinds of persuasion, I position more and more heavy, loss more and more, until the bursting of the warehouse.After I asked her, she still told me that the operation is not wrong, let me hold the loss can come out, also let me not worry, she will help me find the company.I complained to the company, the company repeatedly delayed to ask for instructions to the leadership, then ignored, also frozen my account

Exposure

2019-02-10

张茜娜

Hong Kong

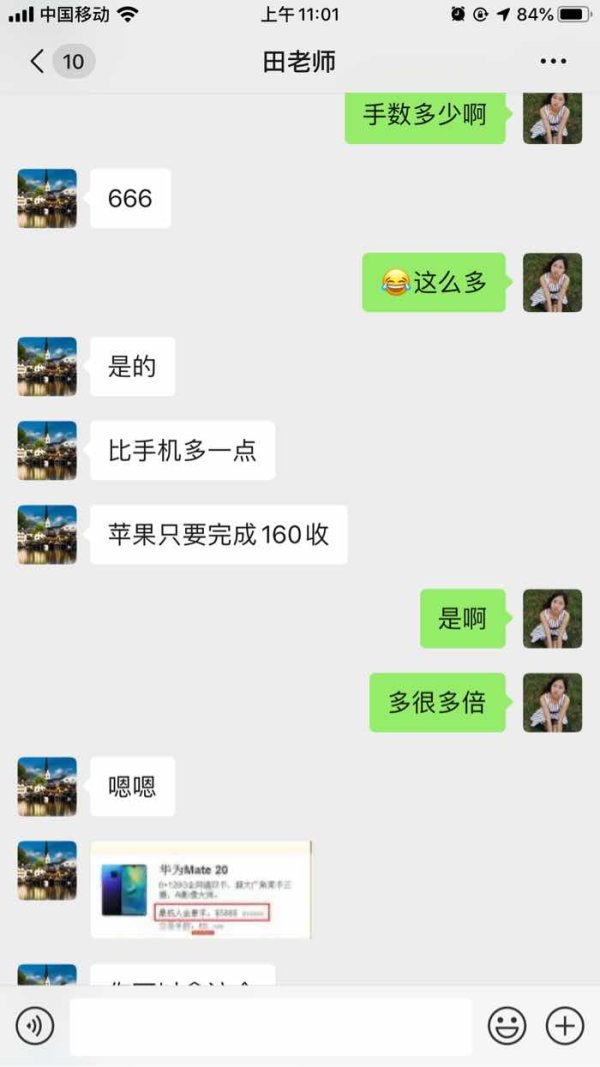

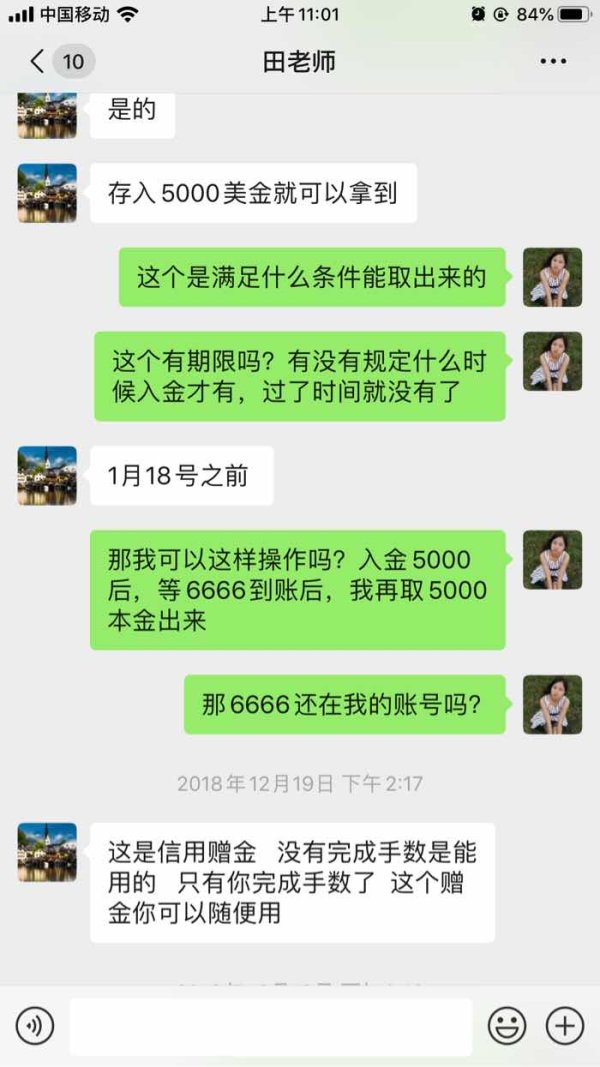

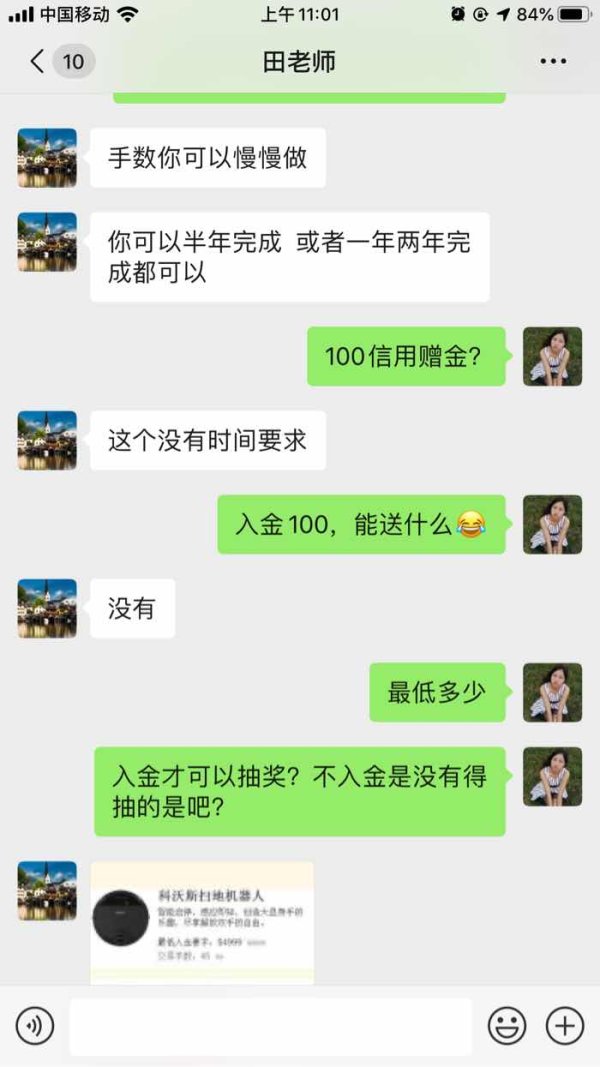

An account manager in Hong Kong who identified himself as pan learned my contact information through forex 110 and sent me the profit screenshots of my client every day after adding my WeChat. He also claimed that there was a bonus for the deposit, which could be used as a deposit. After the operation reached the required number of hands, the bonus could be paid.During the operation some time ago, the platform deducted the deposit from the account suddenly, resulting in the shortage of deposit.Serious inducement and fraud.Prior to the booking, customer manager pan and platform analyst randy did not explicitly inform the ratio of the gold award.As a result of such a loss complaint platform, a person claiming to be the compliance department of the platform contacted me by phone to tell me that the account manager and the analyst had not violated the rules and refused my claim to compensate the capital of the damaged positions.Later found that the Hong Kong yuan hui is a black platform, hope you stay away from the black platform

Exposure

2019-01-05

FX3559927527

Hong Kong

