简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

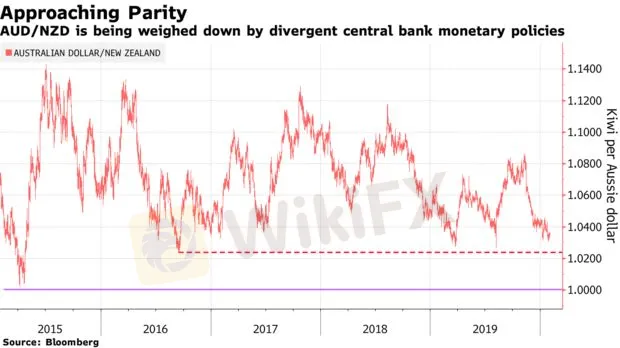

AUD/NZD Shows a Tendency to Approach 1.01

요약:The exchange rate of AUD against NZD fell 5% after reaching the highest point in last November. And whether the tendency this week is strengthened or not, which draws close attentions from investors.

The exchange rate of AUD against NZD fell 5% after reaching the highest point in last November. And whether the tendency this week is strengthened or not, which draws close attentions from investors.

Although the inflation and unemployment rate is well improved, it is estimated that the Reserve Bank of Australia will at least cut interest rates once, and even twice according to the prediction from some banks. By comparison, it is surprising that the Reserve Bank of New Zealand has kept interest rate on hold since last November, which weakens the prediction that RBNZ will ease monetary policy further. The latest market expectation suggests that there is a possibility of 62% that RBZN may cut interest rate this year.

Per price trend, monetary policy has a significant impact on AUD/NZD. The possibility of RBNZ‘s further interest rates cut in February is reduced expectedly. If New Zealand Treasury worries about the novel coronavirus’ pressure on the economy in New Zealand, the possibility of rate cut will be increased. And the views can be proved by some new trends this week. RBAs Chairman Philip Lowe gave a speech at Sydney on Wednesday, and will make the half-year statement to Congress on Friday.

AUD/NZD recently hovers above the support level of 1.0238, the lowest point since September 14, 2016. And any breakthrough in this level will help increase the tendency above.

We expect the RBA will reduce the cash rate to 0.5% in April, while RBNZ will stabilize the rate at 1.0% in the first half of 2020, and AUD/NZD is expected to be close to 1.01 by June.

AUD/NZD Daily Pivot Point: 1.0355

S1: 1.0340 R1: 1.0370

S2: 1.0325 R2: 1.0385

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

더 보기

부자(父子)간 꼼수로 마스크 '폭리' 판매

대외 마스크 수출을 관리하고, 하루 1천만 개를 생산한다 해도 왜 소비자들은 마스크를 살 수 없었을까요?

거액 자금 사기에 또 여러차례 당해. 알고보니 여기에 문제점이

많은 업종과 마찬가지로 외환업계는 급속도로 성장하고 있는 가운데, 일부 외환 플랫폼들이 투자자들의 일확천금을 노리는 심리를 이용하여 투자자들이 불법 조작이나 고위험한 투자를 하도록 유도하여 투자자들에게 피해를 주고 있다.

미국 주식 어떻게 증가하나? 큰 이견차 보이는 시장

미국 S&P 500지수와 나스닥 지수가 3거래일 연속 휴장 기록을 갈아 치웠다.

재상 사퇴, 파운드 큰 파동 보여

13일 사지드 자비드 영국 재무장관 임명 6개월 만에 돌연 사태를 선언하였다.

WikiFX 브로커

최신 뉴스

제1회 모의 투자 대회 수상자 발표

벚꽃 앱테크 이벤트 당첨자 발표

[4월 2일 거래 팁] 美 관세 발표 임박,‘불확실성 장세’에서 살아남는 법은?

환율 계산기