简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Use Tweezers Candlestick Pattern in Trading?

Abstract:Candlestick charts are a type of price chart used by traders for technical analysis. They display the highest, lowest, opening, and closing prices of an asset during a time period. Steve Nison, a renowned figure of technical analysis, is credited with introducing candlestick charting techniques to the Western world. In his book Japanese Candlestick Charting Techniques, he explained the Tweezers Bottom and Tweezers Top patterns. The tweezer candle chart is a technical analysis graph that appears at moments of trend reversals. This pattern consists of two or more similar candle lines, usually located near support or resistance levels, signaling a possible reversal in the market.

Who Invented the Tweezers Candlestick Pattern?

Candlestick charts are a type of price chart used by traders for technical analysis. They display the highest, lowest, opening, and closing prices of an asset during a time period.

Steve Nison, a renowned figure of technical analysis, is credited with introducing candlestick charting techniques to the Western world. In his book Japanese Candlestick Charting Techniques, he explained the Tweezers Bottom and Tweezers Top patterns.

The tweezer candle chart is a technical analysis graph that appears at moments of trend reversals. This pattern consists of two or more similar candle lines, usually located near support or resistance levels, signaling a possible reversal in the market.

Tweezers Candlestick Pattern

Tweezers are mainly divided into top tweezers and bottom tweezers.

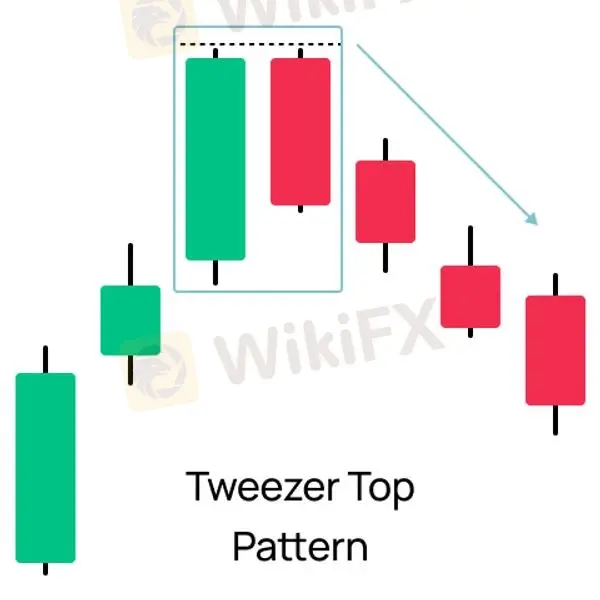

Tweezers Top

Typically appears at the end of an uptrend.

Characteristics are that two or more candlesticks with the same or very similar open and close prices, and their highs are almost identical, forming a “top” shape.

The Tweezers Top is generally seen as a bearish signal, indicating that the market may be about to reverse, and a downtrend could begin.

Tweezers Bottom

Typically appears at the bottom of a downtrend.

Characteristics are that two or more candlesticks with the same or very similar open and close prices, and their lows are almost identical, forming a “bottom” shape.

The Tweezers Bottom is generally seen as a bullish signal, indicating that the market may experience a reversal, and the price could start rising.

Tweezers Candlestick Trading Strategy

Confirming Reversal Signals

The tweezers candlestick pattern typically appears at key points of trend extremes, such as near historical highs, lows, or significant support/resistance levels.

Two or more candlesticks with the same highs or lows indicate a shift in the balance of buying and selling forces. For example, if the price is near a high and forms a tweezers top, it may signal that the upward momentum is fading. Conversely, if the pattern forms near a low, it could suggest that the downward momentum is running out.

Entry Strategy

- Bearish Signal (Sell): When a tweezers pattern forms after an uptrend, and the next candlestick closes below the previous low, consider selling (going short). This usually indicates that the market is about to reverse, and a downtrend may begin.

- Bullish Signal (Buy): Consider buying (going long) when the next candlestick closes above the previous high after forming a tweezer pattern following the downtrend. This usually indicates that the market is about to reverse and an uptrend may begin.

Stop Loss and Target Setting

- Stop Loss: Set the stop loss just below the lowest point (for buying) or above the highest point (for selling) of the tweezers pattern to avoid premature stop-outs due to market fluctuations.

- Target: Set the target price at previous support or resistance levels, or use market volatility to forecast the target price. You can use a multiple of the volatility range, such as 1.5 to 2 times the range, to determine your target.

Combining with Other Technical Indicators

You should combine the tweezers candlestick pattern with other indicators to improve the accuracy of trading signals.

- Moving Averages: Confirm the direction of the trend to ensure that your trade aligns with the market trend.

- Relative Strength Index (RSI): Helps confirm whether the market is overbought or oversold, providing better insight into the likelihood of a reversal.

- Support and Resistance Levels: Combine the tweezers candlestick pattern with support and resistance levels for a more accurate determination of whether the pattern is a valid reversal signal.

Risk Management

- Stop Loss Control: Set stop-loss orders strictly to prevent excessive losses due to unexpected market fluctuations. The stop-loss point should be placed at key levels within the pattern.

- Position Sizing: Manage your position size based on market volatility and your personal risk tolerance, avoiding large single investments that may expose you to significant risk.

Confirm the Tweezers Bottom Forex Pattern with MACD Indicator

Assumed a situation that the market is experiencing a downtrend, with prices gradually declining. At a key support level, two consecutive candlesticks form with nearly identical low points. This is a potential reversal signal, indicating that prices may start to rise.

Using MACD to Confirm Reversal

- MACD Crossover: When the Tweezers Bottom pattern appears at the bottom of a downtrend, observe if a bullish crossover occurs on the MACD indicator. For example:

- The MACD line (typically the difference between the 12-day EMA and the 26-day EMA) crosses above the signal line (9-day EMA), forming a bullish crossover. This suggests that the selling momentum in the market may have exhausted, and buying momentum is beginning to increase.

- The height of the MACD histogram may start to increase, indicating that the downward pressure in the market is weakening, and the likelihood of a reversal is rising.

- MACD Zero Line Break: Another confirmation signal occurs when the MACD line crosses above the zero line (from negative to positive), which indicates that the market trend may start shifting upwards. When combined with the Tweezers Bottom pattern, this signal strengthens the buying confidence.

Trading Strategy

After the tweezers bottom pattern has formed and the MACD shows a bullish cross above the zero line, you can consider entering a long position. Set the stop loss below the lowest point of the pattern and set a target based on the previous resistance level or MACD price target.

For example, if EUR/USD forms a tweezers bottom at 1.1000 and MACD confirms the uptrend through a bullish cross and uptrend bar, then enter above 1.1000 with a stop loss at 1.0950. By combining MACD with tweezer bottom mode, you will get stronger confirmation, improving the accuracy of your trades and the likelihood of success.

The Bottom Line

These patterns are, to some extent, indicative of trading signals. However, no pattern is perfect, and the tweezer pattern does not always result in a reversal. Investors used candlesticks to confirm the subsequent short-term reversal signal. Before trading with cash, we should practice recognizing and trading tweezer patterns.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator