Overview of One Ozo

One Ozo is a brokerage based in the United Kingdom and operates without regulation, offering trading services through desktop, mobile, and web platforms. With a minimum deposit requirement of $100, traders can access a variety of assets including forex, CFDs, indices, stocks, and cryptocurrencies across different account types such as Ozo Start, Ozo Gold, Ozo Prime, and Ozo Power. However, the absence of a demo account and limited transparency regarding fees for payment methods may pose challenges for traders.

Is One Ozo legit or a scam?

Since Ozo broker is unregulated, there isn't a specific regulatory framework governing its operations.

Pros and Cons

Market Intruments

Ozo broker still offer trading instruments such as stocks, forex, commodities, and cryptocurrencies to its clients. These instruments allow investors to speculate on the price movements of various assets.

In terms of stocks, Ozo broker offers trading in a variety of equities from different global markets, allowing investors to buy and sell shares in publicly traded companies.

For forex trading, Ozo broker may provide access to the foreign exchange market, enabling investors to trade currency pairs and speculate on the exchange rate fluctuations between different currencies.

Commodities trading through Ozo broker could involve trading in assets such as gold, silver, oil, agricultural products, and other raw materials. Investors can take positions on the price movements of these commodities in the global markets.

Additionally, Ozo brokers offer trading in cryptocurrencies, allowing investors to buy and sell digital assets like Bitcoin, Ethereum, and others.

