简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

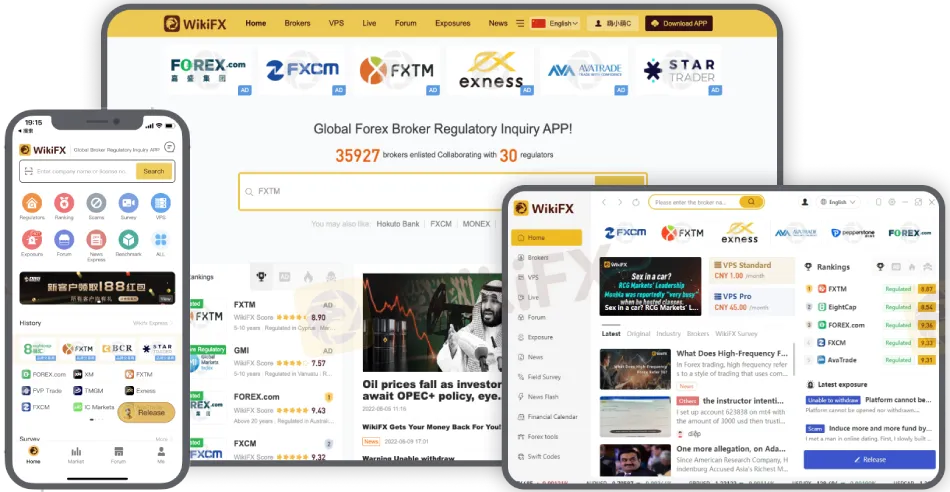

WikiFX September Exposure: Brokers With Reported Complaints

Abstract:September's WikiFX report exposes questionable activities of online forex brokers, highlighting the importance of thorough research before investing. Learn about brokers receiving negative feedback and tips to ensure a safe trading experience. Stay informed and protect your investments.

Introduction

The online forex brokerage world is vast and intricate, brimming with numerous players that promise lucrative returns on investments. But, as with every investment avenue, there are potential risks, and one of them is falling prey to fraudulent brokers. WikiFX, a prominent app designed to verify the authenticity of online brokers, exposed several complaints in September, shedding light on brokers' dubious activities.

To the diligent people of the Philippines, please be warned: It's essential to do thorough research before investing in any online broker. Here's a look at some brokers who have garnered negative feedback this month.

List of Brokers

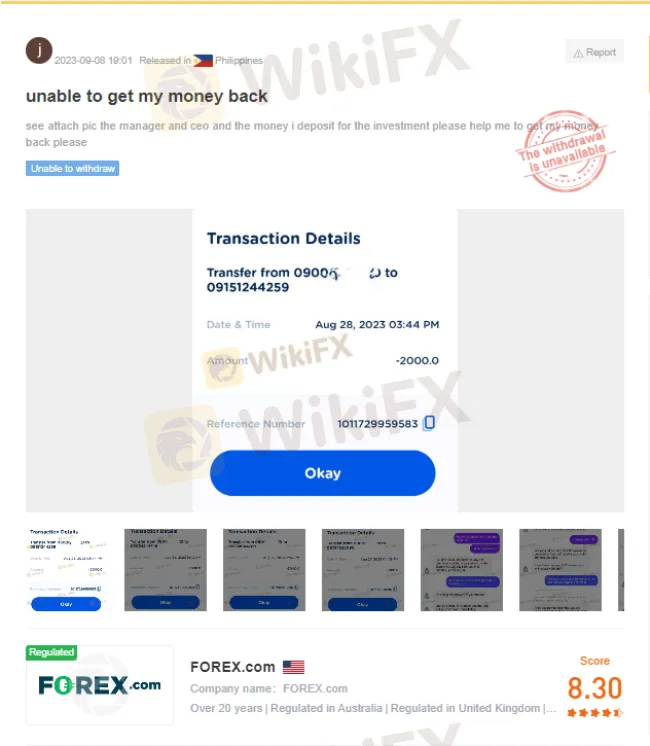

1. Forex.com

Case: Withdrawal Unavailable

The client made a distressing report that not only was withdrawal from their account unavailable, but also there was a lack of communication from the broker's manager and CEO. The plea was simple: “Help me get my money back.”

2. Coral FX

Case: Withdrawal Issue (Resolved by WikiFX)

A user reported a hitch while attempting to withdraw their funds. To add to the quandary, Coral FX demanded a substantial fee for processing the profits. Thankfully, with the intervention of WikiFX Support, the situation was resolved. However, the underlying concern is evident - the unforeseen charges imposed by the broker.

