简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Best Moving Averages for Swing Trading

Abstract:Swing Trading is a short- to medium-term strategy for profiting from market price fluctuations, distinct from long-term investment or intraday trading, with the core principle of “buy low and sell high” and involving multiple market entries and exits during price trends to accumulate profits.

Swing trading has gained popularity in the financial world. It allows traders to take advantage of price swings instead of waiting for significant gains over months. Unlike intraday trading, which involves rapid price movements, or long-term investing, which requires patience, swing trading calls for two essential skills: the ability to make quick decisions and a talent for identifying market trends.

It is very important for volatility traders to master the technical indicators. Among these tools, the moving average (MA) is a key part. This article will examine the most efficient moving averages in swing trading, covering their basic definition, calculation methods, and practical applications in trading.

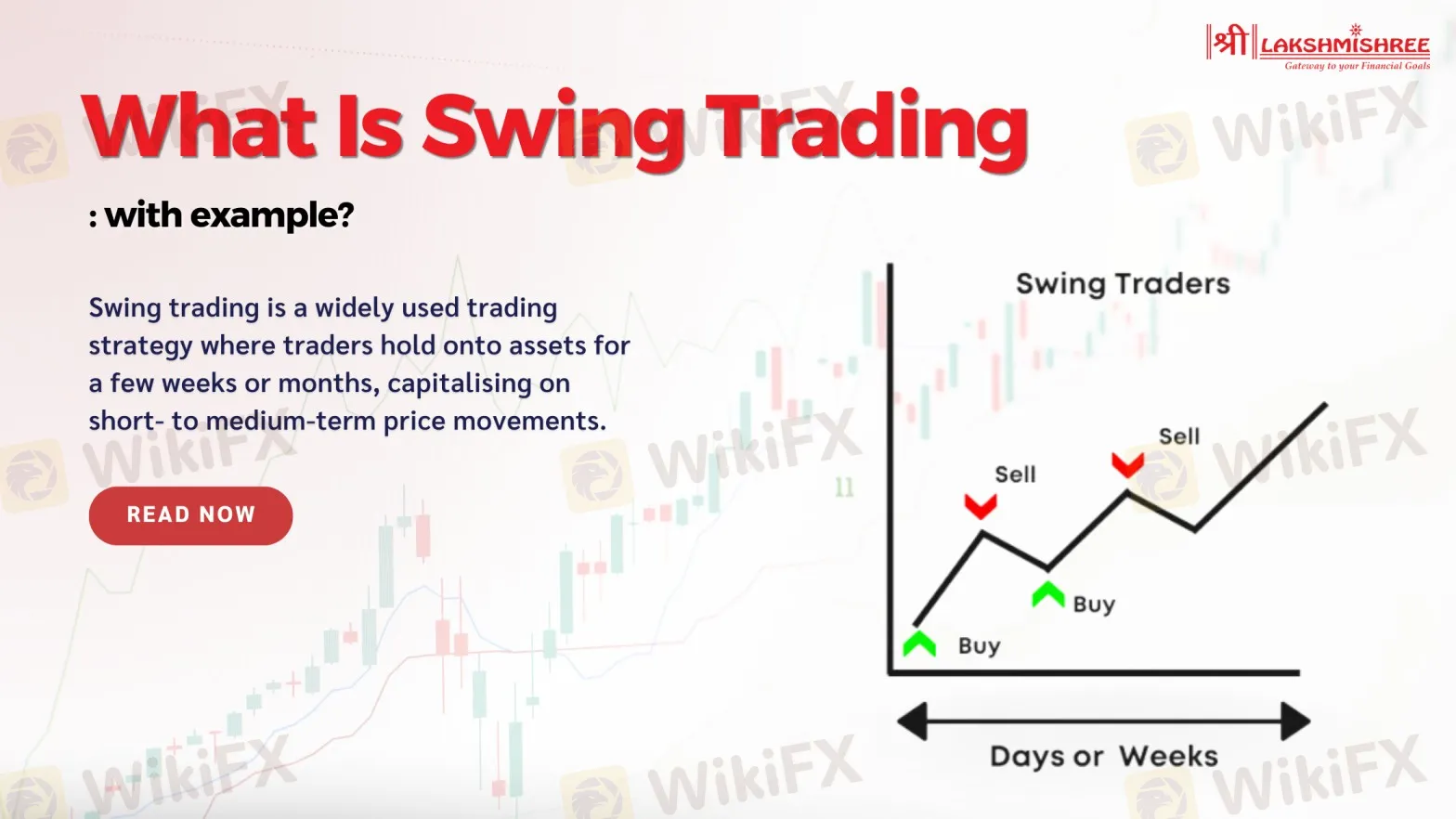

What is Swing Trading?

Swing trading is a short - to medium-term strategy that takes advantage of market price movements. Unlike long-term investing or day trading, it operates on the principle of “buy low, sell high,” entering and exiting several times during price trends, resulting in long-term profits.

Here are its key features:

Holding Period: Trades last several days to weeks. For example, buying a stock at $100 and selling at $110 within a week.

Technically Driven: It uses chart patterns, indicators like RSI and MACD, and volume-price analysis to spot trend changes. For instance, buying when RSI is below 30 and selling when its above 70.

Clear Objectives: Traders set profit targets and stop-loss points to aim for steady gains. A common rule is “2% stop-loss, 5% take-profit.”

The Moving Average (MA) is a widely used tool that smooths price data to show market trends. It helps traders focus on longer-term movements by filtering out short-term noise.

Types of Moving averages

Moving averages help with swing trading by using the 20-day and 50-day moving averages. The 20-day moving average provides short-term insights, while the 50-day moving average offers a balance of the trend. Try to find the moving average that matches your trading goals.