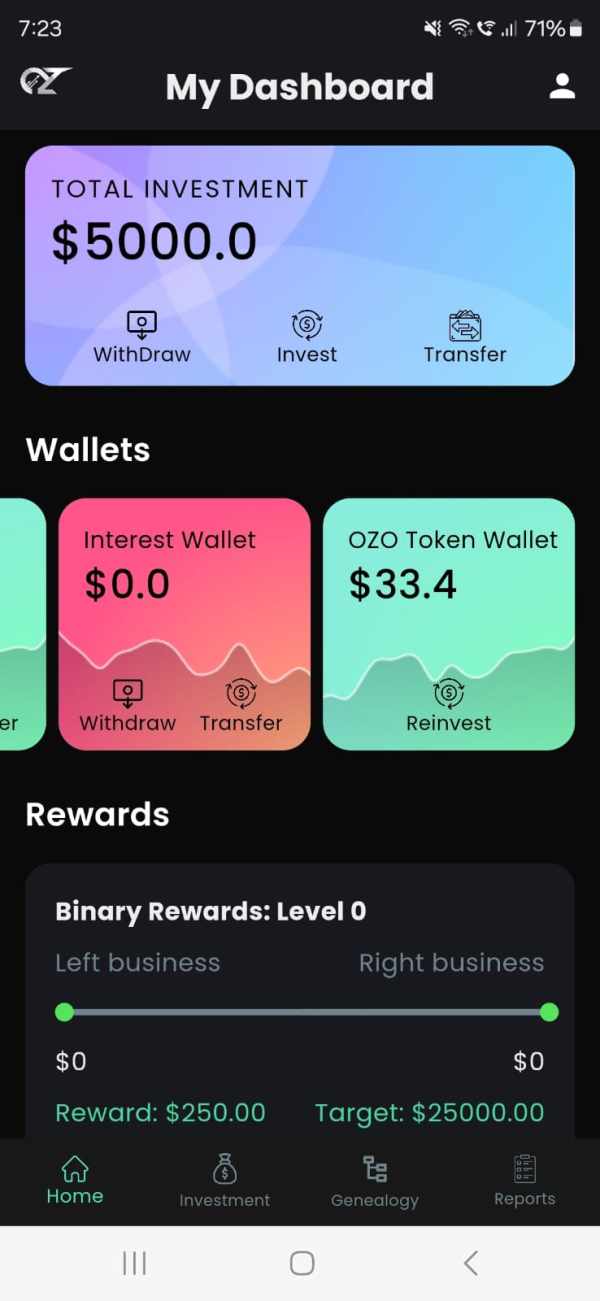

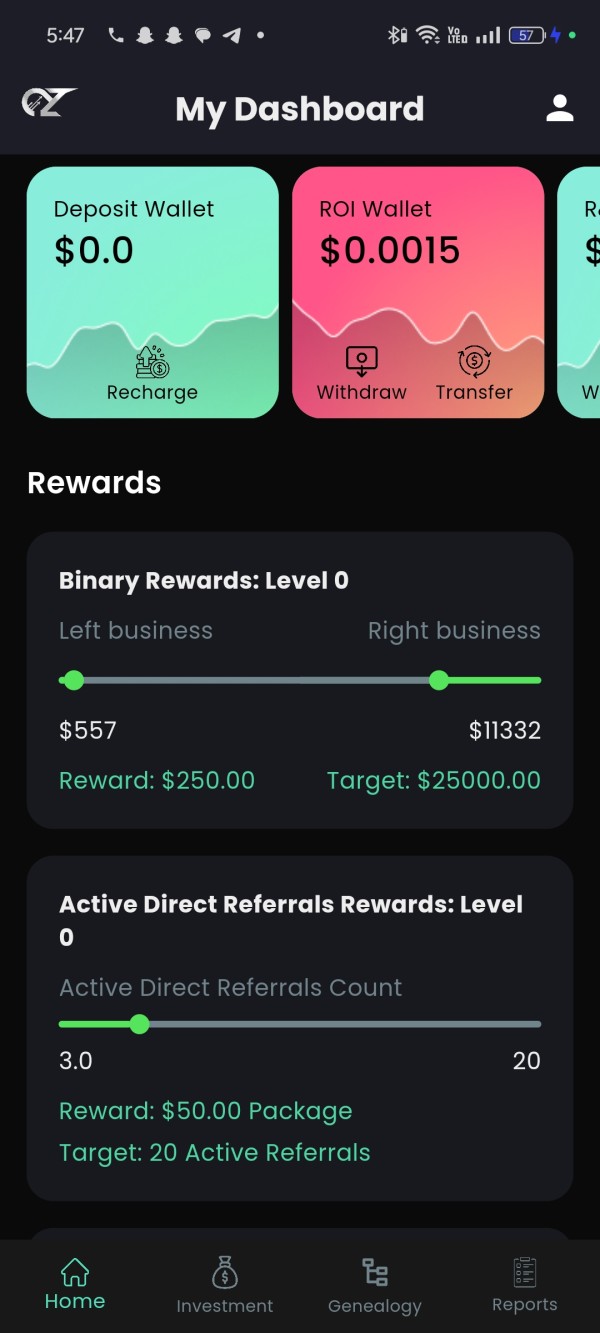

Account Types

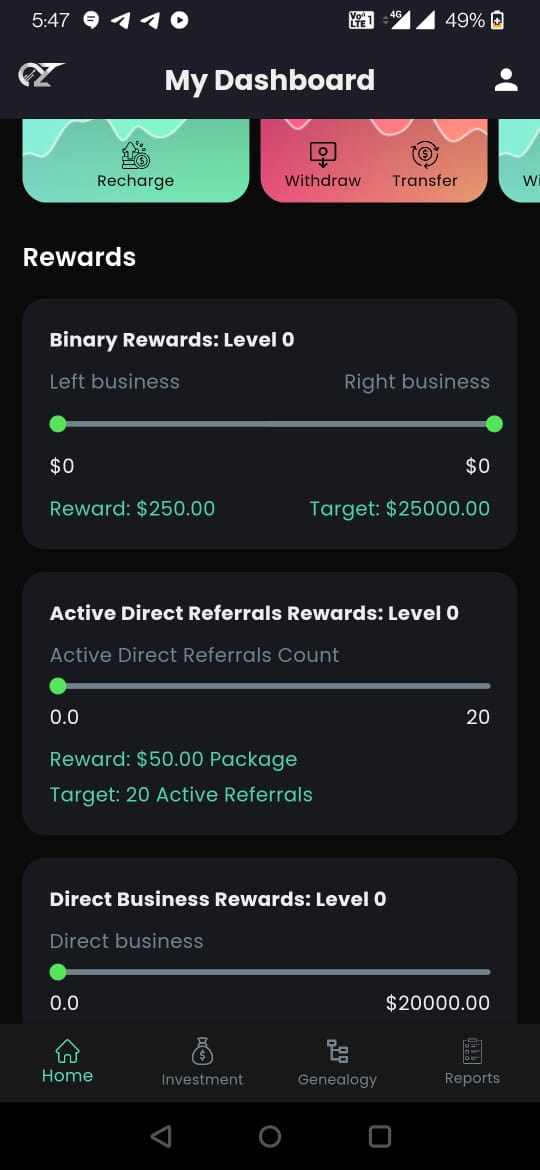

These accounts offer varying levels of returns, durations, and bonuses, allowing investors to choose the option that aligns with their investment preferences and risk tolerance. Additionally, the referral bonus provides an incentive for investors to introduce others to the platform.

