简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】Sachs is optimistic about gold prices as U.S. retail sales grow strongly in November

Abstract:US retail sales data showed the resilience of consumer spending and solid economic growth. Retail sales rose 0.7% in November, beating expectations of 0.5% and the previous value was revised up from 0

US retail sales data showed the resilience of consumer spending and solid economic growth. Retail sales rose 0.7% in November, beating expectations of 0.5% and the previous value was revised up from 0.4% to 0.5%. This growth reflects the continued resilience of US consumers and is an early sign of a strong start to the holiday shopping season. Sales excluding automobiles and gasoline rose 0.2% in November, lower than the expected 0.4%, while the control group data rose 0.4%, in line with expectations.

Seven of the 13 categories reported posted gains, with auto sales particularly strong due to lower interest rates and year-end discounts offered by dealers. New car and truck sales jumped 2.6%, leading retail growth. E-commerce sales increased 1.8%, and receipts at building material stores rose 0.4%. However, in a negative sign, restaurant sales fell 0.4%, the first decline since March and typically seen during times of economic stress.

While consumers remained resilient during the critical holiday shopping season, lured by discounts and boosted by faster-than-price income growth, the resilient labor market, strong household balance sheets and support for consumption from household savings cannot be ignored. Federal Reserve officials are expected to cut interest rates by a quarter point on Wednesday, which would be the third rate cut since the U.S. central bank began its easing cycle in September.

Strong retail sales, combined with more muted inflation readings in recent months, suggest the Fed may pause its rate cuts in January. Policies planned by President-elect Trumps incoming administration, including tariffs on imports and mass deportations of undocumented immigrants, are also seen as creating complications for the Fed.

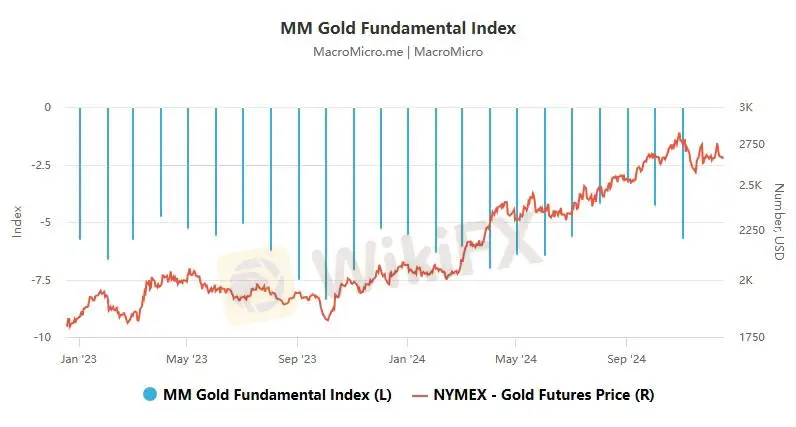

Meanwhile, Goldman Sachs precious metals analyst Lina Thomas is optimistic about the gold market, predicting that gold will rise to $3,000 an ounce by the end of 2025. Thomas refuted skeptics' views that gold cannot reach this price amid the continued strength of the US dollar.

She put forward four reasons: First, Goldman Sachs economists expect the Federal Reserve to cut interest rates, and it will be the U.S. policy rate, not the U.S. dollar, that will drive investor demand for gold; second, the central bank's increased gold purchases will cause the gold price to rise by 9% by the end of 2025, and the central bank tends to use its U.S. dollar reserves to purchase gold internationally; third, the trend of the U.S. dollar and gold prices rising with uncertainty supports its role as a portfolio hedge; finally, Goldman Sachs economists expect that broader easing policies should have a roughly neutral net impact on China's retail gold demand.

Goldman Sachs' predictions have already begun to play out, with central banks buying a whopping 64 tons of gold in October, with China once again being the largest buyer, buying 55 tons. This purchase is much higher than the official figures reported by the People's Bank of China, suggesting that China is secretly buying 10 times more gold than it publicly admits.

Goldman Sachs analysts believe that central banks in emerging market countries buy gold to hedge against financial and geopolitical shocks, and concerns about geopolitical shocks have structurally increased since Russia's reserves were frozen in 2022. According to a survey by the World Gold Council, 81% of central banks expect global central banks' gold holdings to rise in the next 12 months, and none expects a decline.

In summary, the strong growth in US retail sales and the optimistic forecast of the gold market together paint a complex economic picture. Although the retail sales data show that consumer spending remains strong, the Fed's interest rate cut expectations and the increase in gold purchases by global central banks indicate that the market remains vigilant about future economic uncertainties and potential risks.

These factors work together on the U.S. economy, foreshadowing the challenges and opportunities that may be faced in the future. At the same time, the continued gold purchases by global central banks, strong investment demand in Asia, resilient consumer demand, and continued geopolitical uncertainty are all important factors supporting the booming gold market. Gold will continue to play an important role in a sound asset allocation strategy, benefiting global investors.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Forex Trading: Scam or Real Opportunity?

The Hidden Tactics Brokers Use to Block Your Withdrawals

Beware: Online Share Buying Scam Costs 2,791,780 PHP in Losses

5 things I wish someone could have told me before I chose a forex broker

Unmasking a RM24 Million Forex Scam in Malaysia

U.S., Germany, and Finland Shut Down Garantex Over Money Laundering Allegations

What Impact on Investors as Oil Prices Decline?

Gold Prices Fluctuate: What Really Determines Their Value?

Dollar Under Fire—Is More Decline Ahead?

Is the North Korea's Lazarus Group the Biggest Crypto Hackers or Scapegoats?

Currency Calculator