Below are the most common types of moving averages, along with their definitions, examples, and features.

Simple Moving Average (SMA)

The Simple Moving Average (SMA) is the most common type of moving average. It is calculated by taking the arithmetic mean of a given set of prices over a specific time period. For example, a 10-day SMA is the sum of the closing prices of the last 10 days, divided by 10.

Example:

Suppose the closing prices for the last 5 days are: 1.2, 1.3, 1.4, 1.5, and 1.6. The 5-day SMA is calculated as:

(1.2 + 1.3 + 1.4 + 1.5 + 1.6) / 5 = 1.4.

Pros:

- Simple and easy to understand.

- Helps identify long-term trends by smoothing short-term fluctuations.

Cons:

- Slow to react to market changes, especially in volatile markets, which can result in missed opportunities.

- Longer period SMAs can be too delayed to capture fast market changes.

Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) is similar to the SMA but gives more weight to the most recent prices, making it more sensitive to recent price changes. It reacts more quickly to price movements compared to the SMA.

Example:

To calculate the 5-day EMA, you would use the previous day's EMA and the current closing price, giving more weight to the latest price. This makes it more responsive than the SMA.

Pros:

- Reacts more quickly to recent price changes, making it suitable for capturing rapid trends.

- More responsive to the market, especially for short-term traders.

Cons:

- Can overreact to short-term market noise, leading to false signals.

- More complex to calculate than the SMA.

Weighted Moving Average (WMA)

The Weighted Moving Average (WMA) is similar to the EMA but assigns linearly increasing weights to each price point in the time period. The most recent data points have the highest weight, and earlier data points are weighted less.

Example:

For a 5-day WMA, the weights could range from 1 to 5, with 1 being the weight for the earliest data and 5 for the most recent. Using the closing prices 1.2, 1.3, 1.4, 1.5, and 1.6, the 5-day WMA is calculated as:

(1.2×1 + 1.3×2 + 1.4×3 + 1.5×4 + 1.6×5) / (1 + 2 + 3 + 4 + 5) = 1.47.

Pros:

- More responsive to recent price movements than the SMA.