How to open an account?

Based on the available information, the specific steps for opening an One Ozo account are not explicitly provided. However, here's a general outline of the likely process:

- Visit the One Ozo Website:Navigate to the One Ozo website (https://www.onezo.us/).

- Locate the Registration Page:Look for the “Sign Up” or “Register” button or link. It might be located in the top right corner or on a dedicated registration page.

- Complete the Registration Form:Provide accurate and complete personal information, including your name, email address, phone number, and country of residence. Set a strong password and confirm it. Then agree to the Terms of Use and Privacy Policy.

- Verify Your Email Address:A verification link will be sent to your registered email address. Click on the link to confirm your email address and complete the registration process.

- Fund Your Account:Select the desired investment tier (Ozo Start, Ozo Gold, Ozo Prime, or Ozo Power). Choose a payment method (e.g., credit card, bank transfer, cryptocurrency). Deposit the minimum required amount for your chosen tier.

- Complete the Investment Agreement:Review and agree to the investment agreement, which outlines the terms and conditions specific to your chosen tier.

- Start Investing:Once your account is funded and the agreement is accepted, you can start investing and earning returns according to your chosen tier.

Trading Fees

One Ozo might offer trading options alongside their fixed-term investment packages. In this respect, spreads and commissions would apply.

Non-Trading Fees

Account Management Fee: Ozo Broker charges a monthly account management fee of $5.

Deposit/Withdrawal Fees: Ozo Broker charges a fee of 2.5% for deposits made via credit card and debit card, and a fee of $10 for deposits made via wire transfer. For withdrawals made via credit card and debit card, a fee of 3% is charged, while a fee of $25 is charged for withdrawals via wire transfer.

Inactive Account Fee: If your account remains inactive for 6 consecutive months, Ozo Broker will charge a monthly inactive account fee of $10.

Conversion Fee: Ozo Broker charges a fee of 0.5% for currency conversion.

Margin Interest: Ozo Broker charges an annual interest of 5% for margin trading.

