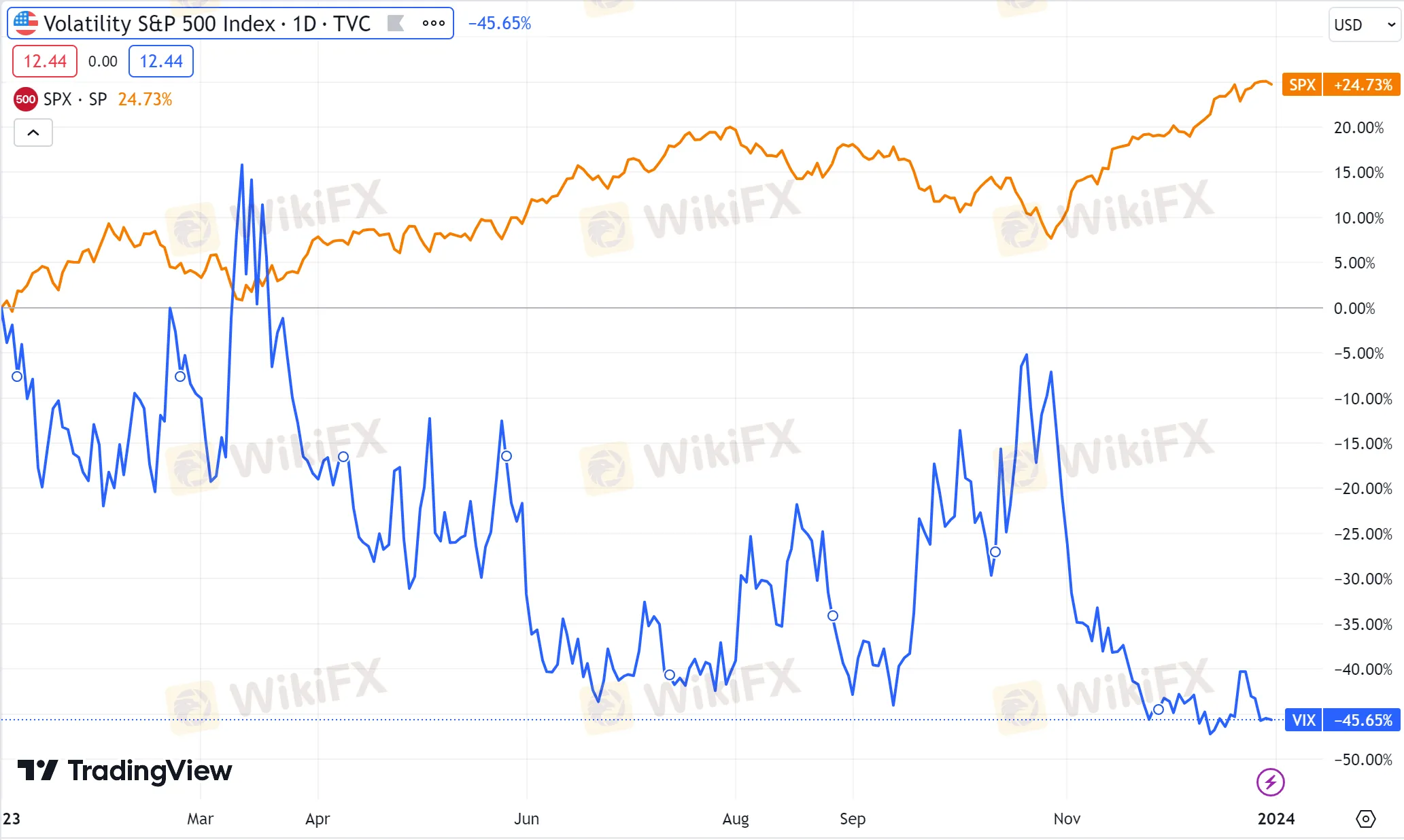

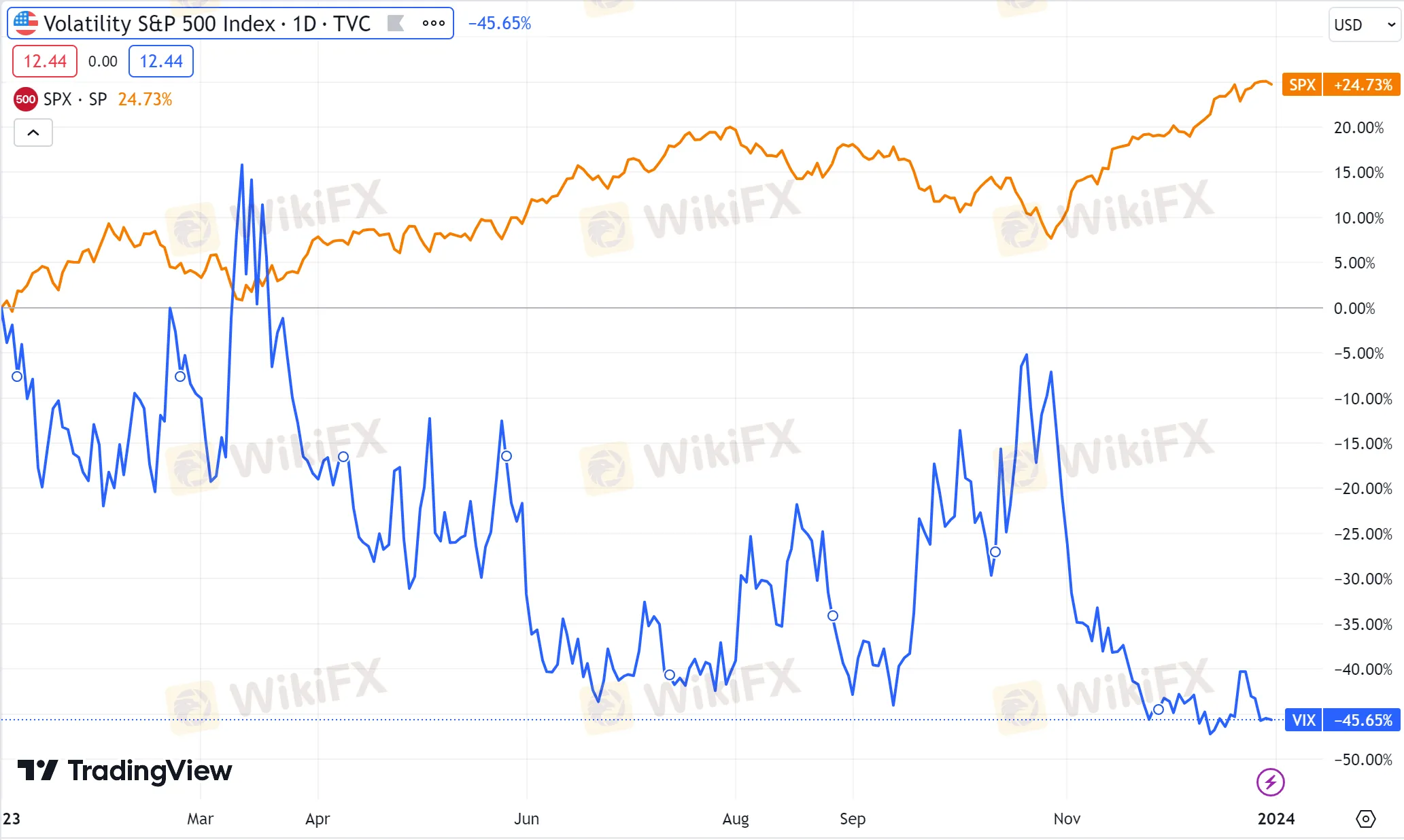

Abstract:VIX is one of the most recognized indicators for expected market volatility, reflecting the market's anticipation of volatility in the S&P 500 index options market for the next 30 days.

Definition

VIX, also known as the Chicago Board Options Exchange Volatility Index (CBOE Volatility Index), is a measure of short-term volatility expectations in the prices of S&P 500 index options. It real-time represents the market's anticipation of volatility for the next 30 days. It is often referred to as the “fear index” or “panic gauge.” When the VIX is high, it indicates traders expect significant price fluctuations in the S&P 500 index, implying a higher level of uncertainty or panic in the market. Conversely, a lower VIX suggests market participants anticipate relatively stable and calm conditions. However, it's important to note that while volatility may carry negative connotations, such as increased risk or deeper uncertainty, volatility itself is a neutral term, and fluctuations may also signal rapid market advances.

Investors and traders use the VIX to assess market sentiment and reference it when making portfolio decisions. It is crucial to recognize that the VIX reflects expectations and perceptions of volatility, not actual historical volatility. Therefore, it is just one of many tools investors employ to evaluate market conditions and make informed decisions.