- Smooths out market noise, making it less susceptible to sudden price spikes.

Cons:

- More complicated to calculate than SMA and EMA.

- Still has some lag, especially in rapidly changing markets.

Smoothed Moving Average (SMMA)

The Smoothed Moving Average (SMMA) is a type of moving average that smooths the data over a longer period. It gives more weight to the entire dataset rather than just the most recent prices, providing a smoother trendline.

Example:

The SMMA is calculated by smoothing out the SMA over a longer period, which helps reduce the effect of short-term price fluctuations.

Pros:

- Helps filter out short-term noise, making it better for long-term trend tracking.

- Provides a more stable and reliable trend line.

Cons:

- Slow to react to quick changes in the market.

- Can miss early signs of reversals or trend changes.

| Type | Pros | Cons | Best for |

| SMA | Simple, easy to understand, good for long-term trends | Slow to react, lagging in volatile markets | Long-term trend analysis, stable markets |

| EMA | Quick response to market changes, good for short-term trends | Can overreact to market noise, false signals | Short-term trading, fast market changes |

| WMA | More responsive than SMA, reduces noise | Complex to calculate, still lags | Balanced approach, recent price analysis |

| SMMA | Filters short-term fluctuations, good for long-term trends | Slow to react to market changes | Long-term trend tracking, conservative traders |

Which Moving Averages Should Be Used for Swing Trading?

The choice of moving averages depends on your trading style, the timeframe you are analyzing, and the assets being traded. Here are some commonly used moving averages in swing trading:

Short-Term Moving Averages (with a period of 50 or less)

• 50-Day Simple Moving Average (SMA) or Exponential Moving Average (EMA)

◦ The 50-period moving average is one of the most popular indicators in swing trading. It helps identify short-term trends and can serve as dynamic support or resistance.

◦ Compared with SMA, EMA is often preferred because it reacts more quickly to price changes, which is useful for capturing swing trading opportunities.

• 20-Day SMA/EMA

◦ Shorter moving averages like the 20-period ones can be used to identify very short-term trends and entry points for swing trades.

Medium-Term Moving Averages (with a period of 50 - 200)

• 100-Day SMA/EMA

◦ The 100-period moving average is another commonly used indicator in swing trading. It helps filter out market noise and presents a clearer picture of medium-term trends.

• 200-Day SMA/EMA

◦ Although the 200-period moving average is often used to identify long-term trends, it can also be helpful in swing trading to determine the overall market bias (bullish or bearish).

Combining Multiple Moving Averages

Using multiple moving averages simultaneously can provide better insights into market conditions:

• 50-Day and 200-Day Moving Averages (Golden Cross/Death Cross)

◦ When the 50-day moving average crosses above the 200-day moving average, it is a bullish signal; conversely, when it crosses below, it is a bearish signal. Although this is more commonly used in trend-following trading, it can also help swing traders identify strong trends.

• 20-Day and 50-Day Moving Averages

◦ Traders often look for crossovers between these two moving averages to confirm trends or potential reversals.

Weighted Moving Average (WMA) or Hull Moving Average (HMA)

• Weighted Moving Average (WMA)

◦ The weighted moving average assigns more weight to recent prices, making it more responsive to price changes compared to the simple moving average.

• Hull Moving Average (HMA)

◦ The Hull Moving Average is designed to reduce lag while maintaining smoothness, making it a good choice for swing traders who want to react quickly to price movements.

Combining Bollinger Bands with Moving Averages

Bollinger Bands incorporate a moving average (usually the 20-period SMA) and standard deviations to measure volatility. Swing traders use Bollinger Bands to identify overbought or oversold conditions and potential reversal points.

Considerations for Using Moving Averages in Swing Trading

Timeframe: Choose moving averages that match your swing trading timeframe (e.g., 15-minute, 1-hour, daily charts, etc.).

Asset Type: Different assets (stocks, forex, cryptocurrencies, etc.) may respond better to certain types of moving averages.

