Score

MACRO MARKETS

Australia|5-10 years| Benchmark C|

Australia|5-10 years| Benchmark C|https://www.macrogm.com/

Website

Rating Index

Benchmark

Benchmark

C

Average transaction speed (ms)

MT4/5

Full License

MacroMarketsSolutions-Demo

Benchmark

Speed:AAA

Slippage:D

Cost:C

Disconnected:A

Rollover:AA

MT4/5 Identification

MT4/5 Identification

Full License

Australia

AustraliaContact

Single Core

1G

40G

1M*ADSL

- The Seychelles FSA regulation with license number: SD139 is an offshore regulation. Please be aware of the risk!

Basic Information

Australia

AustraliaAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed MACRO MARKETS also viewed..

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Benchmark

Website

macroglobalmarkets.com

Server Location

Hong Kong

Website Domain Name

macroglobalmarkets.com

Server IP

180.188.198.67

macrogm.com

Server Location

Australia

Website Domain Name

macrogm.com

Server IP

146.185.236.41

macromarkets.co

Server Location

United States

Website Domain Name

macromarkets.co

Server IP

172.67.149.117

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| MACRO MARKETS Review Summary | |

| Founded | 2018-11-04 |

| Registered Country/Region | Australia |

| Regulation | FSA(Offshore Regulated), ASIC, HKGX |

| Market Instruments | 这个是交易工具 官网也可能会用assets, markets, products等表达 |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.1 pips |

| Trading Platform | MT4(Web Trader, Mobile) |

| Min Deposit | $100 |

| Customer Support(24/7) | Phone: +61 4 3486 9014 (Australia) |

| Email: support@macrofx.com | |

| Live chat | |

| Telegram | |

MACRO MARKETS Information

Headquartered in Sydney, Australia, Macro Group specializes in brokerage and asset management services for securities, futures, currency pairs, CFDs, funds, and other financial products for global clients and institutions. Macro Group legally holds financial regulatory licenses in Australia, Seychelles, Hong Kong, and other places.

It owns subsidiaries such as Macro Global, Macro Markets, and Macro Bullion. Macro Markets is an online brokerage platform under Macro Group. Macro Markets provides forex, stocks, indices, precious metals, commodities, and cryptocurrencies trading. The broker also offers MT4 platform, STD & ECN accounts with maximum leverage of 1:500, and 24-hour customer support.

Pros and Cons

| Pros | Cons |

| Regulated | Islamic account unavailable |

| MT4 available | Unspecific withdrawal information |

| 24-hour customer support | |

| Leverage up to 1:500 | |

| Spread from 0.1 pips |

Is MACRO MARKETS Legit?

It is relatively safe for investors to conduct financial activities in regulated entities. The regulatory information of this broker is as follows:

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| ASIC | MACRO GLOBAL MARKETS PTY LTD | Market Making(MM) | 000363972 | Regulated |

| HKGX | 巨富金業有限公司 | Type AA License | 229 | Regulated |

| FSA | Macrofx(Seychelles)Limited | Retail Forex License | SD139 | Offshore Regulated |

What Can I Trade on MACRO MARKETS?

MACRO MARKETS offers various market instruments, including forex(30+ currency pairs), stocks, indices, precious metals & energy, commodities, and cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Precious Metals & Energy | ✔ |

| Indices | ✔ |

Account Type

MACRO MARKETS has an STD account and an ECN account. The STD account is suitable for most professional traders with no fees and low spreads. The ECN account is ideal for experienced traders.

Beginners can also explore a demo account, allowing them to practice trading different products and familiarize themselves with the platform. Macro provides a demo account with virtual funds of up to $100,000 for beginners to practice before transitioning to a live account.

| Account Type | STD Account | ECN Account |

| Trading Platform | MT4 | MT4 |

| Currency | USD | USD |

| Trading Products | Securities, Futures, Currency, Metals, Commodities, Stock, Indices | |

| Minimum Deposit | 100 USD | 1000USD |

| Transaction Fees | - | Yes |

| Order Execution | Market Execution | Market Execution |

| Spread | Medium | Low |

| Minimum Lot Size | 0.01 | 0.01 |

| Maximum Lot Size | 20 | 20 |

| Maximum Opening Position | Unlimited | Unlimited |

| Stop Out Level | 50% | 50% |

| Free Demo | √ | √ |

| Expert Advisor | √ | √ |

MACRO MARKETS Fees

The spread starts from 0.1 pips. The lower the spread, the faster the liquidity.