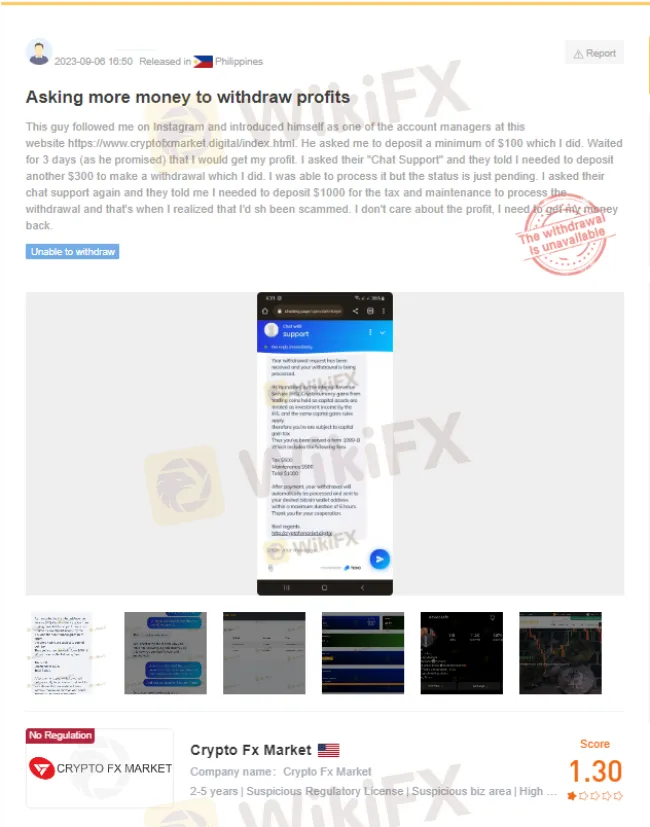

3. Crypto FX Market

Case: Additional Funds Needed for Withdrawal

Here, a client narrates their unfortunate experience with a broker found via Instagram. After making an initial deposit and being promised profits in a short span, the broker demanded more money under the guise of various fees to allow withdrawals. Every query to their chat support led to a demand for additional money. The client's realization? They'd been ensnared in a scam.

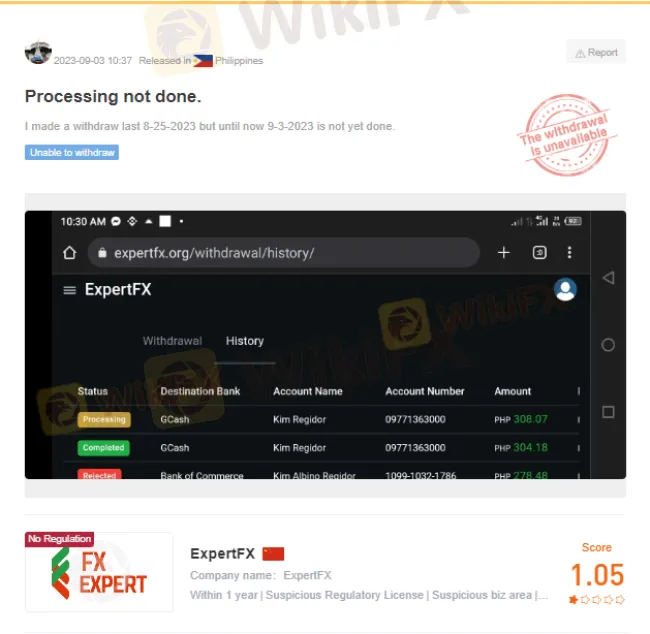

4. ExpertFX

Case: Withdrawal Delay

A user lamented about the prolonged delay in processing their withdrawal. A transaction initiated on August 25, 2023, still hadn't seen the light of day by September 3, 2023. Such elongated processing times can be incredibly distressing for investors.

Choosing the Right Broker

Every broker presents itself as the best, offering enticing incentives, rewards, and guarantees of high returns. But how do you differentiate between genuine offers and honey-traps? Here's where due diligence comes in. Before parting with your hard-earned money, take a moment to research the broker:

Reputation: Look for reviews and feedback from other users. Platforms like WikiFX catalog user experiences, providing invaluable insights into broker practices.

Regulatory Status: Ensure the broker is regulated by a recognized financial authority. Regulation not only adds legitimacy but also provides a recourse in case things go south.

Transparency: Genuine brokers maintain transparency in their operations. Hidden fees, sudden charges, and unexplained delays can be red flags.

Communication: Reliable brokers prioritize customer communication. If your broker is evasive or doesn't address your concerns, it's a sign to be cautious.

Remember, the world of online trading can be rewarding, but only when navigated wisely. By taking these initial steps of investigation and utilizing tools like the WikiFX App, you can protect your investments and avoid the pitfalls that many unsuspecting traders fall into. Equip yourself with knowledge, and your trading journey will be both safer and more profitable.

Conclusion

While these are just a few examples, they underscore the importance of vigilance when choosing an online forex broker. For those in the Philippines, or anywhere else for that matter, it's crucial to remember: Always verify a broker's license and regulatory status, ideally through reliable sources like the WikiFX App.

Be informed, stay safe, and protect your hard-earned money. The realm of online trading offers many opportunities, but it's vital to tread with caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

Authorities Alert: MAS Impersonation Scam Hits Singapore

MAS scam alert: Scammers impersonate officials, causing $614K losses in Singapore since March 2025. Learn how to spot and avoid this impersonation scam.

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

Billboard warns against fake crypto scams using its brand. Learn how to spot fraud and protect yourself from fake promotions.

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

WikiFX Broker

Latest News

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

Currency Calculator