简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD Price Analysis: Risk of Deeper Losses as Fed Confirms U-Turn

Resumo:USD Price Analysis: Risk of Deeper Losses as Fed Confirms U-Turn

USD Price Analysis and Talking Points:

美元价格分析和谈话要点:

Fed Delivers as U-Turn is Confirmed

美联储提供大转弯确认

ECB vs. Fed | Fed Have More Firepower

欧洲央行与美联储美联储拥有更多火力

USD Technical Outlook | Key 200DMA Eyed

美元技术展望|关键200DMA Eyed

See our quarterly USD forecast to learn what will drive prices throughout Q2!

请参阅我们的季度美元预测,了解将在第二季度推动价格的因素!

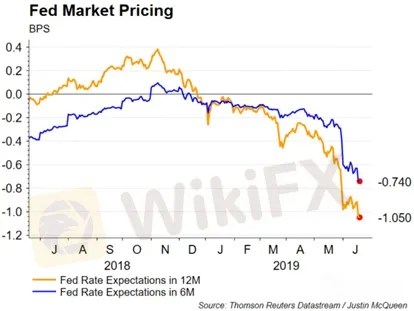

Fed Delivers as U-Turn is Confirmed

如美联储提供大转弯确认的结果

Yesterday, the Federal Reserve confirmed its U-Turn in monetary policy, delivering what the markets had wanted. The Federal Reserve dropped its guidance of “patient” and instead highlighted their “readiness to act in order to sustain the expansion”, thus opening the door to rate cuts. This was also reaffirmed by the dot-plot projection, which showed a sizeable shift with 8 members projecting a rate cut, 7 of which are looking for 50bps worth of easing. Chair Powell also noted that those who saw rates on hold, the case for a cut had strengthened. To add to this, Powell stated that the Fed could potentially bring its QT unwind to an end, earlier that previously stated. In reaction to the dovish signal from the Fed, the USD index had come under pressure across the board with US 10yr yields dipping below 2%, while US equities edged towards record highs.

昨天,美联储确认了货币政策的大转弯,提供了什么市场本来想要的。美联储放弃了对“耐心”的指导,而是强调了他们“为维持扩张而采取行动的准备”,从而打开降息的大门。点图投影也证实了这一点,该投影显示了一个相当大的转变,有8个成员预测降息,其中7个正在寻找50个基点的宽松价值。鲍威尔主席还指出,那些看到利率暂停的人,削减的情况得到了加强。除此之外,鲍威尔表示美联储可能会在之前表示的情况下将其QT放松到最后。针对美联储的温和信号,美元指数受到全面压力,美国10年期国债收益率跌破2%,而美国股市则小幅创下历史新高。

As we highlighted at the beginning of the year, markets are indeed dictating monetary policy. (full analysis) In turn, this sees Gold in pole position to benefit. (full analysis) Of course, focus will turn towards the G20 summit and most importantly the talks between Trump and Xi.

正如我们在年初所强调的那样,市场确实在决定货币政策。 (全面分析)反过来,这看到黄金处于领先地位,受益。 (全面分析)当然,焦点将转向G20峰会,最重要的是特朗普与习近平的会谈。

Source: Refinitiv, DailyFX (Fed Rate Expectations)

来源:Refinitiv ,DailyFX(美联储利率预期)

ECB vs. Fed | Fed Have More Firepower

欧洲央行与美联储美联储有更多的火力发货

When it comes to easing monetary policy, the Fed have seemingly more firepower than the ECB, given that the latter is already in negative territory. Source reports earlier this week noted that the ECB would use rates as its first policy tool, as such, with all else being equal, the USD stands to weaken against the Euro with the Fed seen easing policy by almost 75bps, relative to the 13bps by the year-end. Consequently, the greater focus for ECB policy will be on whether they reintroduce QE for the Euro to materially weaken against the greenback.

在宽松货币政策方面,美联储似乎比欧洲央行更具火力,因为后者是在负面领域。本周早些时候的消息来源报告指出,欧洲央行将把利率作为其首要政策工具,因此,在所有其他条件相同的情况下,美元兑欧元走弱,美联储政策放宽近75个基点,相对于13个基点而言年末。因此,欧洲央行政策的重点将放在是否重新引入欧元的量化宽松政策以大幅削弱美元。

USD Technical Outlook | Key 200DMA Eyed

美元技术展望|关键200DMA注视

The USD is now edging back to the pivotal 200DMA, previous attempts to make a closing break has failed. However, a firm move below puts the greenback at risk of further losses, opening a move towards the 96.00 handle.

美元现在正在回到关键的200DMA,此前尝试进行收盘时失败。然而,下方的坚定走势使美元面临进一步下跌的风险,开始向96.00处理。

US Dollar Index Price Chart: Daily Time Frame (Dec 18 – May 19)

美元指数价格走势图:每日时间框架(12月18日 - 5月) 19)

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora WikiFX

Últimas notícias

2025: Expecativas para o Mercado Forex Brasileiro

Descubra as Corretoras ECN: Benefícios e Vantagens

EC Markets: É uma Boa Opção para Investir o seu Dinheiro?

Royal Camel: O Golpe dos Saques Retidos

O Relatório Anual de WikiFX 2024 foi lançado, venha e reivindique seu status exclusivo!

W7 Broker&Trading: Golpe dos Saques Bloqueados Atinge Brasileiros

Saxo Bank: Uma Análise Completa do Broker Multiactivos

Cálculo da taxa de câmbio