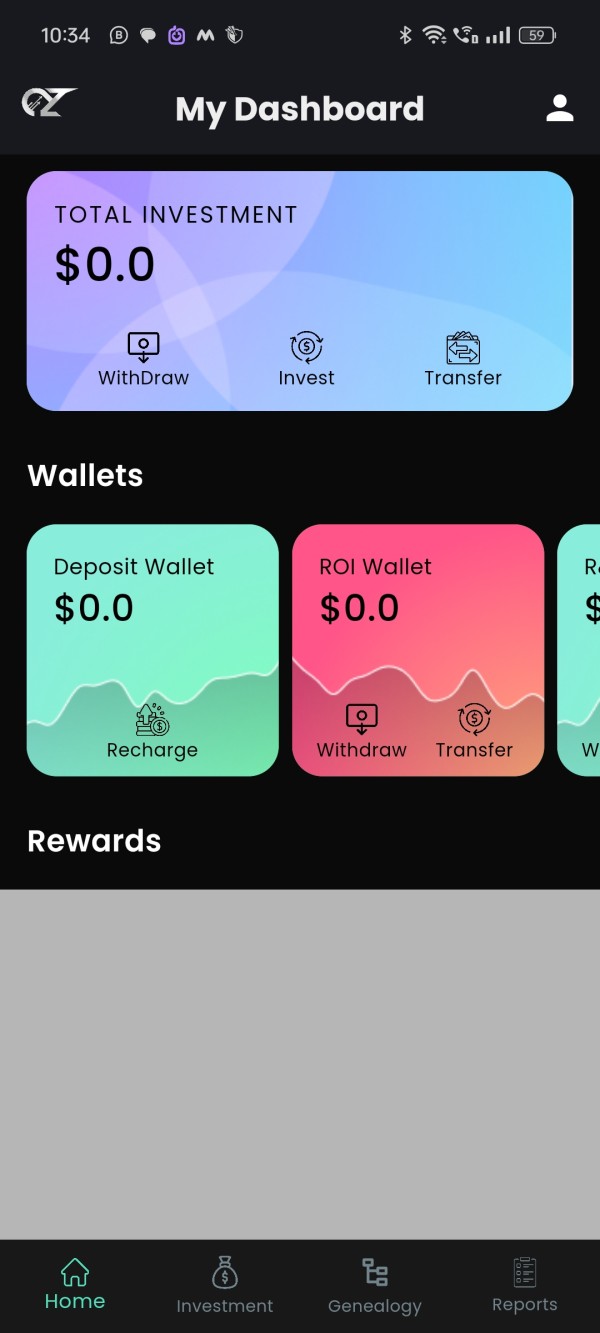

Trading Platform

Ozo Broker is an online trading platform that allows traders to trade forex, CFDs, indices, stocks, and cryptocurrencies. The platform is available for desktop, mobile, and web browsers. The platform offers several advantages, including a wide variety of trading instruments, comprehensive analysis tools, real-time data and news, and 24/7 customer support. However, it also has some drawbacks, such as being limited to online trading, lacking a demo account, requiring a minimum deposit of $100, and charging trading and additional fees.

Deposit & Withdrawal

Deposits:

Minimum deposit: $25

Deposit methods: Ozo Broker might offer various deposit methods, but information readily available online is limited. Here are some common methods generally offered by brokers:

- Credit/debit card: Deposits are usually instant but might come with fees (be sure to check Ozo's fee schedule).

- Bank transfer: This can take 1-3 business days to reflect in your account.

Withdrawals:

Withdrawal processing time: Generally, withdrawals can take 3-7 business days depending on the chosen method.

Withdrawal methods: Similar to deposits, withdrawal methods might vary. Here's a breakdown of common methods and their potential drawbacks:

- Credit/debit card: Withdrawals might take longer than deposits due to additional verification steps. Fees might also apply.

- Bank transfer: This is a secure method but can be slow.

Customer Support

Ozo Broker offers comprehensive customer support to assist its clients with any inquiries or issues they may encounter. Here are some common channels through which customers can reach Ozo Broker's support team:

- Phone Support: Customers can contact Ozo Broker's support team via phone:+44 7452118915 for immediate assistance. The phone number is typically provided on the broker's website or through account documentation.

- Email Support: Clients can also reach out to Ozo Broker's support team via email:Info@oneozo.com. This allows for non-urgent inquiries or issues to be addressed in a timely manner. The email address for support is usually listed on the broker's website.

- Live Chat: They offer a live chat feature on their website :https://api.whatsapp.com/send?phone=447452118915, allowing customers to chat with a support representative in real-time. This can be convenient for quick questions or technical assistance.

- FAQs and Knowledge Base: Ozo Broker may have a comprehensive FAQ section or knowledge base on its website, providing answers to commonly asked questions and troubleshooting guides for common issues.

- Social Media: Ozo Broker maintain active social media profiles where customers can reach out for support or updates. This can include platforms like Twitter, Facebook, or LinkedIn.

Educational Resources

Ozo Broker offers various educational resources to help traders improve their skills, including:

- Trading Guides and Articles: Covering topics like fundamental and technical analysis, risk management, and strategies.

- Webinars and Seminars: Live sessions with experts, ranging from beginner to advanced topics.

- Video Tutorials: Step-by-step guides on using the platform and analyzing markets.

- Educational Courses: Structured courses on forex, stocks, and options trading.

- Market Analysis and Research: Regular reports offering insights into market trends and trading opportunities.

Conclusion

Ozo Broker presents a situation with some potential benefits but overshadowed by significant drawbacks. On the positive side, Ozo offers a vast selection of instruments for trading, from forex to cryptocurrencies. They also boast 24/7 customer support and a user-friendly platform accessible on various devices.

However, these advantages become less appealing when considering the critical issue of regulation. Ozo Broker lacks oversight from major financial authorities, which exposes you to greater risk. This means your funds might not be protected in case of unforeseen circumstances. Furthermore, readily available information regarding Ozo Broker is limited. Details on deposit/withdrawal methods, fees, and the effectiveness of customer support are unclear. This lack of transparency makes it difficult to assess the true cost and reliability of using their platform.

In conclusion, while Ozo Broker might seem like a convenient option with a wide range of instruments, the lack of regulation and limited information online raise significant red flags.