简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

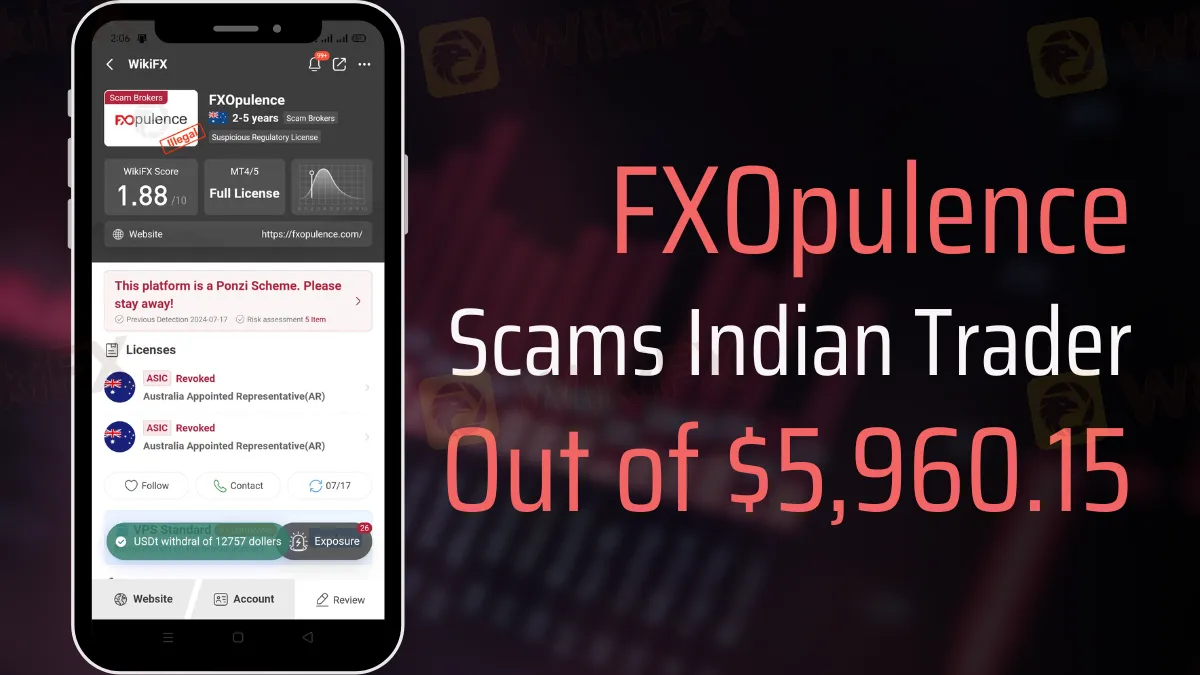

FXOpulence Scams Indian Trader Out of $5,960.15

Abstract:Indian trader lose $5,960.15 to FXOpulence after being unable to withdraw funds. Learn how to avoid such scams and protect your investments.

In a distressing turn of events, Indian traders have become victims of an unscrupulous broker, FXOpulence. Despite their best efforts, these traders faced significant financial losses when attempting to withdraw funds from their FXOpulence accounts. This article delves into the details of the scam, providing insights into the shared experiences of the victims and offering guidance on avoiding similar pitfalls.

Case Study: A Trader's Nightmare

One Indian trader, who prefers to remain anonymous, reported losing 5,960.15 USD after FXOpulence denied his withdrawal request. The trader expressed his frustration, stating, “I cannot withdraw my money from FXOpulence. Please do what is needed.” Despite repeated attempts, the trader could not retrieve his funds, highlighting the deceitful practices of FXOpulence.

Unfortunately, this trader is not alone. Another Indian national fell victim to the same scam, losing 5,834.75 USD. These cases underscore the significant risk posed by unregulated brokers like FXOpulence.

Read the article case below:

Avoiding Scammers Like FXOpulence

Protecting oneself from such fraudulent brokers requires constant vigilance and the right tools. Here are some essential tips and features from WikiFX to help traders safeguard their investments:

- Verify Regulatory Status: Always check a broker's regulatory status before investing. WikiFX provides detailed information on brokers' regulatory compliance.

- Read User Reviews: Look for user feedback and reviews on platforms like WikiFX to gauge a broker's credibility and reliability.

- Check Broker Ratings: Use WikiFX's rating system to assess a broker's overall trustworthiness based on various criteria.

- Stay Informed: Keep up-to-date with the latest news and alerts about broker scams and fraudulent activities through WikiFX's news section.

- Use Trusted Platforms: Only trade with well-regulated brokers with a proven track record of ethical practices.

Conclusion

The cases of the Indian traders scammed by FXOpulence are a stark reminder of the dangers posed by unregulated brokers. By leveraging the tools and resources provided by WikiFX, traders can make informed decisions and protect their investments from similar fraudulent activities. Always prioritize safety and due diligence to ensure a secure trading experience.

Avoid falling victim to brokers like FXOpulence. Check reviews and regulatory status now. Visit FXOpulence's page on WikiFX for details.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

March 27, 2025, Hong Kong—The highly anticipated WikiEXPO Hong Kong 2025 concluded successfully at the city’s iconic Sky100 Observation Deck. Under the theme “Bridging Trust, Exploring Best,” the event was hosted by WikiGlobal, co-organized by WikiFX, and partnered with government entities including FSI Mauritius (Financial Services Institute Mauritius) and Liberland, creating a top-notch platform for collaboration and innovation.

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

A finance manager in Malaysia lost more than RM364,000 after falling victim to an online investment scam that promised quick and high returns.

Couple Arrested in Thailand for Billion-Baht Crypto Scam & International Kidnapping

Thai authorities have announced the arrest of 27-year-old Chinese national Wu Di, who is believed to be at the centre of a large-scale cryptocurrency investment scam that has defrauded victims of over 600 million baht (approximately US$17.7 million) within a span of just two months.

How Cyberattacks Cost BSP-Overseen Institutions P5.82 Billion in 2024

Cybersecurity risks cost BSP banks P5.82B in 2024. Phishing and AI-driven attacks surge as digitalization widens vulnerabilities. Explore the rising cyber threat impact.

WikiFX Broker

Latest News

Africa Cybercrime Bust: Over 300 Arrested in Fraud Crackdown

The Growing Threat of Fake Emails and Phishing Scams

Hong Kong Banks and Authorities Collaborate to Freeze Fraudulent Accounts Faster

SocialFi and the Forex Market: A New Era for Decentralized Social Trading?

Is Billion Bucks Fx Scam?

BaFin Halts USDe Token Issuance, Citing Serious Compliance Failures

The Rise and Risks of Forex Signal Apps: An In-Depth Analysis

Enlighten Securities Penalized $5 Million as SFC Uncovers Risk Control Failures

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Currency Calculator