I opened two accounts on CFX. Initially I just wanted to test the quality of the platform. But later its analysts contacted me, insisting on my adding him via WeChat. For the sake of respect, I did. Later, he often gave order advice on on WeChat. I personally didn't like to follow others’ order, so I didn't pay attention to him. I have gained profits on my own. The platform specially called me to ask why I didn't follow the analyst. I said I don't like it and have no such habits.From now on, as long as they called me, their attitude was completely different from the previous one, just like who owes him money. Then there was a platform data anomaly, which was different from the data of other platforms, similar to the fake data. When I lost money, I decided to withdraw the money. Then CFX called me with a tone of accusation, asking me why I withdraw money and why I did not add position and the like. Their attitude is very uncomfortable. I traded myself. One problem happened in a night. The orders placed by me, some should have been profitable but were abnormal while the losses were still there... After that I contacted the analyst, but he never appeared again. There was no news, and I couldn’t contact him. The WeChat senior analyst in the picture called randy is his WeChat, everyone. Be more careful when you see this.

Exposure

2018-12-05

paul97327

Spain

I see that this company has a Chinese only website, and the supposed license granted by FCA is possibly cloned! I can understand the content thanks to google translate, that the trading conditions are attractive, but I don't dare put my money at risk.

Neutral

2022-12-05

FX1244383336

New Zealand

The website of this company CFX is only available in Chinese. More importantly, it has no valid regulations at all. Please, invest in an unregulated company is like playing with fire.

Positive

2023-02-17