简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

India Successfully Registers 28 Crypto Firms

Abstract:India has successfully registered 28 crypto service providers, reinforcing compliance and fostering positive regulation of offshore exchanges.

The Indian government just announced that they have registered 28 cryptocurrency service providers with their Financial Intelligence Unit. Furthermore, the Ministry of Finance has said that anti-money laundering and reporting requirements apply to offshore cryptocurrency exchanges serving the Indian market.

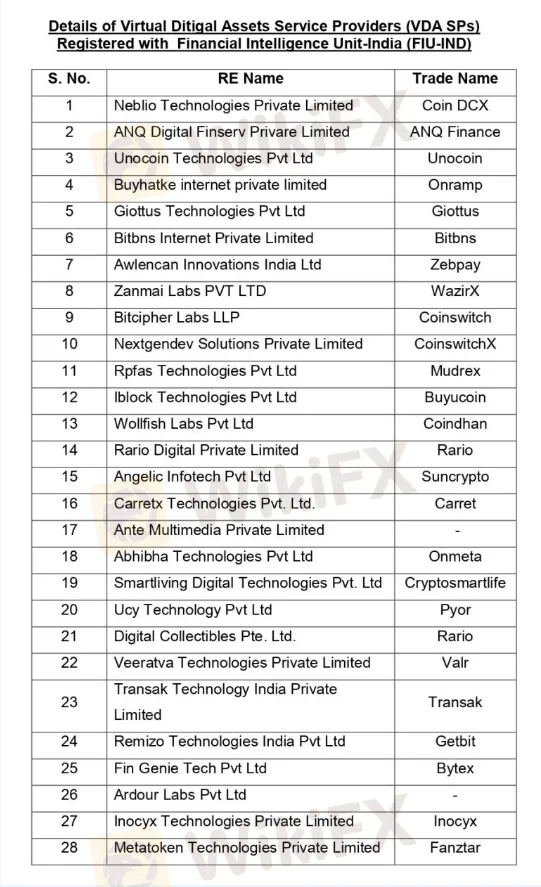

New Delhi, India The Indian Ministry of Finance provided important information on the Indian crypto sector during a session of the Lok Sabha, India's lower house of parliament. In response to a question from a parliament member about entities following Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) Guidelines for Reporting Entities Dealing with Virtual Digital Assets, Pankaj Chaudhary, Minister of State in the Ministry of Finance, shared a list of 28 Virtual Digital Assets Service Providers (VDA SPs) registered with India's Financial Intelligence Unit (FIU).

These registered entities include well-known names such as Coindcx, Unocoin, Giottus, Bitbns, Zebpay, Wazirx, Coinswitch, Mudrex, Buyucoin, Pyor, Valr, and Bytex, among others.

The Ministry of Finance emphasized earlier in March that entities involved in virtual digital assets, which include cryptocurrency exchanges and intermediaries, fall under the category of “reporting entities” as per the Prevention of Money Laundering Act (PMLA).

Furthermore, when questioned about whether the guidelines and reporting requirements extend to offshore cryptocurrency exchanges catering to the Indian market, Minister Pankaj Chaudhary confirmed, “Yes, Furthermore, when asked if the guidelines and reporting requirements apply to offshore cryptocurrency exchanges serving the Indian market, Minister Pankaj Chaudhary confirmed, ”Yes, the guidelines and reporting requirements apply to offshore crypto exchanges servicing the Indian market.“ The registration procedure for these VDA SPs has begun, and relevant steps under the Prevention of Money Laundering Act will be implemented in situations of noncompliance by offshore platforms.”

This announcement is a huge milestone in the Indian cryptocurrency market. The registration of crypto service providers with the FIU reflects the government's commitment to regulating and monitoring the cryptocurrency business in order to avoid illegal activities like as money laundering and terrorism funding.

The inclusion of offshore crypto exchanges under the regulatory framework guarantees that all firms participating in the Indian crypto industry follow the same AML and CFT requirements, promoting a safer and more transparent environment for investors and consumers.

Finally, the Indian government's move to register 28 crypto service providers and extend regulatory measures to offshore exchanges is a proactive step toward safeguarding the integrity and security of India's cryptocurrency sector.

To learn more about the newest advancements in the cryptocurrency business and to remain up to speed on regulatory changes, go to https://www.wikifx.com/en.

Bottom Line

The Indian government has registered 28 crypto service providers with the Financial Intelligence Unit, stressing compliance with anti-money laundering norms and reporting requirements for both local and offshore exchanges servicing the Indian market.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

JPMorgan Expands Rapid Forex Settlements with JPM Coin Blockchain

JPMorgan to offer instant USD/EUR settlements via JPM Coin, with plans to include GBP. Blockchain tech aims to streamline forex for fintech firms.

Polish Financial Regulator Issues Warning on Crypto.com

The Polish Financial Supervision Authority (KNF) has recently issued a cautionary warning regarding Foris DAX MT, the Malta-based entity operating under the Crypto.com brand

FCA Convicts 2 Individuals from CCX Capital & Astaria Group in £1.5M Crypto Scam

The Financial Conduct Authority (FCA) recently secured convictions against Raymondip Bedi and Patrick Mavanga, from CCX Capital and Astaria Group respectively, for orchestrating a £1.5 million investment fraud that affected over 65 investors between February 2017 and June 2019.

Saxo Singapore Discontinues SaxoWealthCare and SaxoSelect

Saxo Singapore will discontinue SaxoWealthCare and SaxoSelect by December 2024, advising clients to withdraw funds and offering alternative investment options.

WikiFX Broker

Latest News

FCA WARNING AGAINST Touchstone Markets

CySEC Tightens Compliance Rules for Crypto and FX/CFD Brokers

Will Trump's reelection drive more market growth?

Do You Really Know Your Trading Game?

Caroline Ellison Begins Two-Year Sentence for FTX Scandal

FCA Convicts 2 Individuals from CCX Capital & Astaria Group in £1.5M Crypto Scam

Beginner 101: WikiFX’s Guide on How to Choose the Right Broker

Join the WikiFX “Monthly Interaction, Quarterly Rewards” event and win exciting prizes!

Trump Win Spurs Historic Stock Rally as Markets Hit Record Highs

Launch of the SkyLine Judge Community, Partnering with Top Judges to Build Industry Excellence

Currency Calculator