Score

MTF

Hong Kong|2-5 years|

Hong Kong|2-5 years| https://mingtakfn.com/en

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

MingTakInternational-Server

Influence

C

Influence index NO.1

Hong Kong 5.39

Hong Kong 5.39MT4/5 Identification

MT4/5 Identification

Full License

Singapore

SingaporeInfluence

Influence

C

Influence index NO.1

Hong Kong 5.39

Hong Kong 5.39Contact

Licenses

Licenses

Licensed Entity:明德國際盈富有限公司

License No. 194

Basic Information

Hong Kong

Hong Kong

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed MTF also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM)

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

mingtakfn.com

Server Location

United States

Website Domain Name

mingtakfn.com

Server IP

172.67.199.209

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Registered Country/Area | Hong Kong |

| Founded Year | 2-5 years |

| Company Name | 明德金融 (MTF) |

| Regulation | CGSE |

| Minimum Deposit | No minimum deposit required |

| Maximum Leverage | Not specified |

| Spreads | Fixed spread starting from 0.15 pips |

| Trading Platforms | MT4, MT5 |

| Tradable Assets | Precious metals (Spot Gold, Silver), US Crude (Spot): |

| Account Types | Not specified |

| Demo Account | Not specified |

| Customer Support | Telephone: +852 54454098, Email: support@mingtakfn.com |

| Payment Methods | Not specified |

| Educational Tools | Daily reports, economic calendar, investment class, financial encyclopedia, seminars, online teaching, investment strategy sharing, lecturer interviews |

Overview of MTF

MTF (明德金融) is a forex broker operating in Hong Kong offering market instruments such as precious metals like Spot Gold (XAUUSD) and Silver (XAGUSD), as well as US Crude (spot) oil options. However, it's important to note the absence of regulation and the associated risks when considering MTF as a trading platform.

MTF provides the MT5 and MT4 trading platforms, which are advanced online platforms offering various features for trading in different financial markets. They are available on different devices and operating systems. Additionally, MTF offers trading tools such as daily market reports, economic calendars, and investment analysis resources to assist traders in making informed decisions.

MTF offers several promotions, including account opening rewards, trading rebates, referral rewards, and switch account rewards. These promotions provide potential incentives for customers, but it's crucial to carefully evaluate the risks associated with trading on an unregulated platform.

Pros and Cons

MTF (明德金融) is a forex broker that offers market instruments such as precious metals and US Crude. It has some positives and negatives below:

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Is MTF Legit?

MTF (明德金融) is a forex broker that is regulated by the Chinese Gold & Silver Exchange Society (CGSE) under regulatory license 194, which may give traders some confidence when trading with this broker.

Market Instruments

The MTF offers market instruments, including precious metals and US Crude (spot):

Precious Metals:

The MTF offers precious metal trading instruments, including Spot Gold (XAUUSD) and Silver (XAGUSD). These instruments have gained popularity among customers. Spot Gold trading features a fixed low spread, making it a preferred choice for traders. It also boasts a lower entry cost compared to traditional brokerage houses. Additionally, the MTF eliminates the need for authorization, slippage, and handling fees, providing a straightforward trading experience for investors. The minimum lot size for a single position is 0.01 lot, with an initial margin requirement of US$1,000.

US Crude (Spot):

The MTF addresses the scarcity of trading services for the spot oil market by offering fixed-spread trading options for New York (spot) oil and UK Brent (spot) oil. These services have gained popularity in the market. The MTF's platform allows customers to conveniently explore different market opportunities. For US Crude (XTIUSD) and UK Brent (XBRUSD) trading, there are no account open or platform fees. Moreover, there are no deposit or withdrawal fees, or handling fees associated with these instruments. The minimum lot size per position is 0.01 lot, with a maximum trading lot of 30 lots. The contract unit for both instruments is 1,000 barrels, , with an initial margin requirement of US$1,000.

Pros and Cons

| Pros | Cons |

| No account open or platform fees | Initial margin requirement of $1,000 |

| No account open or platform fees | Minimum lot size of 0.01 lot |

| No deposit or withdrawal fees | Potential for fraudulent activities and loss of funds |

| Provides educational resources in finance | Maximum trading lot of 30 lots |

| Contract unit of 1,000 barrels |

How to Open an Account?

To open an account with MTF, follow these steps:

Visit the MTF website and click on the “Join Now” button.