Lag and Sensitivity: Shorter moving averages (such as EMA) are more sensitive to price changes but are prone to false signals; longer moving averages are smoother but react more slowly.

Confirmation: Use moving averages in conjunction with other indicators (such as RSI, MACD, volume, etc.) to confirm signals.

Day Trading vs. Swing Trading

The key difference between day trading and swing trading is the time frame and how often trades are made. Day traders finish all their trades in one day, aiming to profit from short-term price changes. This means they trade often and face higher risks.

Swing traders, however, hold their positions for days or weeks. They focus on medium-term trends, trade less frequently, and have longer holding periods. This allows them to manage risk more calmly. Day trading works best for traders who can act fast, while swing trading suits those who can wait patiently for trends to unfold.

Risk Management Methods for Swing Trading

Although swing trading has its advantages, the market is uncertain. Risk management is crucial for long-term and stable profitability.

Setting Stop Loss and Take Profit

Fixed Amount Stop Loss:

Set the stop loss amount as a certain percentage (such as 2% - 5%) of the account funds. For example, if the account has 100,000 yuan and the stop loss ratio is 3%, close the position when the loss reaches 3,000 yuan.

Technical Support Level Stop Loss:

Analyze the price chart to determine the support level. If the price breaks below it, execute a stop loss. For instance, consider a stop loss when the stock price falls below the support level of an important previous low point.

Trailing Stop Loss:

Dynamically adjust the stop loss position as the price moves favorably. Move it up (for long positions) when the price rises and down (for short positions) when the price falls to lock in profits and control risks.

Target Price Take Profit:

Set an expected profit target price before trading and close the position decisively when it is reached. For example, if it is expected that a stock will encounter resistance at 20 yuan, take profit when the price touches this level.

Trailing Take Profit:

Gradually raise the take profit position as the price moves favorably forward. However, set a maximum profit target to avoid being too greedy and missing opportunities.

Controlling Position Size

Fixed Position Method: Use a fixed proportion of funds for each trade. For example, always trade with 10% of the account funds to prevent overtrading.

Adjusting Position Size According to Market Volatility: Judge volatility through indicators (such as ATR). Reduce the position size when volatility is high and increase it when the market is stable.

Diversifying Investments

Trading Different Varieties: Select multiple varieties with low correlation for diversified investment. For example, choose stocks from different industries and with different market capitalizations, or involve multiple markets.

Building and Closing Positions in Batches: Do not buy or sell all at once.When you're buying, start by purchasing only half of the amount you initially intended. If the price continues to fall after that, keep buying the remaining half. The same goes for closing positions. First, sell a portion of your holdings to make some profit, and then make further decisions based on the performance of the market.

Risk Assessment and Strategy Adjustment

Make it a habit to review your transactions regularly. Analyze past trades to understand trading strategies that need to be improved. For instance, during a recession, it's wise to reduce your positions and make your stop losses more stringent.

Avoiding Emotional Trading

Come up with a trading plan and follow it religiously. Keep your emotions in check and stay calm and rational. After making a profit, don't get overconfident and increase your position size recklessly. Also, avoid the temptation to trade frequently just to recover losses.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Are Financial Firms Adopting Stablecoins to Enhance Services and Stability?

Experienced Forex Traders Usually Do This Before Making a Lot of Money

Octa vs XM:Face-Off: A Detailed Comparison

When High Returns Go Wrong: How a Finance Manager Lost RM364,000

Bridging Trust, Exploring Best—WikiEXPO Hong Kong 2025 Wraps Up Spectacularly

Fidelity Investments Explores Stablecoin Innovation in Digital Assets Sector

Interactive Brokers Expands Crypto Trading with Solana, XRP, Cardano, and Dogecoin

SEC Ends Crypto.com Probe, No Action Taken by Regulator

Why More People Are Trading Online Today?

Gold Surges to New Highs – Is It Time to Buy?

Currency Calculator