简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Apex Legal Limited Losses License

Abstract:Apex Legal Limited's recent license revocation by the UK's Financial Conduct Authority (FCA) on January 5, 2024, unveils regulatory concerns over the firm's lack of engagement in authorized activities, reflecting broader shifts in the FCA's approach towards ensuring active compliance in the financial sector.

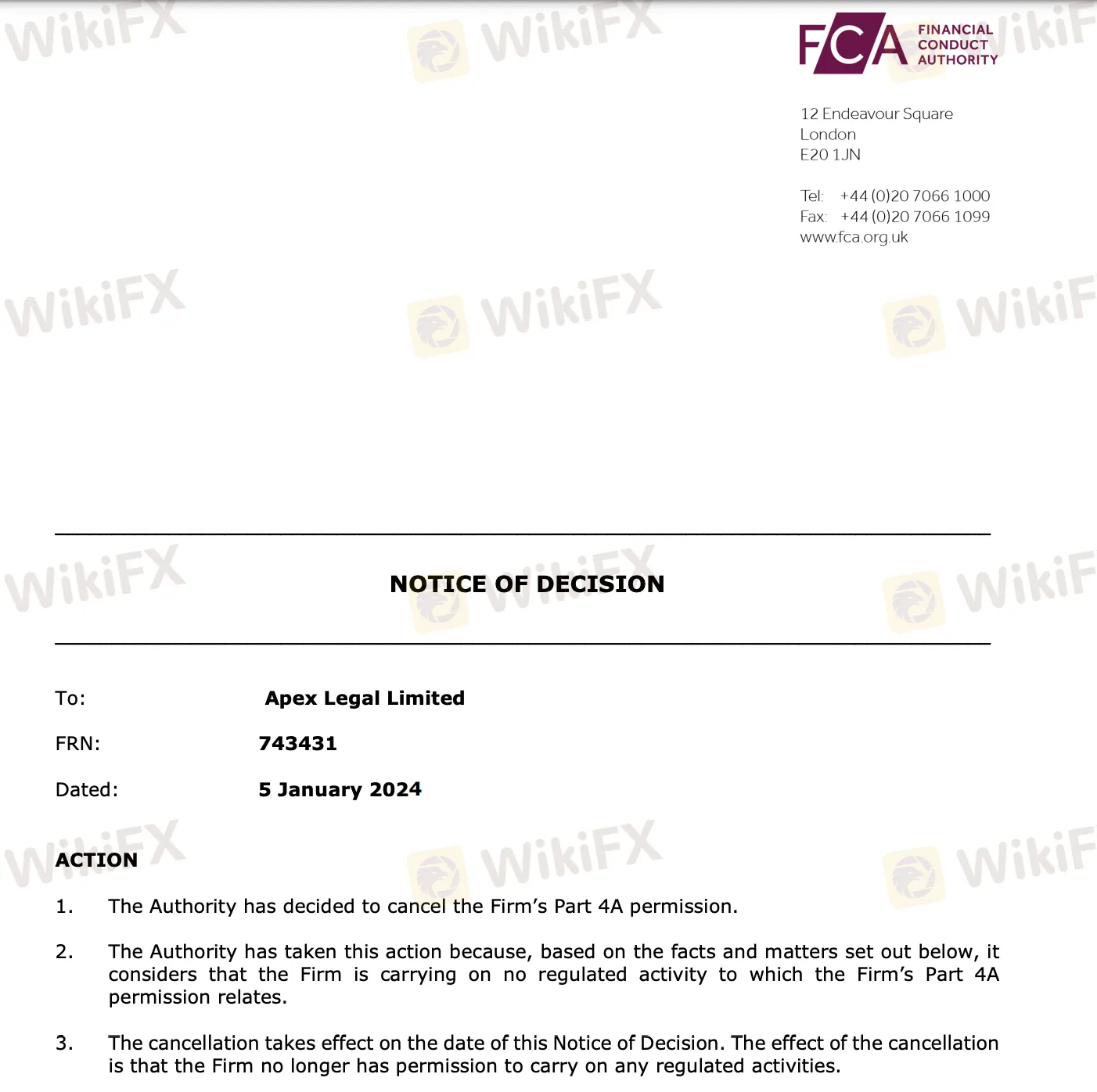

The UK's Financial Conduct Authority (FCA) officially revoked Apex Legal Limited's Part 4A permission, effective January 5, 2024, as the Authority observed the firm's lack of engagement in any regulated activities covered by its Part 4A permission.

Apex Legal obtained FCA authorization on September 1, 2016, enabling specific regulated activities such as arranging investments, assisting in insurance contracts, acting as an agent in investments, organizing transactions in investments, and agreeing to regulated activity.

The FCA issued two notices to Apex Legal, expressing concerns about the firm's non-engagement in regulated activities aligned with its Part 4A permission and proposed cancellation. Despite these notices, Apex Legal did not take the required specified actions.

Information obtained from FCAs official website: https://www.fca.org.uk/publication/decision-notices/apex-legal-limited-2024.pdf

Consequently, the FCA decided to cancel Apex Legal's Part 4A permission. This decision aligns with the FCA's recent efforts to protect consumers by rescinding unused financial licenses across the UK. The regulatory changes empower the FCA to cancel licenses within 28 days, a significant shift from the previous 12-month timeline. This approach aims to ensure active participation in regulated activities by licensed firms, emphasizing the risk of losing licenses for non-compliance.

The FCA emphasizes that dormant licenses could mislead consumers, citing cases where firms with inactive licenses attracted investors to unregulated products, resulting in substantial financial losses. Recent data shows that in 2023, the regulator revoked licenses from 1,266 firms for failing to meet minimum authorization standards, indicating a doubled firm cancellation rate compared to the previous year.

