简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

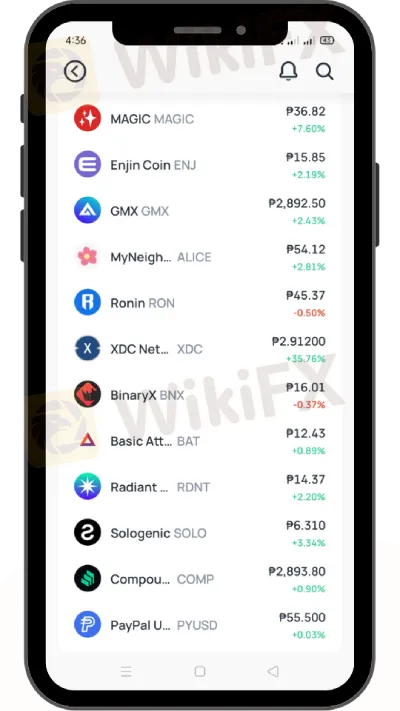

Coins.ph Added Paypal Stablecoin as Traded Assets

Abstract:Coins.ph, a leading Filipino cryptocurrency exchange, has integrated PayPal's stablecoin, $PYUSD, into its platform. $PYUSD, launched by PayPal in 2023 and pegged to the U.S. dollar, is designed to provide stability in digital transactions, particularly for cross-border transfers. This integration offers Coins.ph's 18 million users a seamless way to conduct international transactions with zero trading fees for the PYUSD/PHP pair. The process involves simple steps for buying, receiving, and cashing out $PYUSD. This move highlights a significant advancement in blockchain technology and its practical application in financial transactions.

In a significant move to enhance the capabilities of digital transactions and remittances, Coins.ph, a renowned Filipino cryptocurrency exchange platform, has proudly introduced the integration of PayPal's stablecoin, $PYUSD, into its services. This integration marks a major advancement in the field of blockchain technology, especially for cross-border transfers.

Transforming Digital Transactions with $PYUSD

$PYUSD, also known as PayPalUSD, is a stablecoin pegged to the U.S. dollar, launched by PayPal in 2023. This digital currency is designed to provide stability and reliability in digital transactions, making it an ideal choice for cross-border transfers. Developed in collaboration with Paxos, a leader in digital asset issuance, $PYUSD operates on the Ethereum blockchain and is specifically tailored for digital payments and web3 applications.

Benefits for Coins.ph Users

The integration of $PYUSD into Coins.ph offers its 18 million Filipino users an incredibly seamless and efficient way to perform cross-border transfers. This initiative is particularly beneficial for those who regularly engage in international transactions. To further support this development, Coins.ph has announced the removal of trading fees for the PYUSD/PHP trading pair, enabling users to buy and sell $PYUSD with zero trading fees through the platform's Convert and Pro features.

Coins.ph has streamlined the process of buying $PYUSD. Users first need to register and verify their account with a valid ID. Following account verification, they can easily cash in through various banks and e-wallets to start purchasing $PYUSD. The process involves simple steps on both Coins.ph and Coins Pro platforms, ensuring a user-friendly experience.

Receiving and Cashing Out $PYUSD

Receiving $PYUSD from PayPal to Coins.ph is straightforward. Users simply select $PYUSD in PayPals crypto section, enter the amount, and specify their Coins wallet address for the transfer. Similarly, cashing out $PYUSD involves converting it to PHP and then transferring the funds to banks or e-wallets through Instapay or PesoNet.

The launch of $PYUSD has drawn attention from U.S. regulators, concerned about the potential impact of a major tech platform‘s token on financial stability. In response, PayPal has been actively communicating with the U.S. SEC’s Division of Enforcement to ensure compliance and transparency.

A Step Forward in Blockchain Technology

Coins.ph's adoption of $PYUSD represents a significant leap forward in utilizing blockchain technology for practical, everyday financial transactions. This move not only enhances the user experience for its Filipino users but also sets a precedent for the integration of stablecoins in mainstream financial transactions.

For more information about this exciting development and to start using $PYUSD on Coins.ph, please visit our website or contact our support team.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Georgia man James Schwab charged in Danbury kidnapping tied to $230M crypto heist. Plot targeted couple for ransom after Miami altercation with son.

Bybit Shuts Down NFT Marketplace Amid Crypto Market Downturn

Bybit announces the closure of its NFT marketplace, citing efforts to streamline offerings. Discover the latest trends in the declining NFT market and its shift to utility-based growth.

Galaxy Digital Settles $200M in Luna Token Manipulation Case

Galaxy Digital pays $200M to settle Luna token manipulation probe by NY regulators, linked to TerraUSD’s 2022 crash, impacting crypto market stability.

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

Know April’s forex seasonality trends for EUR/USD, GBP/USD, USD/JPY, AUD/USD, and USD/CAD. Historical insights and key levels to watch in 2025.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

FCA to Investors: Think Twice Before Trusting These Brokers

Trump\s tariffs: How could they affect the UK and your money

Trump gambles it all on global tariffs he\s wanted for decades

TradingView Brings Live Market Charts to Telegram Users with New Mini App

HTFX Spreads Joy During Eid Charity Event in Jakarta

Currency Calculator