2. Fill in the required personal information, including your name, ID card number, email address, and contact number.

3. If you have an IB number, you can provide it as well.

4. Upload the front and back images of your ID card for verification purposes.

5. Submit proof of address, such as a utility bill or bank statement, to confirm your residential address.

6. Enter the details of your bank card and specify the withdrawal bank.

7. Indicate how you came to know about MTF.

8. If you have any special needs or if you were referred by a friend, you can leave a message or attach a note.

9. Enter the Captcha code to verify that you are not a robot.

10. Review all the information you have provided and click “Submit” to complete the registration process.

Spreads & Commissions

MTF (明德金融) offers a fixed spread starting from 0.15 pips for its trading services. This spread is presented without any mention of additional commissions, indicating that the spread itself encompasses all relevant costs associated with the trades.

Promotions

MTF 明德金融 offers several promotions to its customers.

The first reward is an Account Opening Reward, where customers can receive $50 upon opening an account using a promotion code. This bonus can be withdrawn along with any profits derived from it, as long as the customer accumulates a single order within a month.

The second promotion is Trading Rewards, which offers a trading rebate of up to HK$12,000. The rebate amount depends on the deposit made and the number of lots traded within a month. The rebate amounts range from HK$200 for a $2,000 deposit and 5 lots traded, up to HK$12,000 for an $80,000 deposit and 100 lots traded. The rebate is not cumulative.

The third promotion is the Referral Rewards, where customers can receive HK$500 for referring a friend who opens an account and deposits at least $2,000 and trades over 3 lots. There is no upper limit to the number of friends that can be referred.

Lastly, the Switch Account Reward offers HK$780 to customers who open an account, deposit more than $2,000, trade over 3 lots, and provide statements from other brokers.

Deposit & Withdrawal

Deposit:

Non-domestic customers have multiple options to deposit funds into their trading accounts. In addition to depositing funds through email notifications, agents, or customer service, customers can also upload receipts online. These receipts serve as an additional confirmation of the deposit request. Upon confirmation, the funds will be transferred immediately to the customer's trading account. To complete the deposit process, customers need to provide their Mingtak account number, upload the receipt, and provide a contact number for communication.

Withdrawal:

To initiate a withdrawal, customers are required to follow a specific format. They need to provide their trading platform account information and specify the amount to be withdrawn, denoted in either USD or HKD. Furthermore, customers must provide the name of the deposit bank account, the bank number, and the name of the bank itself. To notify the platform about the withdrawal, customers need to send an email to support@mingtakfn.com from their registered email address. Once the verification process is successfully completed, the platform will assign a bank account for the customer's withdrawal. The withdrawal can be made through a cheque, CHATS, or wire transfer. It's important to note that Mingtak does not accept third-party transfers, excessively frequent or same-day transfers, or any form of money laundering activities.

| Pros | Cons |

| Customers can deposit funds through email notifications, agents, customer service, or by uploading receipts online. | The deposit process requires a Captcha verification, which can be inconvenient for some users. |

| Once a deposit is confirmed, the funds are transferred immediately to the customer's trading account. | There is no option to deposit funds through a bank transfer. |

| Customers can withdraw funds through a cheque, CHATS, or wire transfer. | The withdrawal process can be time-consuming, as it requires manual verification by the platform. |

| Mingtak does not accept third-party transfers, excessively frequent or same-day transfers, or any form of money laundering activities. |

Trading Platforms

MTF offers two advanced online trading platforms for financial intermediaries: MT5 and MT4.

MT5 Trading Platform:

MT5 is an advanced online trading platform offered by MTF. It is specifically designed for financial intermediaries to offer their customers trading opportunities in various financial markets such as foreign exchange, contracts, stocks, and futures. The platform provides traders with a wide range of powerful features, including diverse trade execution functions, an abundance of technical indicators and charts, customizable indicators and scripts, as well as the ability to create unlimited charts.

The MT5 trading platform is available on different devices and operating systems. It can be downloaded as a Windows version, an Apple Mac version, an Apple iPad version, an Apple iPhone version, and two versions for Android mobile devices (one being the latest version and the other an older version, for devices with incompatible configurations). Additionally, there is an iOS version of MT5 for Apple devices.

For those who are new to MT5, there is a teaching component that provides guidance on various aspects of the platform. This includes instructions on how to log in and change passwords, as well as tutorials on how to use the transaction features within the MT5 platform.

MT4 Trading Platform:

MT4, is another advanced online trading platform offered by MTF. Like MT5, it is designed for financial intermediaries to provide trading services to their customers in foreign exchange, price difference, contracts, stocks, and futures markets. The MT4 platform comes equipped with powerful functionalities, including diverse trade execution functions, a wide range of technical indicators and charts, customizable indicators and scripts, and much more.

