简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Forex investment: Malaysian Man charged with cheating

Abstract:Azlin is accused of deceiving 10 individuals by leading them to believe that he could secure favorable returns on foreign exchange investments through Prixo Markets. Between April 20, 2020, and April 21, 2021, at different locations, he allegedly persuaded them to hand over money to him.

In Kota Kinabalu, Malaysia, a former director of an investment company, Azlin Awang Chee, 42, was charged in the Magistrate's Court on Thursday with 10 counts of cheating 10 individuals in relation to a forex investment totaling RM457,735.50.

Azlin Awang Chee faced the first eight charges before Magistrate Stephanie Sherron Abbie and the remaining two charges before Magistrate Lovely Natasha Charles. He pleaded not guilty to all the charges.

Azlin is accused of deceiving each of the 10 individuals by persuading them that he could secure favorable returns on foreign exchange investments through Prixo Markets. He allegedly induced them to hand over money to him at different locations here, between April 20, 2020, and April 21, 2021.

Each charge under Section 420 of the Penal Code carries a potential jail term ranging from one year to 10 years, along with whipping and liability to a fine, upon conviction.

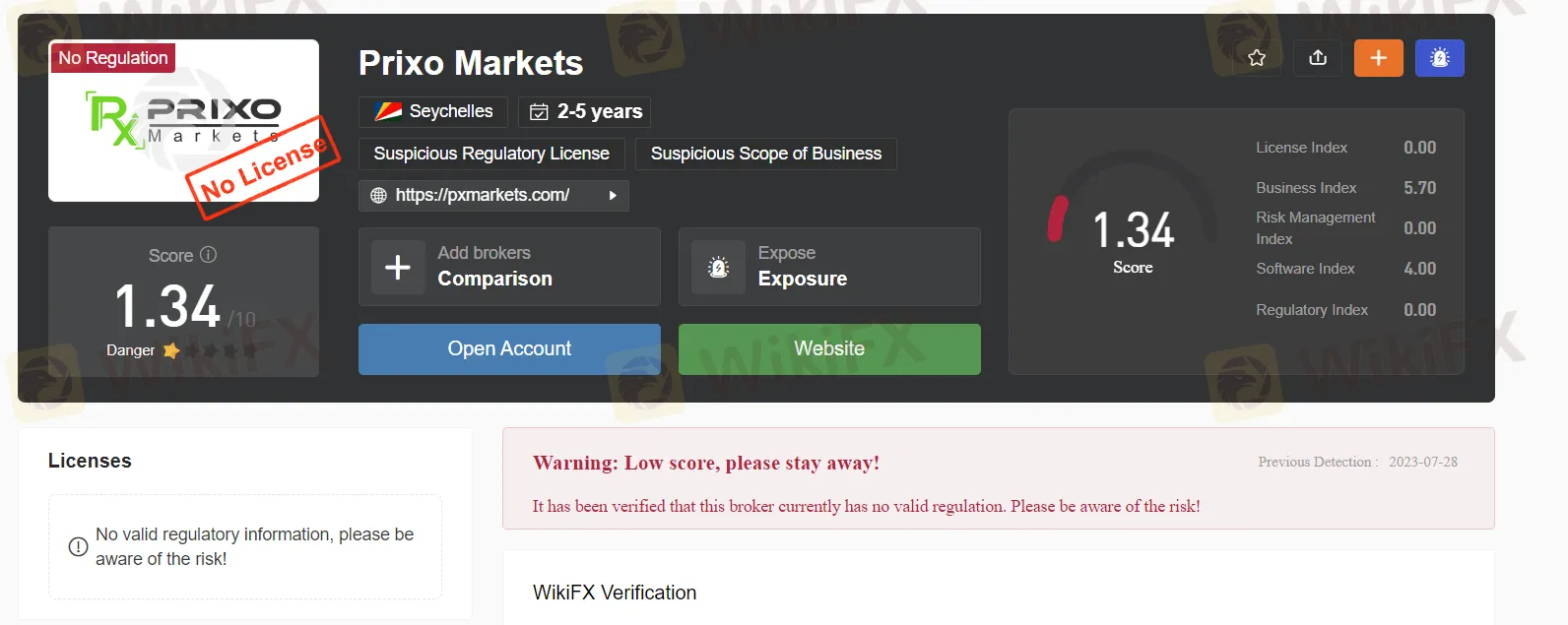

According to WikiFX, this broker is not regulated by any regulatory institution, which means that if something goes wrong, no one can hold it accountable. WikiFX has given this broker a very low score of 1.34/10. Such a low score reflects the risk of investing in Prixo Markets. On March 18, 2021, Prixo Markets was listed on the Securities Commission Malaysia (SC) Investor Alert List, which reportedly contains the names of unauthorized websites, investment products, companies, and individuals. Please be aware of the potential risk.