Leverage

The maximum leverage is 1:500 meaning that profits and losses are magnified 500 times.

Trading Platform

Traders can use MACRO to conduct financial activities in Apple, Android, and PC applications supported by MT4. With MT4, traders can easily access the gold standard through Web Trader and mobile applications.

Copy trading is also available, a way for inexperienced traders or followers who dont have the time to do extensive research or want to diversify their portfolio to copy the trades of experienced traders (also known as money managers or copy trading gurus).

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web Trader, Mobile | Junior traders |

Deposit and Withdrawal

The first deposit amount must be $500 or above and the deposit commission is zero. MACRO MARKETS accepts USDT, International & Local Bank Wires, Visa/Master, and more for deposit and withdrawal.

Bonus

All customers who trade in MacroMarkets quasi-accounts can sign up and enjoy a 15% loss-resistant and tradeable credit bonus upon deposit. 20% deposit bonus & 2.0 cash points per lot for liquidation and instant cash-back activity

Keywords

- 5-10 years

- Regulated in Australia

- Regulated in Hong Kong

- Regulated in Seychelles

- Market Maker (MM)

- Type AA License

- Retail Forex License

- MT4 Full License

- Global Business

- Medium potential risk

- Offshore Regulated

News

Review 【MACRO Insight】 Global risk aversion heats up, and the gold market is in turmoil again

As global geopolitical tensions intensify and Trumps tariff policy continues to advance, risk aversion in the gold market continues to heat up, and the price of COMEX gold futures climbed to $3,177 pe

2025-04-02 15:15

News 【MACRO Alert】Gold prices soared - market competition and outlook driven by risk aversion

Recently, the global financial market has shown a complex and changing situation under the intertwined influence of trade tensions and economic uncertainty, and the price of gold has continued to rise

2025-03-28 16:37

News 【MACRO Alert】The "crossroads" dilemma under Trump's tariff policy - the choice between rising inflat

Recently, the US economic situation has become complicated, with rising inflation expectations, falling consumer confidence and volatility in the gold market intertwined, bringing many uncertain

2025-03-26 16:14

News 【MACRO Alert】Global financial markets are in turmoil again: In-depth analysis of the monetary polici

In todays complex and ever-changing global economic environment, the monetary policy decisions of central banks have become an important indicator of the financial market. Recently, the interest rate

2025-03-20 16:06

Review 【MACRO Alert】The "epic escape" of US stocks and the "historic expansion" of German finances under th

A Bank of America survey of fund managers showed that investors made the “biggest ever” cuts to their U.S. stock allocations in March, with allocations to U.S. stocks falling sharply by 40%, from a 17

2025-03-19 16:23

News MACRO Markets — Opening up new horizons for global investment

As the global financial market becomes increasingly complex and changeable, investors are eager for a comprehensive platform that can integrate massive amounts of information, provide accurate analysi

2025-03-17 16:33

Comment 5

Content you want to comment

Please enter...