Similar to MT5, the MT4 trading platform is available for different devices and operating systems. It can be downloaded as a Windows version, an Apple Mac version, an Apple iPad version, an Apple iPhone version, and two versions for Android mobile devices (one being the latest version and the other an older version for devices with incompatible configurations).

| Pros | Cons |

| Wide range of features | Can be complex for beginners |

| Available on multiple devices and operating systems | Tutorials can be outdated |

| Powerful technical indicators and charts | Spreads can be wider than some other platforms |

| Customizable indicators and scripts |

Trading Tools

Daily: The daily trading tool provides information on market events and news that can impact trading decisions. It includes updates on interest rate changes, market reactions, and other relevant factors. For example, on June 16th, the European Central Bank (ECB) raised interest rates, and the market digested the Federal Reserve chairman's suggestion of possible rate hikes. These daily reports help traders stay informed about current market conditions.

Calendar: The calendar tool displays upcoming and recent events, allowing traders to plan their trading activities accordingly. It provides information on events such as economic data releases, earnings reports, and central bank meetings. Traders can access the calendar to see the schedule of events for today, tomorrow, and the entire week. For example, on June 19th, the calendar indicates the release of the NZD BusinessNZ Services Index.

Investment Class: The investment class tool categorizes different approaches to investment analysis. It includes fundamental analysis, technical analysis, and technic analysis.

Fundamental: Fundamental analysis focuses on the factors that influence the supply and demand of investment products. It considers economic news, monetary policy, and labor market data to determine the intrinsic value of an investment. For instance, investors interested in gold may analyze quantitative easing policies, interest rate changes, and labor market indicators to make informed investment decisions.

Technical: Technical analysis complements fundamental analysis by studying past price movements to predict future trends. It is commonly used in foreign exchange and gold markets. Technical analysis relies on chart patterns and assumes that all market information is reflected in prices. Traders employ various methods such as price action, wave theory, and technical indicators to identify potential trading opportunities.

Technic: Technic analysis refers to trading techniques that traders can use to mitigate risks and increase their chances of success. It involves implementing different strategies based on the analysis of market conditions. This trading tool provides insights into common trading techniques that traders can apply to their trading activities.

Financial Encyclopedia: The financial encyclopedia serves as a resource for understanding economic concepts, market indicators, and their implications for trading. It offers explanations and insights into various topics relevant to the financial markets. For example, it may provide information on the yield curve inversion as a potential sign of an economic recession or explain the significance of the “Beige Book” in the context of the Federal Open Market Committee (FOMC) and interest rates.

| Pros | Cons |

| Provides information on market events and news that can impact trading decisions. | The information may not be comprehensive or up-to-date. |

| Displays upcoming and recent events, allowing traders to plan their trading activities accordingly. | The calendar may not include all relevant events. |

| Categorizes different approaches to investment analysis. | The information may be too technical for some investors. |

| Provides insights into common trading techniques that traders can apply to their trading activities. | The information may not be applicable to all trading strategies. |

| Serves as a resource for understanding economic concepts, market indicators, and their implications for trading. | The information may be too complex for some investors. |

Educational Resources

MTF offers a range of educational resources in the field of finance, providing individuals with practical knowledge and skills to navigate the complexities of investments.

Finance Seminar:

MTF offers a Finance Seminar that focuses on providing practical knowledge and skills in trading strategies to address investment challenges. Led by Luo Jiacong, this seminar is designed to help individuals navigate the chaos in the investment market. The seminar is scheduled for 17th June 2023, from 14:00 to 16:00.

Free Online Teaching:

MTF provides free online teaching sessions aimed at enhancing investment success. One such session, conducted by tutors Edmund and Winson, highlights three methods to increase the probability of successful investments by 80%. The online teaching sessions are scheduled for 20th June and 5th July, both at 7:00 PM.

Jasper Lo's Investment Strategy:

MTF features an educational resource where Jasper Lo, an expert in finance, shares his investment strategy for the second half of the year. This resource is intended to provide valuable insights into making informed investment decisions. Jasper Lo's session is scheduled for 24th June 2023, at 2:00 PM.

Lecturer Interview:

MTF offers an opportunity to engage with expert lecturers through interviews. These interviews aim to provide additional educational content and insights into various finance-related topics. Further details about specific lecturer interviews are not provided in the given information.

Customer Support

MTF is a company that provides customer support services to its clients. With the aim of assisting customers and addressing their concerns, MTF offers multiple channels through which customers can contact their support team. Customers can reach out to MTF's customer support via telephone by dialing +852 54454098. Alternatively, they can send an email to support@mingtakfn.com to communicate their queries or seek assistance. The physical address of MTF's support center is located at Room 1106, Tower 2, Ever Gain Plaza, 88, Container Port Road, Kwai Chung, N.T. HK.