Calculation Method

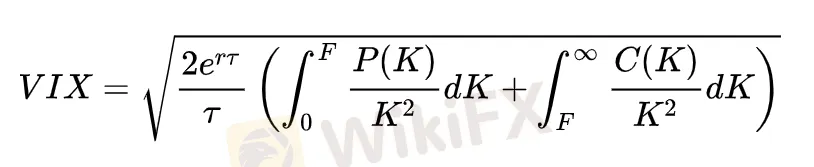

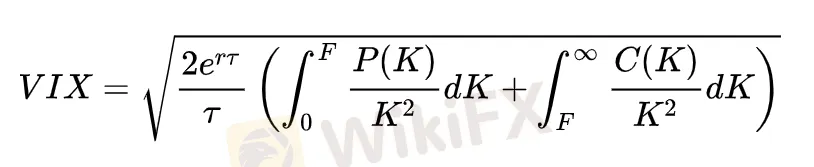

The calculation of the VIX (Volatility Index) is based on the prices of options on the S&P 500 index (SPX), and the details are so complex that the mathematical principles and accompanying explanations occupy a significant portion of the 15-page white paper published by Cboe. Therefore, we have summarized the key points. Here is an overview of the approximate calculation method and steps for the VIX, understanding them can enhance your comprehension of the VIX.

Option Selection

Choose a series of options on the S&P 500 index (SPX), including out-of-the-money call and put options with different expiration dates and strike prices.

Calculate Implied Volatility

For each option contract, calculate its implied volatility using an option pricing model (generally based on the Black-Scholes model).

Select Weights

To reflect the overall market expectation of future volatility, assign a weight to each option contract. These weights are typically based on the option's price and remaining time to expiration.

Calculate Weighted Volatility

Multiply the implied volatility of each option by its corresponding weight, then sum the results for all options to obtain a weighted volatility.

Annualize Volatility

Multiply the weighted volatility by a constant (known as an adjustment factor, typically an annualization factor) to obtain an annualized volatility.

Convert to VIX Index

Adjust the annualized volatility to derive the VIX Index. This adjustment often involves standardization and smoothing procedures.

τ represents the average number of days in a month (30 days),

r is the risk-free interest rate,

F is the 30-day forward price of the S&P 500 index,

P(K) and C(K) are the prices of put and call options with a strike price of K and an expiration of 30 days.

Meanings of Different VIX Value Ranges

VIX Less Than 20

Low Volatility: A VIX value below 20 is generally considered indicative of a relatively stable market, with investors having lower expectations for future volatility.

Market Optimism: Lower VIX values may suggest optimistic market sentiment, with investors less concerned about extreme fluctuations in the future.

VIX Between 20 and 30

Moderate Volatility: VIX values between 20 and 30 may indicate moderate market volatility, with investors anticipating increased volatility in the future.

Market Observation: VIX values in this range may reflect an observant attitude among investors, expressing some concerns but not reaching extreme levels.

VIX Between 30 and 40

High Volatility: VIX values between 30 and 40 are typically interpreted as relatively high market volatility, with investors expressing concerns about future uncertainty and volatility.

Market Anxiety: Higher VIX values may reflect market anxiety, potentially accompanied by stock price declines and increased trading activity.

VIX Greater Than 40

Extreme Volatility: VIX values exceeding 40 are often seen as indicative of extremely high market volatility, suggesting investors hold very pessimistic expectations for future volatility.

Market Panic: Higher VIX values may indicate market panic, potentially associated with sharp declines in stock prices and increased trading activity.

How to Make Investment Decisions Based on VIX?

In the financial realm, especially in technical analysis, mean reversion is a key principle indicating that asset prices generally tend to revert to their long-term average levels. If prices rise very rapidly or fall significantly and quickly, the mean reversion principle suggests that they should soon return to their long-term average levels. Based on this overarching principle and considering the significance of different VIX ranges, the following investment decision guidelines are summarized:

If you observe the VIX index rising to near the level of 30, it could be a sign of future volatility. You may consider shifting a portion of your investment portfolio into assets deemed to have lower risk, such as bonds or money market funds. Alternatively, you might adjust your asset allocation to cash in recent gains and keep funds available for potential market downturns. Conversely, when the volatility index drops to around 15, indicating a more stable stock market, focusing on individual stocks or other riskier assets that may perform well during growth periods might be more meaningful.

Financial instruments related to VIX

VIX Futures (VIX Futures)

VIX futures are derivatives whose prices are linked to the expected volatility of the S&P 500 index in the next 30 days. Investors can trade VIX futures to profit from or hedge against market volatility. Futures trading involves considerations such as contract expiration dates and rolling costs.

