简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FXCM UK Rebrands to Stratos Markets

Abstract:FXCM UK rebrands to Stratos Markets Limited, aligning with recent changes in its Cyprus-based entity. This restructuring aims for greater flexibility, with FXCM operating under Stratos, akin to Google under Alphabet Inc.

FXCM UK, a leading player in the forex industry, has officially changed its name to Stratos Markets Limited. The transformation was confirmed through the UK Companies House database, with the necessary paperwork filed on September 10, 2023.

The change is not just nominal. The company's website now prominently reflects this adjustment, noting that “Stratos Markets Limited is an operating subsidiary within the FXCM group of companies.” Importantly, despite the change, all references to “FXCM” on the site will continue to allude to the overarching FXCM Group.

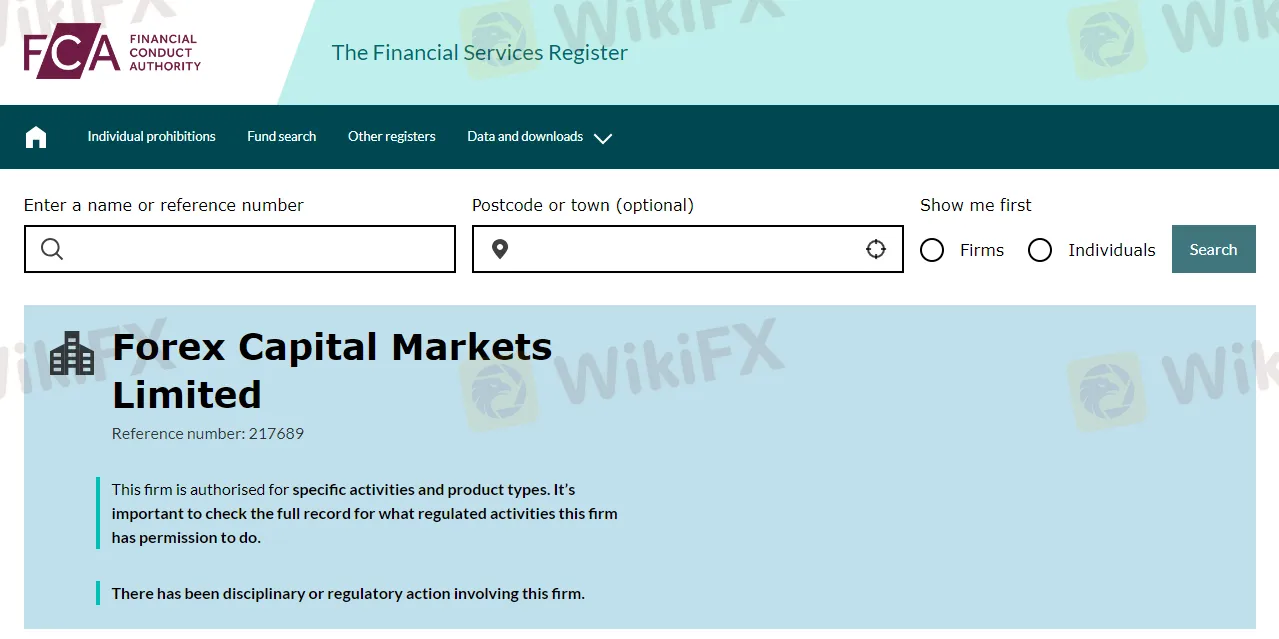

For its credibility and operations within the UK, Stratos Markets Limited maintains its authorization and regulation by the Financial Conduct Authority, with a registration number of 217689. Furthermore, it remains registered in England and Wales under the company number 04072877.

Another intriguing development noted by FX News Group is the recent name shift of the Cyprus-based FXCM entity, FXCM EU Ltd. As per records from the CySEC register of investment firms, it has now become Stratos Europe Ltd.

Amidst the series of changes, there has been speculation about a possible extensive rebranding of FXCM. Addressing these speculations, a company spokesperson commented, “The name change to Stratos is part of a restructuring of the firm to give us more flexibility. FXCM will still function as a subsidiary of Stratos, drawing parallels to how Google operates under Alphabet Inc.”

For those keen to stay abreast of such developments, the WikiFX App offers real-time updates.

Download the App through the link: https://www.wikifx.com/en/download.html.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Georgia man James Schwab charged in Danbury kidnapping tied to $230M crypto heist. Plot targeted couple for ransom after Miami altercation with son.

Bybit Shuts Down NFT Marketplace Amid Crypto Market Downturn

Bybit announces the closure of its NFT marketplace, citing efforts to streamline offerings. Discover the latest trends in the declining NFT market and its shift to utility-based growth.

March Oil Production Declines: How Is the Market Reacting?

Oil production cuts in March are reshaping the market. Traders are closely watching OPEC+ decisions and supply disruptions, which could impact prices and future production strategies.

How to Calculate Leverage and Margin in the Forex Market

Leverage amplifies both potential profits and risks. Understanding how to calculate leverage and margin helps traders manage risks and avoid forced liquidation.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

HTFX Spreads Joy During Eid Charity Event in Jakarta

How Will the Market React at a Crucial Turning Point?

Currency Calculator