In a landscape where financial regulations and firm compliance are crucial, staying informed is essential. To remain up-to-date with broker-related developments like this, leveraging the free WikiFX mobile application and official website is your best option. WikiFX serves as the ultimate destination for all broker-related inquiries and information. By downloading the app or visiting our official website, users gain access to comprehensive and real-time updates, making WikiFX your indispensable tool to navigate the dynamic world of brokers with confidence and clarity. Stay informed, stay empowered with WikiFX!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

INFINOX has teamed up with Acelerador Racing, sponsoring an Acelerador Racing car in the Porsche Cup Brazil 2025. This partnership shows INFINOX’s strong support for motorsports, adding to its current sponsorship of the BWT Alpine F1 Team.

The Daily Habits of a Profitable Trader

Every professional trader follows a structured approach to ensure they are well-prepared, disciplined, and able to seize opportunities with confidence. Whether you are a seasoned investor or an aspiring trader, adhering to a robust daily checklist can significantly enhance your performance. Use this checklist to check if you are a qualified trader

The Impact of Interest Rate Decisions on the Forex Market

Interest rate changes determine currency attractiveness, influencing capital flows and exchange rate trends. Understanding this mechanism helps investors navigate the forex market effectively.

How a Housewife Lost RM288,235 in a Facebook Investment Scam

A 47-year-old housewife in Malaysia recently fell victim to an online investment scam, losing a substantial sum of RM288,235 after engaging with a fraudulent scheme advertised on Facebook.

WikiFX Broker

Latest News

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Billboard Warns of Crypto Scams Using Its Name – Stay Alert!

The Impact of Interest Rate Decisions on the Forex Market

STARTRADER Spreads Kindness Through Ramadan Campaign

Rising WhatsApp Scams Highlight Need for Stronger User Protections

A Trader’s Worst Mistake: Overlooking Broker Reviews Could Cost You Everything

How a Housewife Lost RM288,235 in a Facebook Investment Scam

The Daily Habits of a Profitable Trader

Currency Calculator