Comment 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

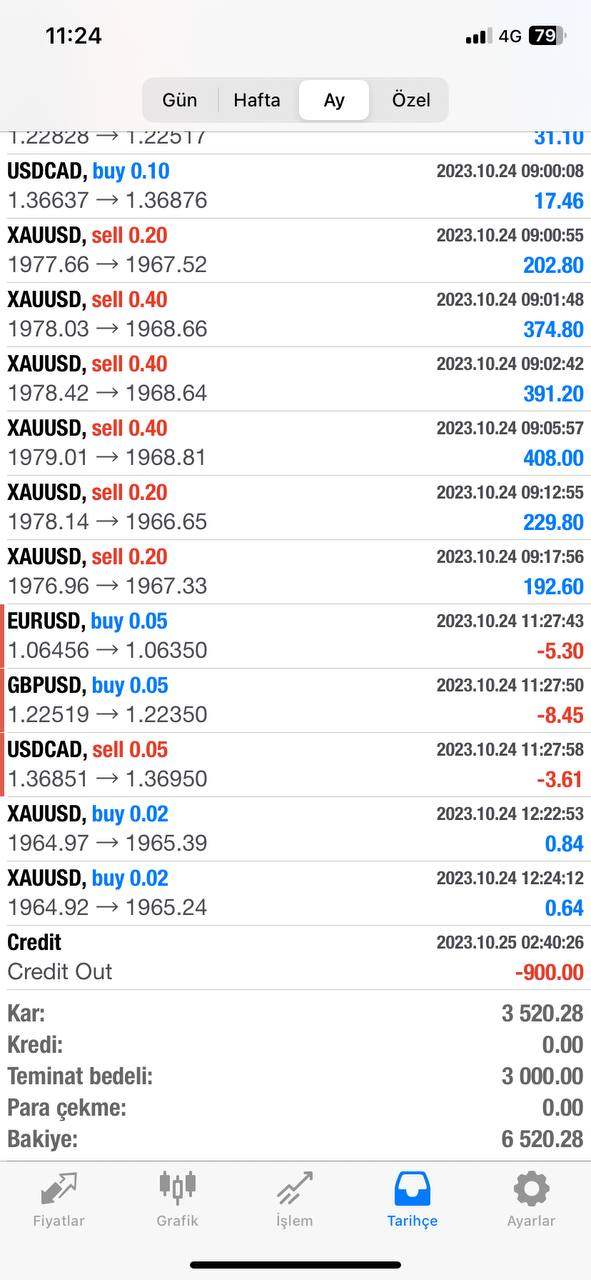

Seyhmus POLAT

Turkey

No one should trust this company and deposit money. Don't let the company's ratings mislead you. Definitely a scammer and not sending money.