VIX Options (VIX Options)

VIX options allow investors to engage in options trading on the VIX index. Buying VIX call options expresses a bullish view on increasing market volatility, while purchasing VIX put options reflects a bearish outlook on decreasing market volatility.

VIX ETFs (Exchange-Traded Funds)

Some ETFs track the VIX index or VIX futures, providing investors with a way to participate in VIX-related trading on the stock market through regular securities trading. Examples include iPath S&P 500 VIX Short-Term Futures ETN (VXX) and ProShares VIX Short-Term Futures ETF (VIXY).

VIX ETNs (Exchange-Traded Notes)

Similar to ETFs, VIX ETNs are securities that track the VIX index or VIX futures. They are typically issued with fixed interest rates and do not directly hold assets like ETFs. iPath S&P 500 VIX Short-Term Futures ETN (VXX) is a common VIX ETN.

VIX Index Stock Selection Strategy Products

Some funds or trading strategy products are built based on the VIX index, implementing investment strategies by tracking changes in the VIX index.

VIX Swaps Trading

Some financial institutions offer VIX swap trading, allowing investors to engage in customized volatility trades.

VIX Options Strategy Products

Some funds and trading platforms provide complex trading strategy products based on VIX options, enabling investors to participate in market volatility trading in more sophisticated ways.

Extended Reading

Is a decrease in the VIX index a positive sign?

A decline in the VIX is often considered a positive sign. The VIX tends to move inversely to market trends. When the VIX rises, it may indicate increased fear and risk in the market. Conversely, when the VIX falls, it may suggest a more stable market environment.

What is the association between VIX and Financial Crises?

There is a certain association between the VIX (Volatility Index) and financial crises because the VIX is generally regarded as an indicator of market volatility, and financial crises often accompany extreme market fluctuations. However, it's crucial to note that the VIX is a measure of market sentiment and volatility, not the cause of a crisis. Historically, the VIX has often reached elevated levels during the outbreak or intensification of financial crises. During such periods, markets typically face increased uncertainty, including credit risks, liquidity issues, and macroeconomic uncertainties. These factors may lead investors to pay more attention to future market volatility, reflected in the VIX. For instance, during the global financial crisis in 2008, the VIX experienced significant fluctuations, particularly in late September and early October, reaching historic highs around 60.

How to Trade VIX?

Trading the VIX (Volatility Index) typically involves using financial instruments such as VIX futures, VIX options, and VIX ETFs/ETNs. Investors can adopt corresponding strategies based on their expectations for market volatility, such as buying VIX-related instruments for hedging or speculation when anticipating an increase in market volatility, or engaging in opposite trades when expecting a decrease in market volatility. It is essential to prudently manage risks, fully understand the characteristics of VIX-related tools, and consider market background, trends, and other technical analysis factors in investment decisions to formulate comprehensive and prudent trading strategies. Investors in VIX trading can also choose to use options and futures tools, but cautious operation is advised, especially for beginners, who are recommended to conduct operations after gaining a thorough understanding of the market and tools.

Differing Views

Reflecting Past Volatility: Volatility indices may reflect past volatility, and despite the complexity of the VIX formula, the predictive ability of most volatility forecasting models is similar to common indicators, such as simple historical volatility.

Overreaction: The VIX may be overly influenced by market sentiment, especially during periods of extreme volatility or panic. Therefore, high levels of the VIX do not always indicate an imminent significant market decline.

Options Market Disruptions: The calculation of VIX is based on option market prices, which may be influenced by non-fundamental factors, such as options traders' sentiment and demand, potentially making VIX less accurate in some situations.

Failure in Extreme Cases: Examining history, it's found that the VIX calculated in 1929 did not predict volatility beyond the Great Depression, suggesting that in exceptional circumstances, the VIX may even fail to weakly predict future severe events.

Bottom Line

In conclusion, the VIX serves as a crucial indicator of short-term volatility expectations in the S&P 500 index options, offering insights into market sentiment. Its calculation involves a complex process based on option prices and implied volatility. Different VIX value ranges signal varying market conditions, guiding investors in decision-making.

The article also highlights investment strategies based on VIX levels and introduces various financial instruments related to VIX trading. Despite its utility, differing views emphasize the need for cautious interpretation. Understanding the VIX and its associated tools is essential for navigating and leveraging market volatility effectively.