简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

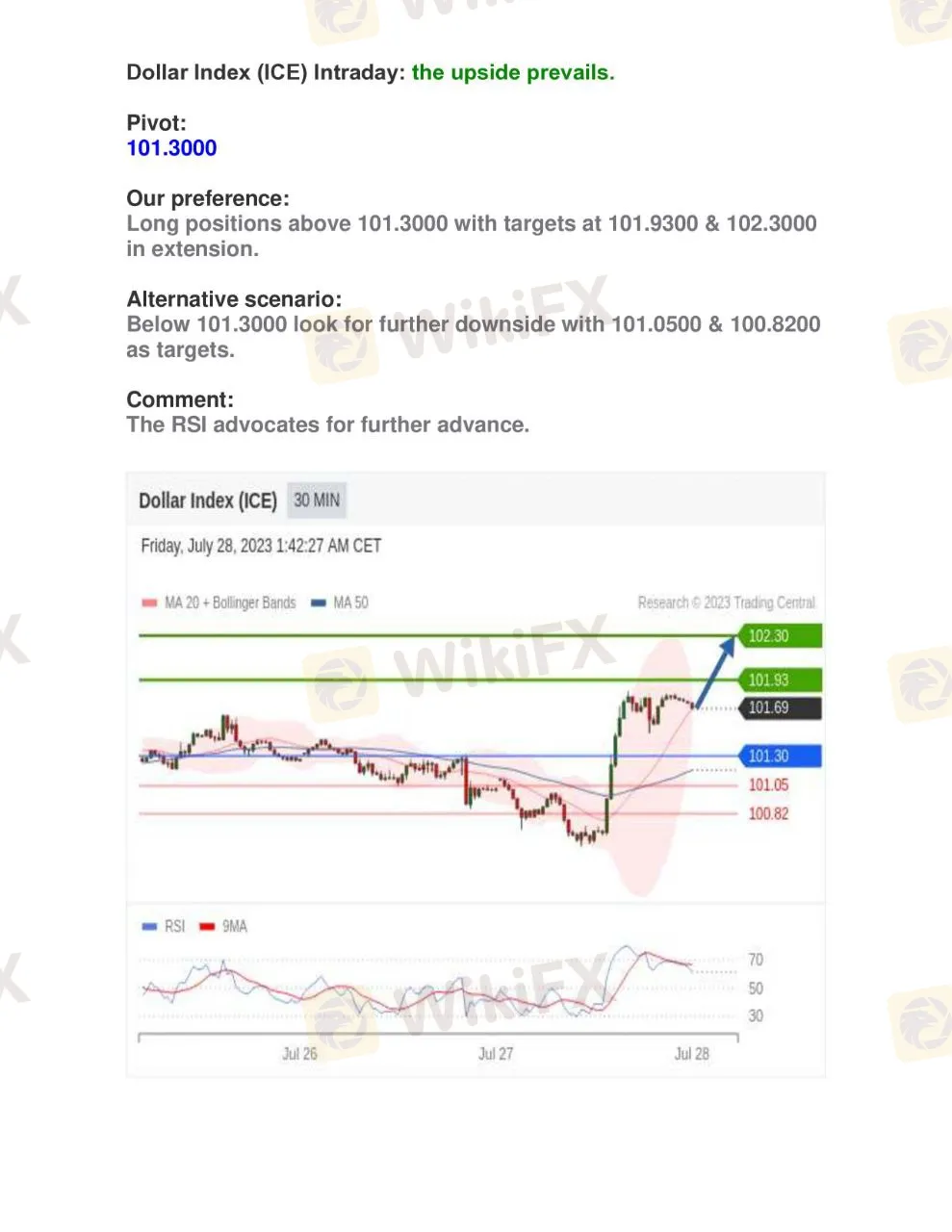

Intraday Chart Tips

Abstract:Powered by WikiFX: (GOLD, EUR/USD and DOLLAR INDEX) Technical Analysis July 28 , 2023

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Gold Prices Fluctuate: What Really Determines Their Value?

Gold prices have been fluctuating recently, influenced by multiple factors. Since the beginning of 2025, gold has risen by 11%, hitting new historic highs multiple times in the first quarter.

Investors Beware! A Trillion Naira Wiped Out in a Week

Market takes a hit: a trillion naira wiped out—what happened?

Dollar Under Fire—Is More Decline Ahead?

The dollar faces its biggest decline of the year, strong-dollar logic challenged.

What Impact on Investors as Oil Prices Decline?

Oil prices have come under pressure amid mounting concerns over U.S. import tariffs and rising output from OPEC+ producers. With tariffs on key trading partners and supply increases dampening fuel demand expectations, investor appetite for riskier assets has cooled. This shift in sentiment poses a range of implications for different segments of the investment landscape.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

What Impact on Investors as Oil Prices Decline?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Currency Calculator