Exposure

2023-11-07

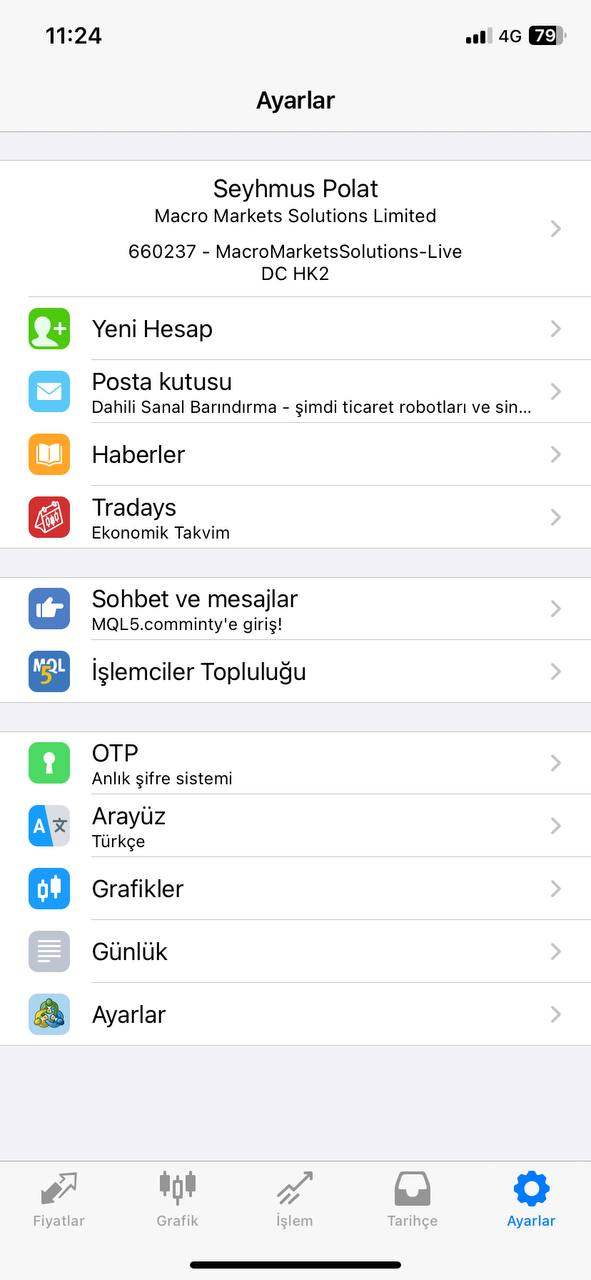

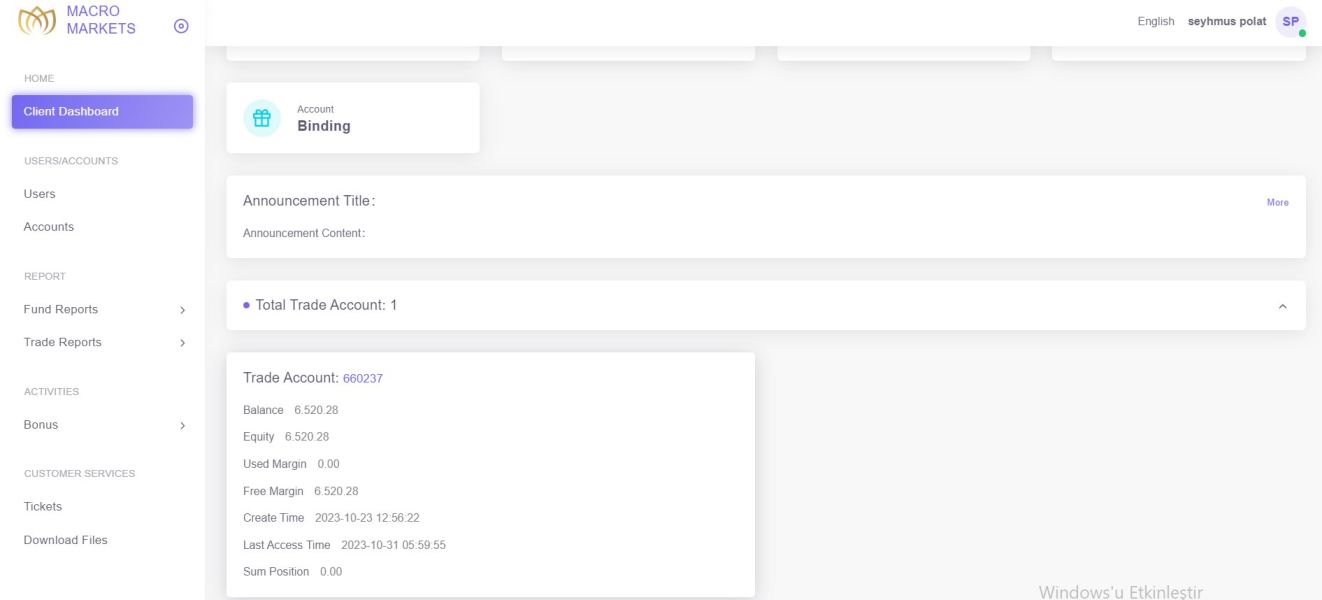

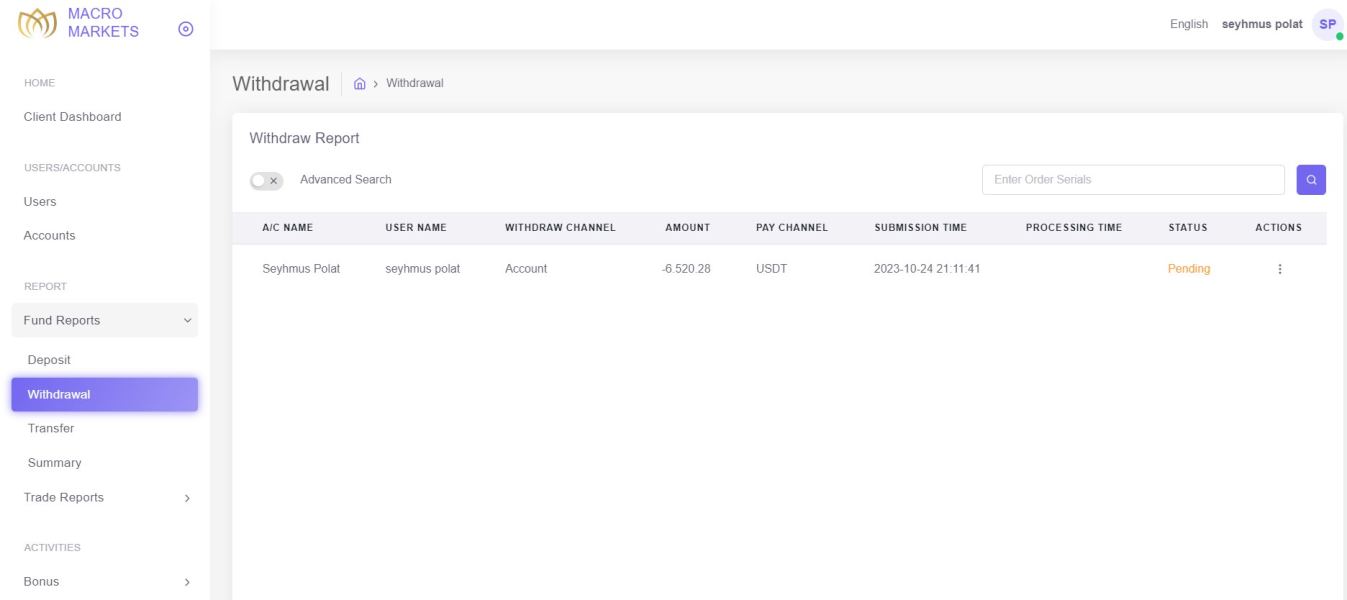

Seyhmus POLAT

Turkey

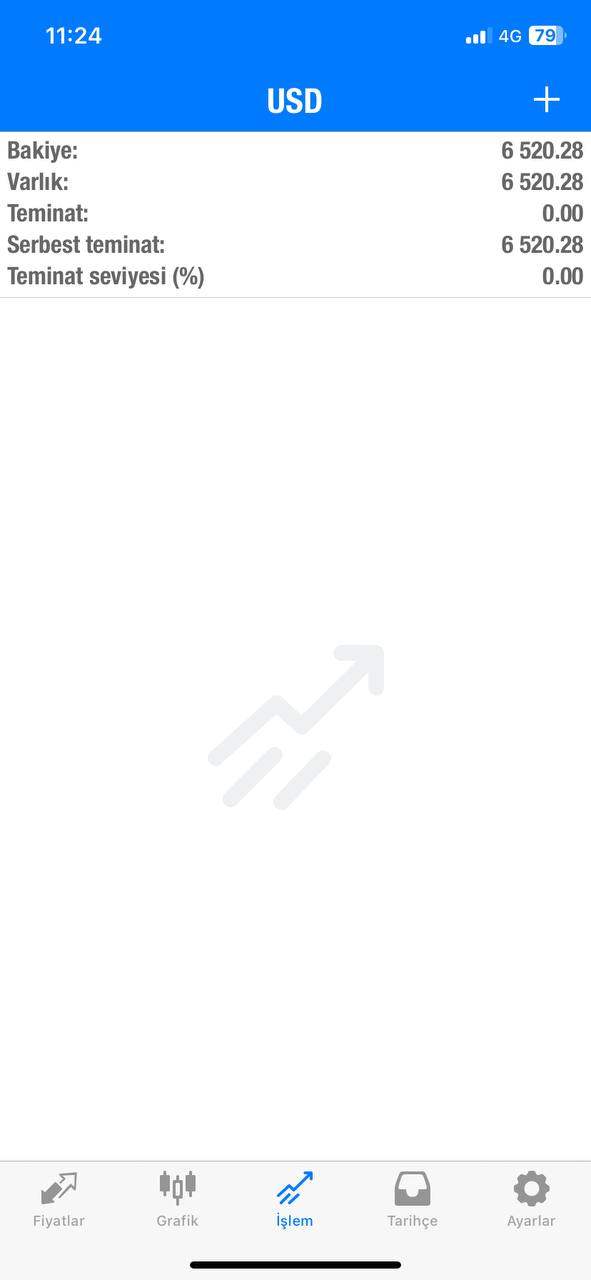

İ made deposit to Macro Markets 23-10-2023. After my deposit,they were providing bonus promotion to the deposits,so i got deposit 3000$,they got me credited 900$ on 24-10-2023. İ traded on my account,after my transactions are done from my side. İ wanted to make a withdrawal to test,how they are fast and reliable. My balance reached 6520$. İ made a request from client panelt o withdrawa the amount. So i waited 24 hours in a patiente way,because they told formal procedure is 24 hours for withdrawals. After that,they told me suddenly,your account is under investigation from risk department of Macro Markets. After this messafe they are not paying my money. 8 days are already done from my request. Still i can not withdraw,my money.

Exposure

2023-10-31

Pongin

Italy

MACRO MARKETS offers a robust selection of market instruments with a strong regulatory framework, making it a reliable choice for traders looking for a secure and diverse trading platform.

Positive

2024-07-30

Mark Carter

New Zealand

Trading costs are transparent, but the overnight interest rates seem a bit high. The regulatory status is solid, offering peace of mind about fund safety. Well, it's a decent choice for cautious traders, like me.

Positive

2024-06-28

46etth

Philippines

I enjoyed using the MT4 and Pro Trader platforms and appreciated the variety of trading instruments. The hassle-free account opening and smooth deposit and withdrawal process were positives.

Positive

2024-05-15