In addition to traditional communication methods, MTF recognizes the significance of digital platforms in today's interconnected world. Customers can connect with the company through various social media platforms including Facebook, YouTube, Telegram, Instagram, and WeChat. These channels provide an additional avenue for customers to engage with MTF's customer support team and seek resolution for their concerns.

Conclusion

MTF (明德金融) is a forex broker offers market instruments such as precious metals and US Crude (spot), which have gained popularity among customers. The broker provides fixed spreads for trading services, starting from 0.15 pips, without mentioning additional commissions. MTF also offers several promotions to customers, including account opening rewards, trading rebates, referral rewards, and switch account rewards. The broker supports the MT5 and MT4 trading platforms, which offer advanced features for trading in various financial markets. MTF provides trading tools such as daily market updates, a calendar of events, and resources for investment analysis. The broker offers educational resources such as finance seminars, free online teaching sessions, and insights from expert lecturers. Customer support is available through phone and email, with additional communication options via social media platforms.

FAQs

Q: What market instruments does MTF offer?

A: MTF offers precious metals (Spot Gold and Silver) and US Crude (Spot) for trading.

Q: How can I open an account with MTF?

A: To open an account with MTF, visit their website, provide personal information, upload necessary documents, and complete the registration process.

Q: What are the spreads and commissions at MTF?

A: MTF offers fixed spreads starting from 0.15 pips, and no additional commissions are mentioned.

Q: What trading platforms are available at MTF?

A: MTF offers the MT5 and MT4 trading platforms for traders' convenience.

Q: What are the deposit and withdrawal processes at MTF?

A: Customers can deposit funds through various methods, and withdrawals require specific information and verification.

Q: What educational resources does MTF provide?

A: MTF offers seminars, free online teaching sessions, investment strategies, and access to expert interviews.

Q: How can I contact MTF's customer support?

A: You can reach MTF's customer support through phone, email, and various social media platforms.

Keywords

- 2-5 years

- Regulated in Hong Kong

- Type AA License

- MT5 Full License

Comment 9

Content you want to comment

Please enter...