In the first count, Azlin was charged with cheating Tay Sui Jhung of RM192,672.50 between October 27, 2020, and August 5, 2021, at a unit in Asoka Condominium, Luyang. On the second count, Azlin allegedly cheated Elsie Anna Wilfred of RM9,000 between May 8, 2021, and May 12 of the same year at Alam Damai Condominium.

For the third count, Azlin was accused of cheating Tiong Hau Chong of RM2,700 between 1:36 pm and 6:07 pm on December 30, 2020, at a restaurant in Lintas Square. Meanwhile, on the fourth count, Azlin was charged with cheating Alexander Ngoh of RM56,250 between April 14, 2021, and April 19 of the same year at the City Mall here.

On the fifth count, Azlin allegedly cheated Oliver Thien of RM36,000 between November 8, 2020, and May 20, 2021, at Alam Damai Condominium. Moving on to the sixth count, Azlin was accused of cheating Chung Teing Hau of RM45,000 at Mesra Apartment here between 9:07 am and 9:10 am on February 5, 2021.

On the seventh count, Azlin was charged with cheating Liu Ping Shi of RM18,000 at 7:53 pm on April 21, 2021, at a coffee shop in Foh Sang. Finally, on the eighth count, Azlin allegedly cheated Mathew Wong of RM20,000 between 3:21 pm and 3:31 pm on April 20, 2020.

In the case at hand, Azlin faces charges on two separate counts. In the ninth count, she stands accused of defrauding Robin Nicholas Yong of RM39,113 between September 30, 2020, and November 11 of the same year. The alleged incident took place at Taman Antarabangsa. Moving on to the tenth count, Azlin is charged with cheating Monica Yong of RM39,000 during the same period, September 30, 2020, to November 11, 2020, at the same location.

The prosecuting officers, Inspector Suzie @ Stephanie Kupit and Kelvan Elson Maik, have sought bail for Azlin at RM6,000 and RM4,000 for each respective charge. They have requested two sureties for each bail amount. Additionally, the prosecution has applied for case management dates to further proceed with the legal process.

Representing Azlin in court, Counsel PJ Perira sought a reduction in the bail amount based on several grounds, one of which was Azlin's local ties as a resident with a family consisting of a spouse and three children. Perira also emphasized that Azlin poses no risk of fleeing from the authorities.

Perira further disclosed that at the time of the alleged offenses, Azlin held a directorial position in an investment company. However, following investigations under the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA) and Section 420 of the Penal Code, Azlin has been unemployed.

With these circumstances in mind, Counsel PJ Perira proposed a bail amount of RM1,000 for each charge against Azlin.

After due consideration, the Magistrates granted bail to Azlin at RM2,000 in two sureties for each charge. Additionally, the court scheduled the case management to take place on August 24.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Ultimate Guide to Automated Forex Trading in 2025

Modern markets are revolutionized by automated trading systems, which now execute 70-85% of all transactions. These advanced automated trading software solutions, commonly called trading robots or Expert Advisors (EAs), leverage algorithmic precision for automatic trading across forex, stocks, and commodities 24/7. By removing emotional interference and executing trades in microseconds, auto forex trading platforms create fair opportunities for all market participants. For those new to automated trading for beginners, these systems provide disciplined, backtested strategies while significantly reducing manual effort.

Anti-Scam Groups Urge Tougher Action on Fraudsters in UK

Anti-scam groups demand tougher police action on fraudsters as UK fraud rates surge 19%, targeting millions in a penalty-free crime spree exposed by a $35m scam leak.

Will natural disasters have an impact on the forex market?

The forex market is known for its rapid responses to global events, but the influence of natural disasters, such as earthquakes and typhoons, can be less straightforward. While headlines may scream about catastrophic damage and economic disruption, the long-term effects on currency values often depend on a blend of immediate shock and underlying economic fundamentals.

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Online scam groups in the Philippines trick Filipinos into gambling and love scams, from Manila to Bacolod, causing trafficking and pain as police fight back.

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

UK would not hesitate to retaliate against US tariffs - No 10 sources

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Navigating the Intersection of Forex Markets, AI Technology, and Fintech

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Currency Calculator