简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

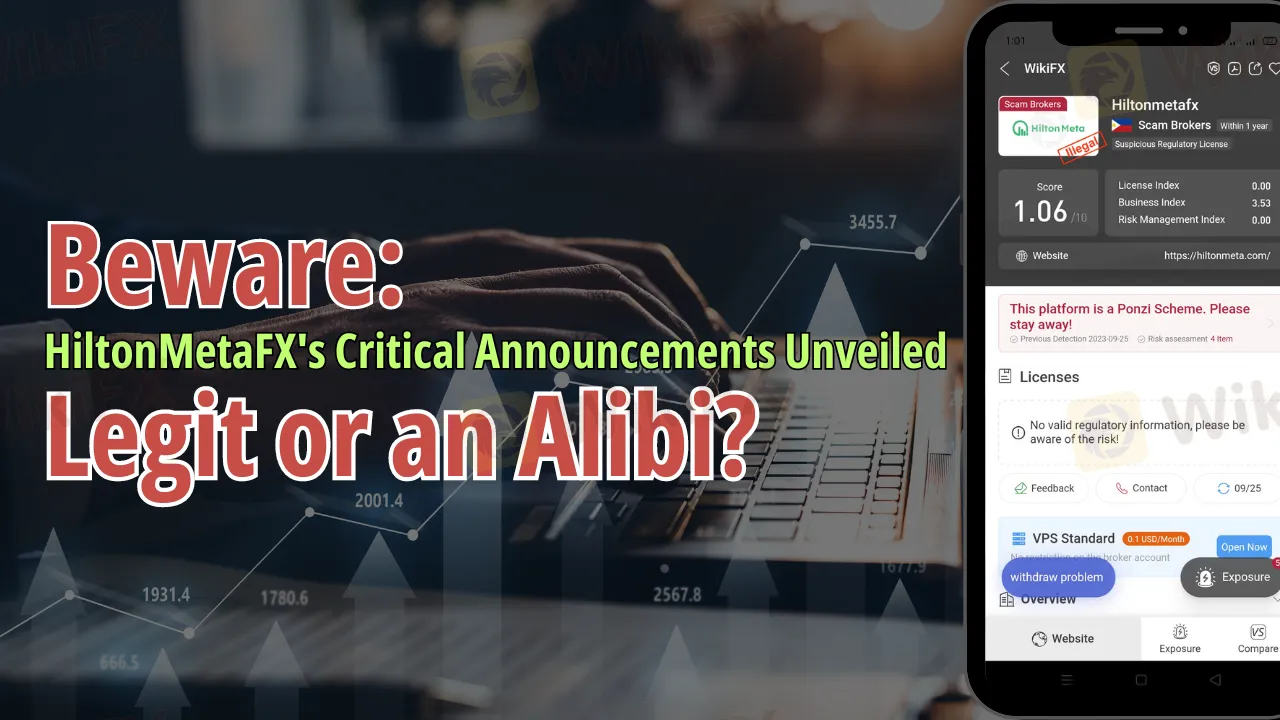

Beware: HiltonMetaFX's Critical Announcements Unveiled - Legit or an Alibi?

Abstract:Is HiltonMetaFX's System Update Trustworthy? Investor Concerns and Risks Explored. Stay Informed!

Introduction

In recent times, HiltonMetaFX has been in the spotlight due to an ongoing system update that has left many investors with questions and concerns. The latest announcement from HiltonMetaFX hinted at a 10 to 12-day integration process, raising concerns about the impact on investors' accounts and the reasons behind such a prolonged maintenance period. In this article, we will delve into the situation, shed light on the possible implications for investors, and explore the regulatory status of HiltonMetaFX.

Latest update dated September 25, 2023

According to HiltonMetaFX's latest statement on its official community channel, the company has been making strides in improving its system's reliability and security. They claim to have successfully completed 70% of the data recovery process and are actively working on finalizing the remaining 30%. While the company thanks its community for its patience and support, the fact remains that any online trading platform is susceptible to unexpected glitches, data losses, and other operational hiccups.

The Uncertainty Surrounding the System Update

The recent statement from HiltonMetaFX outlined an exciting upcoming integration with their API aimed at enhancing services and user experience. However, what caught the attention of many investors was the unexpected timeframe mentioned – a 10 to 12-day period. This deviation from the previous announcement, which did not specify any downtime, has sparked concerns and uncertainties among the user base.

Last September 10, HiltoMetaFX CEO spoke about the system maintenance rolled out and he said that it will be fine in 15 days. On September 25, the broker again announced another System update that was never stated that it would be done in days.

See the news below:

Investor Panic and Withdrawal Dilemma

The sudden extension of the system update timeline has raised questions about how investors can manage their funds during this period. Investors typically rely on a broker's platform to access and manage their accounts, but with the system in maintenance mode, this becomes challenging. The fear of losing access to their investments or encountering delays in withdrawals has led some investors to consider withdrawing their funds prematurely.

Urgent Considerations for HiltonMetaFX Users

If you are a HiltonMetaFX user, it is crucial to be proactive about the safety and security of your account. Keep an eye out for updates from the company regarding system improvements and make backup plans for your investments.

System Maintenance: Legit or Alibi?

One of the critical questions that arise is whether this extended maintenance is a legitimate technical necessity or an alibi to deter massive withdrawals. It's essential to understand that HiltonMetaFX is not a regulated broker. The absence of regulation can raise doubts among investors about the broker's intentions, particularly when significant changes or updates to the system are announced.

The lack of regulation means that HiltonMetaFX operates without oversight from financial authorities, potentially allowing them more flexibility in managing user accounts and funds. This raises concerns about the safety and security of investors' assets, especially during system maintenance.

The Risks of Trading with an Unregulated Broker

Despite ongoing system improvements, it is vital to note that HiltonMetaFX is not a regulated broker. This means that the platform doesn't adhere to the regulations and guidelines that provide a safety net for investors' accounts on many other platforms. Here are some potential risks:

- Lack of Investor Protections: Regulated brokers typically offer a form of investor protection, but this is not the case with unregulated platforms like HiltonMetaFX.

- Data Security Concerns: The absence of regulatory oversight could mean fewer security protocols, thus making your data and investment vulnerable.

- Account Instability: Your trading account is subject to unexpected closures, loss of funds, or other adverse occurrences without the regulatory safety nets in place.

The Importance of Transparency

In situations like this, transparency becomes paramount. Investors have a right to know why system maintenance is required, how it impacts their accounts, and what measures are in place to safeguard their funds during this period. HiltonMetaFX should provide clear and detailed explanations to address investor concerns and ensure trust remains intact.

Conclusion

The ongoing system update at HiltonMetaFX has left investors with a sense of uncertainty and concern. The extended maintenance period and the lack of regulatory oversight have raised questions about the broker's intentions and the safety of investor funds. It is crucial for HiltonMetaFX to maintain transparency and provide reassurance to its user base.

Investors should stay informed, exercise caution, and consider their options while the system update progresses. As always, being vigilant and informed is key to making sound financial decisions in the world of online trading and investment.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

Authorities Alert: MAS Impersonation Scam Hits Singapore

MAS scam alert: Scammers impersonate officials, causing $614K losses in Singapore since March 2025. Learn how to spot and avoid this impersonation scam.

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

Billboard warns against fake crypto scams using its brand. Learn how to spot fraud and protect yourself from fake promotions.

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

U.S. March ISM Manufacturing PMI Released

Currency Calculator