Comment 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

sweet8724

Bangladesh

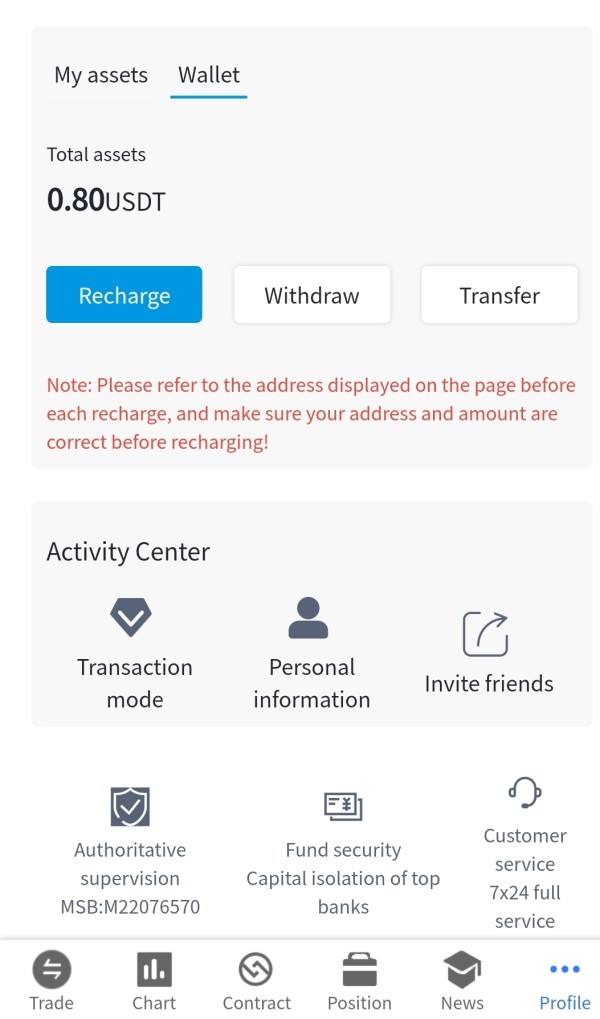

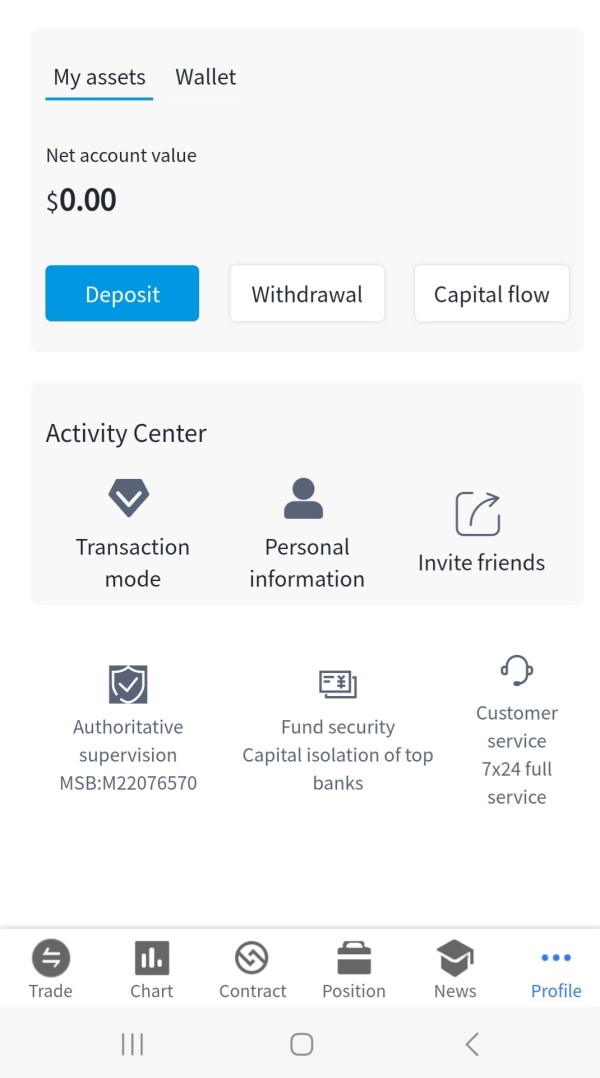

assest to wallet not transfer with 5 day

Exposure

2023-08-12

FX1027111783

Hong Kong

The advantage is of course low spreads. But when you make any trades, there are actually people watching you. For example, if you buy or sell gold and the US releases data that affects the price of gold, your entry price will be far from the market price (gold can exceed $10), which means there is a significant slippage. Without underestimating it, it is crucial to slow down your buying price. Other brokers also have slippage, but not as slow as this. Keep up the good work, everyone! 💪

Neutral

2024-09-21

FX1685654954

Ukraine

MTF has ctrader account to connect TradingView, however, it often fail to login, keeps saying

Neutral

2024-06-14

欣欣向荣35460

Taiwan

Although. . but. . The minimum deposit of ten dollars is really low, but I still wish I could have a demo account for me to test the waters first, but they don't have it. . . It is said to provide the mt5 platform, but I have to ask the customer service for the download link, which is very troublesome.

Neutral

2022-12-15

FX1146376721

Hong Kong

I saw this company without a regulatory license advertise its own bonus on the homepage... Seriously, don’t be tempted easily, because for a scam company, whether it’s your money or the bonus he gives you, it will all go to him in the end account!

Neutral

2022-12-13

Chi-ming

Hong Kong

I am Chi-ming from Hong Kong, having been use MTF for two years, it is a quite stable platform. Haven't met any issues so far.

Positive

2024-04-28

Tracey

Hong Kong

Hello, mates in trading! My experience with Ming Tak Financial (MTF) has been invigorating. I appreciate the company's decision to be regulated under CGSE, as it adds a sense of trust. The impressive feature that reeled me in was the fixed spread starting from as low as 0.15 pips. I found their focus on precious metals trading, including spot Gold and Silver, in addition to US Crude, appealing for a metal trader like me. But MTF being silent on trading conditions did throw me off balance. I suggest reaching out to their support team via the provided contacts for more detailed information.

Positive

2023-12-01

Starrr

New Zealand

I've had a stimulating journey. Based out of Hong Kong and regulated by CGSE, it's indeed gratifying that the company ensures a secured trading environment. One of the highlights that appealed to me is the absence of a minimum deposit, which is a significant advantage, especially for new traders or those who wish to trade with lesser-risk capital. The trading of precious metals and US crude offered me a diversified investment experience. MT4 and MT5's inclusion as the trading platforms was reassuring, given their popularity and comprehensive features.

Positive

2023-11-30

hei040

Hong Kong

The deposit and withdrawal are safe, the spread is low, and there is no slippage after using it for half a year, which is good overall.

Positive

2023-07-18