简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

JJPTR founder Johnson Lee announces a new "pi coin" money-making scheme.

Abstract:JJPTR founder Johnson Lee announces a new "pi coin" profit-making plan, claiming it can recover previously lost funds.

Originally touted as a savior for ordinary people, JJPTR attracted over $300 million (approximately 1.2 billion Malaysian Ringgit) in funds within just two years of its establishment. JJPTR was once seen by investors as a life-changing opportunity, but the organization aimed at “saving ordinary people” ultimately could not escape its fate of collapse and downfall. The company collapsed on April 23, 2017, causing a nationwide sensation, and investors suffered significant losses, unable to recover their investments. The company's founder, Johnson Lee, was even reported missing for a period.

Now, it appears that JJPTR, short for “Jutawan Jutawan Plus Tolong Rakyat” (which roughly translates to “Millionaires Help the People”), is attempting a comeback. Johnson Lee, the founder of JJPTR, is notifying members via text messages about another money-making scheme. He has also posted on his Facebook page, urging members to mine “pi coins” on their phones and claiming that it can help recover previous losses incurred with JJPTR.

It is reported that many members have received text messages from JJPTR with content like “I have a plan that can help you recover JJ losses, and you don't need to spend a single cent! If you're interested, you can message me on Facebook.” These messages include a link to Johnson Lee's Facebook profile.

In his Facebook post, Johnson Lee wrote, “Hello everyone, over the past five days, all JJ members have been receiving this message. This is the last opportunity for everyone to recover the losses, please be sure to contact me. I have spent a lot of money sending these messages to all members!”

He explained in the post that it's a mobile mining scheme for “pi coins,” not Bitcoin. Johnson Lee stated, “Pi coins have great potential in the next few years, and you may be able to recover your losses at JJPTR this year! Of course, if you haven't suffered losses or are already making money, you can also download the mining app and treat it as extra pocket money.”

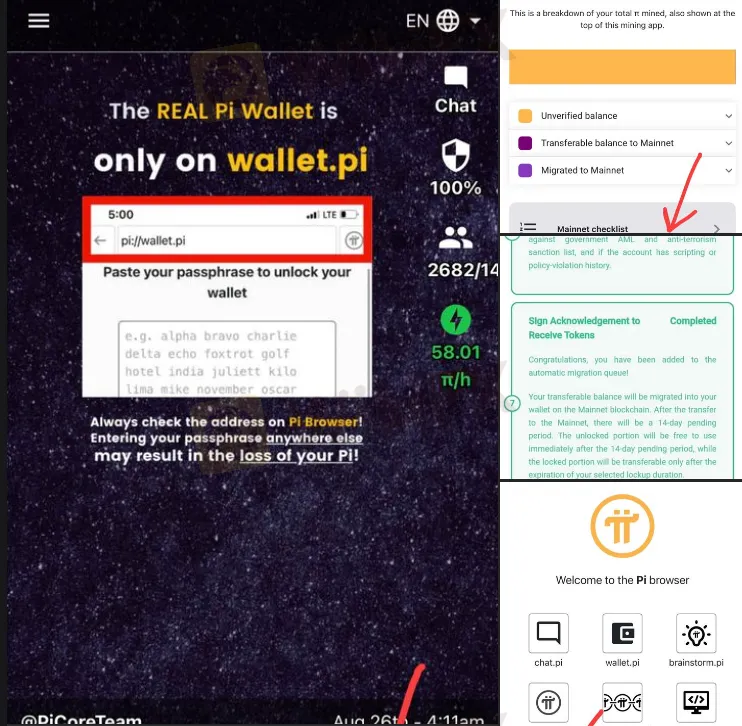

Furthermore, Johnson Lee uploaded two videos explaining how members can download the “Pi Network” mobile application and provided some historical background on “pi coins.” He emphasized that this is not a scam and the project's purpose is to make it easier for everyone to use cryptocurrencies.

In the videos, it is explained that members only need less than 5 seconds to click once on the Pi Network each day. If the value of “pi coins” reaches $1 (about 4 Malaysian Ringgit) when listed on exchanges, its future value could exceed $1,000 (about 4,000 Malaysian Ringgit). However, JJPTR's maximum loss was $1,000. Johnson Lee suggests that making back more than what was lost at JJPTR is straightforward, and there are currently 2.5 million users.

In addition, Johnson Lee listed the steps to download the Pi Network and provided JJPTR's designated invitation code. He also encouraged members to join the JJ community group on Telegram, which currently has 2,500 members.

He repeatedly stressed in his Facebook post and videos that this money-making scheme is entirely free and urged members to participate as soon as possible, as well as inform their upline and downline members.

According to Johnson Lee's Facebook post, he began posting information about “pi free mobile mining” on Facebook in early November last year.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Forex Trading Mastery: The Ultimate Winning Formula

The foreign exchange market is inherently volatile, with its sharp fluctuations driven not only by changes in the global economic landscape but also by large-scale speculative capital and the influence of major market players, further intensifying its instability.

Gold Surge News: Central Banks Expand Gold Reserves—Will Prices Rise?

Central banks have purchased over 1,000 tons of gold annually for three consecutive years, and 2024 is no exception. However, the key question remains: as demand for gold continues to rise, will its price keep increasing?

Famous Olympic Breakdancer’s Brother Faces Crypto Fraud Charges

Australian Olympic breakdancer Rachel "Raygun" Gunn’s brother, Brendan Gunn, accused of crypto fraud involving $181,000. ASIC investigates.

FBK Markets Review 2025: Live & Demo Accounts, Withdrawals to Explore

FBK Markets, a young South African forex broker, targets both beginners and experienced traders within this region. This broker shines at its low minimum deposit required, 100% deposit bonus, and flexible account options, yet we cannot consider it reliable as it operates without any regulation. Furthermore, it features an approximately 70% withdrawal failure rate.

WikiFX Broker

Latest News

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

$13M Pig Butchering Scam: Three Arrested for Money Laundering

FINMA Opens Bankruptcy Proceedings

FCA Issues Warning Against 14 Unregistered Financial Firms

Crypto Scam Exposed: 3 Arrested for Defrauding Investors

Nifty 50 Index Futures Now Available at Interactive Brokers

Grand Unveiling: The Core Reasons Behind the Yen’s Rise

Ethereum’s Shock Drop: What’s The Real Reason?

Currency Calculator