简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

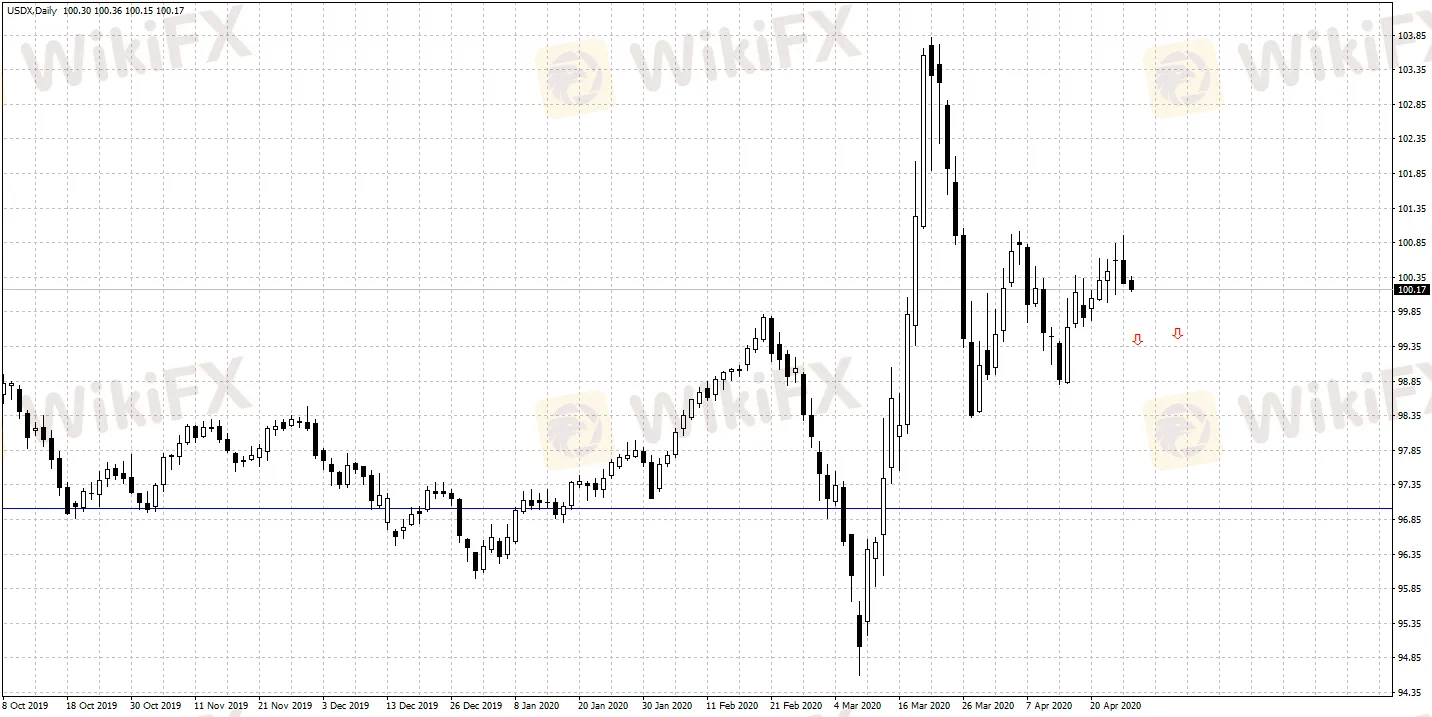

USD Net Shorts Rose to the Highest in Past 2 Years

概要:According to Reuters' calculations and the latest data released by the United States Commodity Futures Trading Commission (CFTC), speculative dollar net short positions have increased to the highest level in the past two years in last week

According to Reuters' calculations and the latest data released by the United States Commodity Futures Trading Commission (CFTC), speculative dollar net short positions have increased to the highest level in the past two years in last week; as of the week ending April 21st, USD net short positions totaled US$11.51 billion. Net short positions of the previous week reached US$ 11.39 billion. Reuters calculation of total USD net position in the Chicago International Monetary Market is based on the net positions of six major currencies: Japanese Yen, Euro, British Pound, Swiss Franc, Canadian Dollar, and Australian Dollar.

Under the impact of the epidemic, the Fed has continuously launched several rounds of quantitative easing that exceeded market expectations, almost exhausting all conventional and unconventional policy ammunition available. As of now, the Fed has reduced interest rates to zero to inject liquidity into various markets. Investors will still pay close attention to the Fed s outlook on the current economy and whether it will give hints on the introduction of negative interest rates in the future.

免責事項:

このコンテンツの見解は筆者個人的な見解を示すものに過ぎず、当社の投資アドバイスではありません。当サイトは、記事情報の正確性、完全性、適時性を保証するものではなく、情報の使用または関連コンテンツにより生じた、いかなる損失に対しても責任は負いません。

WikiFXブローカー

レート計算